I think most investors are relieved to put 2022 in the rear-view mirror. 2022 started with so much optimism from most market participants. The Federal Reserve threw cold water on the markets the second trading day of the year when they warned about the need to fight inflation. Both stocks and bonds reacted negatively, and despite some valiant attempts to rally, ended the year with the worst combined loss for stocks and bonds in the history of the markets.

We discussed this in our quarterly newsletter posted last week:

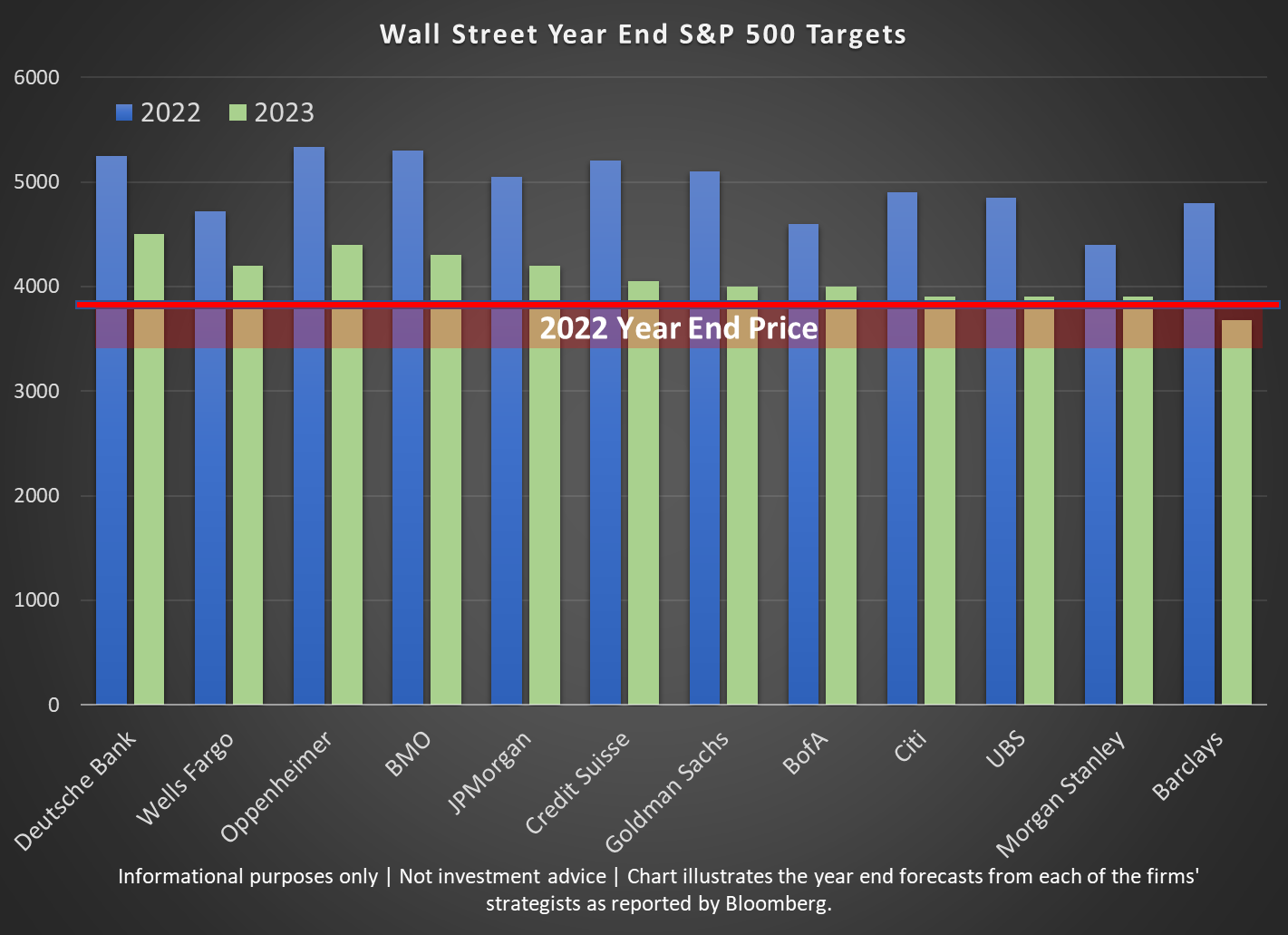

We've all been inundated with predictions for what 2023 will bring. As I say every year, at SEM we do not participate in this pointless exercise. As a consensus, Wall Street has NEVER predicted a negative year for stocks. This means they have never warned us losses were coming. I mentioned a year ago how despite the rarity of 3 consecutive positive years for stocks only one Wall Street firm (Morgan Stanley) had the stomach to predict a drop in stocks. Morgan Stanely called for a 10% drop in stocks for 2022. Most others believed it would be a "below average", yet positive year for stocks.

