Stocks are back to all-time highs despite a brief "inflation" scare a couple of weeks back that knocked 10% off the NASDAQ and significantly more than that off the more popular momentum stocks. Most Americans will be once again receiving some nice payments from the Federal Government and the expectation is it will filter into the economy and allow corporate earnings to catch-up to the sky-high stock prices. I'll leave the guessing about the impact to the "experts".

A year ago I wrote this in the midst of the panic:

The most important thing to do is ignore the advice of the "EXPERTS". We will continue to see all kinds of predictions about what the impact will be on the economy. Just as I said at the beginning of the year when virtually every "expert" out there saw no issues on the horizon for 2020, any predictions about the future are worthless in my opinion. We'll let the data dictate our allocations, not our opinions. It's served us well for 28 years.

The title of the post was "Mapping the Next Move". When the market is at all-time highs and the "EXPERTS" are again predicting no risks in sight, it's important to formulate a plan. To do this you first must look at the environment.

Here are five questions you should be asking as you formulate your plans for the rest of 2021.

1.) How do you value a momentum stock?

I find it laughable that the "EXPERTS" tried to blame the big losses in the momentum/growth stocks on the spike in 10-year Treasury yields. In theory they are correct, higher interest rates make your "discounted cash flow" models generate lower valuations. It's laughable because there is no way mathematically anybody could justify the current valuations in these stocks even after they dropped 10-30% in the past month.

They went up because more people bought than sold. They went down because more people sold than bought. I explained this simple concept when discussing the Game Stop mania. It applies to all stocks.

People buying these stocks at record highs know they can fall just as quickly as they went up, so it makes for nervous holders, which leads to large spikes in volatility. "Buy high, sell higher" is the game they are playing. If you are playing along, it should be with money you can afford to lose.

2.) How much of the stimulus will be spent?

With more payments going out very soon the expectation is it will be spent heavily to help boost the economy. I personally believe reopening businesses, vaccinations, and the return of spring will be more responsible than the stimulus checks, but time will tell.

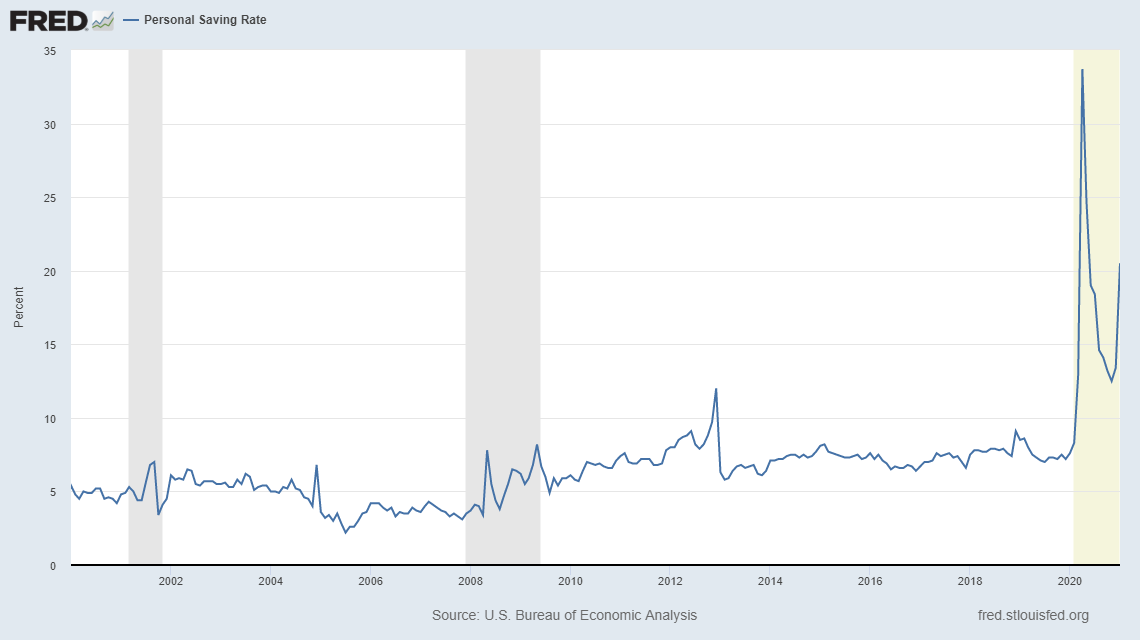

During the first two rounds we saw the bulk of the stimulus being "saved". Whether it was paying down debt or actually going into savings/investment accounts, our country has never seen the personal savings rate so high.

