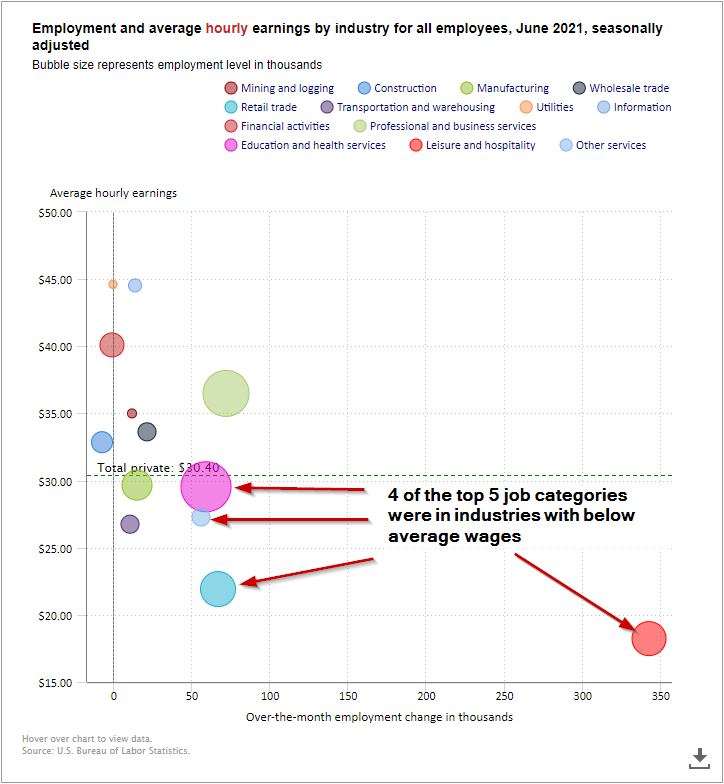

Moving into the second half of 2021 I thought it would be timely to take a walk through SEM's Economic Model to give us an idea of where we stand economically. The markets are obviously pricing in a spectacular recovery and we won't know until the fall what the economy

Maximum Risk

The first half of 2021 was impressive. The S&P 500 returned 15%, nearly double its long-term average annual return! With nearly all aspects of the economy reopening, the expectation is for strong economic growth, which has investors expecting strong earnings growth. This enthusiasm has led to

I've often used the analogy of treating a cancer patient to describe how our monetary and fiscal policy leaders have treated a recession. A doctor has two goals when treating cancer. The first is the most obvious — eliminate the tumor. The second is to make the patient as comfortable as

We know what we do with our money matters. That’s why we started the Cornerstone Portfolios – we wanted to make an impact with our investments. The drawback so many investors have with Biblically Responsible Investing is they’re worried that they’re sacrificing performance.

Do you know how to

Summer is officially here and based on the weekend traffic, the lines at the grocery stores, the lack of inventory in the summer aisles at Target and Wal-Mart, Americans are out and about in full force. At the same time the stock market has stumbled, which begs the question, 'why