This year we see more of the same. I've compiled this chart to illustrate both how wrong the overly bullish firms were in 2022 and how those firms remain steadfast in their belief stocks are going to post above average returns this year.

This year Barclays is the only firm brave enough to predict a loss (-3%), with Morgan Stanley, UBS, and Citi all predicting gains of less than 3%. (It should be noted most of these forecasts were made in early December when the market was about 4% higher, so they were predicting a small loss at the time.)

For quite some time my opinion has been we would see an economic slowdown if not an outright recession in the back-half of 2022 based simply on the fact the $5 Trillion of stimulus plus the $5 Trillion of money created by the Fed to finance the stimulus created huge economic disconnects. I often called the 2021 returns "stupid", especially the last half of 2021 when companies with the worst fundamentals performed the best. It just made sense those gains would be given up.

Now here we are with the market essentially back to where it was in January 2021. The "stupid" returns were wiped out, so now the question is where to from here. Our economic model remains bearish (we'll have a full economic update next week). It went neutral in October 2021 and fully bearish in April 2022 so this is no surprise. Over 70% of analysts are predicting a recession in 2023, yet corporate earnings are still expected to grow at a 13% rate. I'm not sure how that can happen, but maybe I'm wrong.

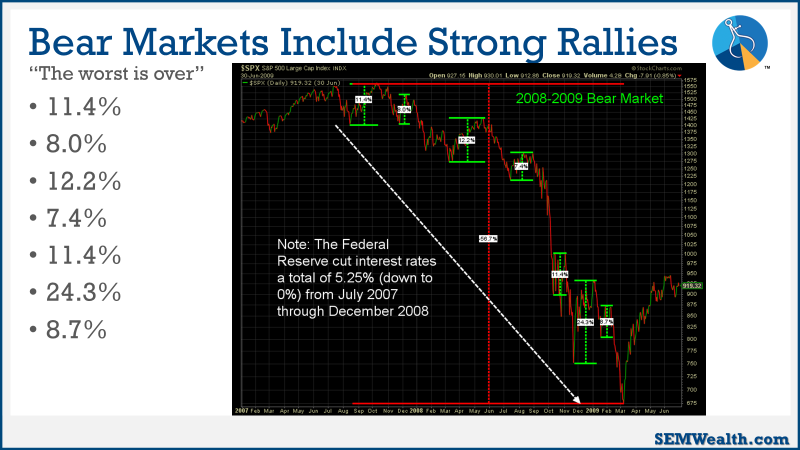

My opinion remains we could be looking at a bear market/recession similar to the 2000-2002 period. Remember, Y2K fears led the Federal Reserve to keep rates low and to pump money into the financial system. At the same time, businesses and consumers alike upgraded all of their hardware, which led to strong earnings growth across the technology and services sector. This caused stock returns to go ballistic in 1999. When the Fed was forced to start pulling back their liquidity and businesses and consumers had pushed forward several years of upgrades, earnings slowed. The recession was quite mild during the bear market (officially only September 2001-November 2001), yet the S&P lost over 50% of its value and the NASDAQ lost over 80%. The worst year for stocks was 2002 (even though the recession was already over and the Fed was aggressively cutting rates).

No bear market or recession is the same, but compare the above situation to what we have now. We pumped massive money into the system to fight the pandemic. Businesses and consumers were forced to upgrade their equipment. We saw huge jumps in earnings and stock returns going ballistic. The Fed has been forced to pull back the liquidity and there is little reason (or available funds) for businesses or consumers to spend more money on technology. Even if the recession is quite mild, stocks can continue to go down. Even if the Fed starts cutting rates (or stops raising them), stocks can still go lower.

These charts serve as a reminder that even in bear markets we will see several "the worst is over" rallies.

