We've reached the last month of our Biblical Approach to Finances series. Last month, we went through what our attitude towards investing should be using various Bible verses. Now, we're going to wrap up the series with some investing 101:

- What makes a good investment?

- Risks and Returns

- Types of investments

- Picking the right investments

What makes a good investment?

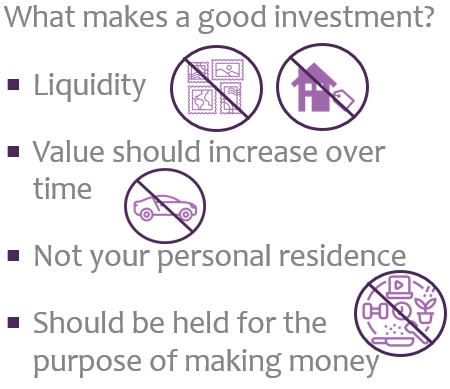

There are several aspects that make up a "good" investment. The first is liquidity. Liquidity refers to how easily something can convert to cash. Things like collectibles or real estate are not considered liquid. Good investments can easily be turned into cash.

Secondly, a good investment's value should increase over time. As we've mentioned in previous blogs, things like your car immediately lose value; therefore, it is not considered a good investment. Similarly, your personal residence is not considered a good investment. When you factor in the amount of money put into a house (fees for closing, loan payments, furnishings, upkeep, and time), most people do not make a high enough profit to consider a personal home an investment. Moreover, your home has intangible intrinsic value that cannot be monetized.

Finally, your investments should be held for the purpose of making money. So, anything you do for a hobby and for fun that doesn't earn you profits should not be considered an investment. The graphic below summarized the aspects which make a good investment.

Risks/Returns

When considering investing, it is important to know that ALL investments are comprised of some degree of risk in order to get a return. Nothing is ever risk-free!

When you hear the word "risk", what is the first word that comes to mind? Some common answers are danger, exposure, uncertainty, opportunity, adventure. Different people are going to have different takes on risk. Some people are highly risk-averse – those people would associate "risk" with "danger". However, some see risk as an "opportunity" or an "adventure". It is important to understand your willingness to be risky BEFORE investing so you're not investing something that you're uncomfortable with.

The objective in investing is to make more from the returns on your investments than you are risking. Risk and return is almost always correlated, and different investments have different risks associated with them, which will earn you different returns.

What loss in value of your investment would begin to make you uncomfortable?

- Any loss

- 10%

- 20%

- 30%

- 40% or more

Just like the last question, there are going to be people who are highly risk-averse and would be uncomfortable with any loss, whiles other people enjoy taking risks.

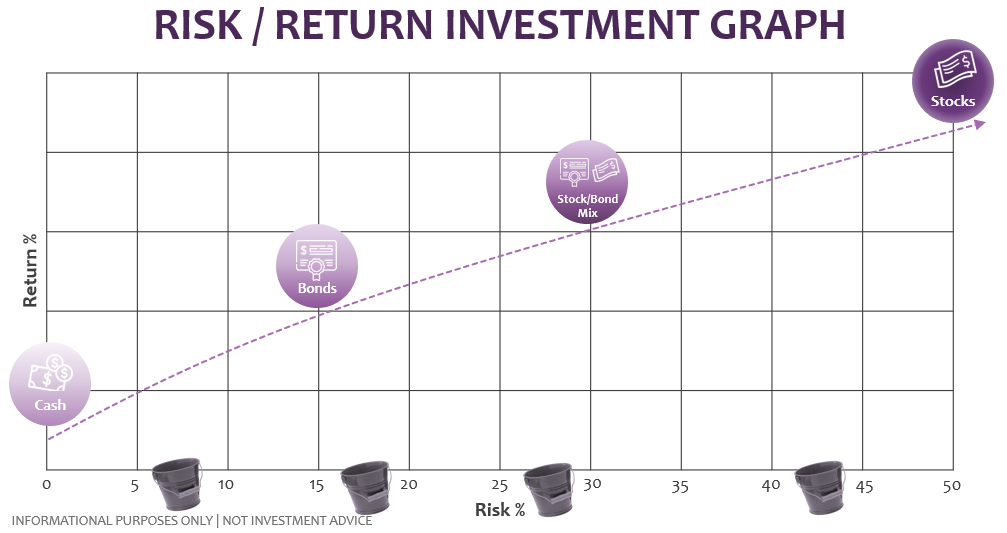

At SEM we have a bucket system for our investment portfolios. I have an example of the risk/return investment graph below. This is just the basic concept of the graphic, but SEM has a more detailed version with their specific investment models.

The x-axis signifies the amount of risk you're willing to take. As the y-axis increases, your returns increase. However, as noted, the highest returns require the riskiest investments, which do NOT have guaranteed returns. The purple circles on the graph represent the type of investment, which we are going to discuss more next.

Types of Investments

Stocks

When you buy a stock, you buy ownership of a company; therefore, you get a share of the income via dividends. If the company does well, you profit; however, if they lose money, you also lose money.

Stocks can be easily bough and sold through the exchanges during market hours (which are standard business hours, Monday-Friday – except bank holidays.) Those "stock exchanges" that you've likely heard the most about are the New York Stock Exchange and the NASDAQ, which most shares (or stocks) are traded.

Stock prices are well-known and easy to find. You can do a quick internet search of your favorite company. If they are a public company that has stocks available, rather than being privately-financed, you'll easily find their stock price.

With stocks, there are different risk involved, including:

- Economic: stocks can change dramatically with what people expect the economy overall to do.

- Industry: any company's specific industry can face unforeseen incidents, either good or bad, which influence how well the company performs financially.

