Stocks are a forward looking mechanism. That is drilled into our heads constantly. It means stock market participants are constantly looking ahead at what the future will look like and then assign a "fair" price today to whatever you think the future will hold. The problem with that method is very few people have a track record of successfully predicting the economic future. More importantly, the way we assess the future is full of behavioral biases that cause significant variability in our assessment.

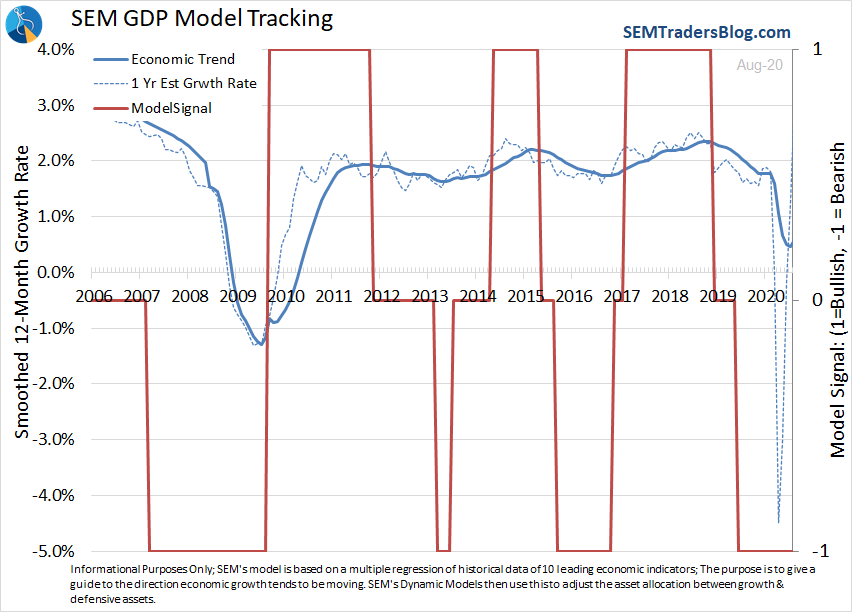

SEM's Behavioral Approach is key to overcoming those biases. We use data and only data to make investment decisions. One of those key data points is our proprietary economic model. It is used inside our Dynamic Models and is designed to give an assessment of the economy to take advantage of changes the Wall Street firms will make to their "strategic" investment portfolios. If Wall Street sees the economy improving they will increase exposure to risky assets. If they see growth slowing, they will decrease exposure. Since every firm has their own team of analysts and is constantly trying to be better than the other firms, not all firms make their moves at once.

Our economic model predicted the recession before anyone on Wall Street had uttered the word Coronavirus. It got defensive in early 2019 as the temporary boost wore off. It has remained negative throughout the recession. It is obviously not designed to see a 10% year-over-year drop that is met with trillions of dollars of stimulus from the Fed or Congress. Stock market participants took that as a buy signal and poured money into stocks, especially those companies who were benefiting from the nationwide lockdowns. We now have large cap stocks back to all-time highs with the economy likely to post another weak quarter.

SEM will not override our signals. By design both our Tactical and "Strategic" (AmeriGuard & Cornerstone) models made adjustments quickly and have thrived in this environment. They reduced risk in February and March and jumped back in in April. Only with the benefit of hindsight will we see if large cap stocks predicted a mind-blowing turnaround in the economy or whether those stocks gave too much credit to stimulus that will have to be paid back (and thus be a drag on 2021 growth and beyond.)