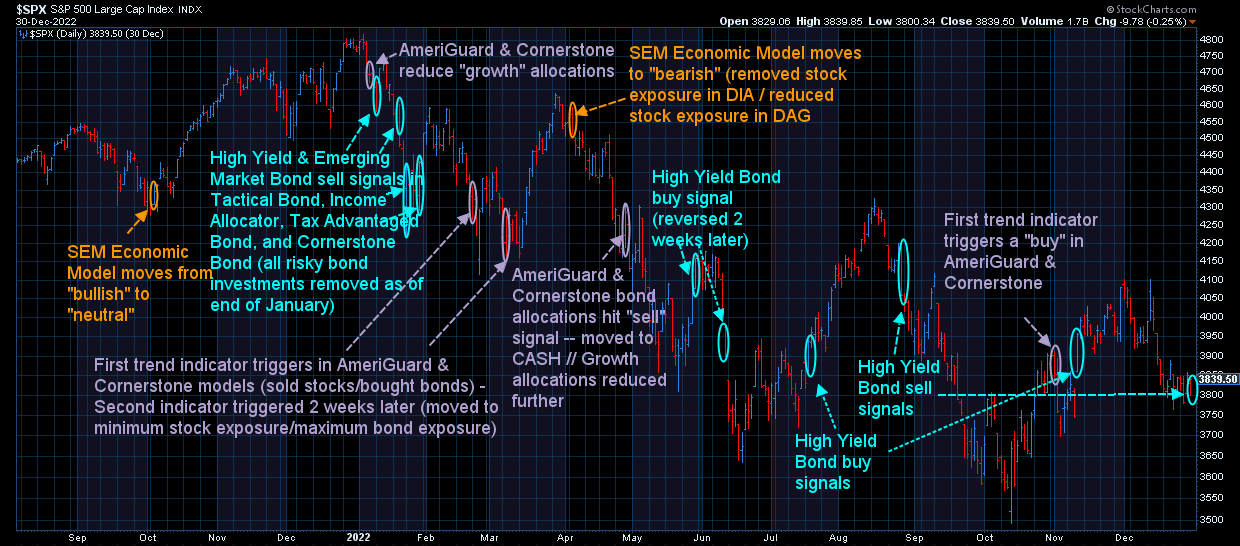

We weren't immune to the losses. Our quantitative systems are designed to ignore the noise, but it also means they "follow the money". With so much momentum behind the 2021 year-end rally we entered the year fully invested across the board. While we are pleased with how our systems managed risk overall during a difficult year, we obviously do not like taking on any losses.

That said, all of our systems performed as expected. This is saying something given how unprecedented the year was for stock and bond returns. We've NEVER had an environment like we saw in 2022, yet our systems held up. We will always take the full force of the losses at the start of a bear market. By mid-March we had put the defense fully on the field.

Along the way we saw strong institutional buying into the rallies, which did lead our high yield system to have a few more buy signals that led to some additional losses. This includes a trade we closed out last week.

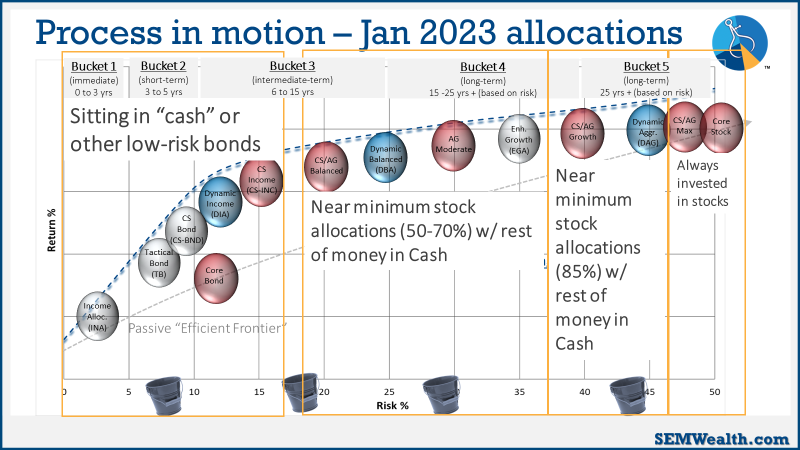

This chart summarizes our positioning as we start the year. The dilemma we have right now is the fact you are getting paid relatively little to take on additional risks. We can earn over 3% just sitting in a money market account and 4% in 1-year Treasury Funds (which carry some downside risk). Stock dividend yields are barley over 2% and high yield bonds are yielding less than 9%.

