Nowhere to hide

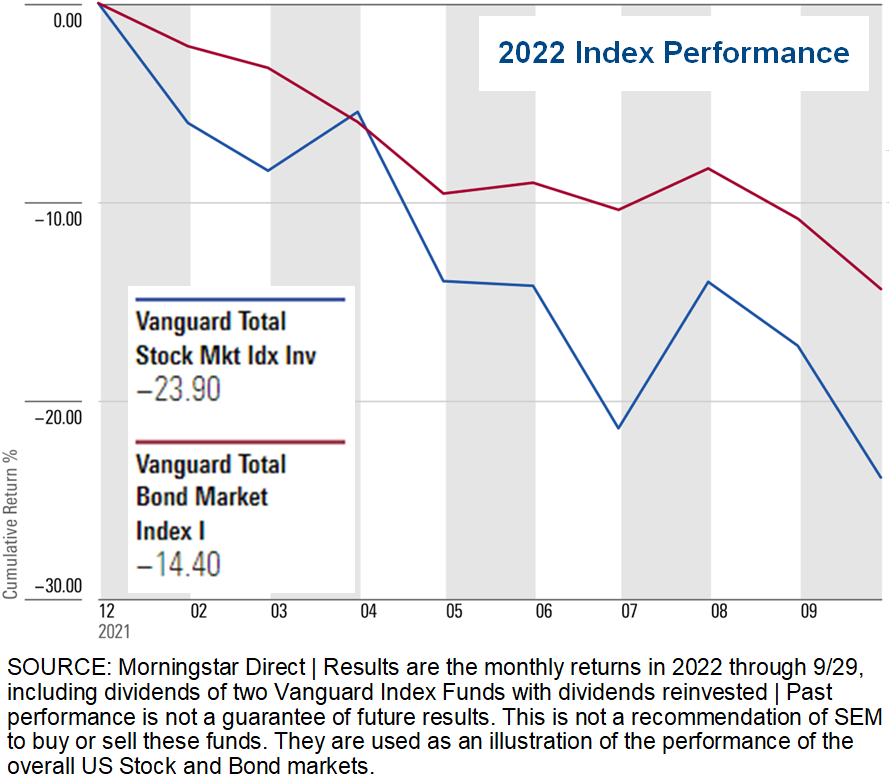

If we were to cover all of the various things which moved the market this year—why they happened, what it means for the future, where we see things going, this newsletter could be dozens of pages. Instead, this chart sums it up. Stocks and bonds are both declining, something which has not happened for this long since the 1970s. For over 30 years our data driven approach has helped us navigate all types of markets. The markets are moving quickly. We will continue to watch the markets daily and adjust accordingly.

How bad can it get?

A year ago we wrote about the many questions facing the market. It is probably hard to remember, but back then seemingly every asset class was rising, and it was a surprise when the market was lower even for one day. Our main concern back then was whether or not the economy, which benefited from massive stimulus in 2020 and 2021 via both Congress and the Federal Reserve could stand on its own. We also pointed out how the market was significantly overvalued when compared to historic norms.

Our core belief is human behavior drives stock and bond prices. Due to our natural behavioral biases, we will see overreactions in BOTH directions. This leads to strong bull markets which go up too far, too fast relative to the underlying fundamentals, followed by strong bear markets which go down too far, too fast relative to the underlying fundamentals. The market was long overdue for a bear market.

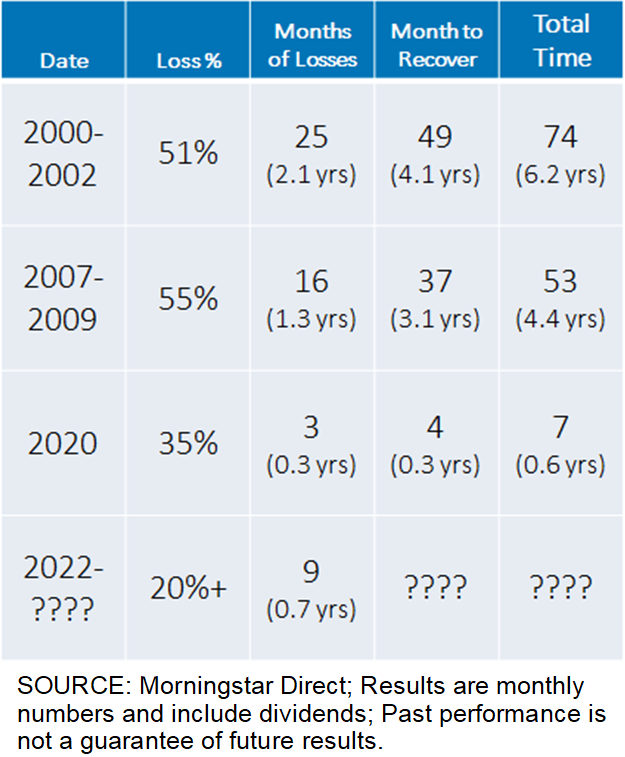

The question now is how bad will it get and how long will it last. The table to the left looks at the past three bear markets. Going back to 1900 research from Ned Davis Research (NDR) shows the average bear market sees a decline of 27% which lasts nearly 12 months. Breaking it down further NDR found a stark difference between bear markets which included a recession and those which did not. With no recession, the average loss was 25% over 8.5 months, but if a recession also occurred, the average loss jumped to 42% and lasted for 19.2 months.