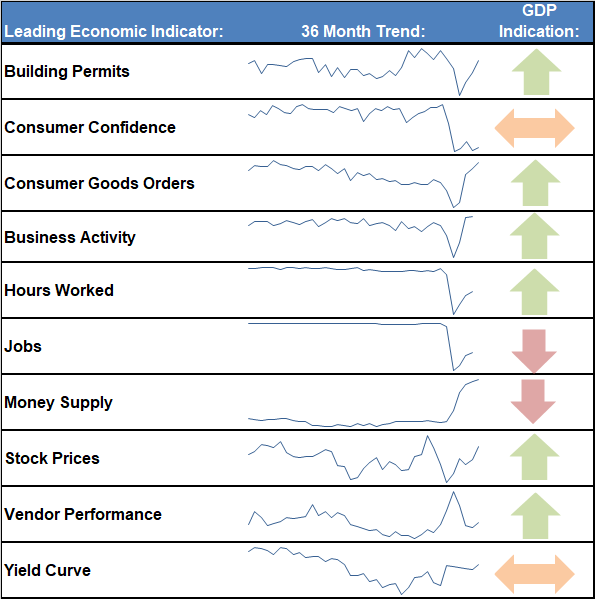

Our economic model remains negative – barely. Let's take a look at some of the indicators to get a feel for where things stand.

The Good

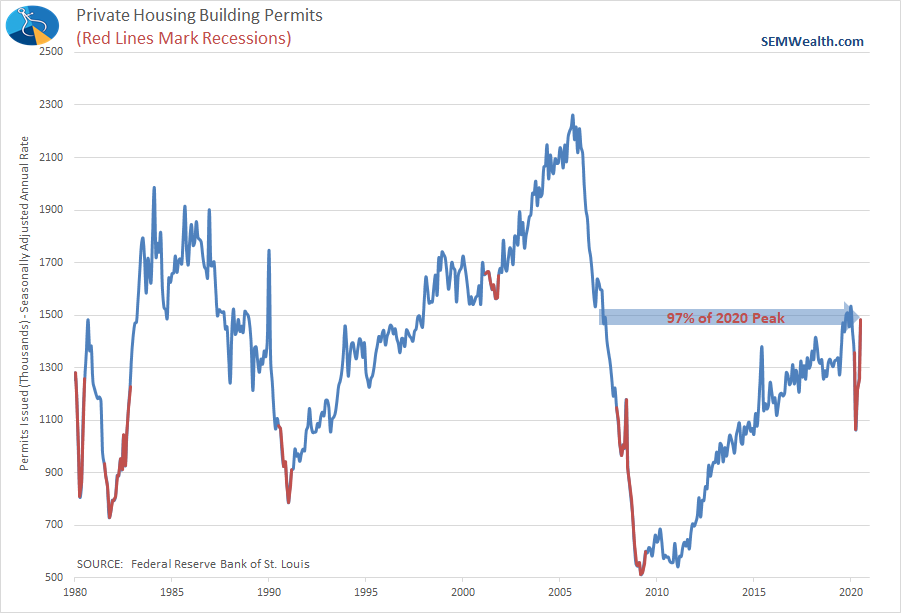

Housing has certainly been the most positive indicator of them all as companies realize they can still function with employees working from home. As somebody who has always had the ability to telecommute and for the last 2 years has lived the "rural" lifestyle, I am excited for people to be able to not waste so much time sitting in their cars driving to and from an office.

