Pillars of the Rally

The market has staged an impressive rally over the past year. The first quarter saw a mass increase in risk tolerance as we saw large moves in many investments. We have to remember the market is always looking toward the future and is expecting a multi-year expansion of our economy. Their rosy outlook is based on the 4 items in the graphic below.

When investing it is critical to look towards the future. This means asking, “what could go wrong?” While we have enjoyed the gains over the past year in our accounts with many of our models still heavily invested, there are many things that could go wrong. If there are any cracks in the pillars, the high current valuations could lead to very large losses as the market resets its expectations.

We covered all of this and more in our Post-COVID Outlook webinar in mid-March. You can watch the replay here.

No risk in sight?

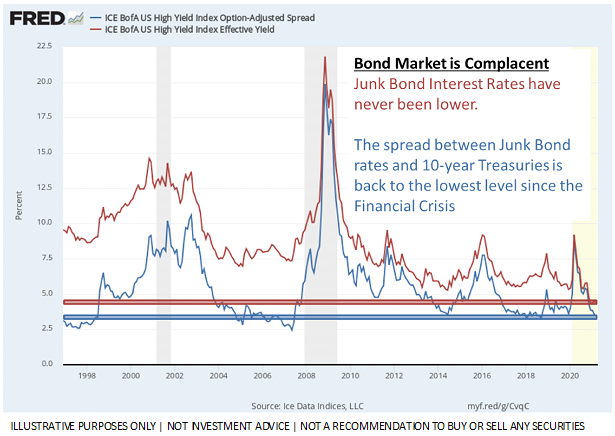

A year ago we wrote about the big opportunities ahead in high yield bonds. Yields and the spread between high yield (‘junk’) bonds and Treasury bonds had hit levels which historically meant strong returns for SEM’s Tactical Bond (TB) and Income Allocator (INA) models.

The combined efforts of the Federal Reserve and Congress to throw unprecedented amounts of money at the problem stopped the sell-off in all risky assets, including junk bonds. Our trading systems pivoted quickly and moved from low risk to higher risk bonds. This led to some very nice gains in both TB and INA over the past year.

Now looking at the chart of junk bond yields and spreads we must dampen our expectations for the near term. Bond (and stock) investors have priced risky assets as if there were no risks in sight. We of course know when that feeling is prevalent the chances of large losses are significantly higher. Bond yields and spreads can certainly move lower (which would cause prices to rise), but history and our experience tells us we are near the end of this cycle.

This is normal for TB and INA. When yields spike, they often make well above average gains. When the cycle nears the end, they wait patiently for better opportunities. No amount of stimulus from the Fed or Congress will change this cycle. When the next spike occurs, we will be ready to pounce again.

We will be watching the high yield bond market closely. We’ve been trading high yield bonds since the 1990s and have found it to be one of the best indicators of pending problems in both the stock and bond markets. As always, for current market and model updates, follow TradersBlog.SEMWealth.com

Control your emotions

If the last year taught us anything it was there is always something lingering that nobody expected. How we react to the unexpected plays a critical role in our ability to achieve long-term financial success.

