The year everything went wrong

A year ago we called 2021, “the year everything went right.” We discussed how all forces aligned to drive the stock market higher. The primary driver was $5 Trillion in stimulus from the government combined with another $5 Trillion of money poured into the Wall Street banks by the Fed. Combine all that with the pent-up demand following nearly a year of economic restrictions and we had a very friendly environment for investors.

Cold water was poured on the markets the second day of the year when the Federal Reserve warned they would have to start raising rates to fight inflation (even though they didn’t act until March). Interest rates started moving higher (meaning bonds lost value) and stocks took a hit. Growth stocks, which had been the standout performers since the spring of 2020 saw the biggest losses. Throughout the year we had short periods of time where yields dropped and stocks rallied. As inflation data remained stubbornly high and the Fed reiterated their desire to slow inflation, yields moved higher again and stocks moved to new lows.

At SEM we started the year close to maximum investment. While this helped 2021 returns, it did mean participating in the first part of the sell-off. By mid-February our indicators inside most of our models had begun to pivot to more defensive positions. While seeing losses inside our accounts is never comfortable, it is an unavoidable part of investing. With stocks posting the 3rd worst drop this century and bonds enduring their worst year ever, there were few places to hide.

2022 was a true “stress test” for all investment portfolios. When structuring portfolios we focus heavily on the potential risk of each portfolio and how it relates to the financial plan, cash flow strategy, and overall investment personality. Despite the terrible year for the investment markets, each of our investment models remained inside the risk parameters we established. In other words, we planned for these losses. Most importantly by keeping losses within the target levels we stand ready to take advantage of the eventual recovery in both stocks and bonds.

When the recovery occurs is obviously not known, which is why having an unemotional, quantitative investment strategy is important. History tells us the best time to enter the market is when it “feels” the worst. We hope it will not get that bad, but as we like to say, “hope is not a strategy.”

If you would like a personalized review of your portfolio, go to Risk.SEMWealth.com

Is recession inevitable?