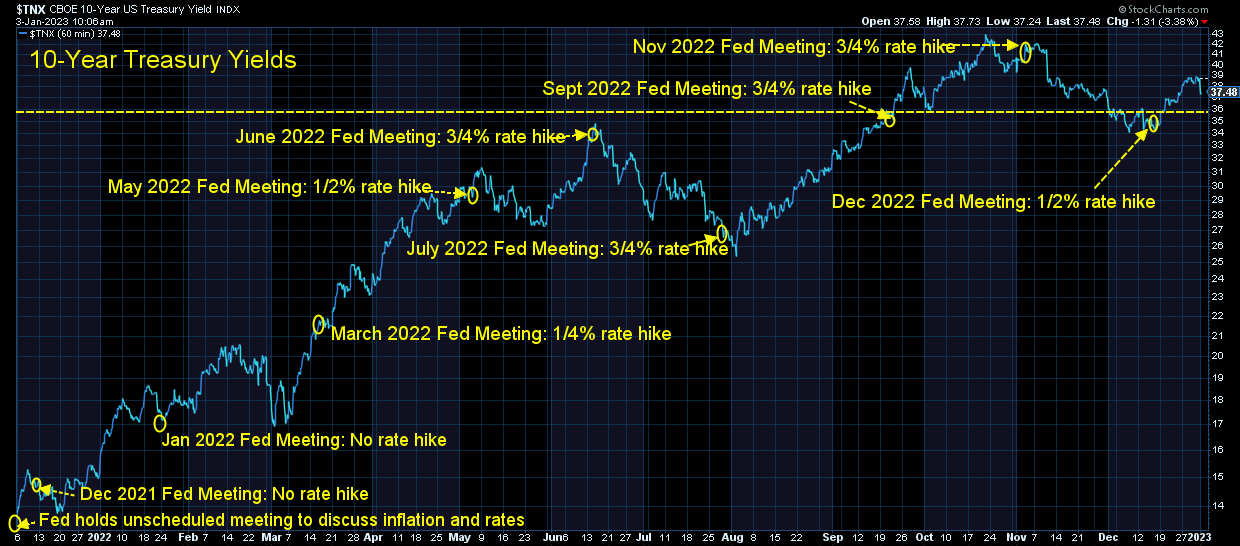

Turning to the market charts I watch every day, we can see how the changes in Fed policies/rhetoric have impacted the stock market. Every time there was "hope" the Fed seemed to crush it (which they have to do if they hope to control inflation, which was sparked in part by way too much speculation in the financial markets.)

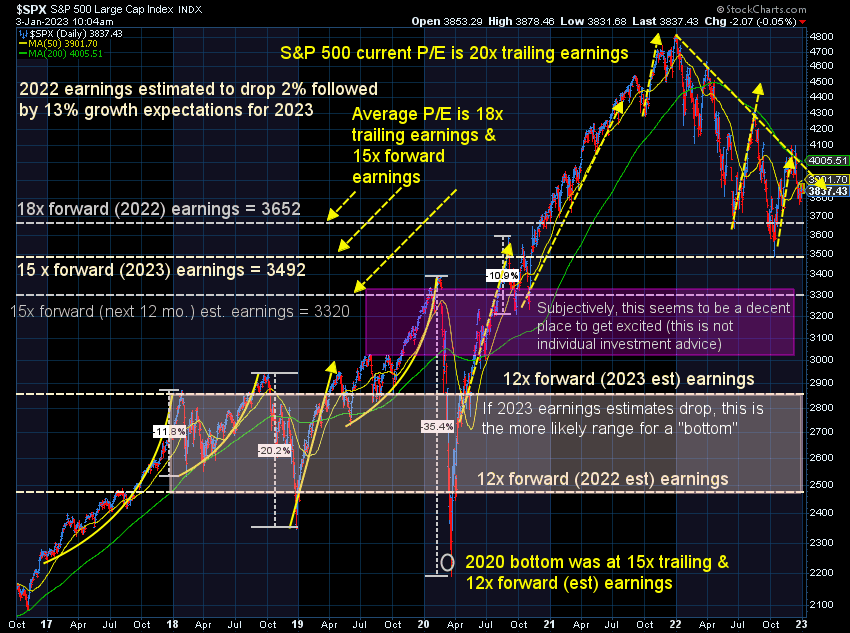

I think this chart is more elightening. As mentioned above, all the stock market has done is give back the "stupid" gains from 2021. It is still overvalued. Subjectively I won't be excited for stocks until we see the market down to the 3000-3300 level. Based on historic recessionary bear markets, this would put the P/E ratio in the range of past bottoms.

Finally, turning to bond yields, it appeared the 10-year yield had broken down to a new trading range under 3.6%. What happens with yields will be a key to what happens the rest of the year for stocks. At some point I would expect yields to fall sharply if it appears a recession is inevitable. The longer the Fed attempts to engineer a "soft landing", the more likely we will see inflation remain stubbornly high. This means higher bond yields and more losses for bond investors.

Patience will be key in 2023. At some point I fully expect the market to "bottom". When that happens is anybody's guess, but if history is a guide the bottom will happen when everyone is the most pessimistic. This means if you choose to just sit in cash now and wait until things "look better", you most likely are going to miss what could be a once in a decade rally in both stocks and high yield bonds.

We won't catch the exact bottom (we never do), but historically we have seen our models move rather quickly to put the cash back to work when the bottom is in. As we saw in 2022, this could mean some false rallies, but our systems are designed to move back to the sidelines if they are wrong.

Anything can happen in the year ahead. The key is to have the systems and plan in place to adapt.