The third quarter is in the books and like the past two we saw stocks and bonds declining. Even inside of a bear market we should see a bounce. As we've been warning throughout the year, just because the market is able to rally it doesn't mean the bear market is over. We are in an environment most people have not experienced.

Our third quarter newsletter was posted last week. If you want a quick snapshot of what happened, how we responded, and what to focus on going forward, I'd encourage you to check it out.

My speaking schedule is quite full this fall. This gives me a chance to hear from other advisors about what is on their mind. I always learn a lot from the questions that come up after my presentations. There is clearly concern about inflation, interest rates, the economy, and the investment markets. At the core of all of this is the Federal Reserve.

Pretty much my entire career, the Federal Reserve has been tinkering with the markets and economy. It started in 1998 when the Fed had to semi-secretly bailout the Wall Street banks because they had loaned way to much money to a hedge fun who was heavily leveraged to the Russian currency. Since then we've seen the Fed "stimulate" any time the economy went down, keep the stimulus far too long, create an asset bubble, and then have to pull back the "stimulus". Even inside of an asset bubble in 1999, the Fed stimulated over fears Y2K was going to cause big disruptions and then started the market crash when they pulled it back out in early 2000.

We saw this again in 2003-2007 and several times in 2010-2019 when the Fed jumped in at every minor hiccup in the markets. In 2020, they then fully implemented the "Helicopter Ben" research paper that said during a crisis the central bank could literally drop money from a helicopter to keep the economy and financial system functioning. What Helicopter Ben (and Alan Greenspan, and Janet Yellen, and now Jerome Powell have no idea how to handle is how the Fed can get out of these policies without cratering the financial system/economy/markets.

This is the environment we are dealing with today.

