With the NFL playoffs in full swing our family’s favorite saying is once again in use, “you have one job!” This is most often said about the kickers who continue to miss extra points and short field goals, costing the rest of the team wins in too many cases. The kicker has one of the most thankless positions in sports. If they make a game winning field goal fans may remember for a day, week, or month. If they miss a field goal in a critical game they will likely be remembered for that one miss for years to come.

Looking at our investment model line-up, I couldn’t help but think of our Tactical Bond model as the field goal kicker of our team. It doesn’t get much glory and people will remember if it doesn’t do its job in key situations. The question is, what is Tactical Bond’s job?

Essentially Tactical Bond is designed to pull the risk of the overall portfolio down to a level that fits the client’s overall financial plan, true risk tolerance, and investment personality. Some clients barely need to use Tactical Bond (because they are so far ahead) while others rely on it heavily because their situation, risk tolerance, or personality requires it.

Overall, Tactical Bond can lose 5 to 10% from high to low, but considering buy & hold bonds lost on average 18% in 2008-2009 and the S&P 500 has twice lost over half its value in the last 20 years, a 5 to 10% risk range is one of the lowest you would see outside of a “guaranteed” type investment like an annuity or bank account. The trade off for the slight amount of risk is the potential for significantly higher returns as well as protection against the erosion of inflation. [I see too many clients being lured into the appeal of fixed annuities that are attractive now while inflation is low, but will hurt when inflation returns to a more normal rate.]

Other than cash, 2018 was a negative year for nearly all other asset classes. In a year that saw a 10% correction in 8 days early in the year, and then a 20% drop in the final 3 months, Tactical Bond did its job, closing the year down a little less than 1%. Earlier this week Cody posted an article discussing some of the moves our models have made to start the year, including a big change in Tactical Bond.

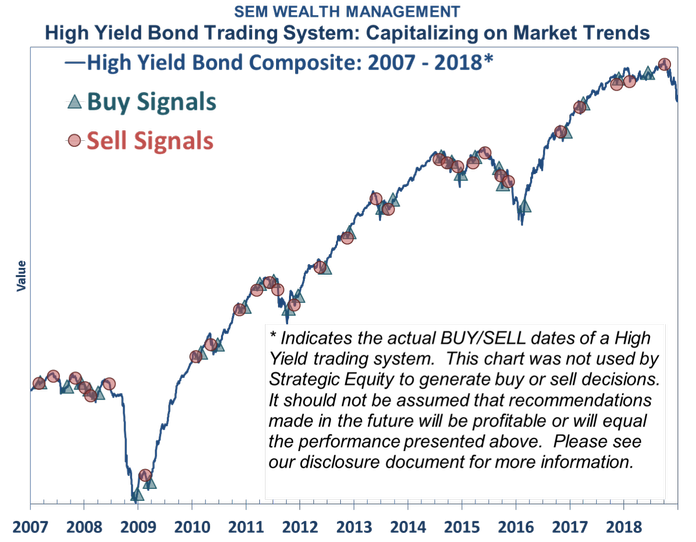

While the potential gains from this trade are not as attractive as 2016 or 2012, this week’s Chart of the Week shows the losses Tactical Bond avoided during the 4th Quarter. The chart also highlights the often thankless job Tactical Bond has — to chop off severe losses while looking for opportunities for strong gains. With hindsight all the green and red clumps of buy signals seem like a waste, but you never know when you’ll get a loss like the one we saw in the 4th quarter. Remember, while the high yield bond market was dropping, Tactical Bond was sitting safely in some low risk investments.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

For those clients that had Tactical Bond in their portfolios, the losses they had in 2018 were significantly lower because Tactical Bond did its job. We have other players on the team that are designed to capture more of the upside growth of the market. With the exception of Enhanced Growth Allocator, which gained 0.6% in 2018 all the other models lost money. This is to be expected. It is nearly impossible to capture a large percent of the upside without having some downside participation — especially early in a bear market (or during a normal correction, whatever this ends up being.)

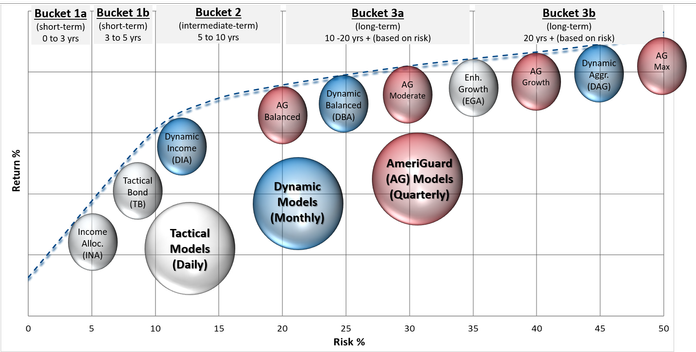

This chart, which I explained in greater detail in this video, discusses where each of the models fits.

If you’d like to discuss a specific portfolio, model, or our overall outlook, please let me know. Despite the gains since Christmas, 2019 could be an even tougher year than 2018. When you’re facing difficult opponents like this it is critical to make sure ALL of your players are ready for whatever situation may come up. Please do not neglect your field goal kickers — you never know when you’re going to need them to win the game.