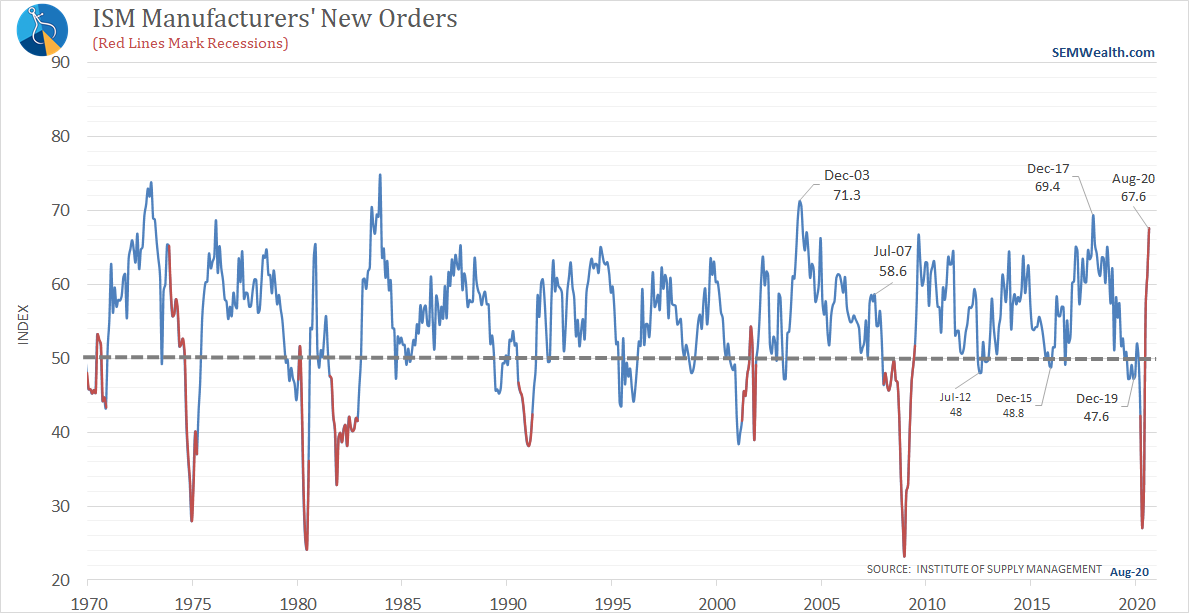

We've also seen a remarkable comeback in manufacturing activity.

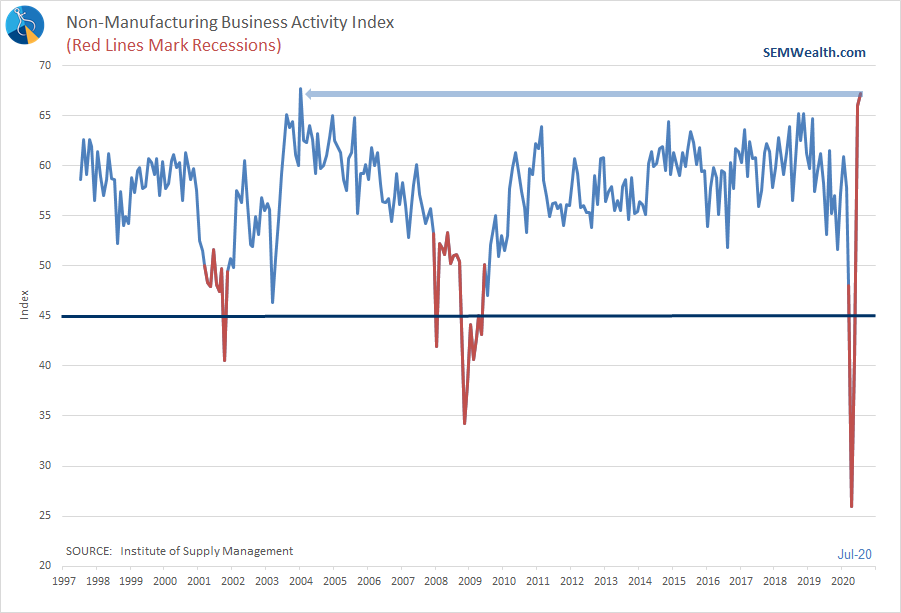

Our country is built on service businesses. We learned the issue with that this spring – service jobs can be erased overnight. So far, we've seen enough of them come back to keep the recovery going.

