On Monday Nvidia lost $589 BILLION on market cap, a new record. Nvidia alone accounted for 2/3 of the drop in the S&P 500 index. We have discussed the lack of diversification and concentration risk in the S&P 500 occasionally the last couple of years.

Tag: Trade War

Last week on an advisor call I was recapping my post-election blogs as I discussed: the euphoric post election rally, not letting political opinions influence our investment decisions, valuations and the chances of yet another 20%+ rally in 2025, what tariffs really are and the likely impact on the economy

On what was a crazy Friday after a crazy weekend prior, it feels like world events are constantly happening more and more. In my experience, there’s about a 75% chance when you tune in to a major news channel that the bottom graphic will have “BREAKING NEWS” on

Thursday started as a good day. After a slow start to the day, the stock market was staging a nice rally as investors figured one rate cut was better than no rate cuts. Both Treasury bonds and high yield bonds were sharply higher (which isn’t usually the case,

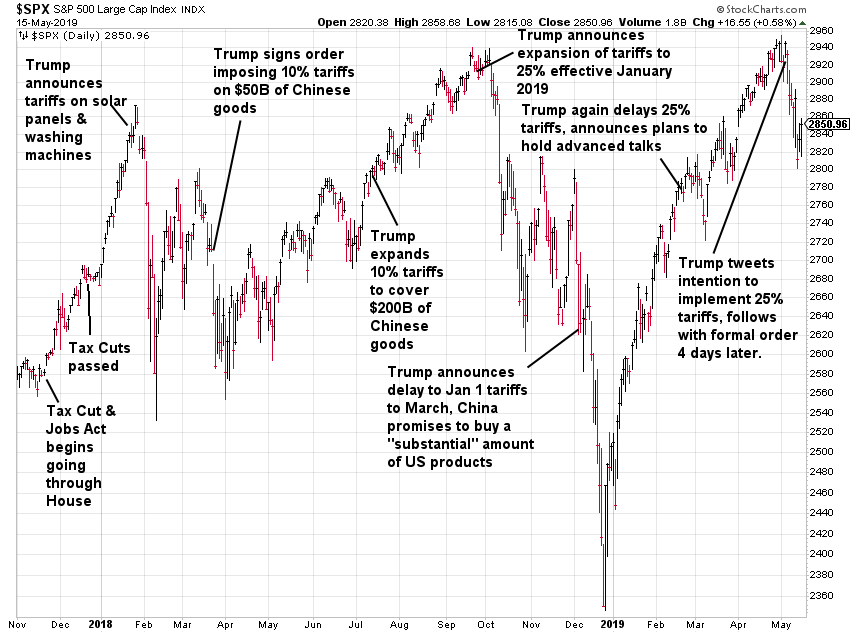

Stocks are attempting to stabilize after President Trump threw everyone for a loop by Tweeting his intention to hike tariffs on $200 Billion of Chinese goods ahead of what was expected to be the week that ended the 17 month trade war. Rather than going into the whys, hows, whats,