Surviving a Bear Market

On the surface, all bear markets are caused by different things. Most of us remember the tech bubble bursting or the financial crisis created by the housing bubble which leads us to compare the current environment to those past two bear markets. When we find things that are “not as bad as back then”, our brains are programmed to believe the market will not be as bad as those past bears. This is a mistake.

In fact, all bear markets are caused by the same thing — human emotions. This means we can follow a data-driven approach to help us monitor the bear market because humans naturally make predictable mistakes. It doesn’t mean we can miss all of the downside and jump back in when the market has reached a bottom. It does mean we can take steps to structure our investment portfolios to survive a bear market. This allows us to take advantage of the bull market on the other side.

Knowing bear markets are an inevitable part of investing, there are three things you can do to help survive a bear market:

- Know your true risk tolerance – go to Risk.SEMWealth.com to take our short risk and objective questionnaire.

- Review the impact of a bear market – We are firm believers in financial planning and using that as the basis for all investment decisions. Most financial plans can be put through a stress test to see if a bear market dramatically changes your plan. If you do not have access to this or want a second opinion, let us know at SEMWealth.com/Contact and we can assist.

- Develop a plan for any portfolio adjustments – It may seem like it’s too late to sell anything with the market down so much, but all bear markets bring counter-trend rallies. In fact, according to Ned Davis Research, 47 of the 50 biggest stock market rallies occurred inside a bear market. Based on history, we should expect several 10-20% rallies before the bear market reaches the ultimate bottom. If you have too much risk in your portfolio, the time is now to develop a plan.

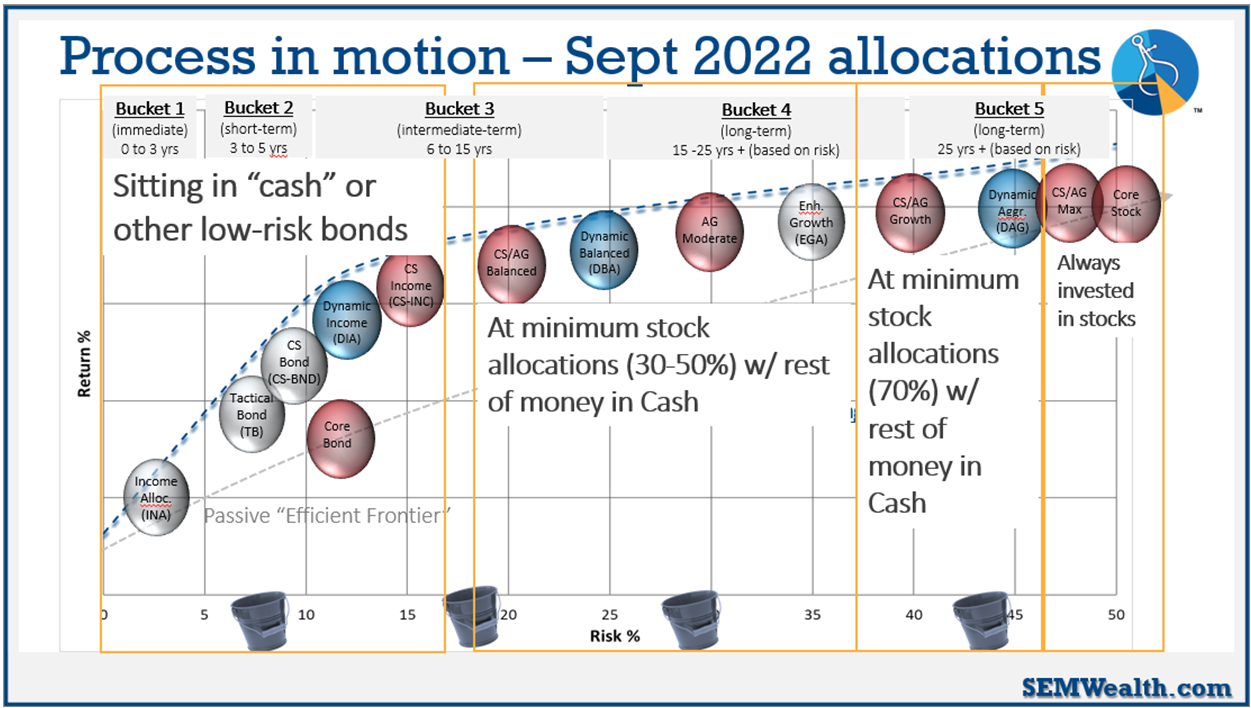

If you are an SEM client, know we have already taken action throughout the year to survive this bear market. We are proponents of a “bucket” system which places money you need sooner in lower risk investment models. This leaves longer-term money in higher risk/higher potential return models. The illustration to the right highlights how we are positioned across our buckets. The key is we have a plan no matter which way the market goes next.

In case you missed it, please watch/read our Navigating the Bear post:

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.