Last week we discussed the "Dog Days" of summer and how August and September tend to be the worst months on the calendar. One thing I point out nearly every time I discuss the markets is, my 'opinion' about what may happen does not impact the way we invest at SEM.

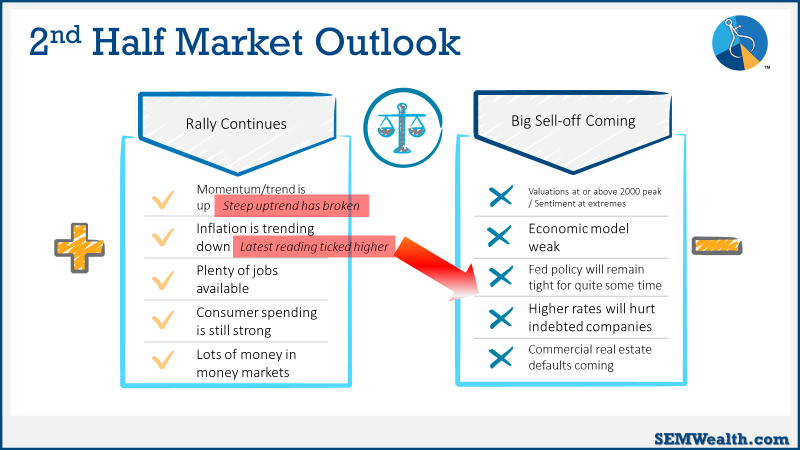

I'll get to that in a moment, but first I wanted to revisit the graphic I created at the start of the quarter, listing both the reasons the rally could continue in the second half, as well as what could cause a big sell-off. The euphoric sentiment has certainly shifted the last several weeks with the market actually going down, so I updated the graphic to highlight what has caused the short-term uptrend to be broken.

The culprit is inflation, what it means for Fed policies as well as the heavily indebted companies (and the US Government) in terms of paying back the debt coming due. We've seen the US Government downgraded, a slew of regional and community banks, and last week a warning that the biggest banks may be downgraded.

The bond market is telling us inflation is a problem and it's starting to hit the stock market. I've said from the outset of the bear market whenever the bond market believes the Fed has lost control of the inflation fight, they force rates higher. The fact we eclipsed the November 2022 peak in rates speaks for itself.

From a historic perspective, 10-year bond yields are all the way back to the December 2007/June 2008 levels which came just before the financial system imploded.

It's interesting to see the current sell-off started after the Fed's latest rate hike. It has now come all the way down to the same level it was when the Fed skipped a rate hike after 9 consecutive tightenings. This puts the S&P 500 essentially back where we were a year ago. Coincidently (or maybe not) the sell-off last August started just before the Fed's annual Jackson Hole symposium. At that symposium, Fed Chair Powell warned the Fed had a "long way to go" in their inflation fight.

What will Chair Powell and his merry group of market manipulators have to say this week when they gather? The main event is Friday at 10 am. There isn't a lot of other economic data this week. We will see a few more retailers report earnings. Based on last week's retail earnings reports, it would be a surprise to hear good news. Probably more importantly, Nvidia, the company which most people believe is the biggest beneficiary of AI reports earnings on Wednesday.

It could be an interesting week.

SEM Model Update

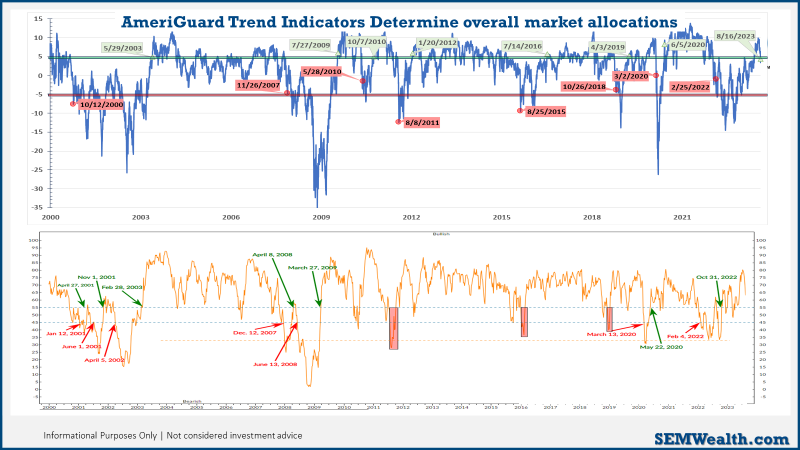

We've been talking since the start of the second quarter about how close the second trend indicator inside AmeriGuard & Cornerstone was to triggering a buy signal. Essentially, it was waiting for a pullback to monitor the underlying 'breadth' of the market. In other words, is the average stock doing better than the index on the decline? The answer so far is 'yes' and we saw the system which sold back in February 2022 move back into the market.

This early in the buy signal the reversing 'sell' is about 3% below the current price of the market. If the signal is wrong, we take a small hit and move back to money market. If the signal is right we SHOULD see a much healthier rally to close out the year.

Along with the trend buy signal, the "core" component was also rebalanced into more broad based allocations – reducing large cap 'value' and adding some small and mid-cap positions. We also eliminated the international position taken to start the year. The data is saying the international economies are at a much higher risk than the US and our models have adjusted accordingly.

While the 'strategic' portfolios have moved to fully bullish positions, we could see sells in our more conservative 'tactical' models any day now. We already sold our emerging market bond positions last week and the high yield positions could be sold with another day or two of losses.

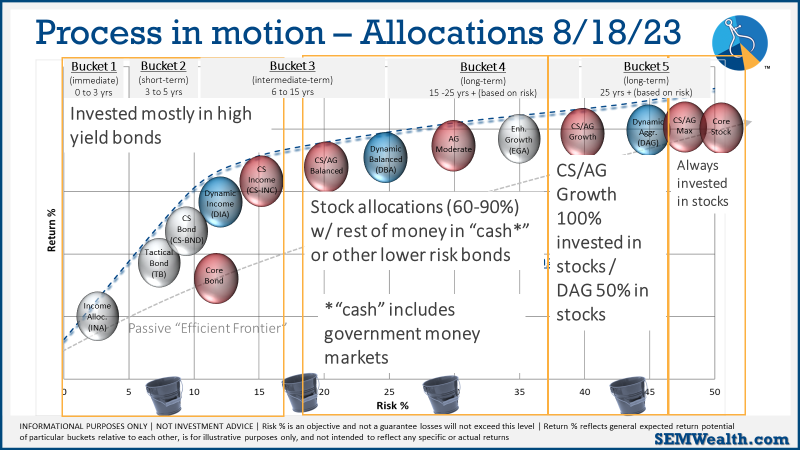

This is the beauty of SEM's truly diversified approach. You get 3 distinct investment management styles inside one portfolio. We can customize models to match nearly any objective, risk level, and investment personality.

Our "bucket" approach allows for different parts of the portfolio to be positioned differently based on where we are in the market cycle. Whenever we are at a crossroads moment it is especially risky. This requires a disciplined approach which is what SEM brings. There will be much easier times to invest. Our goal is to get there with as much capital in tact to take advantage of that opportunity.