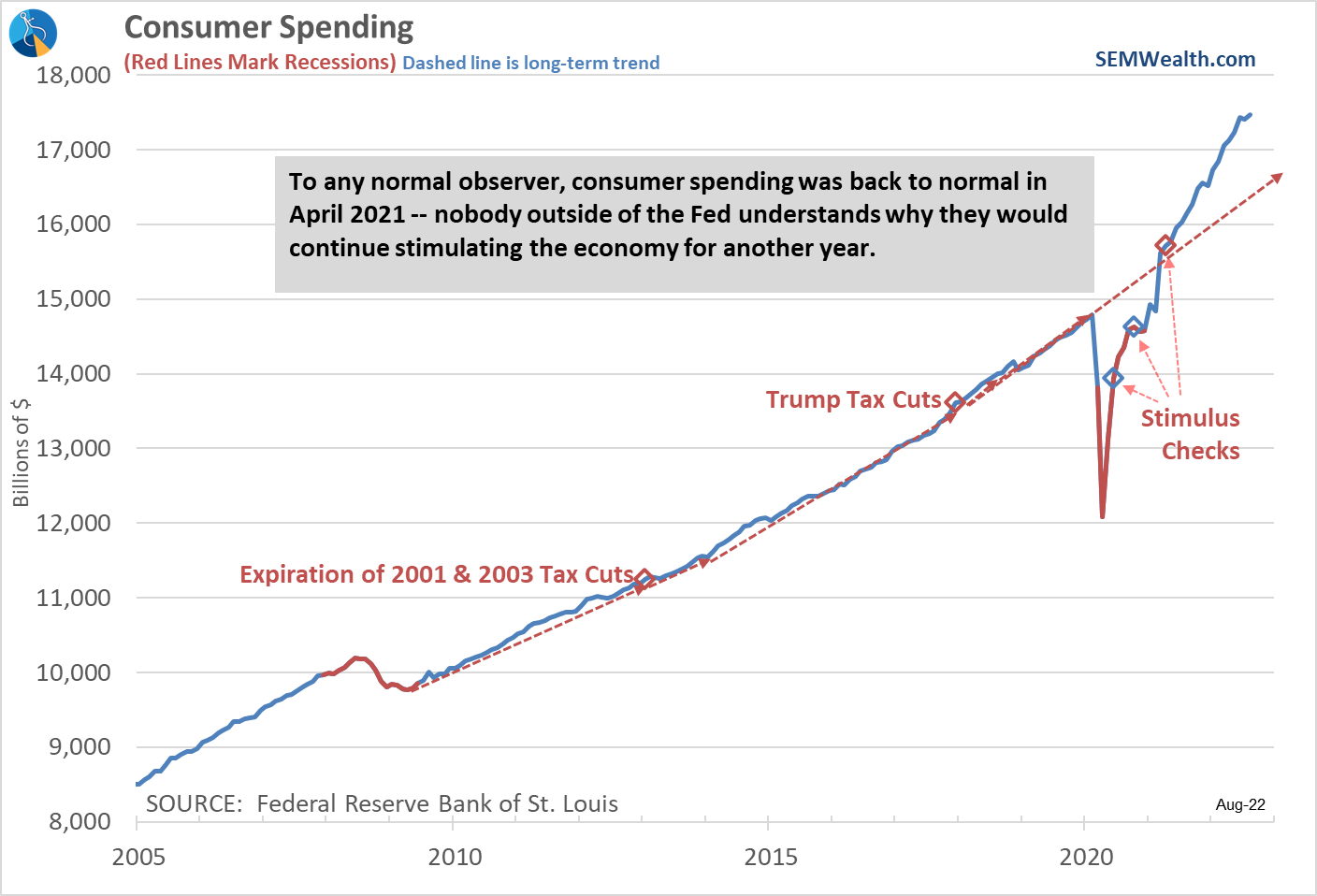

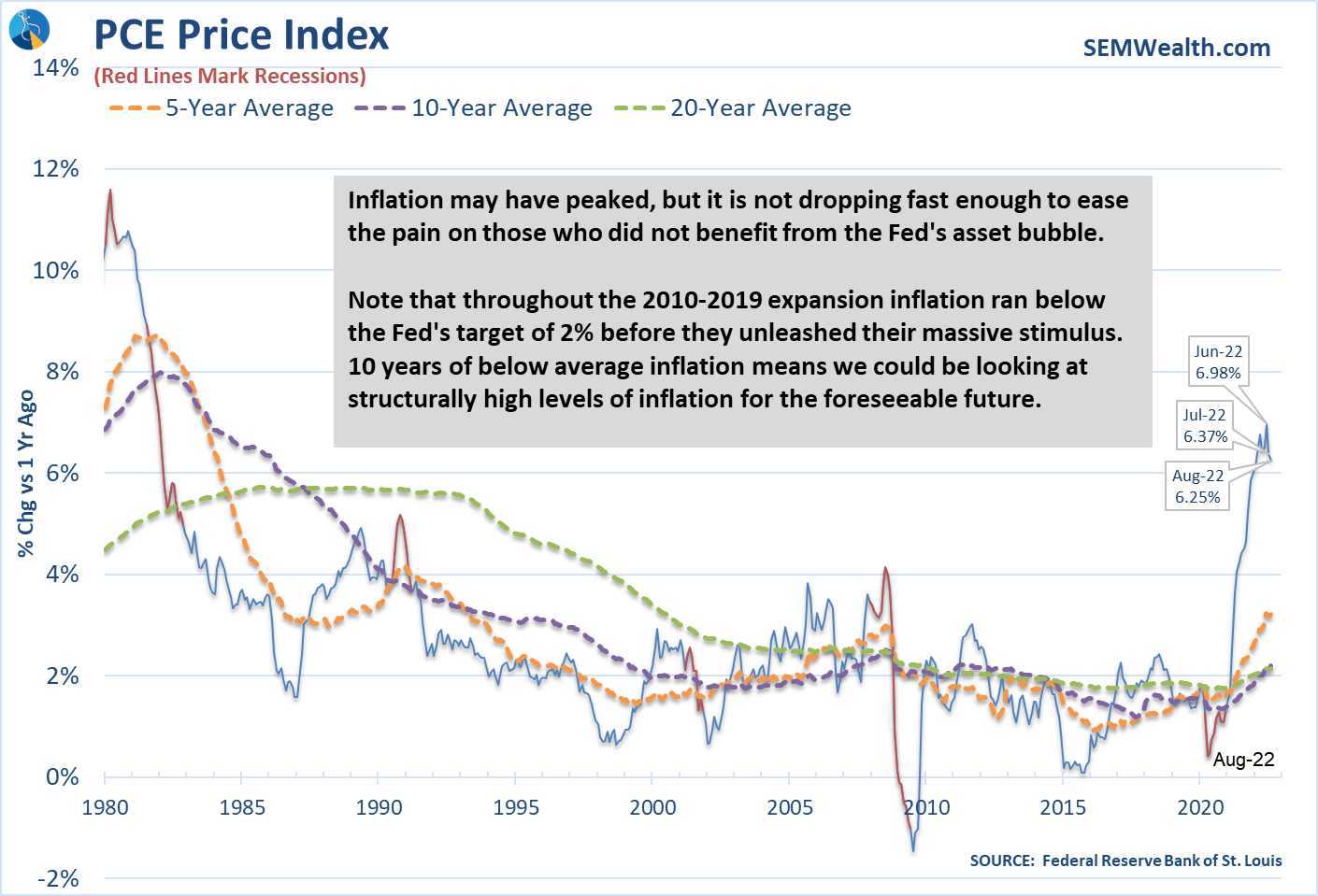

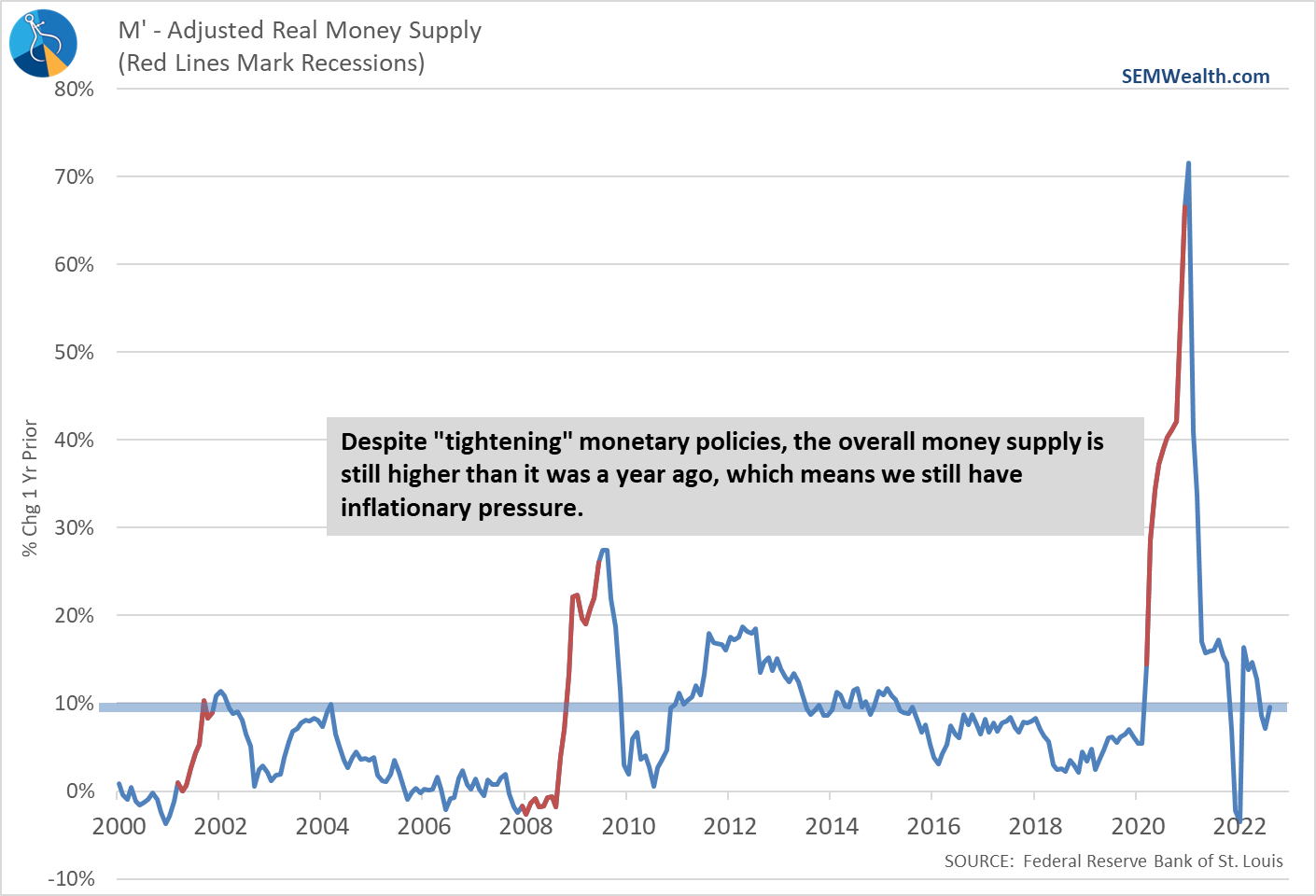

Too much money in the system created too much spending. This led to disconnects in the supply chain, which led to inflation. The Fed thought this would be "transitory", but they were wrong. This led to inflation becoming more entrenched in our economy as businesses saw all of their input prices going up, which led to them deciding they had to pass this on to their customers. This of course raised prices for other businesses, who also passed it along.

