Unlike the January employment report, the April report did not have any blatant data points that caused a “crash”. With average earnings only rising 0.1% myopic market participants celebrated the lack of wage inflation, hoping this will allow the Fed to take a few more months off before the next rate increase. Most people are so focused on the short-term, they tend to miss things that may cause serious problems either late this year or early in 2019.

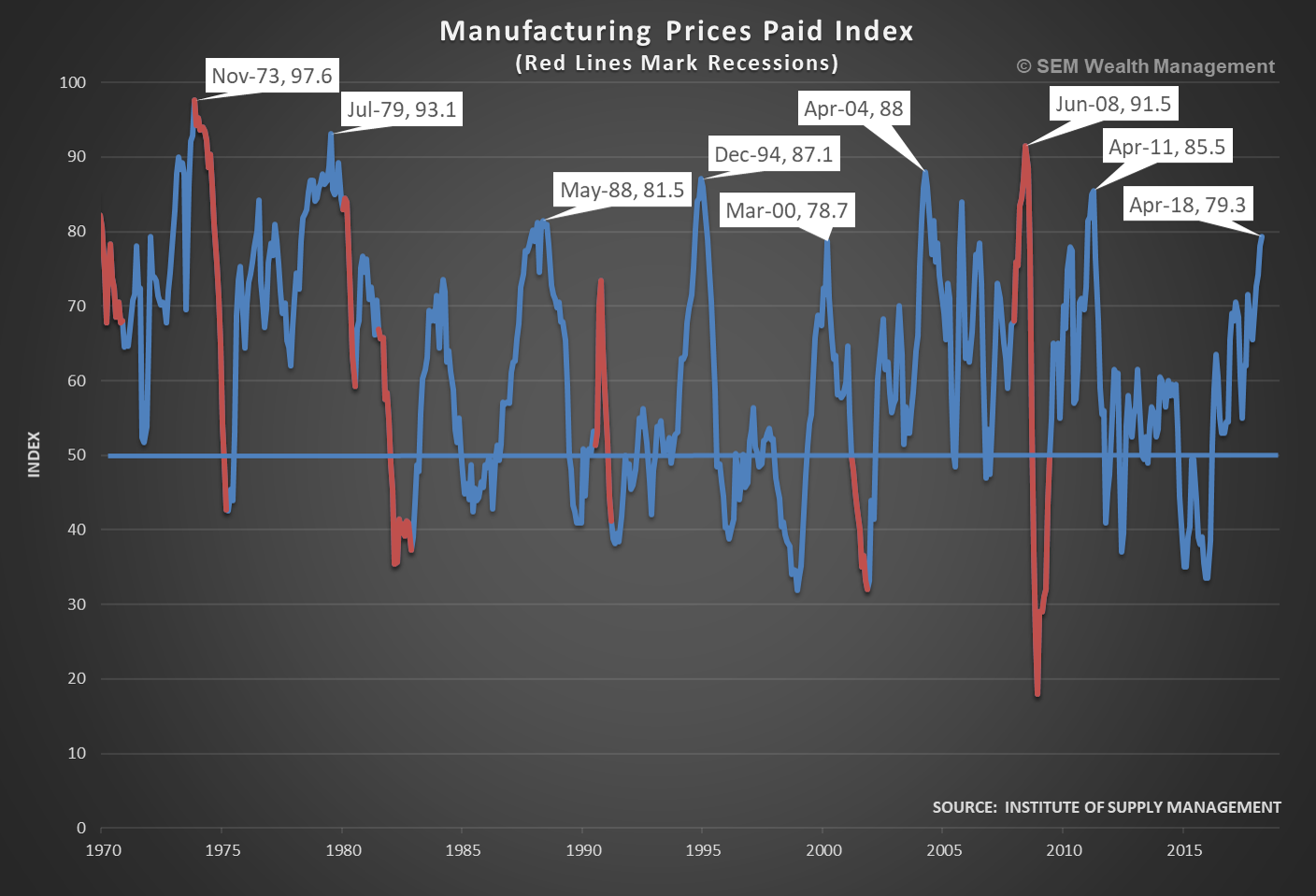

The ISM Manufacturing survey has a data point I think everyone should at least be considering as you evaluate your investment portfolios. The Prices Paid portion of the index has risen the past 6 months and is up sharply from the “deflationary” environment that ended in early 2016.

Like Fed interest rate hikes, the increase in prices takes time to filter through the economic system. As prices keep rising, manufacturers have two choices — eat the cost and thus take a hit on earnings or pass on the price increases to their customers. Either is bad for the market or the economy. If they choose to take the earnings hit, a market that is priced at levels only experienced during past market bubbles (1929, 1999, & 2007) is at risk of a sharp fall-off. If they choose to pass it on to their customers the immediate inflationary impact could cause the Fed to hike rates even faster and most likely throw the economy into a recession. If they choose to assume it is “transitory” and do nothing, they then risk letting inflation take control and eat away the gains the middle class had made from the tax cuts.

None of these scenarios are good for the market. Notice the other times we saw spikes in the manufacturing prices paid. All occurred during or just before a really rough time for the markets and economy. The nice part about this is you have time to prepare as the lead time is quite long. SEM has a wide range of portfolios that can be blended to create a customized portfolio to handle whatever the outcome may be. If you’d like to learn more, drop me a note.