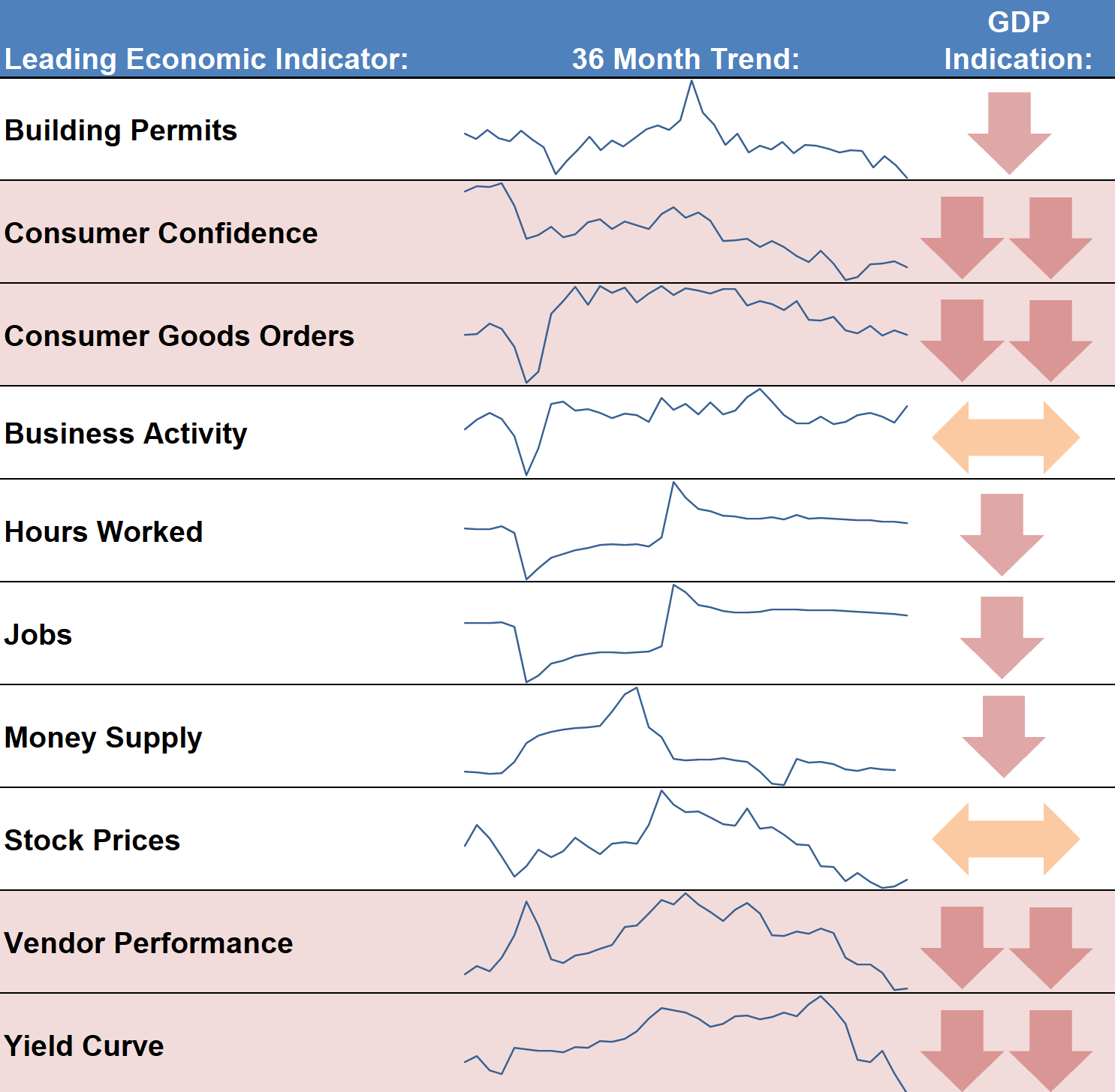

The harder the Federal Reserve has pushed against inflation, the more pundits we’ve seen warning about a recession. At SEM we do not make “recession” calls, but we do have a quantitative economic model designed to give us an idea which way economic growth trends are heading. (This model is used to determine allocations in our Dynamic models).

Our model has 10 leading indicators which have a history of giving us signs about the future direction. For most of 2022 the model was mixed with the labor market being the bright spot. However, over the last few months of the year, all indicators weakened significantly. This could mean a recession is on the horizon for 2023.

If we do see a recession, stocks could take another leg lower, but if the economy is able to stabilize the bear market could quickly be over.

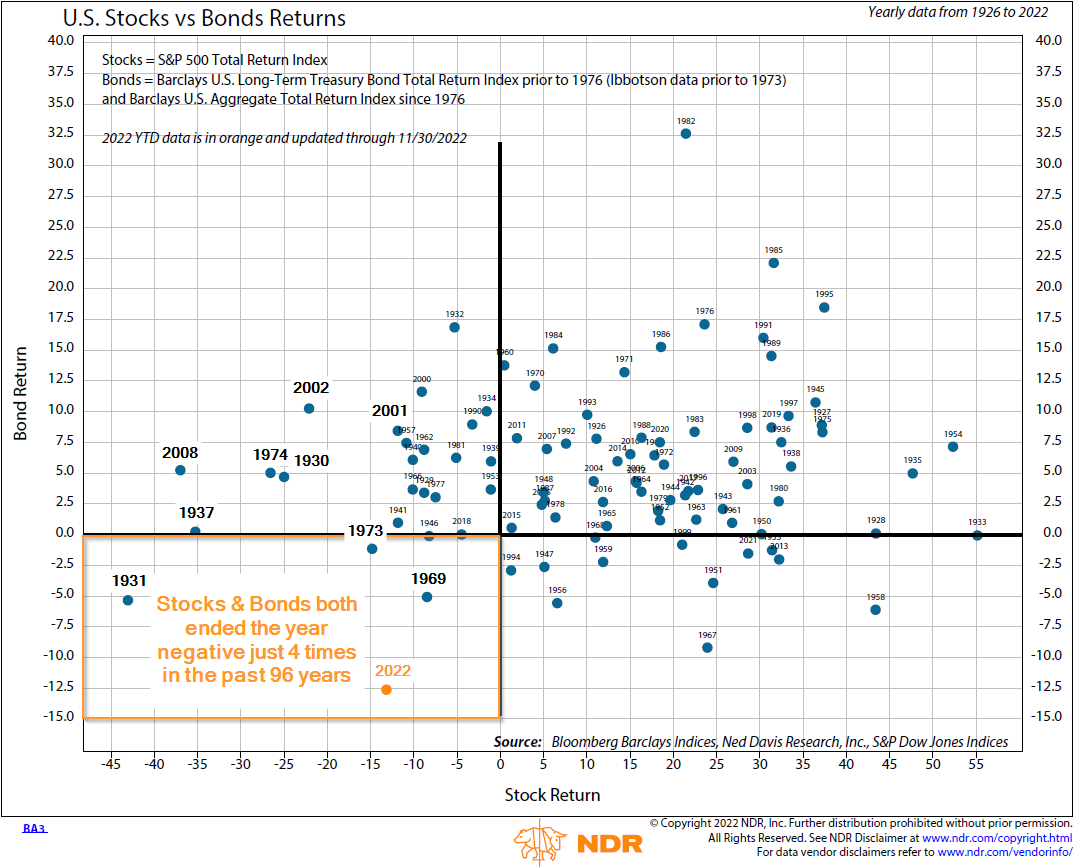

Nowhere to hide

Throughout most of our investing lifetimes, bonds have provided a buffer when the stock market was down. This chart from Ned Davis Research illustrates how rare the 2022 environment was for investors.

Stay tuned to the blog for more details on how we are handling this environment.

News & Notes:

2022 Year-End Tax Statements– what to watch for early 2023:

For taxable accounts, Axos Advisor Services will send your tax documents by February 15, 2023.

SEM strongly recommends you do not make your tax appointment until after March 15. Please wait until you receive Axos’s 2022 Consolidated 1099 prior to completing your taxes.

SEM will be posting additional information on the tax reports on our website:

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.