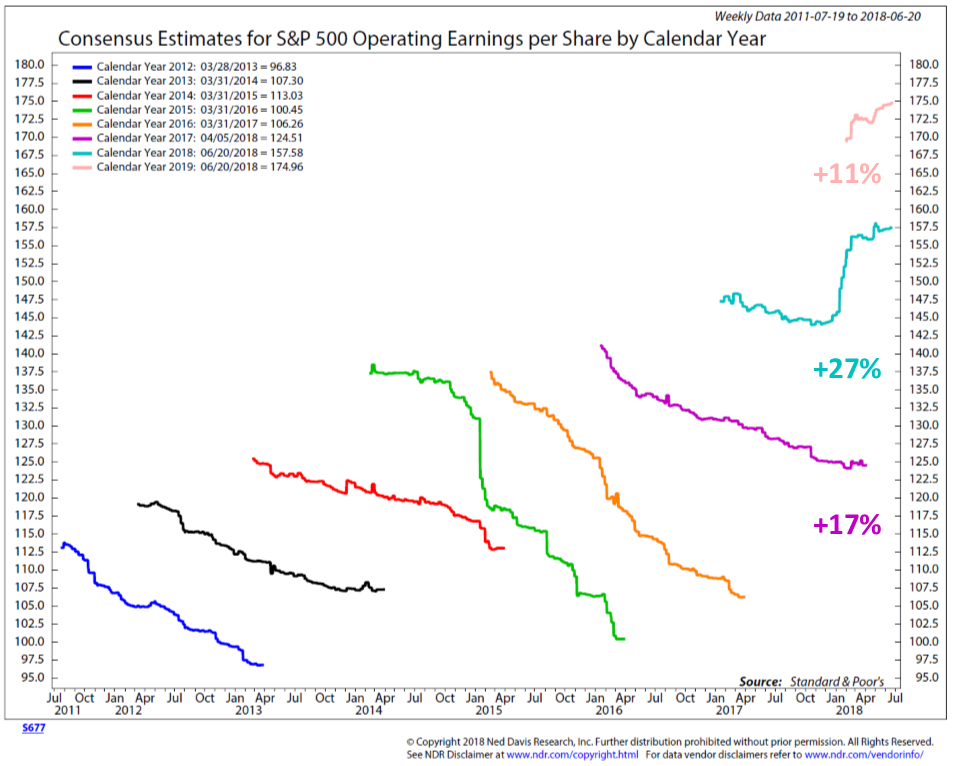

At a time when there is so much angst on the damage the escalating trade war may have on corporate profits, we seem to be losing focus on the fact corporations are expected to post some impressive earnings growth over the next few years. The biggest boost in profit expectations has come from the tax cuts, although we had already seen a boost from a jump in consumer and business sentiment following the election of Donald Trump. This week’s Chart of the Week is a busy one that highlights several interesting data points.

First, each line represents the consensus earnings expectations forecast by analysts. Note the typical trend — analysts start out optimistic only to be significantly cut their forecasts as the year goes on. Following the tax cuts, however we’ve seen a huge jump in expectations both for 2018 & 2019. As more corporations have offered clarity on the impact of the tax cuts on their bottom lines we’ve seen the usual downward trend reversed.

The chart also shows the trend in annual earnings. You can follow the end of each line to see the final calendar year earnings for that year. Notice the drop in earnings throughout 2015, which was a big reason behind the market’s struggles that year. Growth numbers like this are impressive in any environment, but to see something like this 9 years in to the economic recovery is unprecedented.

On the surface, this seems like a positive development and it can be…….if corporations can actually hit these lofty expectations. However, there are two things corporations may run into that could cause major disappointment when they post their earnings — inflation, the Federal Reserve, and the unforeseen costs of the trade war.

First inflation. While growth at any time is welcome, the stimulus of the tax cuts at a time where we are past full employment could be highly inflationary. Companies may be forced to pay higher wages to attract more talented employees. That brings us to the Federal Reserve. They do not want inflation and warned Congress about passing a stimulus bill this late in the economic cycle. This could cause them to hike interest rates to slow down growth, which will also hit corporations at a time where they will have to refinance all the debt they’ve used over the years to pay dividends and buy back their stock (see ‘Source of the Next Crisis?‘).

The big unknown is the short-term impact of the escalating trade tensions. The impact of tariffs and other retaliatory actions will not be felt for years to come, but the biggest concern is a drop in business and consumer sentiment. The economy has been surging lately so any little bump could cause it to fall back to a more normal rate. Looking at the expected growth in earnings any economic slowdown could cause profits to fall short of those expectations.

So why should we care? The answer is simple. The stock market is a forward-looking mechanism. It is already pricing in a two year surge in earnings. Even with this expected strength, valuation metrics using these expectations are at the high end of the spectrum. When stocks are this expensive there is no room for error. At SEM we do not use earnings expectations in any of our models, but we do monitor the underlying market action. The market has been volatile lately because those expectations are in jeopardy. If disappointment appears more likely, stocks could get hurt quickly and severely. Our systems have picked up on this possibility and have reduced our exposure accordingly.