Based on my conversations with advisors and investors, enthusiasm for stocks had hit euphoric levels in mid-September. The most common theme was “why am I not making more money?” or “how can I get in on these record stock market gains?” When previously “conservative” clients (those not wanting to lose more than 10 to 15%) start wanting to jump into the market with both feet, it is typically a sign things have gotten overheated.

In just 3 short months, stocks have done a complete 180 and nearly hit bear market territory. While I’ve yet to see panic among investors, if this continues in early 2019 we are likely to see some full capitulation beginning based on my 20+ years of experience and study of market history. As I’ve said in previous posts (see the “related posts” at the bottom of the page), fundamentally things are ‘ok’, but it doesn’t take much to spark a much bigger sell-off from here.

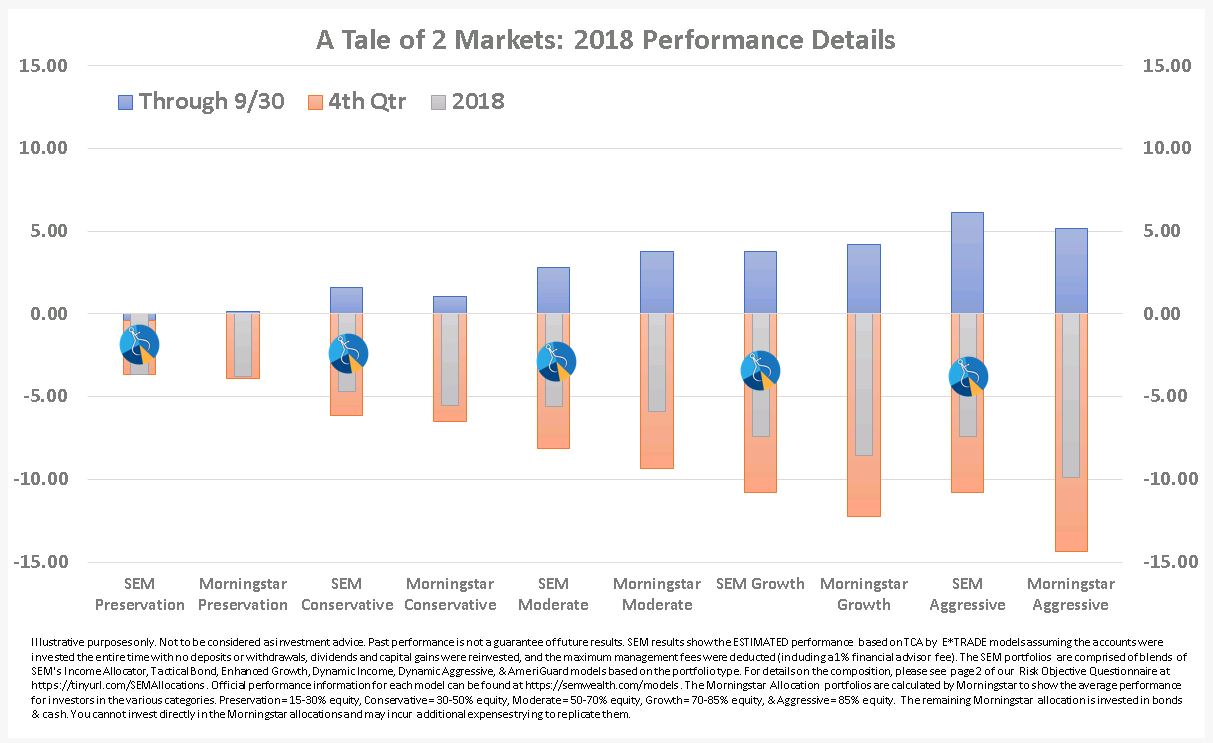

For now as we enter the last few days of 2018 I thought I’d take a look at the performance of SEM’s “model” portfolios (designed around specific client types and objectives) versus a similar passive mandate. Remember, the more return you seek, the higher risk you have in your portfolio. In all cases, SEM’s blend of actively managed models using tactical, dynamic, and strategic styles has outperformed the passive benchmarks.

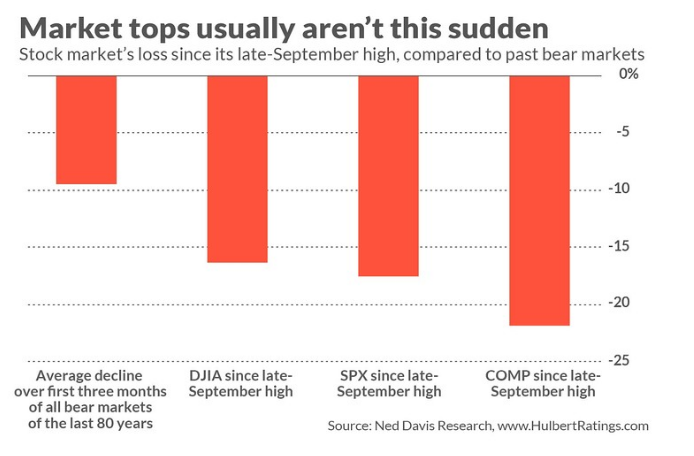

Nobody likes losses and while we would have liked to reduced them even more than we did in the 4th quarter, this chart from Hulbert Ratings compares the average start of a bear market to what we’ve experienced the last 3 months this year. Our trading systems are all centered around probability models based on past market performance. This means they are designed to wait for the first part of a bear market to evolve before reducing exposure. When the market falls this much more than ‘normal’, the systems will not get out as quickly as other times.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

That said, our tactical models, starting with Tactical Bond & Income Allocator (key components of our Preservation & Conservative Allocations) had already reduce most of their risky asset exposure in early October. Enhanced Growth, another tactical model that is a key component of our Conservative, Moderate, & Growth allocations) has spent most of the last 9 months invested between 35 to 65% exposed to the markets. These systems did see something looming on the horizon and have reacted accordingly.

Our dynamic models also reduced exposure in November as our economic model shifted from “growth” to “neutral”. This too has helped mitigate the losses the last two months in those models (all are core components of our allocation portfolios shown above.)

Our strategic models known as AmeriGuard portfolios are the only ones that did not reduce exposure (yet). They are quarterly managed portfolios and by design will allow for a bad quarter or two before looking to shift to the sidelines. Barring a strong recovery the last few days of 2018, we will see these models adjust to their lowest stock market exposure allowed.

Finally, many people marveled at the sharp reversal in the market on Wednesday and Thursday. I am reminded by the old saying, “the most furious rallies always occur inside a bear market.” While I’m not saying we are in a bear market (yet), this tweet from Sentiment Trader highlights how unusual it is to see snapbacks like we’ve witnessed this week.