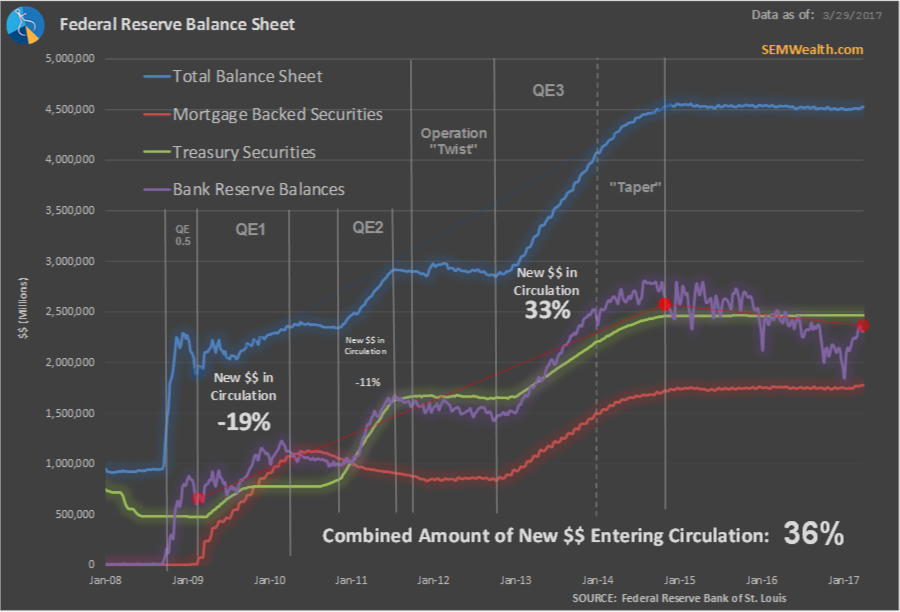

On Wednesday the stock market got spooked when the Fed minutes revealed a lengthy discussion about how & when the Fed will begin to unwind its balance sheet. Many people have forgotten that it is NOT NORMAL for a central bank to hold so many assets on their books. In this case the “assets” are Treasury Bonds & Mortgage Backed Securities (MBS). The problem facing the Fed is how to get back to a “normal” sized balance sheet to offer them more flexibility to fight the NEXT crisis. Never mind the fact we are 8 years away from the LAST crisis and the most the Fed has done to “normalize” their operations is to stop buying bonds from the Wall Street banks with newly created money and to raise interest rates a mere 1/2%.

Why would the market be so afraid of the Fed unwinding its balance sheet? Maybe it’s because the Fed was essentially the only market for several years and nobody is sure what the true market value is of the Fed’s “assets”.

Nobody including the Fed knows what the impact will be. We’ve never been in a situation like this and I have a hard time trusting the 12 people on the Federal Open Market committee with years of classroom experience and very little real world experience actually getting this right. If you are a buy and hold investor you have no choice but to trust them. They’ve controlled the market for 9 years, but that cannot go on forever. This week was a small reminder of what may happen when they finally relinquish control.