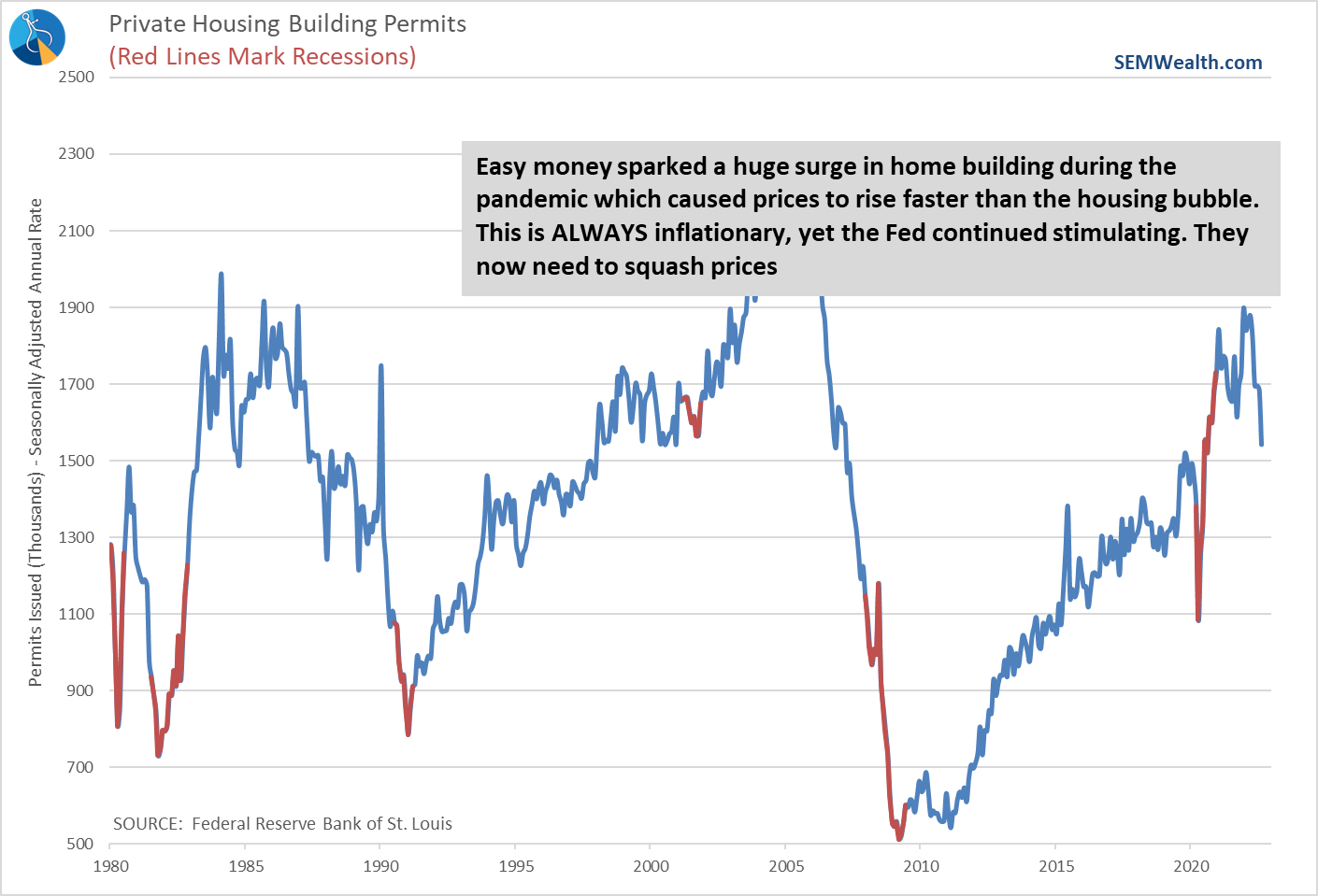

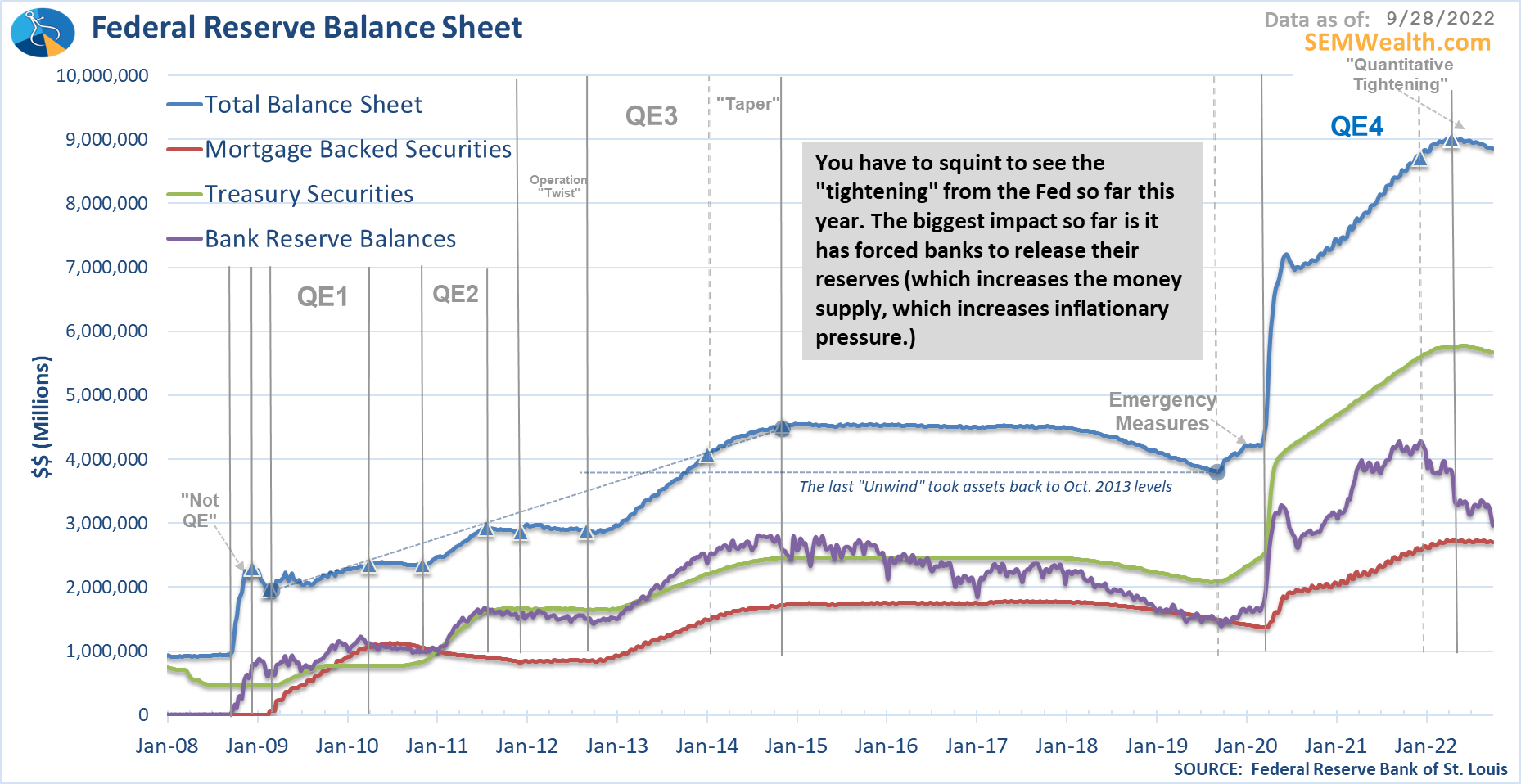

The Fed's tools are designed to encourage more risk taking when the economy is slowing, which if left for too long turns into speculation. On the other side, their tools can only discourage risk taking to squash the speculation. The problem is, a lot of the speculation the Fed encouraged cannot be quickly reversed. When the Fed decided to buy any income security with a CUSIP in 2020, this allowed junk/zombie companies to refinance their debt, allowing them to stay in business for a few more years. This allowed private equity companies to borrow money for 5-10 years at basically 0% interest. They then drove up asset prices with their massive purchases. This allowed home owners to borrow money at historically low levels, who with the extra cash from three rounds of stimulus checks drove housing prices faster than we saw during the housing bubble.

Those companies who were on the verge of failure in 2020 have no incentive to become more efficient. Those private equity companies can absorb a year or two of weaker growth because they are still flush with so much cheap cash. Those home owners locked in their mortgages at levels which allow them to handle an economic slowdown.

The problem is not those who benefited from the Fed's policies, but instead those who are now being hammered by inflation. Those businesses who didn't borrow money are seeing their sales slowdown at the same time every cost is going up. Those businesses who didn't sell out to private equity companies now face competitors who can keep prices lower, which makes them less competitive. Families who were considering moving now have no choice, but to stay put as interest rate hikes have reduced the amount of house they can afford by a couple hundred thousand dollars AND prices have barely started to come down. At the same time, all the private equity owned multi-family housing units continue to increase rent prices.

