Pressing Questions for Investors

The 4th quarter of 2018 was the worst quarter for stocks since the Financial Crisis, with December’s drop coming in as the worst since the Great Depression. The start of 2019 has seen nearly the opposite, posting the best start to the year for stocks since 1987.

The large whipsaws for stocks has led to three common questions from our clients and advisors.

1.) Why didn’t I make money in 2018?

2017 was one of the best years for stocks this century. Going into 2018 investors expected more of the same. We saw conservative clients asking if they could get more participation in the stock market. In other words, very few investors wanted much exposure to assets such as cash or money market accounts.

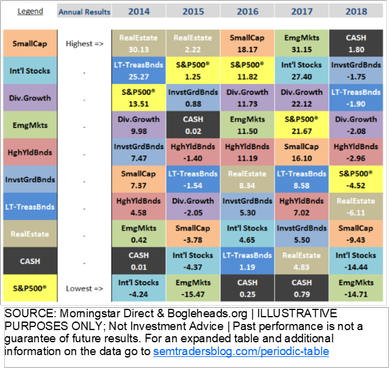

The table to the left plots the returns for a wide range of index funds representing nearly all investment segments available. The only segment that made money in 2018 was CASH (the worst performing asset in both 2016 & 2017.)

The losses in the stock market made headlines, but the losses in the bond market were more alarming to many. Bonds usually provide some risk mitigation, but the losses served as a reminder that bonds do not always provide the protection investors are expecting.

SEM will deploy cash in all of our models at various times, but the timing is not always perfect. The speed of the sell-off in early 2018 caused our models to endure some losses. They all held-up much better than the stock market in the year-end sell-off. This is typical action in the early days of a bear market (fast sell-off, recovery, and then another bigger series of sell-offs). Our systems are designed to focus on the middle part of the move and not catching the beginning of a market shift

2.) Does the 2019 rally mean the coast is clear for stocks?

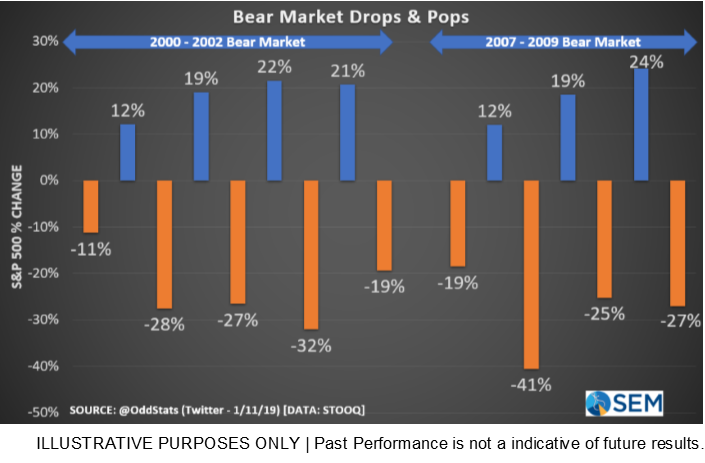

This has been the most often asked question we’ve seen from clients and advisors alike. While the signs are there that the bear market started in 2018, we won’t know until we all have the benefit of hindsight when it began. One of the first things I learned when studying market history is the most furious rallies come inside a bear market. This chart illustrates the swings from the last two bear markets. Every trading day is represented. It is easy to forget all the big rallies that suckered clients (and advisors) into believing the worst was over.

Emotions can get the best of most of us during a bear market. In addition to very large swings in market prices, you are met with a constant barrage of negative headlines along with market cheerleaders saying it is a “buying opportunity”. It is easy to manage money during a bull market. The real value of an investment manager comes during bear markets.

Whether we are in a bear market or not, remember last January started with a 7% rally in the S&P 500 only to see it lose 12% in 8 trading days. If you want to get really dark, realize this is the best start of the year since 1987. (No we are not calling for a stock market crash, just reminding you how quickly markets can switch directions.)

3.) What should I expect for returns going forward?

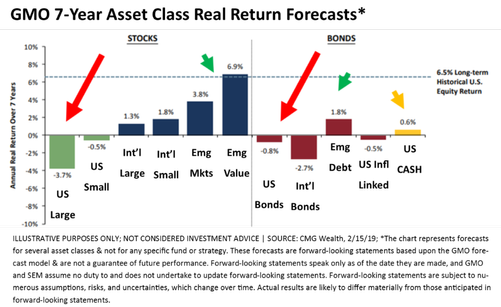

Buy low, sell high. This advice is easy to say, but difficult to follow. In numerous studies, the starting valuation point

has been the number one determinant of longer-term investment returns. Valuations are subjective as are market forecasts. At SEM we choose to focus on DATA not opinions. This is the reason we will use the expected returns from GMO in setting long-term expectations for clients and advisors. GMO takes the current valuation levels for all major asset classes and applies a multiple regression model to forecast the overall annualized returns for the next 7 years. They have one of the best track records we’ve seen.

It is easy to get lost in the short-term noise of the market. Their forecasts are not timing indicators, but expectation setters. Looking at where we are NOW we cannot think of a better reason to deploy a well diversified active management approach similar to SEM’s. We have the ability to go wherever necessary to make money (or to protect it while we wait for valuations to become more reasonable.) Are you ready for negative returns in US stocks and bonds the next 7 years? How will you know when to rotate into Emerging Markets with a heavier allocation (or out of Emerging Markets and back to US stocks)? SEM is here to remove those emotional questions from your mind & to assist in customizing an investment portfolio based on your financial plan, cash flow strategy, and investment personality.

News & Notes:

2018 Year-End Tax Statements

The 2018 Consolidated 1099 mailings to you includes cost basis and sales proceeds for investments sold during 2018. This provides essential information needed to complete your Federal Tax Filing Form 1040 Schedule D and Form 8949. These were mailed in February & are available on Liberty (E*TRADE’s website) or via TD Ameritrade’s website.

For those clients that consolidated taxable accounts from TD Ameritrade to E*TRADE (formerly TCA), you should have received forms from both custodians.

For more information go to our website:

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.