What in the world changed?

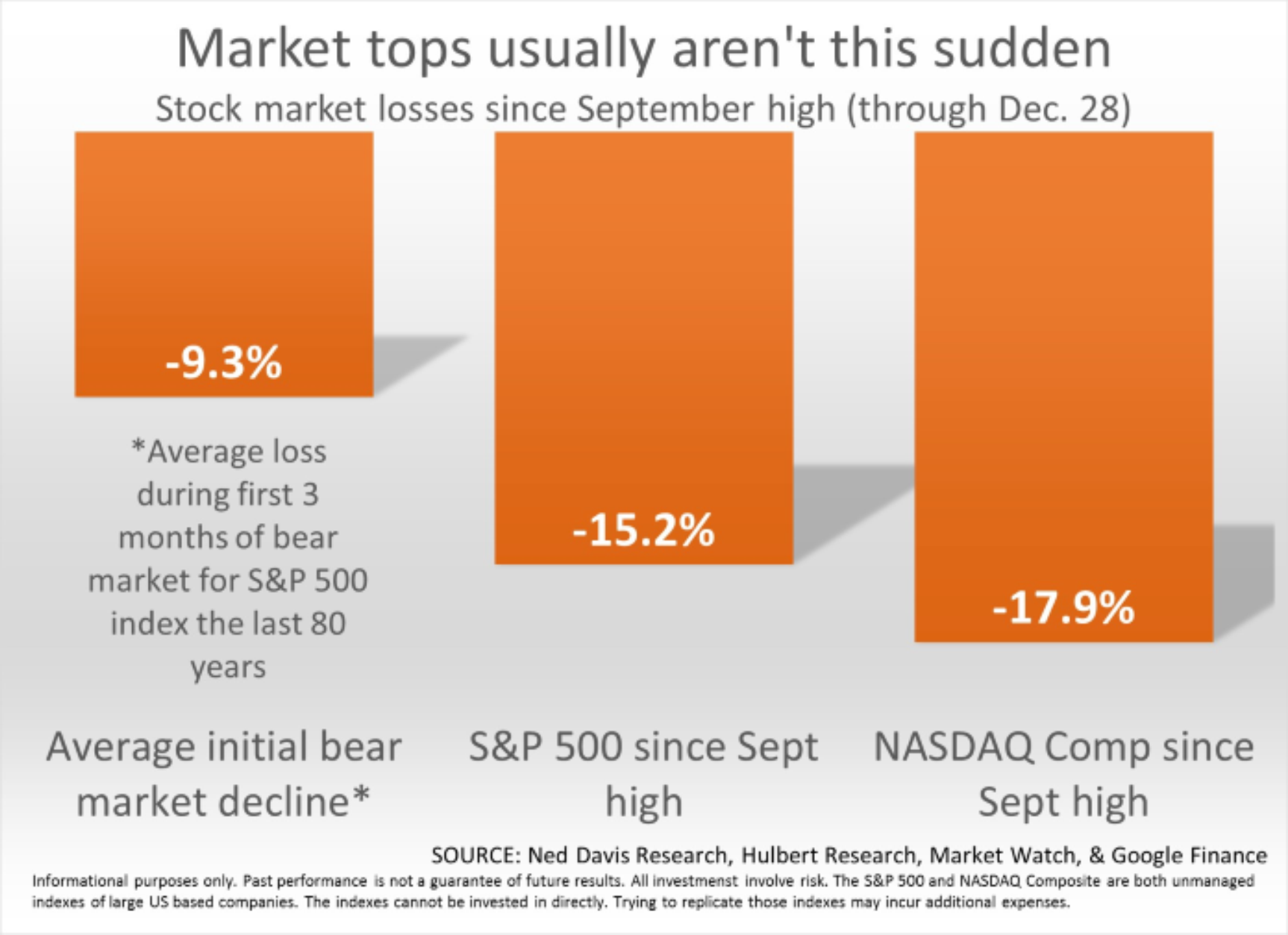

December is supposed to be a good month for stocks. Instead it turned into one of the worst Decembers since the Great Depression. Many people are now asking if this is a start of a bear market..

We will not know until we have the benefit of hindsight when the bear market actually began. By then it may be too late to react. Remember, the S&P 500 rallied 7% the first 4 weeks of the year only to lose 10% in 8 trading days in February. It then recovered and hit all-time highs by the end of September. Euphoria was taking over for investors, then the bottom fell out. So what in the world has changed in such a short amount of time?

