Since the beginning of February stock & bond market participants have been spooked by the prospects of inflation and the impact it could have on investment returns. Last week’s “Chart of the Week” examined the longer-term trend in inflation measurements. The conclusion was yes it is trending higher, but overall it is still below the Fed’s target rate. The bigger problem, however is the places we have seen inflation.

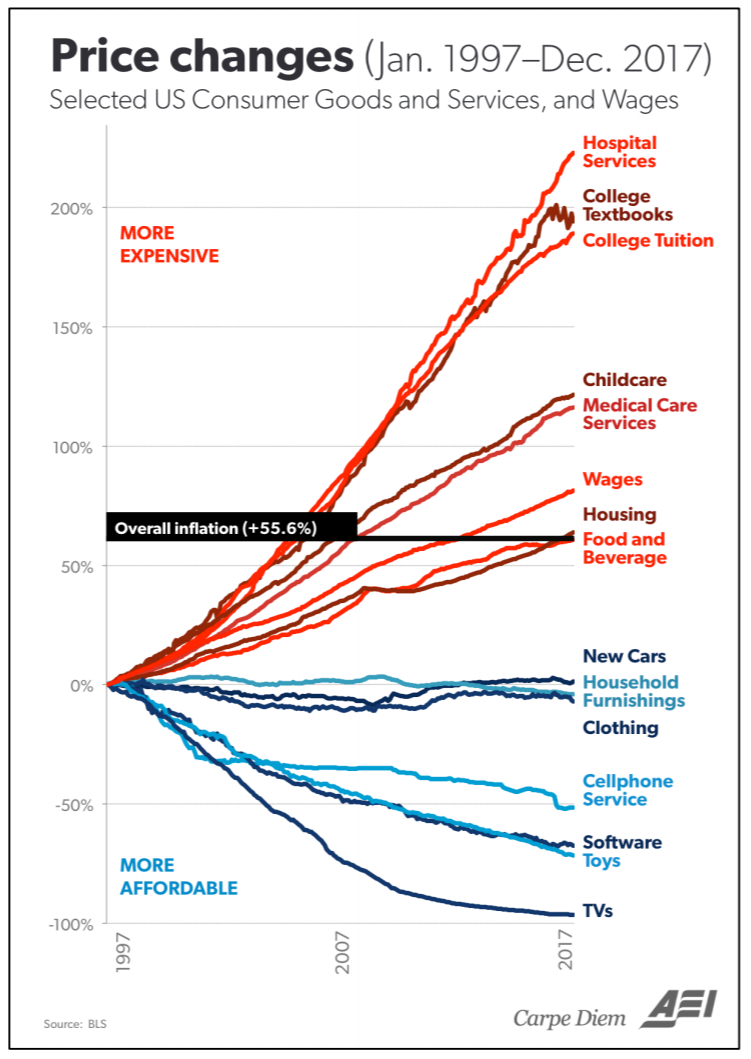

John Mauldin’s Thoughts from the Frontline last week examined the components of inflation and the impact this could have on our future. When I saw this week’s Chart of the Week, the first thing that popped into my mind was a phrase I’ve used many times in seminars when discussing inflation — Things we need vs Things we want.

The real problem here is the things we need have skyrocketed in price while the “stuff” we enjoy buying, but do not necessarily need have plummeted. Worse, we’ve “exported inflation” by outsourcing the manufacture and the raw materials from other countries to help keep prices lower. The side effect of this has been lower personal income and fewer jobs. When you combine this with the high costs of things we couldn’t outsource to other countries, you can see why the economic growth during this recovery has been the worst on record.

I’m not advocating for protectionist policies, but we do have to understand the impact 40 years of outsourcing has had on our country and our ability to support a rapidly aging population that has promised themselves significant public & private pension plans. One reason the markets have dropped the last few days is the understanding of how a trade war could cause immediate inflation in everything, which could quickly offset any impact the tax cuts may have had on the economy.

There are no easy solutions. We can’t instantly go back to making everything in America, but we also cannot continue to have other countries able to import their cheap products into our country. However, all those calling for everything to be made in America have to realize prices could double if companies had to support American’s much higher standard of living, benefit packages, & work week restrictions. Any solution to this problem will be painful and there are many risks as we’ve seen this week in the market that bad policy could derail any positives other policies have generated.

All of this makes me again thankful for our wide range of investment options on our TCA Platform. We can offer diversification of strategies, managers, time horizons, and asset classes all in a single account. Having this kind of flexibility will be the only way to survive what is sure to be a painful adjustment to a more balanced economy.