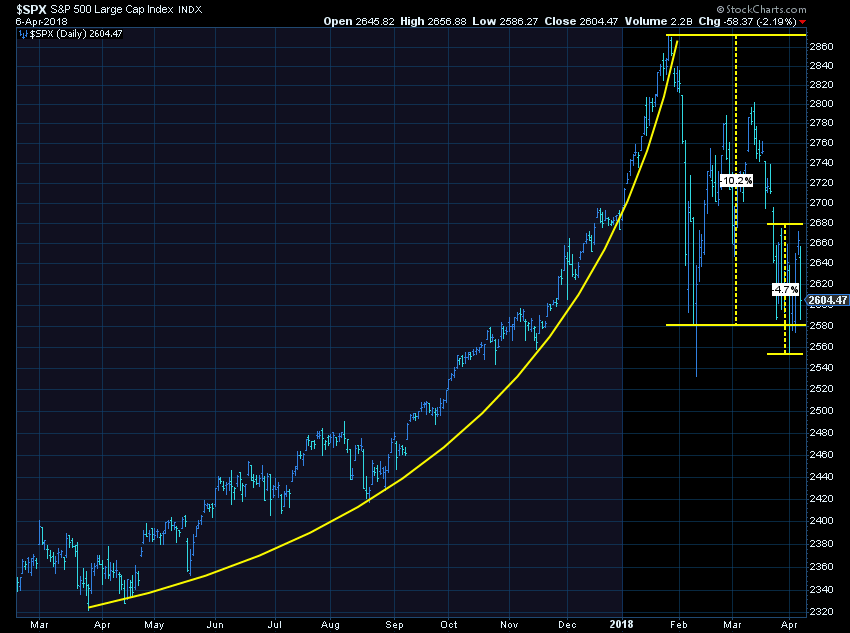

Despite the volatility of the news flow, the stock market made a parabolic move higher in 2017 and set records for the lowest level of price volatility on record. Since the beginning of February, the market has done what I expected when you have a president that tests policy ideas via Twitter without any filters from his staff.

For the past 5 days the S&P 50 has been in a 5% trading range with the direction set by whatever the latest “news” is on the President’s proposed tariffs. The market is looking to start the week higher after a weekend of positive spin from the Trump administration, especially Cheerleader-in-Chief Larry Kudlow, the newest addition to the Trump inner circle.

How the week finishes is anyone’s guess. As I mentioned last week, all of our programs were already defensive (see Slow & Steady) or took action to take some risk off the table. Whether it was our daily managed tactical systems inside EGA, our monthly managed dynamic systems, or our quarterly managed AmeriGuard programs, all see signs of additional risk, which hasn’t happened for us since the early days of 2016. This does not mean additional losses are coming, but it always causes me to raise a yellow flag for our clients and advisors given the long-term success all of these systems have had in navigating through difficult markets.

In cases like this it is best to ignore all the noise in the markets and re-evaluate your overall level of risk. Following the parabolic move in the market even the 10% drop from the highs leaves most investors with significant unrealized gains. If you found your portfolios having more risk than you were comfortable so far this year, it is still a great time to re-adjust into something that is more comfortable.