At the beginning of 2018:

• The stock market was extremely overvalued.

• Investors were complacent following the least volatile year on record (and double digit returns)

• The economy and stock market were a little over a year away from setting a record for the longest expansion / bull market in US history.

• The Federal Reserve was entering its 3rd year of interest rate hikes and 2nd year of scaling back their QE-bloated balance sheet.

• There were high growth expectations following the passing of the Trump Tax Cuts.

At the end of 2018:

• The stock market is still overvalued.

• Investors are starting to get worried, but still fairly complacent.

• The economy is still expanding & we are still technically in a bull market.

• The Federal Reserve is still raising interest rates and scaling back the balance sheet.

• Economic growth is falling back to average (or just below average) after 2 strong quarters.

The key change is the last one. While it is not a very big change in growth expectations, when you combine an overvalued market, complacent investors, a very old economic expansion and bull market you get a HUGE drop in values.

What really happened in 2018?

The Trump tax cuts appear to have only created a temporary boost to economic growth & the on-going “trade war” discussions have caused businesses to “pre-load” their inventory ahead of any tariffs that may come about. Both of these caused the growth rate to look higher than was sustainable. In addition, both the tax cuts and trade war fears are INFLATIONARY. The Fed is deathly afraid of too much inflation and therefore must continue to hike interest rates to stop it. Finally, the December showdown over the border wall funding with the new Democratic leadership served as a reminder that there will be little if any chances of more economic stimulus in the next two years.

What should you expect from SEM in 2019?

Sell-offs are normal and if your SEM portfolio was designed around your financial plan, true risk tolerance, and investment personality everything is functioning as expected. Our Tactical models (Income Allocator, Tactical Bond, & Enhanced Growth) took money off the table in early October. They have minimal exposure to risky assets and are waiting for a better opportunity to invest again. Our Dynamic models also scaled back risk at the beginning of November and will adjust as necessary based on economic growth. The AmeriGuard models (our quarterly managed ‘strategic’ portfolios) are ready to scale back exposure at the end of the quarter if the statistical probability for continued selling is high.

We have seen negative years in the stock market & inside SEM’s models before — 2015, 2011, & of course 2008. While this is not a prediction, keep in mind the years following the losing years ended up being very good years for stocks and SEM’s investment models. The one encouraging thing for us is our economic model indicates the economy is still growing, just at a slower than expected pace. A bear market without a recession is not a big deal. We will be watching all the indicators closely and are ready to adapt to whatever the year brings.

What should you do to prepare for 2019?

-

Understand where each of your investments fits in your overall financial plan.

-

If you are not sure, contact your SEM Financial Advisor or go to WhatsMyScore.net to get started on your free customized investment plan.

-

-

Figure out your true risk tolerance.

-

Simply put, your risk tolerance is the dollar loss you would become uncomfortable and want to consider a change in investments. Take the loss amount divided by the total value of your investments and you have your true risk tolerance. WhatsMyScore.net also can provide a more detailed way of calculating this.

-

-

Prepare yourself for a bear market. Whether it has already started, starts in 2019, or some time down the road, bear markets are inevitable. They will be scary and you need to be ready.

-

SEMTradersBlog.com is full of additional articles, data, videos, and commentary to assist you in understanding what is happening in the market.

-

-

Refer your friends & family to your SEM Financial Advisor.

-

Our investment models can be customized to fit the overall financial plan, true risk tolerance, and financial personality. They are designed to help investors come out of a bear market ready to take advantage of the tremendous opportunities that will come after the scary sell-off that still lies ahead.

-

News & Notes:

2018 Year-End Tax Statements–what to watch for early 2019:

For taxable accounts, federal law requires your custodian to mail your IRS Form 1099 to you by January 31. Due to the increasing amount of reclassified mutual fund distributions, both of our custodians, TCA by E*TRADE & TD Ameritrade have had this extended to February 15, 2019.

SEM strongly recommends you do not make your tax appointment until after February 15.

The 2018 Consolidated 1099 mailings to you includes cost basis and sales proceeds for investments sold during 2018. This provides essential information needed to complete your Federal Tax Filing Form 1040 Schedule D and Form 8949. Please wait until you receive TCA’s and/or TD Ameritrade’s 2018 Consolidated 1099 prior to completing your taxes.

For those clients that consolidated taxable accounts from TD Ameritrade to TCA, you will receive forms from both custodians.

SEM will be posting additional information on the tax reports early next year on our website,

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.