It goes much further. Inflation hurts those living paycheck to paycheck the most. These are also the same people likely to have the most money in short-term debt, which costs more every time the Fed raises rates. The people the Fed helped are not being hurt, but instead those the Fed left behind are bearing the brunt of this. The Fed's playbook says they need to slow the economy to the point where businesses are struggling enough that we see them laying off workers and cutting prices. That could take a long, long time.

At the FPA Symposium a few weeks ago in Virginia Beach somebody asked me what I would do if I were at the Fed. My answer was to go aggressive in Quantitative Tightening and not touch short-term interest rates. Quantitative Easing led to huge profits at Wall Street banks and private equity firms. They are all flush with cash and can afford to take a hit. This will grind all speculation to a halt. Of course the Fed won't do that because Wall Street has their ear and scares them into believing taking away their free money will hurt the economy more than raising interest rates. The Fed also can't do this too quickly because the US Government has to borrow so much money and somebody needs to buy their bonds.

The Fed's Balance Sheet tells the whole story. The blue line is the total level of assets. The green is the amount of Treasuries they own and the red is the Mortgage Backed Securities they purchased. The purple line is the impact it had on the banks. For the most part, when the Fed was "stimulating" the banks kept the money in interest bearing reserve accounts and used it for leverage to speculate. When the Fed tightens, they are forced to release reserves. This causes disconnects in the financial markets which are unpredictable.

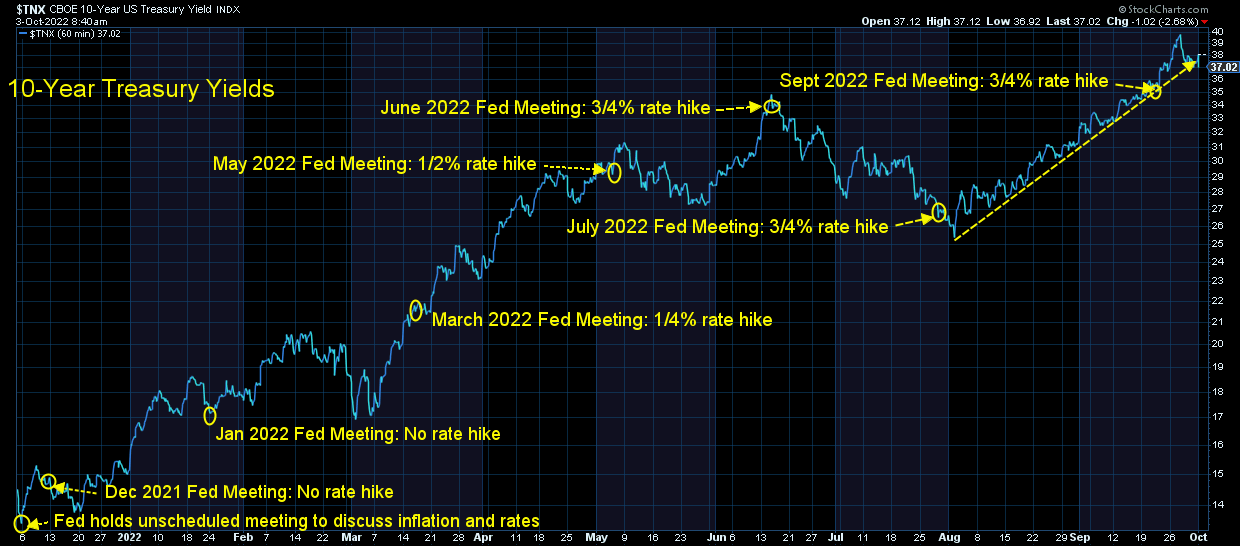

There are no easy answers. The old saying, "when your only took is a hammer, every problem looks like a nail," rings true with the Fed. They had to encourage speculation to spark the economy and now they have to reign it in. Go too quickly and we see a market crash. Go too slowly and we see inflation cause a prolonged recession. For whatever reason Jerome Powell waited way too long to raise interest rates and now we are left dealing with the consequences.

Artificial Gains are Disappearing

What the Fed giveth, the Fed must taketh away. I often described the 2021 stock market as "stupid", especially the last 3 months. Everyone including my 14 year old soccer players wanted to "get rich" in the stock market. Nobody saw any risks because in their minds the Fed would always be there to bail them out. Now we have learned that is not always the case.

All it took was the Fed warning about pulling back stimulus to fight inflation. We've seen some "hope" rallies fail and the market moving to new lows. If you've been following us throughout the year, those failures should not have been a surprise.