Overall, this is a good thing for each individual who decided to save/paydown debt with their stimulus payments. Overall, economists want Americans spending the money.

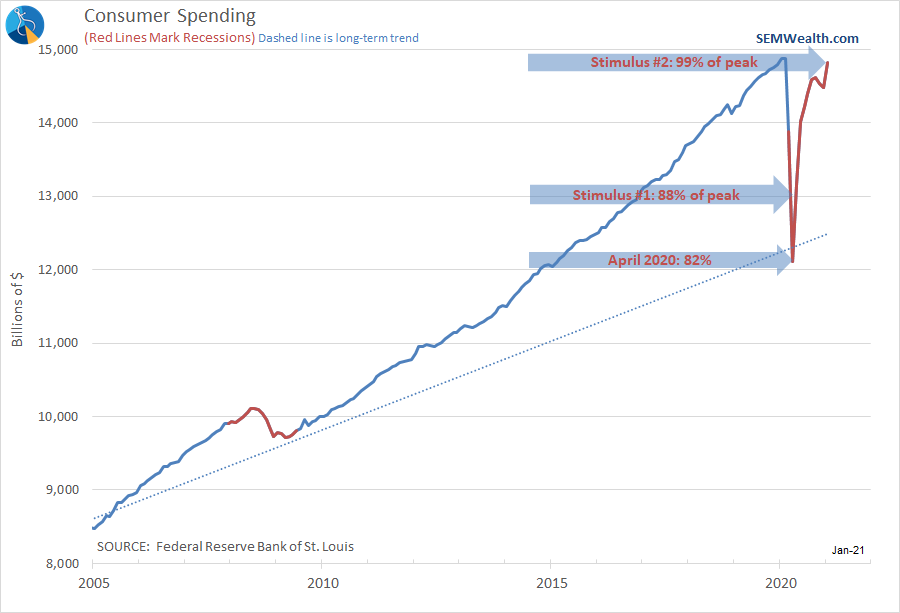

The stimulus has indeed helped boost spending levels. This next round along with the increased level of activity as the pandemic winds down should push consumer spending back above the peak levels.

3.) Will we see runaway inflation?

Depending on the political make-up of your social media feed, you may have seen people blaming President Biden for the spike in gasoline prices. I've kept this chart handy to explain the general direction of gasoline prices follows the general direction of economic expectations. Prices fall quickly during a recession and then spike coming out of it. They then decline when growth expectations wane.

