For the first part of 2024, we took you through a series called BRI Objections. We spent some time explaining how we respond to the reoccurring objections we receive about Biblically Responsible Investing. If you missed that series, you can find all the posts here:

For the remainder of the year, we're going to shift to discussing the birth of the biblically responsible investment movement. Before we jump into the beginnings of BRI, we're needing to look at some basic issues we see in the world today. In today's world, we often hear about "your truth" and "my truth" – this idea where we can make up our own truths that suit our needs and desires. This idea replaces real truth with relativism. Christians have to be careful to not absorb this ideology over sound biblical doctrine.

When it comes to finances and investing, a common mistake made by Christian's is thinking the money we have is ours, not God's. This ties directly into who calls the shots. Just like we've seen people today turn away from what truth actually means, we've seen a lot of Americans turn away from God. Even Christians can fall into the habit of using God as a sort of "consultant" in life until He gets in the way of our plans. Instead of allowing God to call the shots in our lives, we pursue our own interests.

Part of this issue of wanting to call the shots in our life is because of pride. There is a lot of scripture talking about pride being a person's downfall. We've seen the problems when a person is prideful in our Daniel study. A quote from the book, Invested with Purpose, says

"The Spirit should permeate everything we do, including how we handle our money — a topic the Bible addresses in more than 2,300 verses." (viii)

With so many turning away from God and Christians struggling with following the world in all areas of their life (including finances), Arthur ("Art") Ally, founder of Timothy Plan, wanted a way for Christians to invest money without aiding immoral causes. We're going to look at the story of Timothy Plan, which was founded in 1994, and how it helped start the Biblically Responsible Investment movement. These blogs won't share all the details, but you can find them all in the book if you're interested.

Being Invested with Purpose

Have you ever had any moments in your life where you had to fully trust God in seemingly impossible situations? That's where Art found himself after founding Timothy Plan. Between 1994 when it was founded and New Year's Eve 2002, they barely escaped bankruptcy three times. They found themselves in the same situation; however, Art remained calm even in this difficult situation. However, the rest of the employees were not calm like their founder. Was Art just overlooking how terrible the situation was? No! He fully trusted God in this tough time, and before the end of the workday, they received enough capital to keep Timothy Plan's distributor going! After making it through, Art gave all the credit to God, not himself.

After sharing about the times when Timothy Fund almost went bankrupt, the book spends some time looking at idolizing money and debt. Here is some of what is mentioned:

Wealth

One of the most revealing areas of life is how we handle money. As I stated at the beginning, a common mistake Christians' make is thinking the money they have is theirs instead of God's. We respond different in how we handle wealth depending on if we believe the money is ours or if they money is God's and we are to be stewards of it. While there are a plethora of verses with warnings of idolizing money, here are just a few of the verses mentioned in the book:

Money isn't the problem, it's the love of money (see 1 Timothy 6:10). We talked more about shifting our attitude towards money in our Biblical Finance workshop. If you missed that series, you can find all the posts here.

What is your attitude towards money? Are you its master or does it master you?

Debt

In the book it says, "debt is an enemy of a purposeful life." (pg 9) Do you agree with that statement?

The Bible has a lot of warnings about spending too much, we again talked about debt in our Biblical Finance series.

