I've enjoyed the celebrations the past few weeks about how far we've come in the past year. I'm as excited as everyone about our ability to emerge from the pandemic. So many positive things happened in the past year. We of course have had many negative things happen.

The problem I see is very few people are looking at the consequences of the "solutions" used to overcome the pandemic, especially economically. When I bring it up any possible problems most people look at me like I'm crazy. Last week I detailed 5 questions you should be asking as you develop your plans for the future. Whether it is for your own portfolio or your clients, it is critical you walk through this process.

This week I want to add 3 things you should consider as you work on your plans.

The Fed is tone-def

The market had a delayed reaction to the Fed's latest meeting, economic forecast, and press conference. It rallied on Wednesday, but after considering what we learned, it rightly reacted.

The Fed made it clear they do not see any inflation and even the little bit that has popped up they believe is "transitory". They are going to keep short-term interest rates low for several years. Based on their forecast they also expect the growth in the economy to stall in 2022. That is probably the only thing I agreed with following the meeting.

Last week I discussed the flaws in the way inflation is measured. Primarily it ignores the actual cost of housing as well as food and energy prices. All of those things are skyrocketing and risk hurting the part of the economy that has been hurting the most.

The bond market completely disagrees and has moved long-term interest rates up significantly. They are threatening to break the downtrend most of us have enjoyed our entire careers. This has provided a nice wind at our backs for both investment portfolios and economic growth.

One other issue the market had with the Fed was they didn't show any concern with the increase in rates. Most were hoping there would at least be a plan for an "Operation Twist" type operation where they sell their short-term bonds to buy long-term bonds and move those rates lower.

Of course if the unofficial inflation causes economic growth to slow, we'll see interest rates go back down. That also will not be good news for stocks.

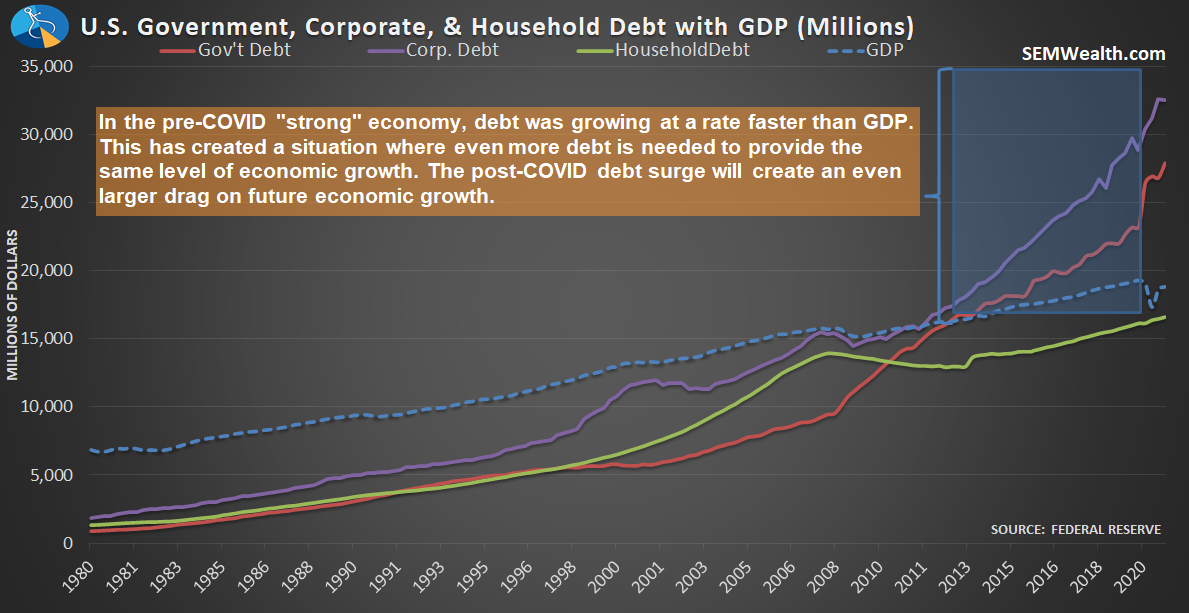

Debt fueled growth will be a problem

One reason the bond market is likely growing concerned is the massive use of debt to solve all of our problems. This isn't new to COVID. I've discussed this for at least the past 15 years. Debt quite simply is future growth brought forward. When you borrow money to stimulate spending you have to pay it back from future revenue. If the spending didn't generate a higher level of growth, we'll see lower growth levels.

This has been going on this entire century, but became clear coming out of the financial crisis. There's a reason it was the worst economic expansion in our history — we SPENT (rather than invested) trillions of dollars to generate short-term growth. We then had to pay it back (as well as sending money overseas due to our large trade deficit).

US based corporations (think the S&P 500) cannot in aggregate grow at a faster rate than the US economy over the long-term (it is mathematically impossible), meaning we will not come close to hitting "average" growth rates.

This brings us to the final point.

There is no way to support these valuations

I started my career as an accountant. I've always loved numbers and math and believe they help us take some biases out of decision making. When I began managing money I used fundamental analysis which rely heavily on accounting statements. I thought it was a good blend. What I quickly learned was:

- There are many tricks companies play to make themselves look good

- The number one driver of "fair value" for a stock is essentially based on how the market feels (earnings estimates, expected growth rates, and risk premium)

This was a hard (and expensive) lesson for me. Thankfully I met Rick and as they say the rest was history. SEM's method of management is designed to essentially get a read on how the market "feels". It has been a much more pleasant way to manage money than how I used to. I couldn't imagine trying to be a fundamental investor the last 12 years.

That said, over the long-run companies do become worth what they actually produce. This means valuation levels can be used to help set long-term expectations. This can be used to re-structure portfolios. When valuation measures are high, we should expect low (or negative) long-term (10-year) returns. By nearly every valuation measure, stocks have never been this expensive.

One thing I learned in my "fundamental" days was it is much harder (though companies still try) to manipulate revenue. Sales are sales (for the most part). Using the price/sales ratio therefore allows us to use a much less manipulated data point than price/earnings ratios. It also allows us to include the companies who don't have earnings and are thus not included in any price/earnings calculations.

Renowned investment manager John Hussman posted this on Twitter last week.

Here's the same data in a scatterplot with actual subsequent 10-year S&P 500 total returns.

— John P. Hussman, Ph.D. (@hussmanjp) March 16, 2021

I know you don't care. pic.twitter.com/LEWNjCQcFA

The scatter plot shows the subsequent 10-year returns based on the starting price-sales ratio. We should EXPECT 10-year returns well below average (or negative). This needs to be factored into your planning.

At SEM we cannot predict the future, but we can rely on the data to make adjustments as required. Our tactical models have moved to more defensive positions over the past week. Our dynamic models did the same a few weeks ago. If they are wrong and the market reverse higher, they should also put money back to work. If they are right, those in a buy and hold portfolio will be wishing they had cashed in some of the historic gains generated over the past year.

The Fed appears to be losing control of interest rates. Debt is going to cause lower growth. The market has never had valuations this high.

All of that will be a problem for buy & hold portfolios. Please factor that into your plan.