A few weeks back, Dr. Richard Thaler won the Nobel Prize in economics for his work on behavioral finance. Anybody associated with SEM the last few years is quite familiar with his work as it along with others in the field has been the major driver behind the re-design of SEM the past several years. The mainstream media, however is acting like this is something brand new despite the fact Dr. Daniel Kahneman won the same prize for the same line of work back in 2002.

Having ready several of their books, I can see why the media ignored Dr. Kahneman’s work and seems so excited by Dr. Thaler’s work. Dr. Kahneman is a trained psychologist and while I thoroughly enjoyed his book, it is much slower reading than Dr. Thaler’s books. Essentially Dr. Thaler used Dr. Kahneman’s research to expand the field and put it in terms everybody can understand. I think one reason people are taking notice is they now realize despite decades of academic & Wall Street brainwashing the market is neither “efficient” or “rational”. The reason is simple — humans are complicated beings that cannot be modeled.

Just this past weekend our local Sunday paper included two articles based on the emotional side of investing. [Emotions can undermine our financial decisions & Lessons of past bear markets] I’m excited that this is getting so much attention, but I’m also well aware that most people will not actually take it seriously until well after the pain of the next bear market is at its peak. It has been more than a year since the market went through a 3% correction (the longest streak on record). The last bear market began 10 years ago this month. While for some the pain of the bear market is so recent they have yet to put any money back into risky investments, for others the lack of a bear market for so long as given them a false sense of confidence.

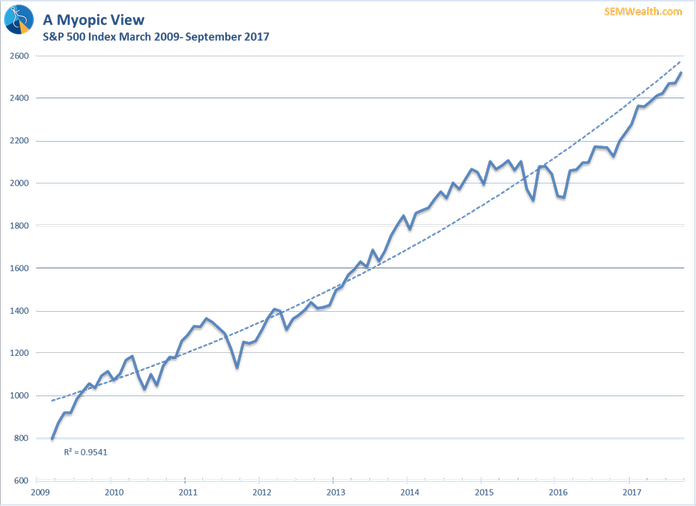

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

As both Dr. Kahneman & Dr. Thaler have pointed out, investors will not react rationally when it comes to losses. Their own behavioral biases cause them to increase the risk exposure in their portfolio at just the wrong time, which usually then leads to them abandoning those risky positions well after they’ve sustained damaging losses.

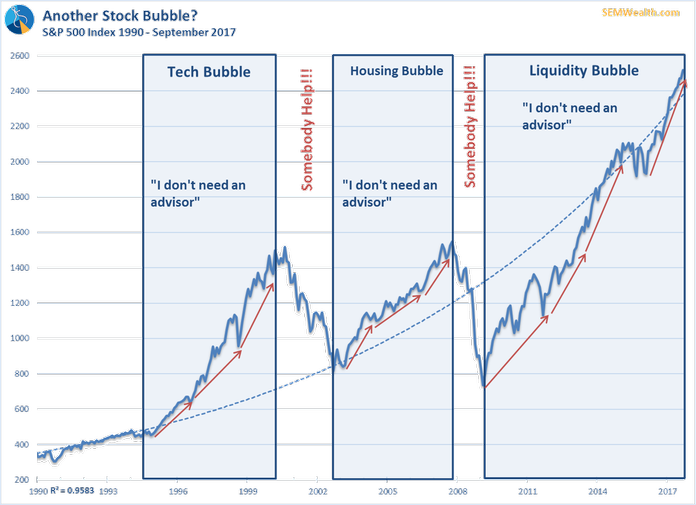

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

Human nature does not change. This is the third bubble SEM has experienced since our founding in 1992. We’ve always known how damaging our emotions were to investing, but the field of behavioral finance is relatively new. As I learned more about it while studying for the CFA, we launched several new strategies, changed the way we design client allocations, and most importantly began educating clients and advisors how to adapt to our personal behavioral biases. There is nothing wrong with being emotional. Everyone is. The key is identifying those tendencies and figuring out a way to adapt to them. SEM is here to help.

Click here for more on Behavioral Biases & how to overcome them