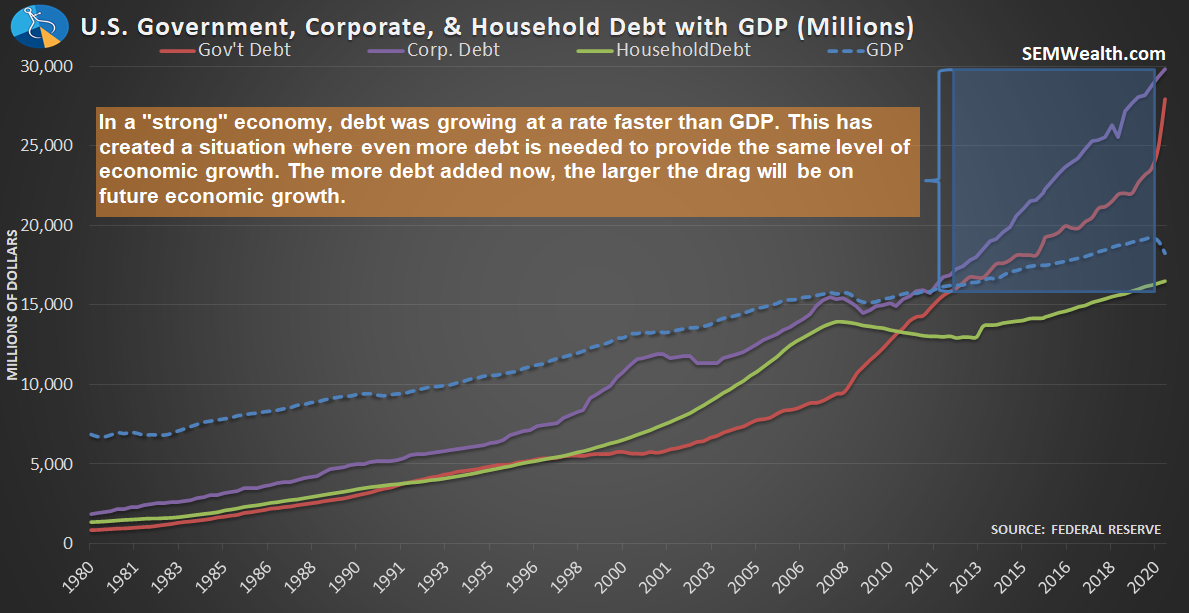

In the fall of 2019, the banking system froze due to the amount of new debt being auctioned by the Treasury Department to finance the budget deficit. The Federal Reserve had to step in and provide "temporary" emergency funding to save the banking system. At the time, the total issuance of new Treasury debt was $730 Billion per quarter. This was during a "strong" economy and one of the best year's in decades for the stock market.

This week, the Treasury Department announced they would be issuing a record $3 Trillion this quarter. This exceeds the TOTAL Treasury issuance for all of 2019. The Federal Reserve has announced "open-ended" Quantitative Easing (QE) measures to help finance the debt. We could very well see the Fed purchase close to 100% of all the new Treasury Debt with newly created dollars. This COULD create runaway inflation down the road, but right now the Fed is trying to fight a deflationary spiral. The consequences of QE is something we can address down the road.

Debt is not free money! For the Chart of the Week this week I want to address the overall health of our country. So many people are banking on a return to the "great" economy we had before Coronavirus reached our shores. The problem is our economy pre-Coronavirus was already bloated with debt from federal and state governments to corporations and all the way down to individual households.