- Business-specific: individual businesses face risks due to their own business processes or things that are happening specific to them.

Bonds

Bonds are ownerships of debt. Essentially, you, the lender, are giving an entity (either a company or the government) a loan that they must pay you back. Bonds are safer than stocks because they must be paid back, and the bond market has historically been more stable and less volatile. With stocks, there is no promise to pay you back. However, it is important to note that bond issuers – those borrowing the money – can default, which means they do not pay you back.

Bonds are also generally harder to buy and sell than stocks because it cannot be done electronically, and they are sold in LARGE dollar amounts. For example, newly-issued US Treasury Bonds are sold in $1,000 increments. These are typically held for several years, and the government pays you back, often with interest. Contrast that with a stock like the Walt Disney Company, which could be sold for around $86.92 (as of August 17, 2023) at any point when the market is open.

Mutual Funds

Mutual funds are a large basket or combination of stocks and bonds. Finance professionals often talk about diversifying your portfolio – you diversity by not holding too much of the same thing, and mutual funds can help you accomplish this. They can be purchased in small dollar amounts, giving the buyer more flexibility. There are MANY choices for mutual funds, with different funds meeting different investment goals.

Mutual funds are carefully managed by an expert, so that you, the individual, do not have to do it by yourself. There are expenses you'll have to pay, and they can vary depending on the type of mutual fund, your risk factor, etc. The values of mutual funds are set at the end of each day.

ETFs

The final type of investment we're going to discuss are ETFs, or exchange-traded funds. ETFs are a type of mutual fund; however, they trade like a stock. One ETF represents a combination of several stocks and bonds, but it trades in the market like a single stock would. Therefore, they are easier to buy and sell. You will still face different expenses like a mutual fund.

Picking the right investments

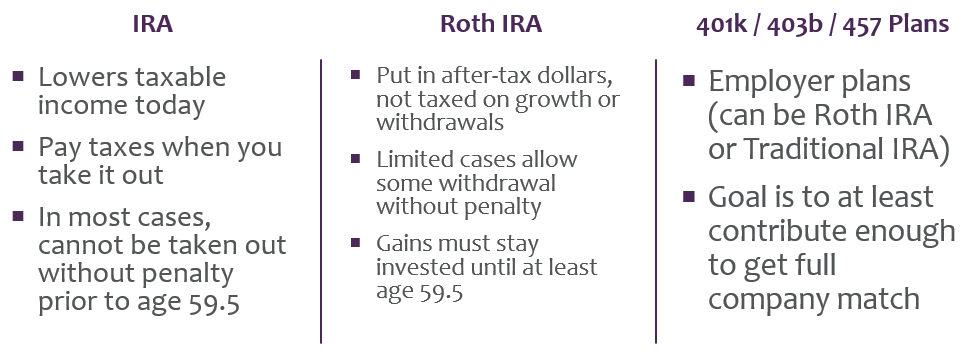

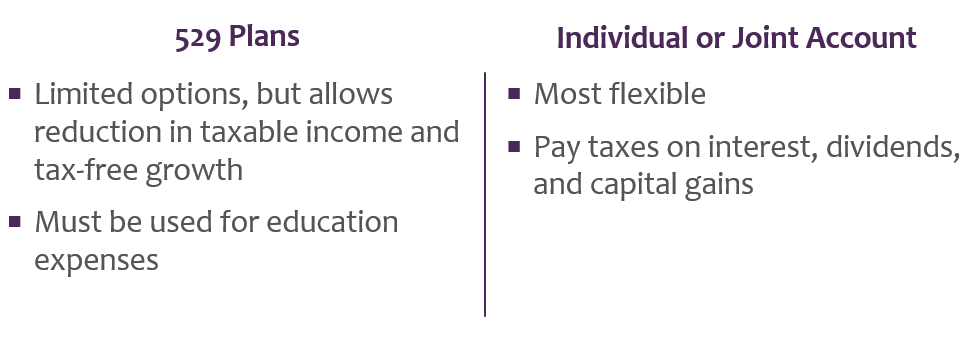

We've already covered a lot, but I want to finish by going through how to pick the right investments. As mentioned earlier when talking about risks and returns, everyone is going to have various levels of comfort. Everyone also has different situations; therefore, an investment that might be a good fit for one person, might not be a good fit for someone else. The first step to figuring out the right investments for you, you need to consider your time horizon and your objective.

When do you need the money and how much do you need? How long you plan to hold onto the account and let it earn money helps determine what kind of account you'll want. There are specific accounts for different parts of life, so what the purpose is helps determine what kind of account to get. The graphic below summarizes some of the different account types.

You can also check out this TikTok video rom Jeff for a short explanation of different investment accounts:

@finance_nerd Financial planning can be overwhelming, especially trying to prepare for retirement. We want to help simplify retirement with this short video explaining the types of retirement accounts. #financialliteracyfriday #financialliteracy #retirement #retirementplanning #retirementaccounts #financialsuccess

♬ original sound - Finance Nerd - Finance Nerd

Going back to time horizon, the longer you have, the more risk you can take on (depending on your comfort level), so stocks are better. If you have a shorter time horizon, you need to have less risk and more guaranteed returns. An emergency fund is important, which we discussed in our savings blogs. For emergency funds, it's important to have it be liquid – it should be able to turn to cash immediately when you need it.

This is a lot of information in regards to investing, and it can seem overwhelming. The best next step to take if you're wanting to start investing, is to take our risk assessment. This helps us figure out what your risk tolerance level is and what your investing objectives are. If you're interested, you can find our risk questionnaire at risk.semwealth.com.