What I don't understand is how in the world Wall Street believes this won't cause problems for earnings. We continue to see companies miss their earnings estimates and lose 10-25% of their value in a single day. I don't get it. Logic would tell you there is no way companies are going to do as well as they were last year, yet Wall Street refuses to lower their estimates.

I've done several TikTok/Instagram videos on this. I'm honestly tired of pointing out the failures of Wall Street. Listen to them at your own risk, just remember it is in their best interest to have you always buying stocks.

@finance_nerd Wall Streer again is surprised the economy is slowing. #Stockmarket #recession2022 #bearmarket2022 #financialcrisis #retirement #financialliteracy #Inverted #greenscreen ♬ original sound - finance_nerd

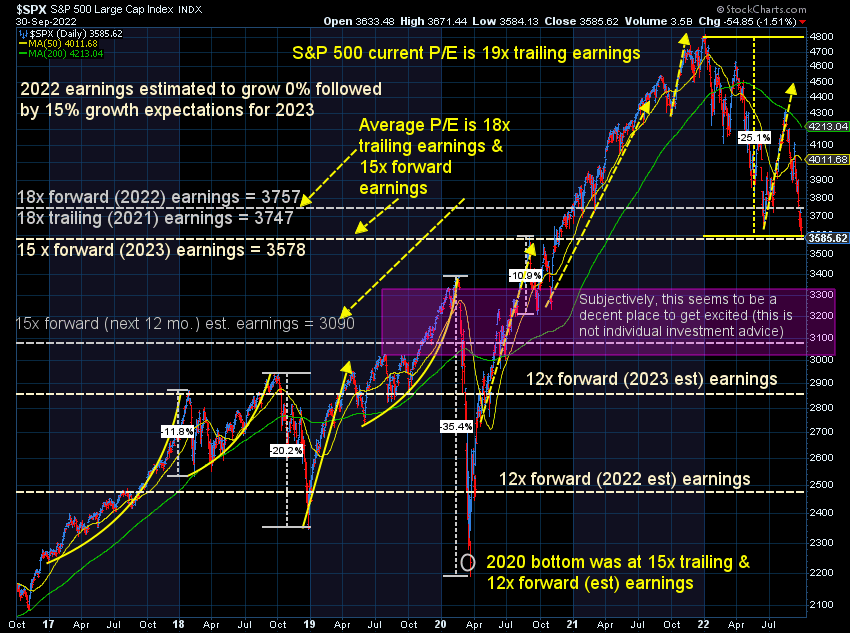

Wall Street originally thought we'd have 10% earnings growth in 2022. They now forecast 0%, but believe earnings will rise by 15% next year (despite large corporations warning that may not happen). Since stocks are valued based on projected earnings, this keeps stock valuations artificially high.

The other question is what P/E should you assign to earnings. When growth is strong and interest rates are low, a higher than average P/E is justified. When growth is weak and interest rates are high, a lower than average P/E should be used. We are just now back to AVERAGE P/E ratios (assuming earnings rebound as fast as Wall Street believes).