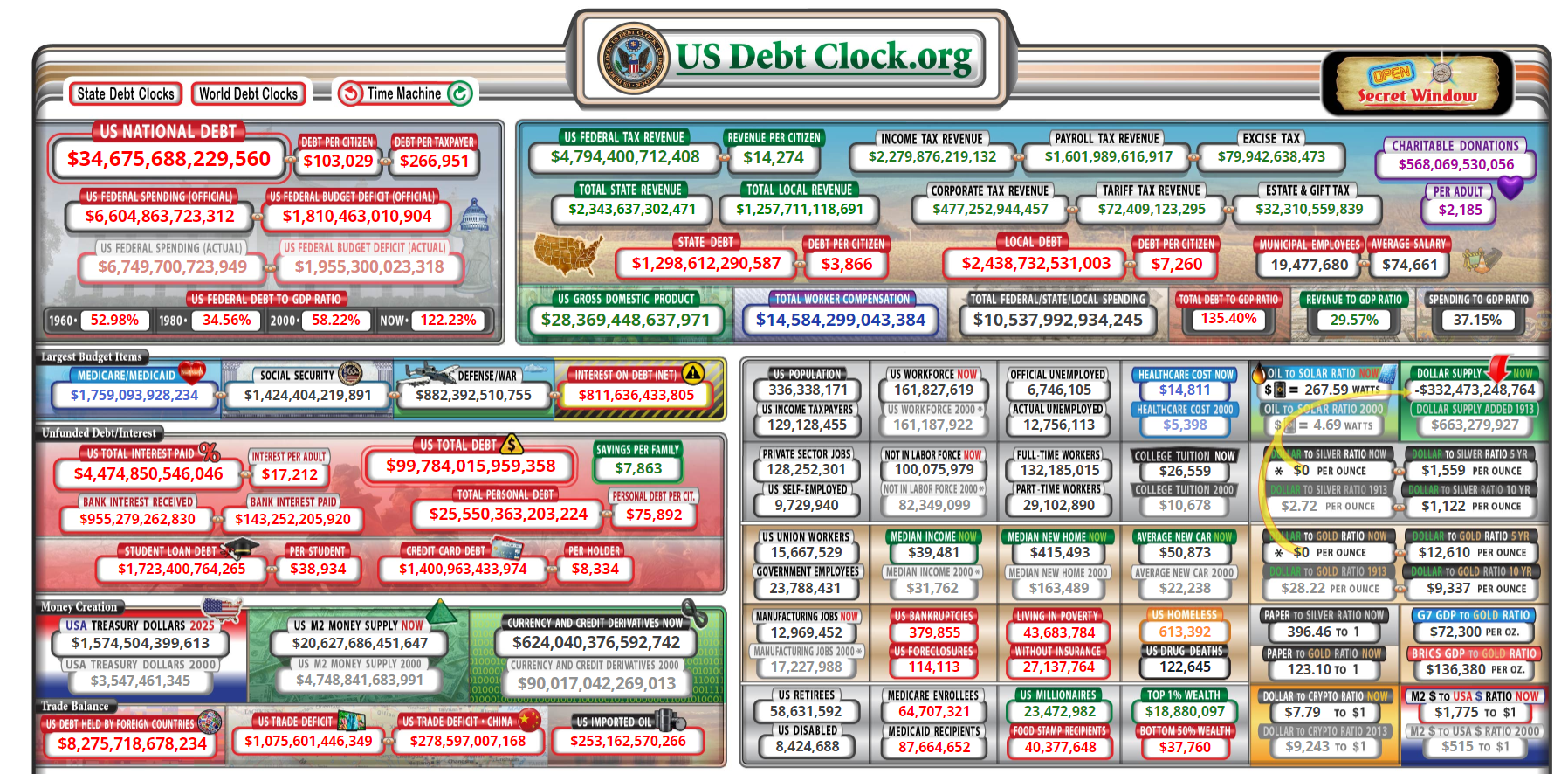

When you're living in debt, you're living beyond your means. The United States lives way beyond our means. Have you ever looked at the USDebtClock.org? When this book was published in 2019, the US debt was past $22 Trillion. Looking at it at the end of April 2024, it's now over $34 trillion. To put that into perspective, the debt per taxpayer is about $267k and the debt per citizen is about $103k.

The US debt is out of hand, and it can be very easy for our own personal debts to get out if hand if we're not careful. The book states, "The problem with debt comes down to trusting God's provision rather than the empty material promises of the world" (pg 13).

Now that we've discussed different aspects of finances and what the Bible says about it, next month, we'll start to jump more into the investing side of things. While this blog didn't touch much on Biblically Responsible Investing, it's important to understand the problems Art Ally has seen which led to him wanting to jumpstart BRI.