The Questionable

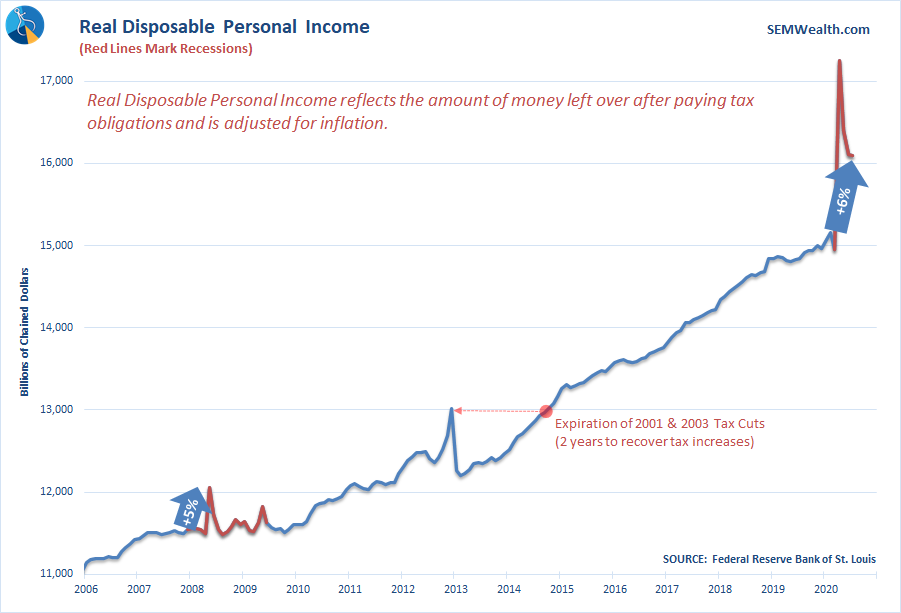

The stimulus really helped (I so much hate saying that). We actually have experienced an overall INCREASE in income since February.

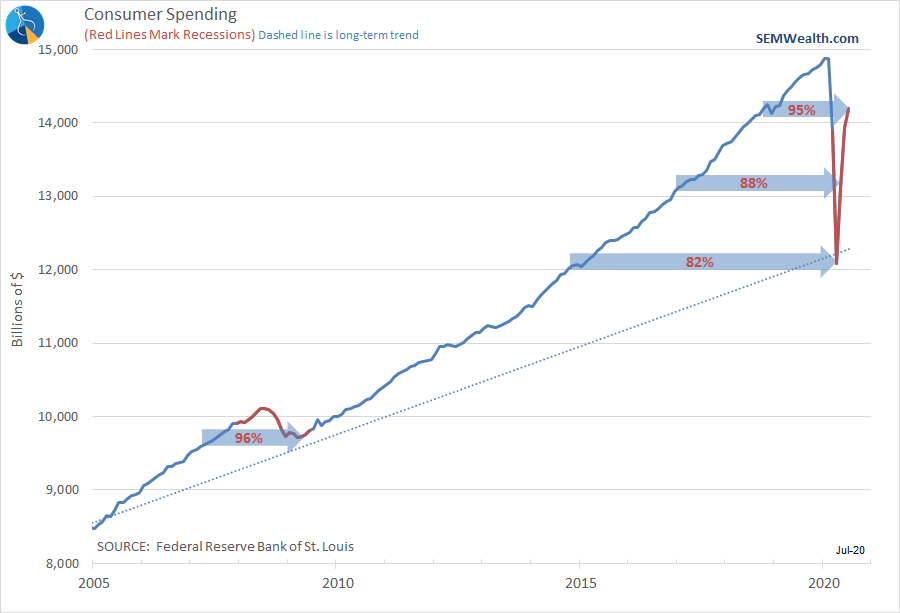

The problem is this has not resulted in a snapback in spending.