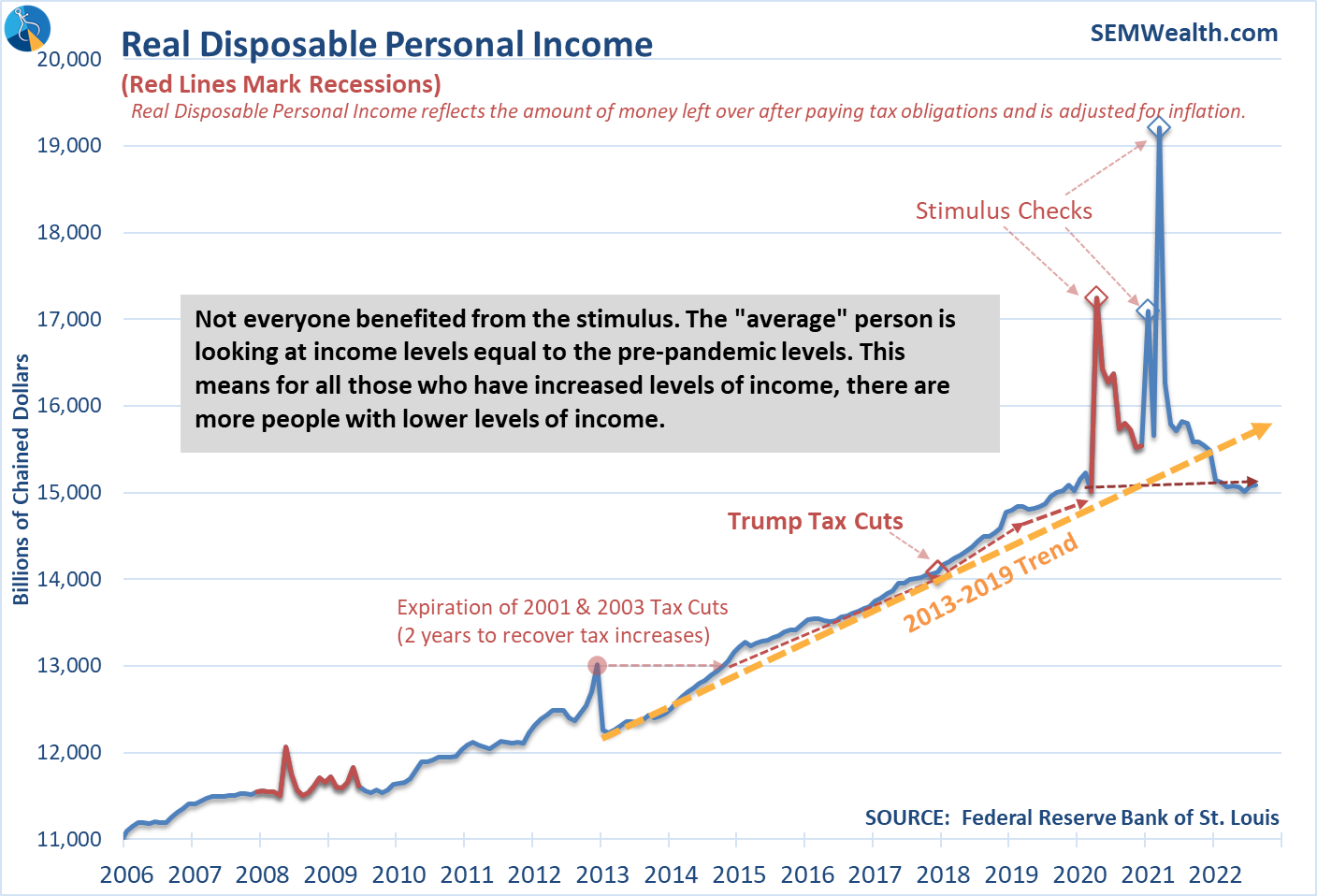

Not only have we saw stocks give back all of their gains from 2021, but we are heading back to mid-2020 levels. Fundamentally this makes sense. The stimulus money is gone. Personal income is down to pre-COVID levels. GDP is only up 3% from the end of 2019 (and likely heading lower in the 4th quarter). Corporate earnings are likely going to be negative this year and could also head back to 2019 levels before this is all over.

I put an area on the chart that would subjectively get me excited (for my long-term money). My age would dictate a retirement portfolio with 75% or more exposure to stocks, but my personality has always had me more in a "balanced" portfolio. If we could get down to the 12x forward earnings level my appetite for risk would increase significantly. However, if the market rallies a bit, I'd be looking to reduce risk UNTIL we get that washout down to the 12x forward earnings level. Again, like the past bear market rallies, the market is overdue for a big one.

On the plus side, we are getting over 2% when we park money in cash inside our models. Last week we saw huge moves in Treasury yields. This was sparked by something breaking in the United Kingdom financial system. This was enough for the Bank of England to intervene. Essentially their pension funds have been using derivatives strategies to boost returns. This strategy assumed interest rates remained stable. With the moves up this year the pension funds were getting margin calls, which forced them to raise cash by selling UK government bonds.

I've long been weary of all the derivatives strategies I've seen deployed in the US. Something here is likely to break. The question will be whether or not the Fed steps in to intervene. For now, it looks like 10-year yields may finally break their uptrend line, which should relieve some of the pressure in the financial system.

The good news is the Aggregate Bond and Government Bond indexes did not break the 2018 lows. We may see some dip-buying in bonds ahead as institutional managers bet on central banks having to reverse their policies and start bailing out banks, pension funds, insurance companies, and others heavily exposed to losses in the bond market.

As we said in our newsletter, during times of uncertainty our data-driven quantitative approach is valuable. This chart highlights the different moves made by our three management styles over the past year. It's hard to believe a year ago our economic model when from "bullish" to "neutral". Remember back then how euphoric everyone was? The environment can shift quickly and our models are designed to be ready to adjust.

Follow us on Social Media

While the blog will continue to be the source for deeper dives into everything that is happening, we post a lot more short-form content to our social media channels. Some are funny, some are quick takes on that day's news, and some are answers to questions we've received. Regardless, if you're looking for some different financial content, make sure you are following us.