The aftermath of a parabolic move

2017 was a record breaking year for the stock market in terms of volatility (or lack thereof). This led to money flooding into stocks to start 2018 as the expectation for more calm ahead drew money away from other lower risk asset classes. The massive influx of cash sparked a nearly parabolic move for stocks in January. In February & March investors learned a hard lesson — when stocks experience abnormal returns they could quickly reverse the other direction.

Despite going through two large corrections in February & March, the stock market finished just below where it started the year. The large swings may lead to even bigger swings in the months ahead as investors question the stability of the stock market.

The car in the median

During the 10 day 11% market correction in February many people asked me why the market could fall so far so fast. Here’s the analogy I used:

You set off on a road trip. Your top priority is getting to the destination safely and in a timely manner. After a while, you may decide to push the speed limit. You push it up to 5 mph over the limit. You don’t see any cops or any accidents. People keep passing you so you go up to 10 mph over the limit. Again you see no cops or accidents and again people are still passing you. You then tend to reason with yourself, “everybody else is speeding,” or “I’m just keeping up with traffic.” The problem is you KNOW you shouldn’t be speeding. You KNOW it’s unsafe, but you’re brain has rationalized you violating these KNOWN rules.

However, the second you glimpse a car in the median, your brain immediately panics and causes you to hit the brakes. Whether it was a cop or not, your brain reacted back to what you KNEW you should have been doing. If too many people are speeding along and too many people hit the brakes, it could cause a chain reaction accident.

What sparked the sell-off was the equivalent of a “car in the median” that may or may not been a cop. All the people that increased their speed 10, 15, 20 mph the last few miles immediately panicked because they KNEW they should not have been taking the risk they had added to their portfolios the past few years.

Like on a road trip, the most important part of investing is getting to the destination safely. SEM’s Scientifically Engineered Models are designed to help you do just that.

Predicting the next crisis

One of the most common behavioral biases in humans is “representativeness” bias. As Nobel Prize winning economist Dr. Daniel Kahneman described how our brains our programmed to work it is easy to see why this is the case — our brains are generally lazy and want the easiest, quickest answer. When dealing with a difficult situation, we want to make the solution and next steps easy to understand. Representativeness bias is one example of a heuristic (mental short-cut) we use as we seek to find a situation that looks similar to the current one and use it to predict the future.

When I describe this market as a bubble people look at me like I’m crazy. They point to the P/E ratio now versus 2000 or the fact housing prices have not heated up across the country. Besides hindsight bias (believing the past bear markets were predictable) they were trying to predict the next crisis by comparing it to past ones. What nearly everyone fails to understand is bear markets do look very similar — in price action, but the SOURCE of the bear market is rarely the same. The reason the price action looks similar each time is due to the collective behavioral biases of the market participants.

If you do not understand that last sentence, you are doomed to expose yourself to the emotional swings the market will inevitably bring. That sentence is the primary reason SEM has survived the last 26+ years and has developed a platform for our advisors and their clients to help overcome the collective biases of the market participants.

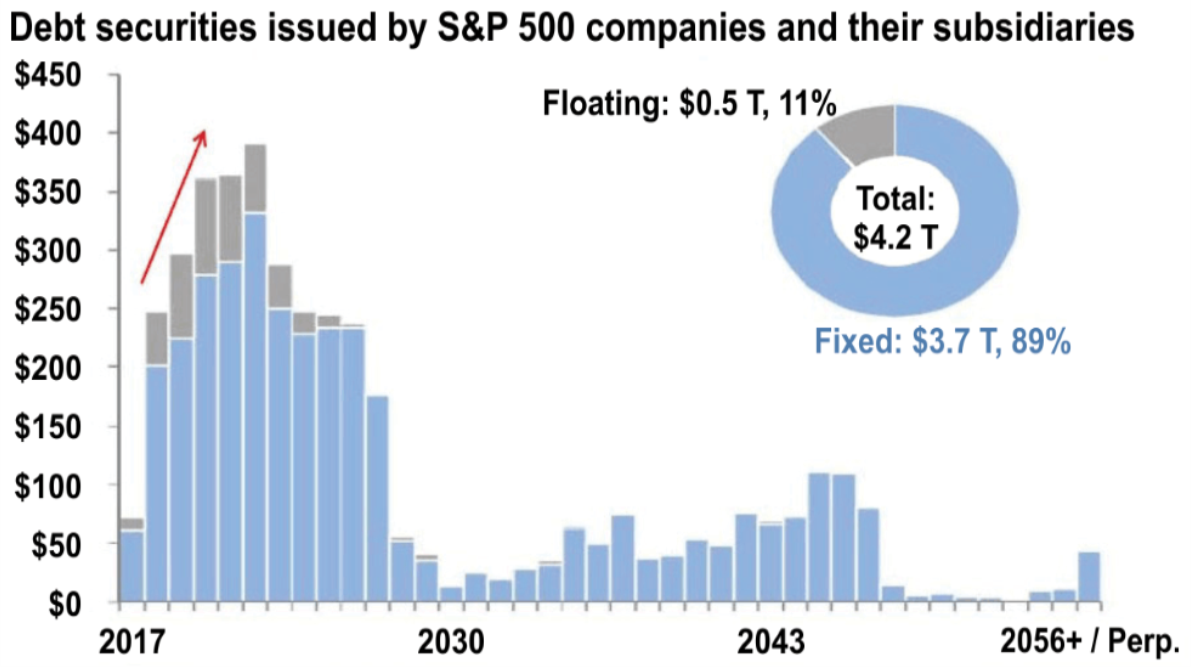

So what might bring the next crisis? I think if we look at what caused this market bubble the last 9 years it is easy to see. The Fed “stimulated” the economy by encouraging borrowing. This hasn’t led to runaway mortgages, but instead runaway corporate debt. For years I’ve lambasted corporations for borrowing money not to invest in capital improvements, but instead to increase dividends and buy back shares. This helped to give their stock a short-term boost, but now with interest rates already moving higher and the Fed likely to keep pushing them up, corporations are facing a serious problem — all that debt they issued is coming due.

Corporations do not have the sales boost capital improvement projects would have brought. Instead they have restless shareholders used to the boost of rising dividends and share repurchases. This chart shows the dire situation the S&P 500 corporations are facing over the next few years.

With interest rates rising rapidly and already significantly higher than when the debt was issued, the refinancing of this debt could have serious consequences on earnings. After 10 years of steady earnings increases, this could have dire consequences for buy & hold investors in the stock market.

Whether this occurs this year or not, SEM is ready as we always have been to use our Scientifically Engineered Models to manage around the behavioral biases of market participants, our advisors, and their clients.

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.