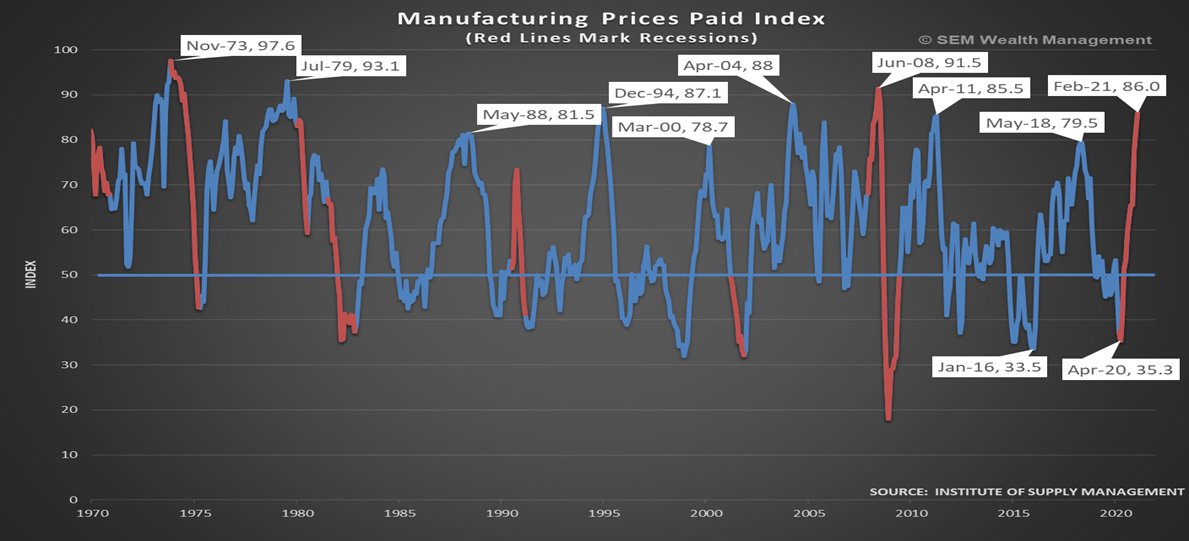

When you combine the shutdown of Texas refiners due to their ice storm (not the President's yet to be implemented climate policies) oil and gas prices are spiking at the expected huge increase in demand. We see and feel the increase in gasoline prices. What people aren't yet seeing, but soon will is the big increase in manufacturing prices.

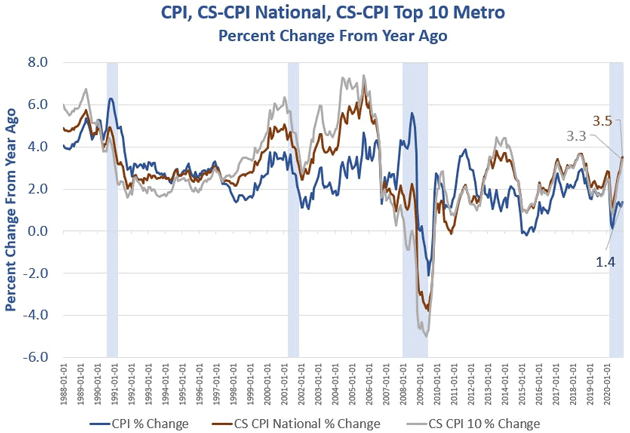

These will start filtering down to consumers in the second half of the year. Some areas, such as appliances and building products have already been passed down to consumers. What is not going up is the official inflation reading. Whether CPI or the Fed's preferred PCE, the official inflation number is ignoring one huge spike in prices that is starting to have an impact on the economic recovery – housing.

John Mauldin detailed this over the weekend in his latest Thoughts from the Frontline. I had always known housing costs were based on "owners' equivalent rent" (OER), but never fully understood how it was calculated. Essentially they survey home owners and ask, "if you were to rent your home, what would you charge?" There is a very high correlation between what they would charge and what their mortgage payment is. So when interest rates are low and banks are loose with their lending as they have been, the housing component of inflation is significantly understated.

John shared this chart in his excellent article. It shows what would happen to the inflation index if the actual COST of homes were used instead of OER.

How different would the Fed be acting if inflation were 3.5% instead of the "official" 1.4%?