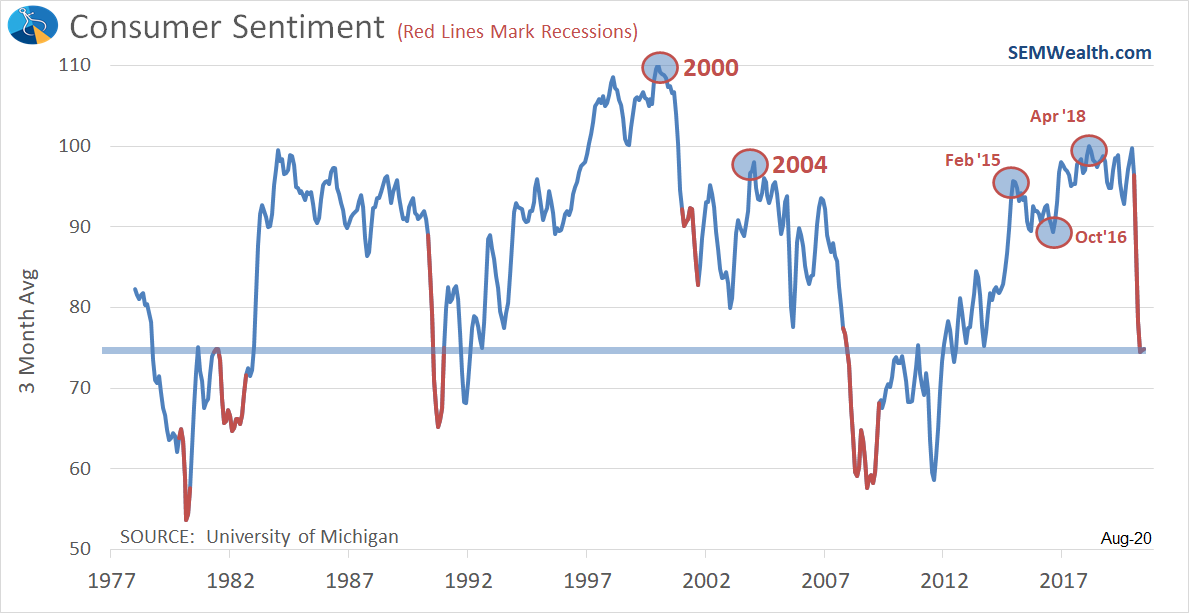

It all comes down to confidence. If consumers are not confident about the outlook they won't spend money as willingly as they did in the past.

