As we enter either the final stages of the bull market or go through the early stages of the bear market (nobody will know until they have the benefit of hindsight WHEN the bear market began) we are witnessing in client and advisor meetings something that always occurs — confusion/angst over what is happening with the market and their investments.

This week I answered those questions in our monthly “Three in Three” (3 charts in 3 minutes) segment.

Why didn’t I make money in 2018?

While we would like to make money all the time, the market does not function that way. Instead we attempt to miss the largest portions of a bear market while capturing the largest portions of a bull market. Each investment model has a specific risk/return mandate, with downside risk always the most important variable.

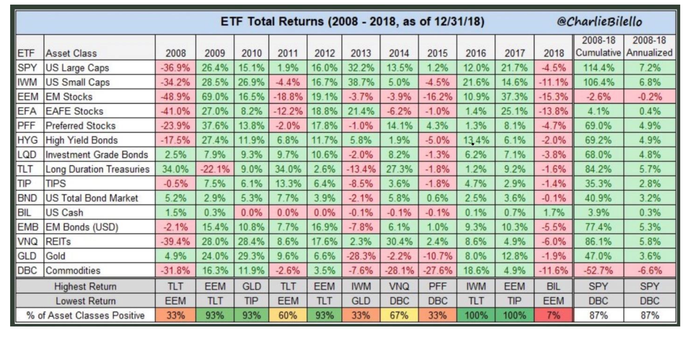

In 2018 the only major asset class that made money was CASH as shown in the table below (source). Even in 2008 there were a few more places to hide. While we deploy cash in most of our investment models it is only during the middle and late stages of a bear market where we will see this asset class utilized in a major way.

Making things tougher in 2018 was the big sell-off in February in both stocks and bonds. Normally bonds provide diversification and downside protection, but the sell-off came so fast in both asset classes there was little opportunity to lock in gains and move to cash. Having trading systems designed to capture those short-term (1-2 week) trends means so many bad trades in a bull market that you don’t capture much of the upside at all (trust me we’ve tested hundreds of ideas.)

The second big sell-off started at the beginning of October, was followed by a brief but sizable November rally, only to go through another big sell-off the first 3 weeks of December. In this sell-off bonds, and in particular SEM’s lowest risk programs handled the second sell-off quite well, barely losing any value. For what it’s worth, SEM’s Tactical Bond model was essentially flat for the year and our Enhanced Growth model made a bit of money. We monitor hundreds of other investment models and that was quite a rare feat in 2018.

Short answer: The early year losses in bonds masked the diversification benefits of lower risk investments. There were no places to hide like there normally would be in a losing year.

What should I expect for returns going forward?

We’ve heard a lot of experts declaring the market is now either fairly or undervalued based on the 4th quarter sell-off. Yes the market dropped nearly 20%, but it has already recovered nearly half of the losses. Even with the 20% drop, valuations were still extremely high, especially if we are a year or less away from a recession.

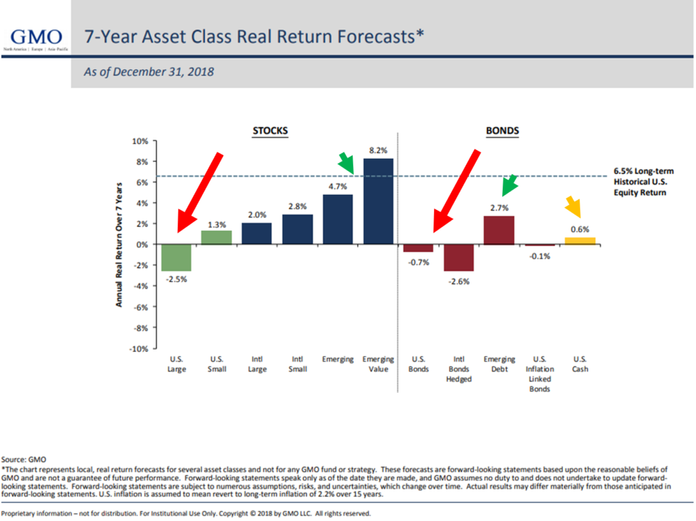

Valuations are subjective as are market forecasts. At SEM we choose to focus on DATA not opinions. This is the reason we will use the expected returns from GMO. They take the current valuation levels for all major asset classes and apply a multiple regression model to forecast the overall annualized returns for the next 7 years. They have one of the best track records we’ve seen. Here is their forecast as of the end of December (source).

It is easy to get lost in the short-term noise of the market. Their forecasts are not timing indicators, but expectation setters. Looking at where we are at NOW I cannot think of a better reason to deploy a well diversified active management approach similar to SEM’s. We have the ability to go wherever necessary to make money (or to protect it while we wait for valuations to become more reasonable.) Are you ready for negative returns in US stocks and bonds the next 7 years? How will you know when to rotate into Emerging Markets with a heavier allocation (or out of Emerging Markets and back to US stocks)?

Short answer: Based on valuations, we should expect losses for US investments the next 7 years. There are opportunities to make money, but it will require a nimble, non-emotional approach.

Does the post-Christmas rally mean the coast is clear for stocks?

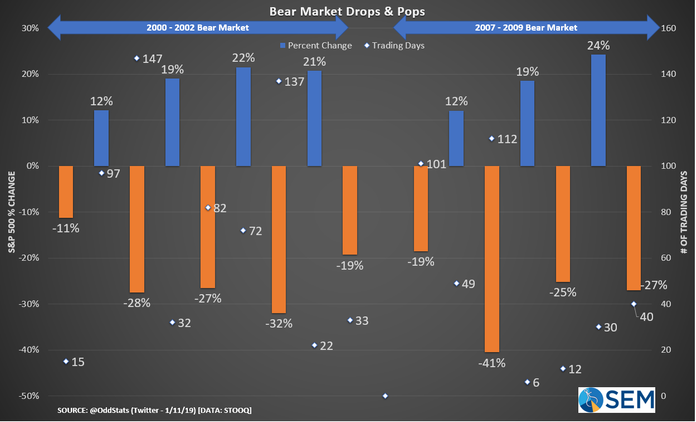

This has been the most often asked question we’ve seen from clients and advisors alike. While the signs are there that the bear market started in 2018, we won’t know until we all have the benefit of hindsight when it began. One of the first things I learned when studying market history — the most furious rallies come inside a bear market. This chart illustrates every move from the last two bear markets (source). Every trading day is represented. It is easy to forget all the big rallies that suckered clients (and advisors) into believing the worst was over.

Emotions can get the best of most of us during a bear market. In addition to very large swings in market prices, you are met with a constant barrage of negative headlines along with market cheerleaders saying it is a “buying opportunity”. It is easy to manage money during a bull market. The real value of an investment manager comes during bear markets.

Whether we are in a bear market or not, remember last January started with a 7% rally in the S&P 500 only to see it lose 12% in 8 trading days.

Short answer: We cannot let the current market trend dictate the perceived value of an active risk management approach. If your portfolio lost more than you were comfortable with during the 4th quarter, this rally should be used to re-position your investments into something that is more suitable.

[Click here for 3 steps you should be taking to prepare for a bear market.]