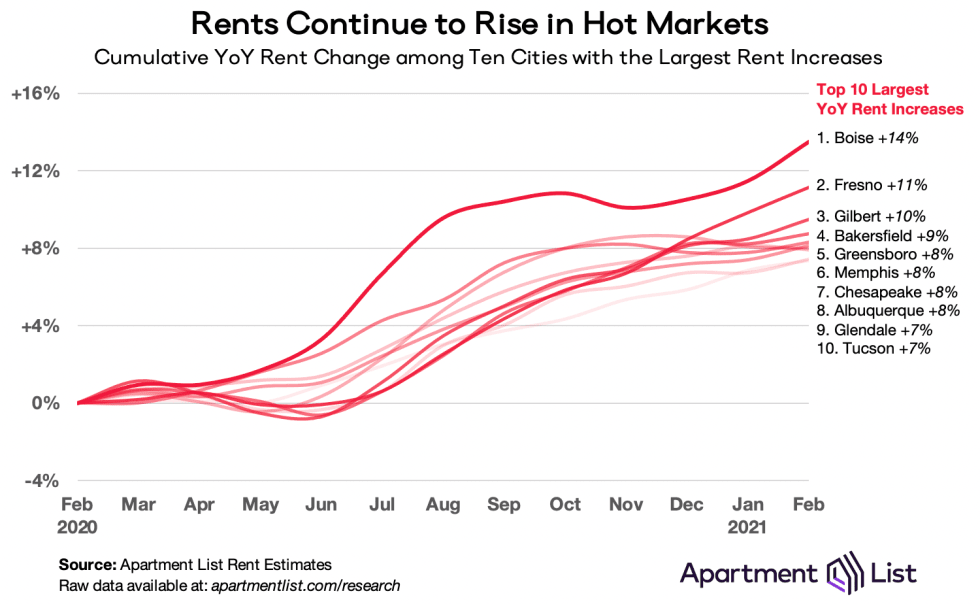

You also have the issue where the high cost cities have seen an exodus with the work from home movement, with workers taking their high salaries to other cities. Overall the drop in the large cities is masking the huge increase in the mid-size cities. This chart shows the increase in some cities. While not on this chart, our unscientific study of rents in Williamsburg, Virginia would show a 50% increase in the last 3 years (14% per year.)

What this means is Americans are seeing a huge jump in prices, yet the Fed doesn't, so we will continue to see prices rise significantly. These price increases will put a drag on the economy.

4.) Will we see a recession in 2022?

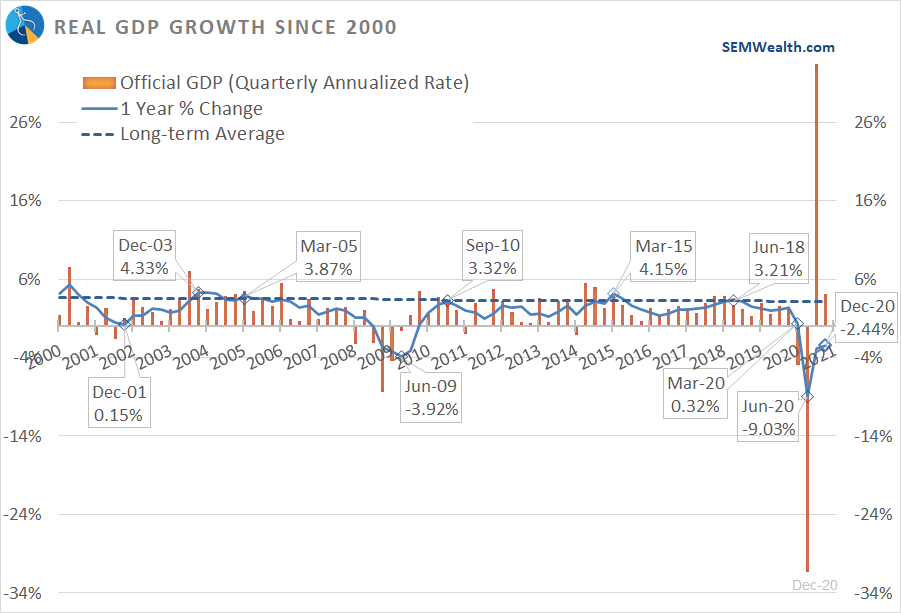

I haven't heard a single "EXPERT" discuss this possibility. They believe the stimulus from Congress and the Fed will lead to a huge spike and then a "return to normal". They look at this as the beginning of the growth cycle. I worry we may see a repeat of the post-Trump tax cut economy. Those tax cuts produced about an 18-month boost in growth before we started sliding back towards a recession. Our economic model began warning of this in the spring of 2019. Look closely at this chart, which is skewed because of the huge drop and then snap-back in 2020 of the "official" GDP reading. Pay attention to the solid and dashed blue lines.

Our economy has struggled to produce 1-year growth rates above the long-term average (the dashed line). Note the Trump tax cuts only generated 1 quarter where the trailing 12-month growth rate was above average.