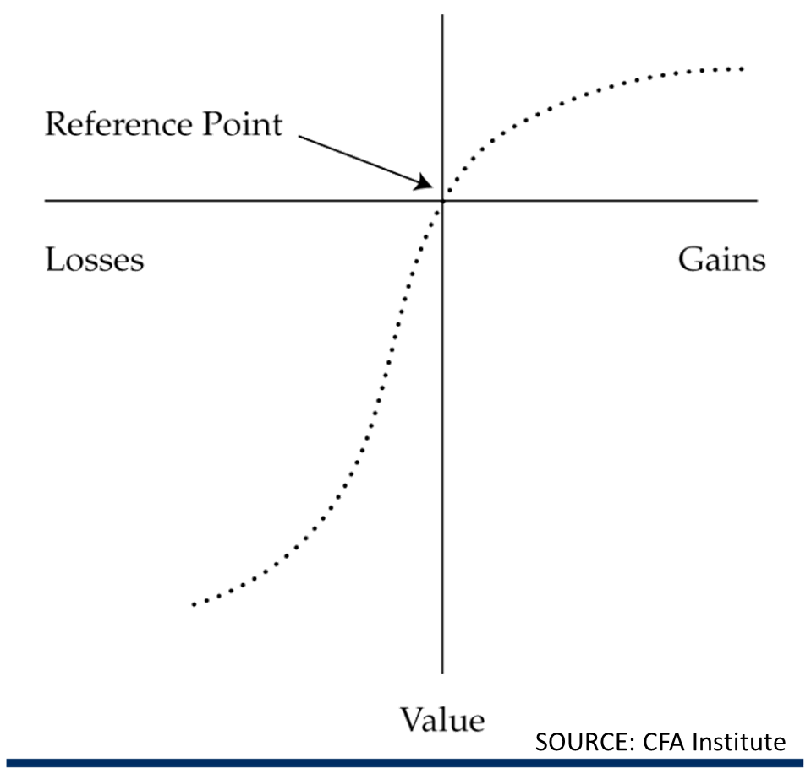

Our brains are fascinating. How humans process information is one of the things that makes each of us unique. There are several things most of us have in common:

- We think in dollars not percentage points

- When we see a dollar value in our account, we remember and "own" that value

- We experience stronger emotions when we lose money than when we make it

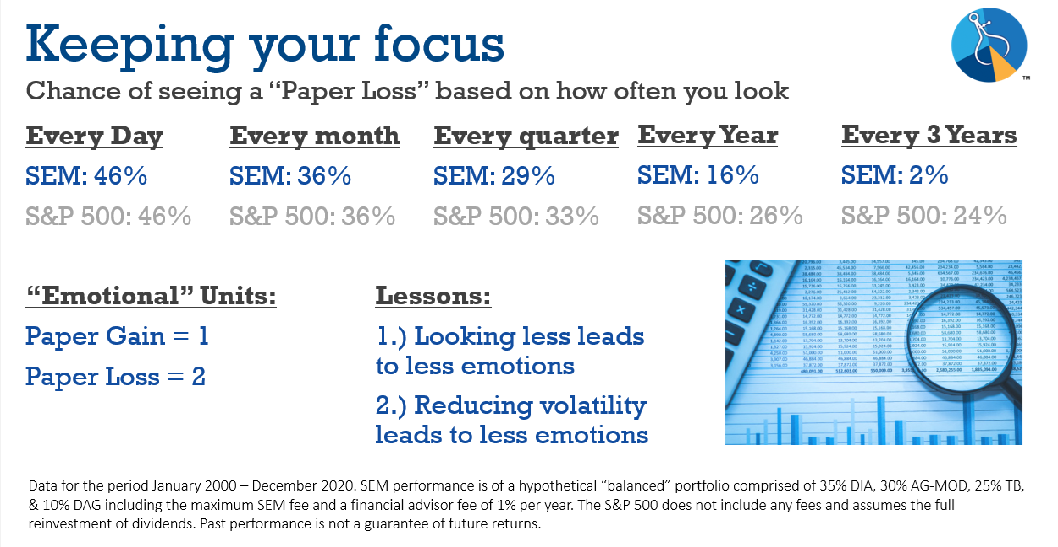

Combined, these three traits play a key role. As our account values grow, a 10% drop in value turns into a much larger dollar amount. The more often we are looking at our account values, the more likely we are to see larger dollar losses. Because losses hurt about twice as much as the joy we feel from gains, the emotional toil could lead to the desire to make changes in your investment allocations.

As part of our Behavioral Approach, I often share this slide with prospective clients. There are two key takeaways — the more often we look at our accounts, the higher the chances we will see a “loss”. Second and more importantly, SEM’s Behavioral Approach has historically reduced volatility, which leads to lower chances of seeing a “loss” compared to an S&P 500 index investment.

We encourage all clients to periodically go to Risk.SEMWealth.com. This allows us to assess your current investment strategy relative to your financial plan, cash flow strategy, and investment personality as well as help you set expectations for your investment portfolio.

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.