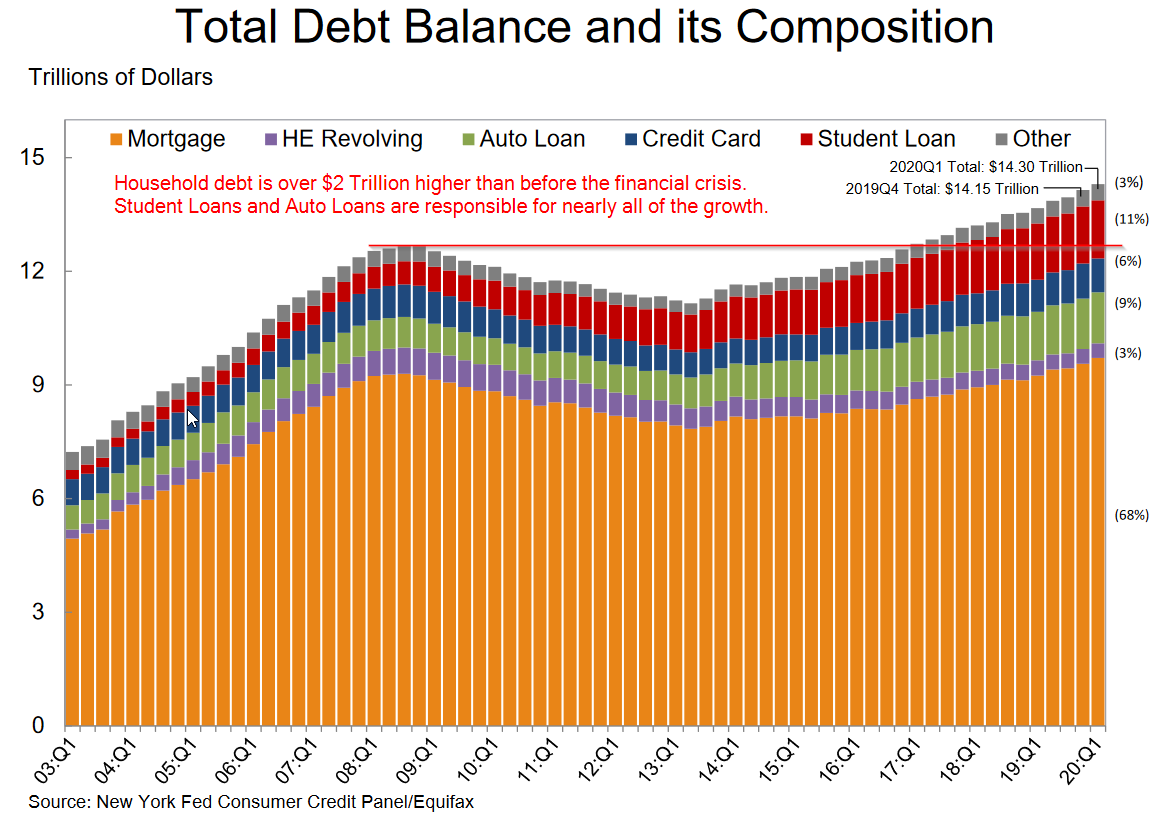

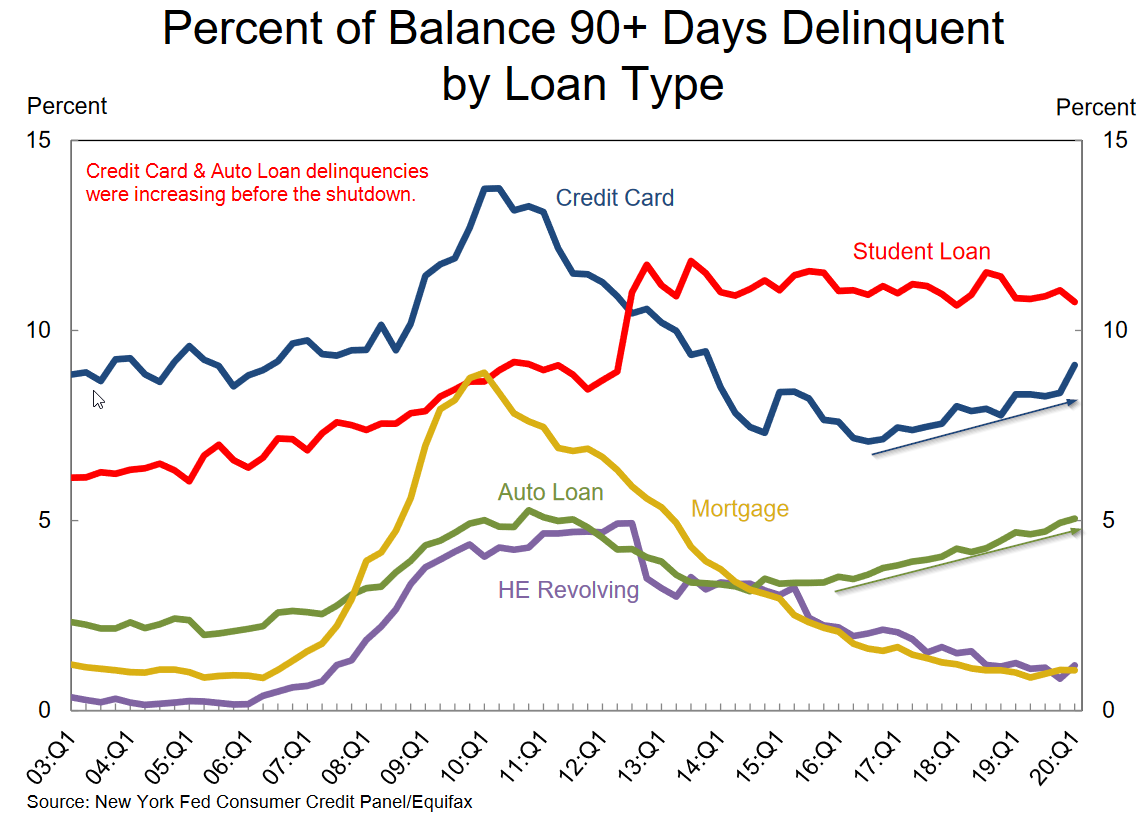

This week the Federal Reserve released their quarterly look at Household Debt. This data was as of the end of March, so included only a short period of the economic shutdown. It helps illustrate why a two month shutdown has crippled so many people.

Going into the shutdown, consumers were struggling to pay their credit cards and auto loans. This is usually a sign of an economy at a tipping point.

While the various stimulus measures were welcome and needed, they will not come close to being enough to save those consumers and businesses living on the edge before the crisis. We will likely see additional stimulus measures attempting to stop the damage over the short-term. Unfortunately, because we've relied on debt to stimulate growth for so many years it takes even more debt to generate the same level of growth.

The bigger issue is the drag this will put on future growth. Whether governments or businesses or households, debt means future income will have to be used to pay for today's spending. If interest rates go up, this makes it even more difficult to generate enough revenue to cover current needs. Before the crisis interest expense was projected to pass defense spending in the federal budget by 2022. The stimulus packages will only accelerate this scary thought. In a couple of years more than 100% of government revenues will be taken up by Social Security, Medicare, and Interest expenses.

