Despite the post-Christmas rally in the stock market, like death and taxes there is something investors cannot avoid — bear markets. The way our brains are programmed, the longer we go without experiencing something, the less likely we are to believe it can happen (this is called Availability bias or “recency” bias). With the current bull market approaching the longest running rally ever, many advisors and investors are not prepared for a bear market.

3 Key Bear Market Steps from the Press – Over the weekend I came across two articles that perfectly illustrate what advisors should be doing for their clients RIGHT NOW to prepare them for the coming bear market. The first was an article from Bloomberg, “What to Expect When You’re Expecting a Bear Market“. The second was a recent article from the CFA Institute. The 3 key points these articles made that can help us help our clients:

-

Some adjustments are needed for clients’ investments at this time

-

Understanding risk tolerance and diversification is necessary to avoid clients abandoning their strategies during a bear market

-

The optimal portfolio is one which keeps clients invested, vs delivering the highest returns

Advisor Action Steps to Prepare for a Bear Market – Given the recent volatility, a number of advisors asked us what they should be doing right now to prepare their clients, and their investment portfolios, for a possible bear market. We have shared these 3 action steps with them:

1. Obtain “risk pulse” of each client – Contact each of your clients to see how they’ve been feeling about the volatile markets. Don’t assume they are OK because you haven’t heard from them, and it enables you to tell them that you’re monitoring the markets, and will make appropriate changes to their programs (see Step 3). Here are some possible questions for you to ask your clients:

-

How have you been feeling about the recent market declines, and overall market volatility?

-

With the recent market volatility and declines, do you have any concerns about the portfolio you and I put together for you?

-

Would you be able to stick with our plan if 2019 was another year like 2018?

Remember: As humans when we get uncomfortable, we are more likely to make emotional decisions. Risk surveys such as Riskalyze or general “risk tolerance” questions answered during a bull market often do not measure the true risk tolerance of a client. It’s always good to check-in with a client following a correction in the stock market to get a real feel for their tolerance.

Side note: SEM’s Platinum Advisors receive a report each week indicating the number of times their clients logged into TCA by E*TRADE’s portal. Reviewing this report each week helps identify clients who may be concerned with the market. For more information on our Platinum Advisor program, click here.

2. Review the impact of a bear market – Because the last bear market was 10 years ago, it is easy for all of us to forget what a bear market in the near future would look like (not saying there will be a bear market soon, just that it is more likely than it was a year ago). Keep in mind, a recessionary bear market would show losses more than twice of what we experienced from Sept. 1, through Dec. 24, 2018. Questions you should be asking yourself:

-

If I were to double the losses in the 4th quarter in my client’s investment portfolios, would that exceed the expectations I set for my clients?

-

Are there any clients that could not afford a doubling of the 4th quarter losses?

-

Were there investments in my portfolios that performed better/worse than I would have expected?

-

Do I know why those investments performed better or worse?

Remember: It is easy to pick investments in a bull market and equally easy to lose track of which investments truly provide diversification during a bear market. Too often most asset classes become correlated at the time you need them to be non-correlated the most — when stock markets are falling.

Side note: One of the favorite things we do is help advisors figure out what it is their clients or prospective clients are invested in. If you would like a free portfolio review showing asset class exposure, correlations, and risk exposure, click here.

3. Determine each client’s portfolio adjustments – The Bloomberg article gave a high level overview of some clear adjustments that advisors can make for their clients right now. The CFA Institute article reminds us finding the “optimal” (best performance vs. risk) portfolio is not as important as finding the “best” portfolio for each individual client. With us at SEM Wealth Management operating as an Outsourced Chief Investment Officer (OCIO), we help advisors implement all of the recommended investment program adjustments noted in these articles. We gladly will talk with you about how we can help you with our OCIO help. Here are some things you should be asking before making any adjustments:

-

Do I know how each client’s portfolio matches the true risk tolerance of the client?

-

Do I have components inside the portfolio (and do my clients understand those components) designed to help clients stick to their plan regardless of where we are at in the market cycle?

-

Do my portfolios have a well thought out plan to adapt to whichever direction the market heads next?

-

Do I have the time/energy/resources/desire to constantly be monitoring the investment portfolios?

-

Am I more valuable in front of clients or in the back office managing the investments and operations of the investment portfolios?

Remember: We have limited time as advisors and should be dedicating everything to our highest and best use. Any time spent on other activities is time that could have been used to grow your practice.

Side note: SEM Advisors who have decided to hire SEM as their OCIO have enjoyed tremendous growth in their practices. We are hosting a webinar series discussing the decision process and action steps these advisors went through. For more information click here.

Take Advantage of Our Help – Because you follow our blog, we gladly will help you with the above three bear market action steps. This initial help is done over the phone, has no cost to you, and provides a helpful orientation for you. Just click here to arrange this call with us.

For those wanting a deeper dive, here are some more thoughts on applying the two articles to your practice with details on how SEM’s investment management process can help:

Highlights from the Bloomberg Article: It is rare you see articles from mainstream media sources that are actually helpful for individual investors, especially ones showing up in a push notification on my phone. Ignoring the “valuations are back to being reasonable” advice from the 31 year-old advisor who couldn’t even enjoy a legal drink the last time we had a bear market declaring valuations are now back to being “reasonable”, here are the helpful tidbits from the article:

-

The losses in the 4th quarter give clients a real-world idea of how much risk you’re willing to take

-

Keep in mind the losses from September to December 24 were not even half of what you should expect in a recessionary bear market. If they were uncomfortable then, they are going to be VERY uncomfortable during the real bear market.