The Ugly

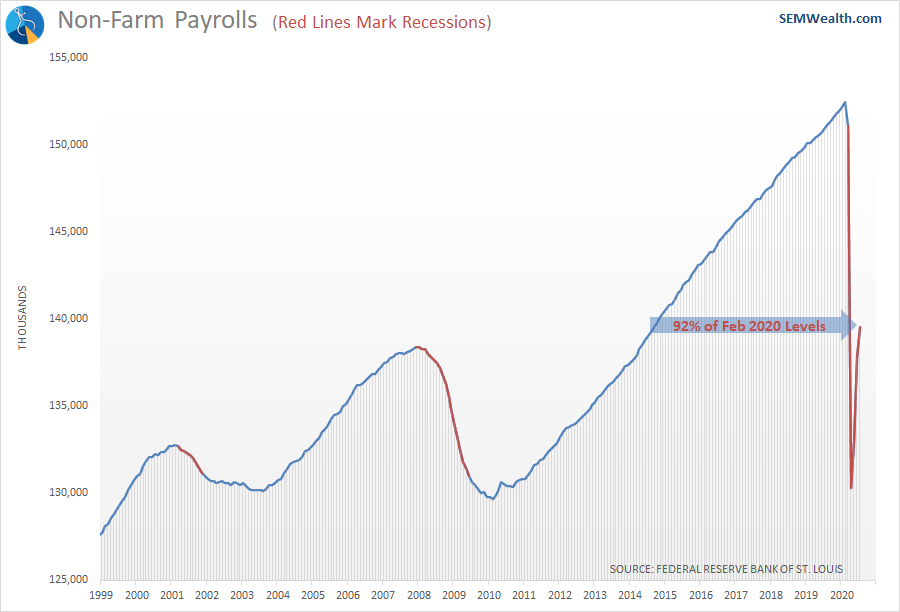

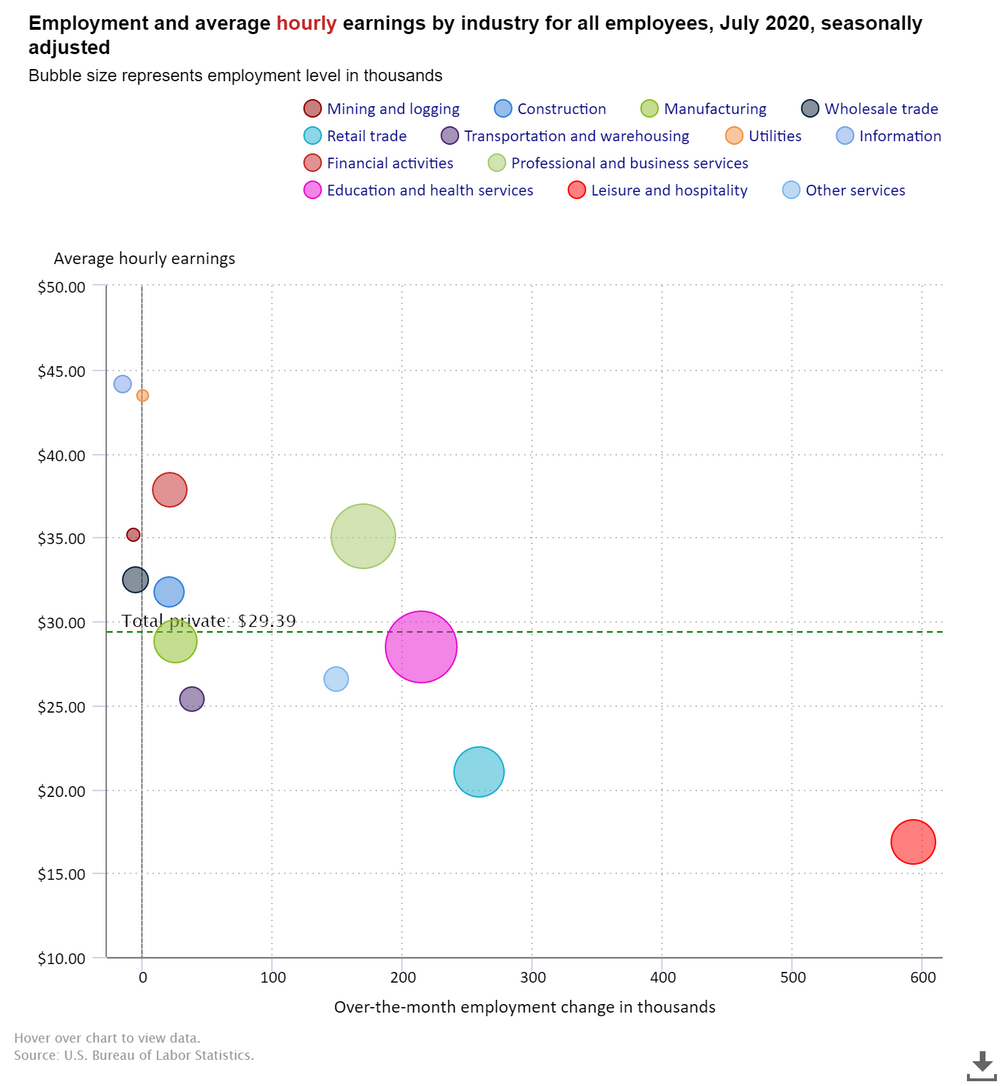

The real issue is in both the number of people working and how much those jobs are paying. Hours have been increasing, but are still well below where they were. Wages are down. The way we count jobs is imperfect (if you worked at all during the survey period it counted as a job). Even with that, the thing holding back economic growth the most is the labor market.

(I'll update the chart above Friday or Monday following the July Payrolls Report).

I shared this chart last month. It illustrates the problem – the jobs we are adding are on the lower end of the pay scale.

Where to from here?

All of the above leaves our Economic Model on the verge of moving to "neutral". The model is designed to learn on the run and adjust to structural changes as they develop. If we've seen big shocks it adjusts accordingly.

Any improvement in GDP growth is likely to be (very) temporary as the measures put in place have to be paid back in the years ahead.

The trillion dollar (or 2-3 trillion dollar) question will be what the inevitable air pocket between the expiration of Federal Unemployment Benefits and any new stimulus will do to stocks and the economy. The pace of the recovery was slowing in July. If Congress does not act quickly with more stimulus (I really, really hate typing that), we could see the economy turn lower again.

Will stocks be able to handle it? I won't make that guess. That's why we follow our Behavioral Approach and advocate a blend of our 3 strategies (Tactical, Dynamic, and Strategic) with a critical focus on how to match the investments with the financial plan, cash flow strategy, and risk personality of the client. You don't have to guess or make predictions when you work with SEM.