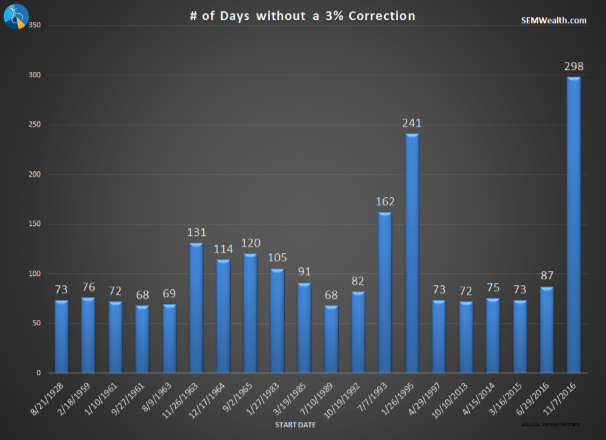

Despite a year of political unrest, the stock market is enjoying the longest streak ever without a 3% correction.

The fact the market has not had even a minor sell-off since the election of Donald Trump does not mean we are at risk of an immediate drop. In fact, our economic and market based indicators are all pointing to a high likelihood of a continuation of the gains.

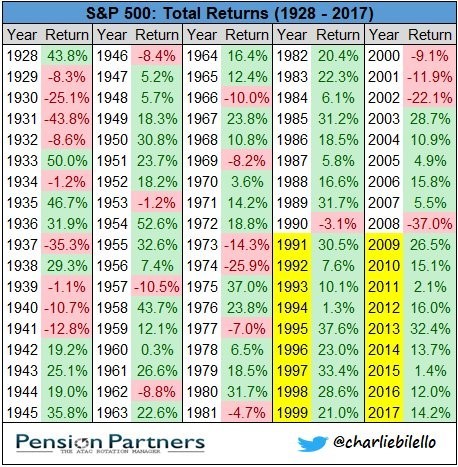

The real issue is the complacency in the market participants. Risk management has been thrown out the window with the belief we are in a “new era”. The bull market is approaching the duration of the 1990s tech boom. This table from Pension Partners highlights the gains we’ve enjoyed the past 9 years.

When market participants are this complacent, the risk when stocks do finally begin to fall is extremely high. They bought simply because it was going up, which means they will sell when it starts going down. I remember using this table in the late 1990s and then again in 2007. In fact, in my weekly emails to advisors (the predecessor to the Trader’s Blog) we would update the number of days since a 10% correction.

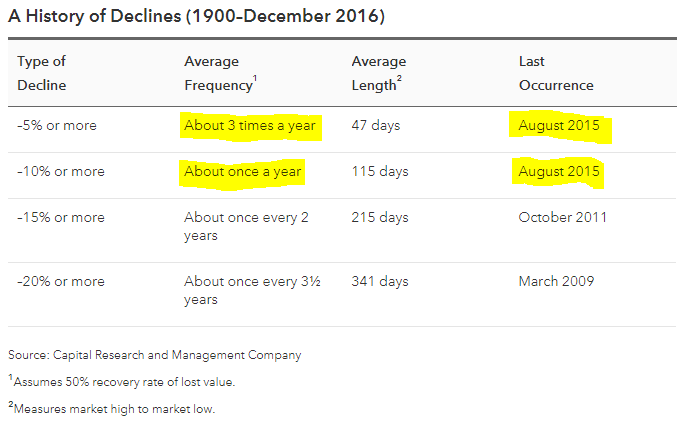

This smooth ride IS NOT NORMAL. The markets are MEAN REVERTING, which means the longer we go without the stated corrections, the harder the markets will fall. The markets are driven by supply and demand, which are driven by fear and greed. These human emotions do not change. It’s never different this time.

SEM will continue to do what we have done the past 25+ years — capture as much of the upside as possible given the mandates of each SEM model while keeping a watchful eye for the opportune time to lock in the nice gains we’ve all enjoyed the past 9 years.