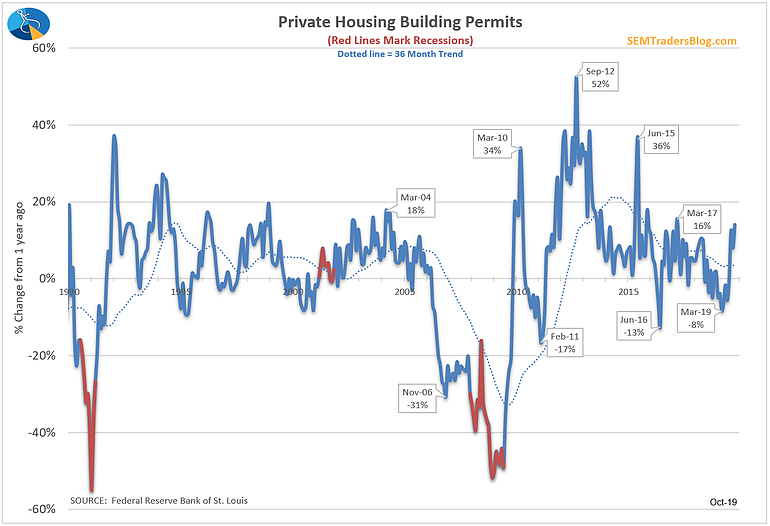

I've often said if I had to pick just one Leading Economic Indicator it would be Building Permits. If you've ever bought a house you know first-hand how much you personally stimulate your local economy. If it was a new home you've already provided jobs to the contractors and the suppliers, demand for raw materials, and all the other related entities and individuals who make money off your home purchase. Then there is the new furniture, window coverings, appliances, electronics, and landscaping purchases that significantly increases the money you spend (and the stimulus your home purchase provides.) Not only that, people do not buy homes unless they are confident in their personal economic outlook. If more people are buying homes, they are more comfortable with their finances, and thus going to be more open to spending money.

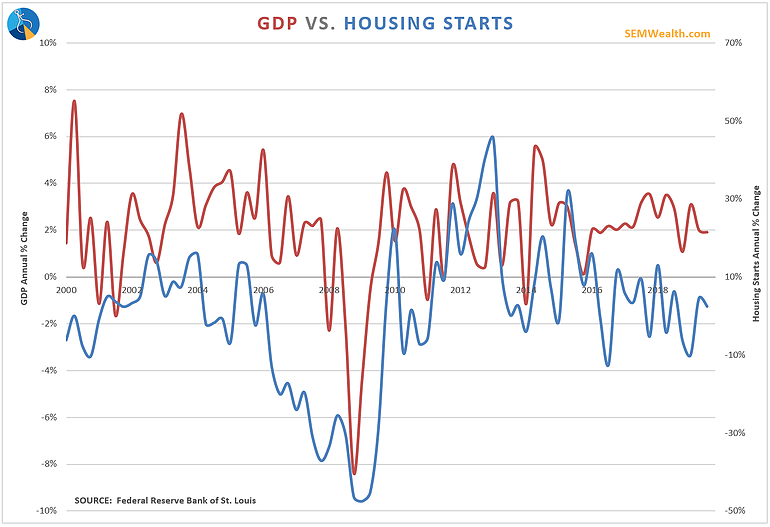

The data shows the correlation between Housing Starts (Blue Line) and Economic Growth (Red Line). While not perfect, you can see how both tend to follow the general direction.

While Housing Starts is slightly leading, Building Permits is a leading indicator of Housing Starts, which makes it a key component in SEM's Economic Model. The last two months we've seen strong increases in Building Permits. This means builders are confident they will be able to sell their houses, which is typically a good sign for the economy.

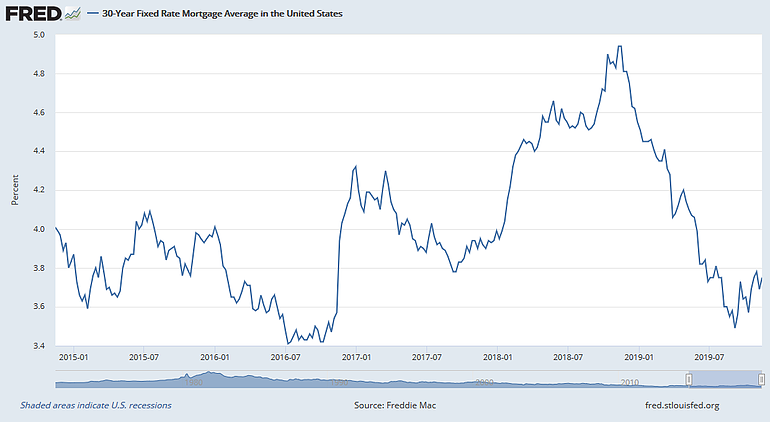

Now the problem --- Since September we've seen the Federal Reserve give the market overwhelming confidence they have removed any prospect for a recession. That doesn't sound bad, except we've seen 10-year Treasury Bond Yields skyrocket from a low of 1.37% to as high as 1.95% (they are now around 1.7%). Mortgage rates have also climbed significantly off the lows. Granted they are still well below the peak from late 2018, but homes are becoming more expensive.

People forget the Fed only controls short-term interest rates. Often we see the Fed's manipulation of short-term rates cause the opposite reaction in longer-term rates. Long-term rates fell to their lows because they are based on the overall economic outlook. Each time the Fed cuts rates, the market participants become more confident we won't see a recession, so long-term rates go up. This is not what the Fed was hoping to accomplish so it will be interesting to see how they react in the coming months.

As for our systems, in particular our Dynamic Allocation models which use this in our allocation decision, so far the strength in Permits would not be enough to get us off the "bearish" allocation we've been in for nearly all of 2019. We need to see other indicators show signs of strength and the move in permits to last for a few more months.