Precious metals have always been such a quandary. Certain TV networks, podcasts, and radio shows bombard the listeners about the benefits of owning precious metals. With the fears of "socialism" and "unlimited money printing" running rampant on those networks, we've found the interest in precious metals escalating in our client base.

I'm not making light of those fears. We do have to remember the networks live on advertising and often they find it in their best interest to cater to their advertisers. It can turn into a feedback loop where the viewer cannot help but believe the worst (this goes for all networks).

We have to take a step back and focus on the bigger picture.

The wisest advice I ever heard on how much precious metals somebody should own in their portfolio came from Art Cashin, the long-time head of trading at UBS. “just enough to bribe the border guards”.

The reasoning is there is not enough physical metal in the world to cover all the paper currency. If the US dollar loses too much value we will see global chaos. Getting physical metals out of an IRA will be close to impossible, so the only way to have a true hedge is to hold coins in a safe at home (not a bank deposit box). That of course is not possible in an IRA, which is where most people hold their assets.

We’ve tried for two decades to find systems to heavily utilize precious metals. Every time the returns do not justify the high risks. We do see precious metals show up occasionally in EGA and even INA (5-12%) if all other assets are trending lower. Most of the time there are more attractive assets even if the market is worried about high inflation.

The academic role precious metals plays in a portfolio is the non-correlation to other assets.

We created Dynamic Asset Allocator (DAA) to fill this role. It holds around 20% in “market neutral” funds, including those that invest in precious metals (as well as going short different assets at different times). The rest of the model follows our economic model with the difference of it will be long one category and short another, keeping market exposure between +20% to -20%.

It can also invest in INVERSE Treasury funds, which theoretically would rally at the same time precious metals would rally. With our economic model currently at “neutral”, we aren’t there yet, but are close.

[Side note: Dynamic Income will also have around a 10% position in inverse Treasury funds when the economic model indicates rapid growth. Tactical Bond utilizes high yield bonds, which theoretically would benefit from a rising inflation environment since it would allow these highly leveraged companies to pay back their debt with lower valued dollars.]

I’ve always described DAA as a transparent, cheaper, hedge fund available to all investors. It is difficult for most to understand, so we typically reserve using it for the more sophisticated, higher net worth clients. We also tend to cap its use around 10-20% of the overall portfolio.

You can view the factsheet for Dynamic Asset Allocator here.

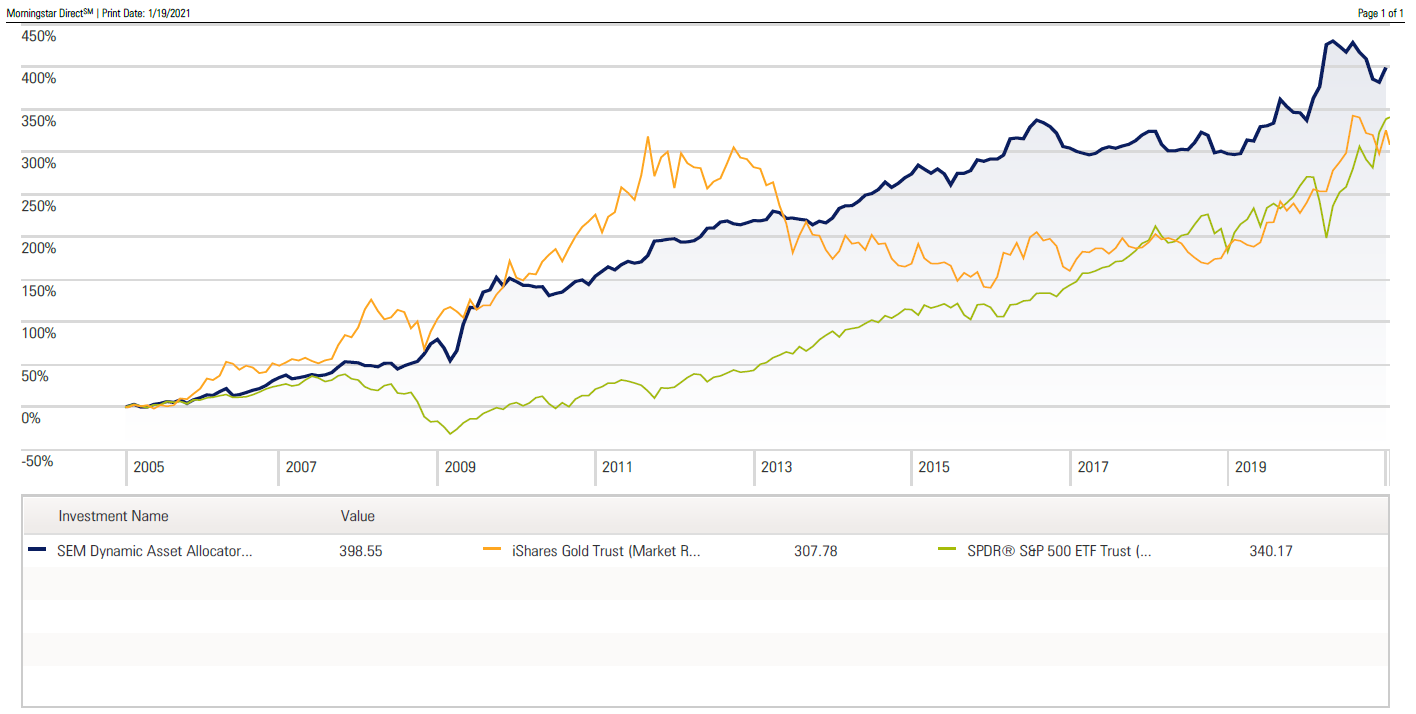

Here's a chart comparing DAA (blue) to IAU (orange) (the iShares ETF which owns physical gold) and SPY (the S&P 500 index) going back 15 years. I'm heavily biased, but I would argue DAA has a higher "hedge" against uncertainty than gold.

When I looked at correlations, DAA actually provides a slightly better hedge against the S&P 500 (-0.20% correlation) versus IAU (0.14% correlation).

I realize this doesn’t provide the psychological “benefit” of having pure precious metals in the investment portfolio, but I wanted to provide the research and thought process we’ve gone through at SEM.

What about cryptocurrencies?

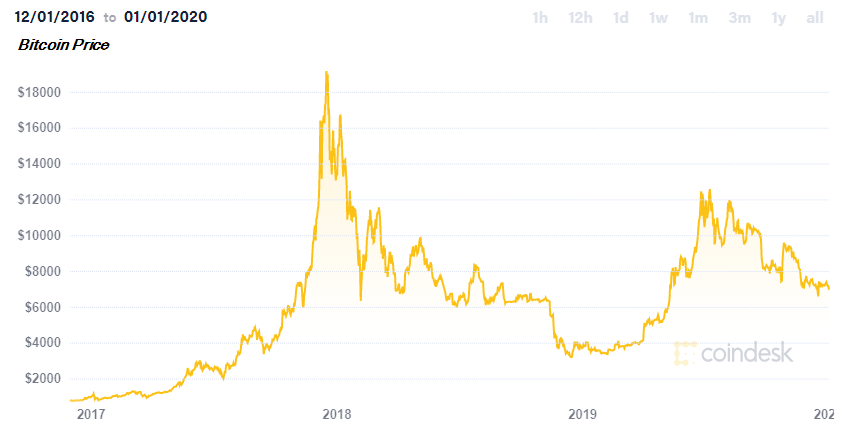

Precious metals and cryptocurrencies such as Bitcoin do not belong in the same category. I know there are big believers out there, but we didn't hear a lot about it when it lost 83% of its value in 2018 – yes you read that right. Everybody was excited about Bitcoin at the end of 2017 when it went from just under $1000 to over $19,000 during the year.

It's now back well above that, which has left may people afraid they are missing out on the next big thing.

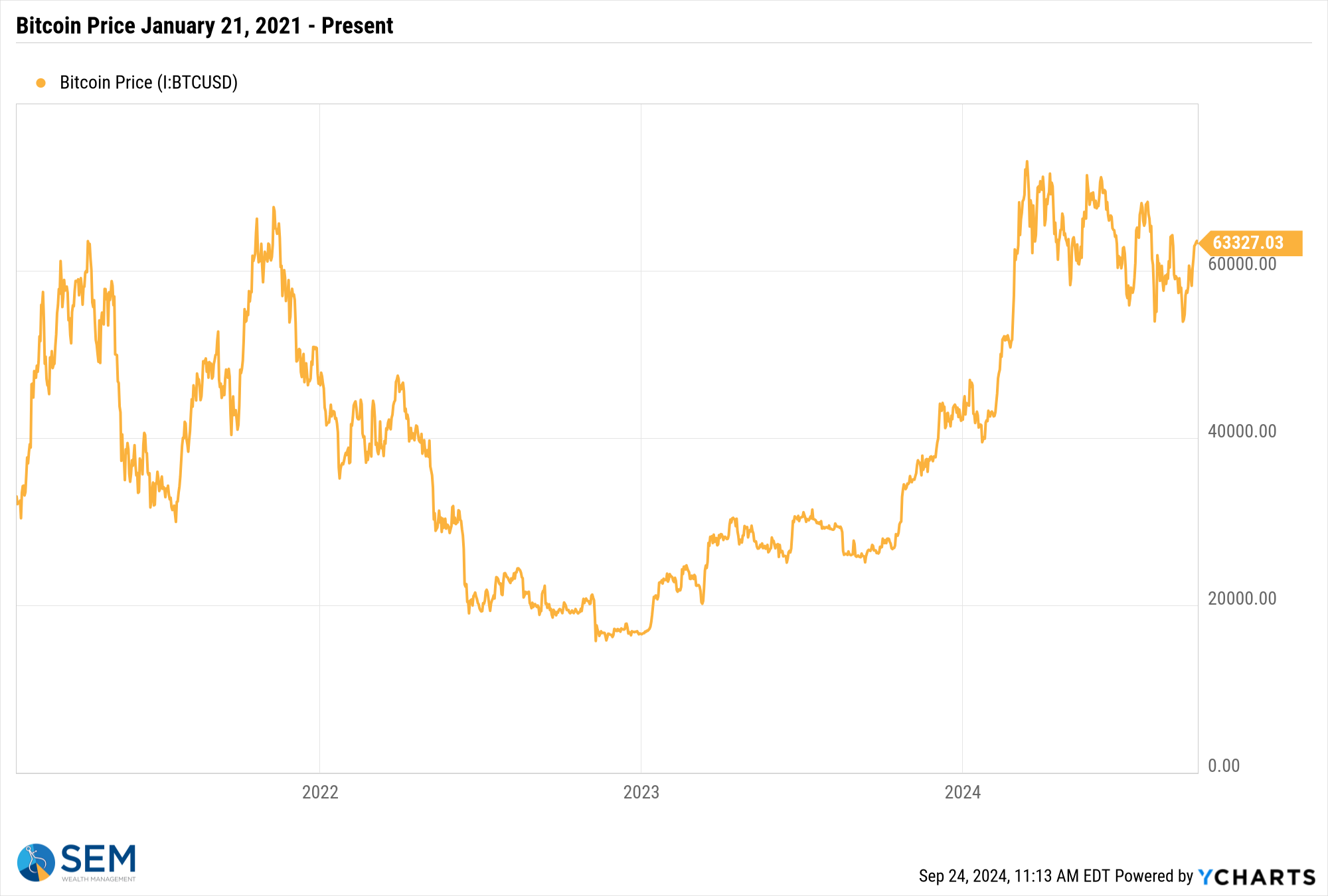

This post was written January 2021. Here's a chart showing the price of Bitcoin since that time. It nearly doubled after the article was first posted, then lost over half its value, it then rallied again, only to lose 2/3 of its value. The 2023-2024 rally again brought interest in speculative assets. It is clear that 3 years later this is nothing more than a gamble.

I won't go into all of the details, but the technology behind cryptocurrencies, blockchain, is supposed to be a game changer. Every financial institution in the world is investing in this new, more secure way to conduct transactions. Whether that will be in Bitcoin or some other cryptocurrency is literally anybody's guess. There is nothing stopping the US government from creating their own digital currency.

From an investment standpoint, it is certainly not a substitute for cash and other short-term investments. You simply can't have money you may need in the short-term in something that literally could lose 10% or more in one day.

The CFA Institute puts it somewhere in the "collectibles" category. You literally cannot value it. It is worth what people are willing to pay. If people suddenly decide it's not worth anything, you lose all your money. If they suddenly decide it's worth $50,000 you make a lot of money. There is no tangible value behind it to base any sort of fair value on it.

I put any cryptocurrency in the "top of the pyramid" basket. This is the place for money you absolutely do not need for your financial plan to work. It is gambling and you should only use money that is not part of your long-term plan to invest in it.

I always challenge somebody who wants to put a significant amount of money into a cryptocurrency to describe to me in layman's terms what it is, how it functions, and what you actually own. If you cannot do that, you should not put any money you cannot afford to lose into these digital "assets".

If it works out, great! You now have even more money. If it doesn't, chalk up your losses and move on.

The reason I ask these questions is if you are not completely convinced about what this digital "asset" really is and why it is so "valuable" than the next time it loses 20 or 30% you are likely to "cut your losses" and miss out on any potential upside. The future looks bright when it's going up, but dire when it's going down. It's simply human nature.