-

With the market recovering about half of the losses — now is the time to look for other options

-

-

“Diversified” portfolios aren’t really diversified

-

S&P 500 overweight a handful of tech companies (Microsoft, Apple, Alphabet, & Facebook)

-

High performing funds also overweight those same companies

-

Need to understand where the portfolios have overlap and more importantly what the DOWNSIDE correlation of the individual holdings are.

-

-

Bonds do not always offer protection

-

Very diverse asset class, with some as risky as stocks

-

The bonds that dampen the losses are likely not the ones most people own (because they weren’t returning much until recently).

-

-

Clients are 10 years closer to retirement than they were during the last bear market

-

Clients may not have the funds available to “buy more”

-

Clients may not have time to recover if they need to start taking money out.

-

-

Setting up a portfolio using “behavioral tricks” is a good way to survive

These are all things that should be reinforced during client review meetings. The most interesting point was the last one. Behavioral finance has been the buzzword in our industry since Richard Thaler won the Nobel Prize in economics in early 2017. Unfortunately, it is often misapplied and far too often comes down to, “tell clients they should expect losses and they should stick to their plan.” The Bloomberg article’s advice is one thing we’ve found in our experience of a behavioral trick that works — the bucket strategy, where you segment the portfolios into pieces they use now, soon, and later (or other variations.)

The knock on the bucket strategy from the academics is it is not “optimal”. Yes you may have some overlap in the portfolio and you may not have the exact perfect mix of assets, but “optimal” does not necessarily mean it is “best” for the individual client. Here’s a quote from a recent article from the CFA Institute.

But since clients do not grasp the purpose of each investment in the context of the overall portfolio, they are more likely to give up on the portfolio, or parts of it, in times of trouble. As a result, the best portfolio is not the optimal portfolio, but rather the one that the client can stick with through the market’s ups and downs. This means reframing the role of different asset classes or funds relative to the investor’s goals and sophistication rather than to volatility and return.

Lucky for you, by landing on this page you already have access to your own Outsourced Chief Investment Officer (OCIO) who can help you implement all of the recommendations in these articles. Let’s go back to the points in the Bloomberg list for preparing for the bear, but this time looking at ways SEM helps you structure your client portfolios:

-

Understanding true risk tolerance

-

With every proposal we generate we specifically highlight the expected loss and ensure it fits with the client’s true risk tolerance (most investment managers glance over this critical topic).

-

We can even create a Morningstar report showing the current portfolio risk expectations.

-

-

Develop a truly diversified portfolio

-

Downside correlation is one of the key metrics we study whenever we develop a trading system, investment model, or overall portfolio.

-

Our Morningstar portfolio reports will illustrate the area’s the client’s current portfolio is over (or under) exposed

-

-

True protection through the use of bonds

-

Buy & hold bond portfolios are about the worst thing somebody could have in their portfolio. Corporate bonds can lose 20% or more and Treasury bonds can be more volatile than the stock market. Our active approach to bonds allows us to allocate to a wide range of bond market segments based on where we are at in the cycle.

-

Even in our equity portfolios we have the ability to go to low-risk bonds if the longer-term trend shifts downward.

-

-

Portfolios that adapt to the market and the client’s specific situation

-

The goal of each of our investment models is to move money to the side in the early stages of a bear market so we have plenty of cash available to “buy more” when the bleeding has stopped.

-

Despite saying they will “buy more” most clients (and often their advisors) will do the opposite (sell near the bottom) when the real bear market begins.

-

-

Everything we do is centered around “behavioral tricks”

-

Using these “tricks” allows clients (and their advisors) to focus on their own personal goals and to ignore the inevitable emotional swings that occur during bull and bear markets.

-

Remember the difference between traditional and behavioral finance. Traditional finance tells people what they SHOULD do, behavioral finance adapts to what they WILL do.

-

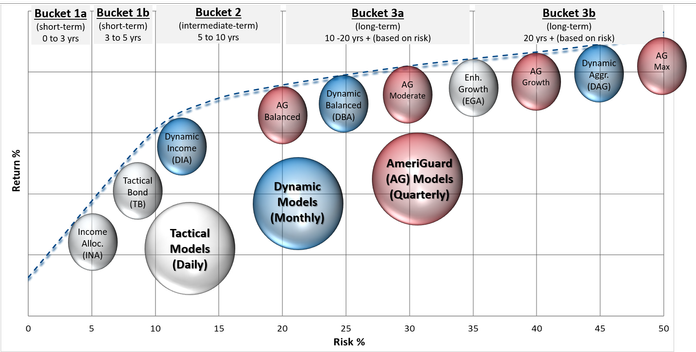

The chart below illustrates where our various investment models fall on the risk/return scale. Using these “building blocks” to create customized portfolios centered around the client’s financial plan, true risk tolerance, and investment personality is the only way to survive the coming bear market. The portfolios offer true diversification of asset classes, management styles, and time horizons. Most importantly each component has a well defined plan of how it will handle the various stages of the market cycle.

We have over 27 years of experience helping clients prepare for and then survive bear markets. Having more money available at the end of a bear market means we do not have to chase the stock market higher during bull markets. By creating customized portfolios using our Scientifically Engineered Models we help remove the emotions that far too often get the better of us. There is no such thing as an “optimal” portfolio. Instead you should focus on what is best for each individual client.

For your advisory practice, I want to leave you with a quote from the Bloomberg article:

“Our highest client acquisition periods are when the markets are getting murdered. We live for this.”

How do you want to spend your time during the inevitable bear market? Do you want to be fielding calls from clients urging them to stick to their investment plan? Do you want to spend your time analyzing each investment or money manager and trying to decipher whether or not it is providing the diversification you thought it would? Or do you want to spend your time acquiring new clients because you had already prepared your clients for the bear market?

If you would like more information on how you can hire SEM as your Outsourced Chief Investment Officer (OCIO), please let me know.