There is a very real possibility this temporary spike in economic activity will have waned in 2022, causing a sharp economic slowdown. We aren't investing in the future, we're simply giving people money to dump into the economy. I also was looking at the tax changes and many of them are for 2021 only. Based on some rough calculations, there is a chance a family of 4 (with both children under age 6) making less than $75,000 will likely not have any tax liability in 2021. Unless some of the provisions become permanent, they will then owe taxes again in 2022.

I realize there are many other agenda items on the table for the Democrats, including an infrastructure bill and discussions of corporate tax increases along with other tax hikes. This could be a dangerous game with a very fragile economy.

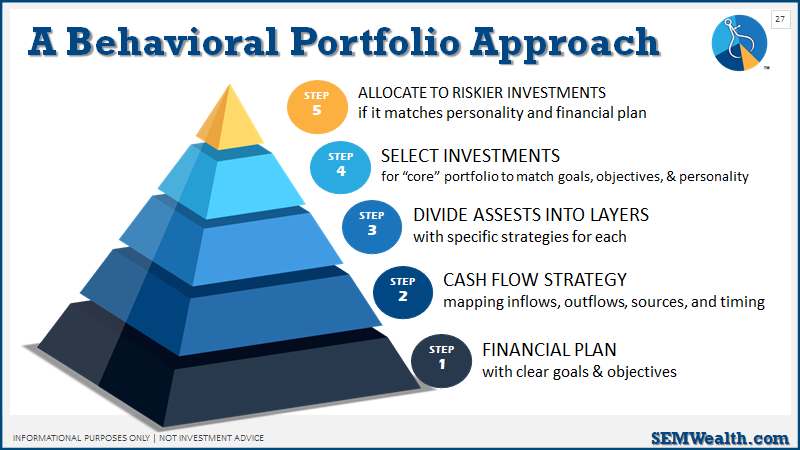

5.) Do you have a plan for all markets?

This is the most important question. I can easily envision a market that continues to march higher for the next year or two or three. We just don't know how much the seemingly unending stimulus will take it. I can also envision a market that craters as the imbalances in our economy finally brings stock valuations back to earth. No matter what, we will have a severe bear market. High valuations turn into low valuations. Where you are at in your journey (or with your client's journey) determines what type of plan you need.

Our Behavioral Approach proved extremely valuable in 2020:

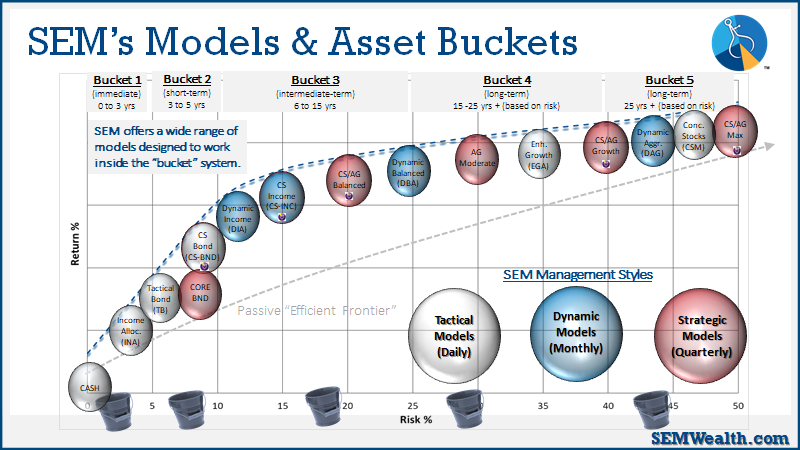

From there we have a wide-range of investment models to choose from. We typically recommend 3-4 models for each client. We all have different needs and personalities. The key is having a plan.

In case you missed it, we discussed much of the above in detail in our Post-COVID outlook. You can watch the replay below:

Finally, there is more to investing than making the highest returns. There is the intangible of making the world a better place. Our Cornerstone Models are designed to do just that. This year, Courtney has expanded our monthly Cornerstone Impact series to look at our relationship with money. She also still highlights what our fund partners are doing with our investments to impact the world. Take a look here: