The last few months I’ve periodically pointed out some stress points that all investors should be wary of as the economic expansion and bull market approaches record length. While the Federal Reserve capitulated to the constant pressure from the president and Wall Street’s panic in the 4th quarter, complacency among investors is creeping back into stock and bond prices. Nothing fundamental has shifted.

-

Over half of the ‘investment grade’ bond market is one step from being classified as junk

-

The Treasury bond market is showing signs of stress

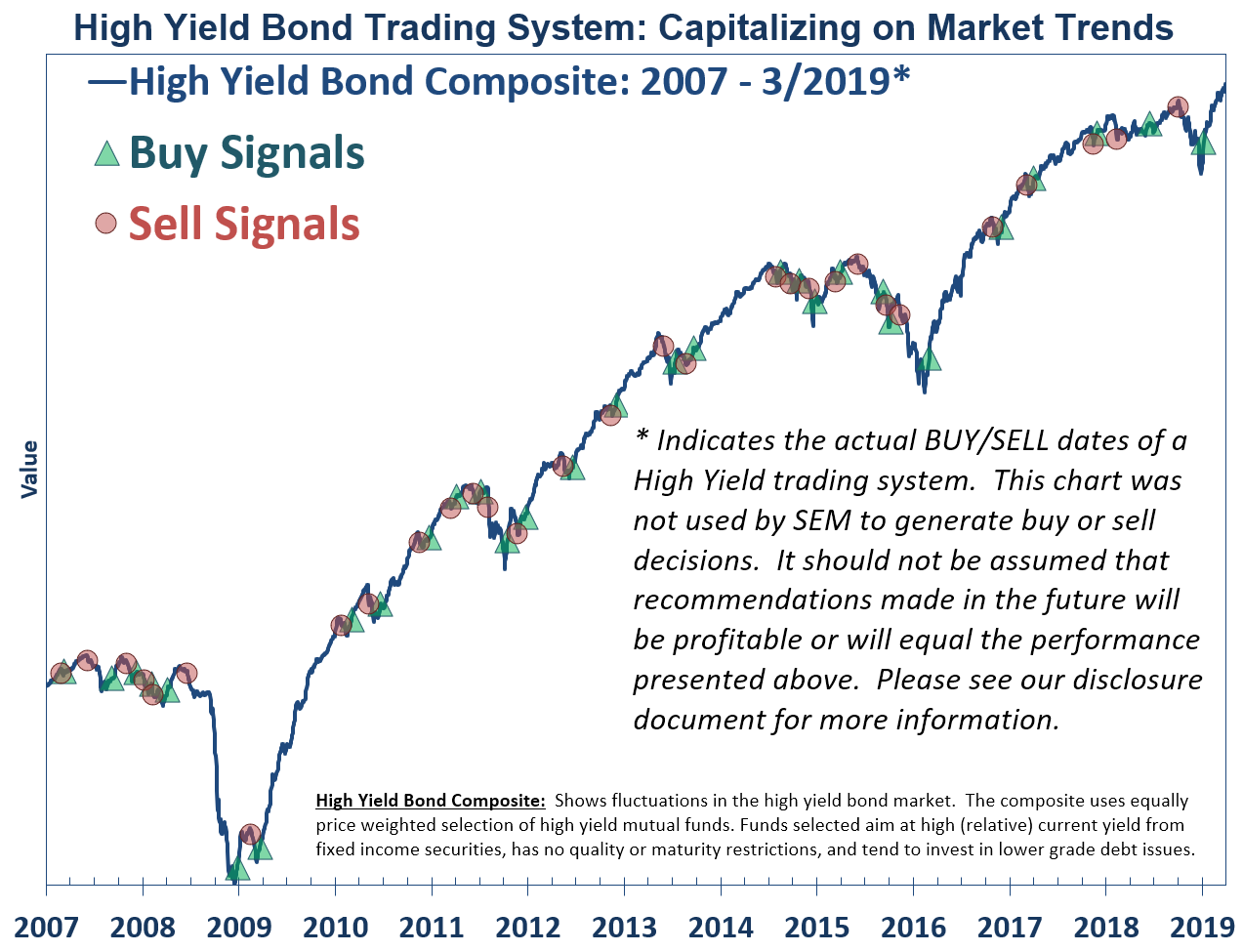

The problem is, none of the indicators mentioned in the above articles are signals of an immediate decline. In fact, our high yield bond trading system, a system that has been around since 1992 is on a buy signal. If I had to pick one signal to use to call a market or economic top, this would be it. (I am NOT recommending this. Remember each of our models has multiple trading systems for a reason — all indicators will generate false signals.)

The reason I’m watching this system so closely is simple. The above articles discuss serious problems in the debt markets that could steamroll the stock and bond markets. High yield bonds have always been a great early indicator of looming problems in the overall credit markets. One thing to keep in mind, this system will have many false signals as shown in this week’s Chart of the Week. However, given where we are at in the cycle, I would pay close attention to this system when it goes back to a sell.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

For now, the sell signal in early October allowed clients in our fixed income models to enjoy a relatively quiet ride while stocks were down at one point nearly 20%. The system then went on a buy on January 7, generating some nice returns for our lowest risk models. I’ve heard from many advisors and clients commenting on the strong quarter for these models. My response has been the same — this IS NOT NORMAL. Investors are desperate for yield and are chasing high yield bonds to levels that make no sense in a slowing economy. The system is certainly nimble and will look to sell as quickly as possible, but I’d be careful to take the strong quarter in high yields as a sign we don’t need to worry about risk.