Last week’s market headlines offered a masterclass in economic complexity, with every story weaving into the next. The focus of course going into the week was the Fed’s rate cut which set the tone, sparking volatility across stocks and bonds and raising fresh questions about inflation’s staying

Tag: Fed

A year ago, the stock market was in the midst of a 10% correction over fears the economic data was too strong, which meant the Fed was going to continue in their inflation fight. The sell-off started when the Fed hiked rates after a one meeting pause. The sell-off didn't

The wait for the Fed to give us more insight into their tapering decisions ended last week, with the tapering set to begin sometime this year. With the Fed's help going away, the market will remove its training wheels. Will that lead to a crash or a sharp pullback like

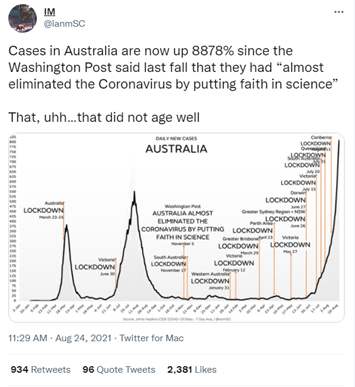

Last week was a good reminder that while things were looking brighter for us economically, we still weren’t fully out of this mess. Perhaps the biggest sign of our complacency has led us to the CDC reversing course on mask mandates, once again recommending masks for people indoors regardless