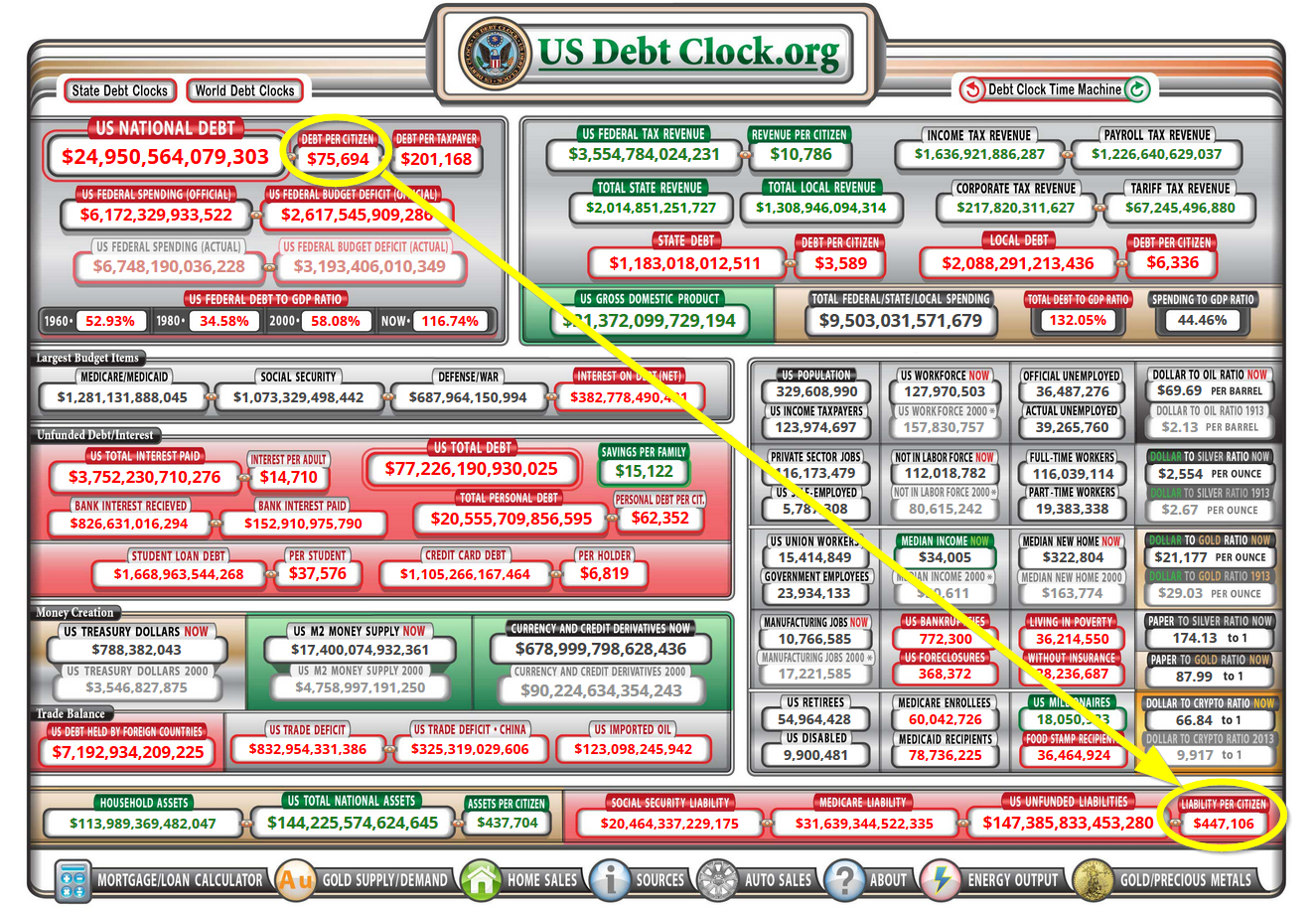

Two weeks ago I shared a snapshot of the US Debt Clock. Here is the current view. Note the debt per citizen compared to the total liability for each citizen when we factor in the promises made in the Social Security and Medicare programs.

In 2 weeks the Debt per Citizen has increased by $1200. The Debt per Taxpayer is up a staggering $3900. In two weeks. That's a pace of $101,000 per citizen per year. Think about that.

The Total Liability per Citizen is up $9300. In two weeks. That's $240,000 per citizen per year. This has to stop.

There are no easy answers to how we get out of this. It certainly will lead to great difficulty for buy and hold investors over the next 10 years. This means if you are retired already or retiring in the next 10 years, now is the time to look to a more dynamic, adaptive strategy for your portfolio. We've detailed the last two weeks our core solutions for these uncertain times. The links below take you to a more detailed discussion of each.

- Dynamic Income Allocation (DIA) - Your Core Income Portfolio

- Tactical Bond (TB) - (Delayed) Opportunities Emerging

Before we go, I'd also encourgage you to check in on the blog each Monday. I've been posting all the random thoughts that occurred to me over the weekend. It serves as a summary of all the things to be focusing on to start your week. Here is this week's post:

Monday Morning Musings - Week 8

Over the long-term I know we'll get through this current crisis and will figure out a way to re-create the American dream. The problem is all the solutions are terrible over the short-term, which means you cannot rely on buy & hold strategies that worked well in the past when we didn't have this much debt. We'll be here, ready to adapt to whatever comes next.