Summers are typically the time in the markets where it is difficult to get a read on the direction of the investment markets. With large amounts of decision makers and clients on vacation you typically do not see much in the way of large allocations to help us determine the trend. With so many vacations cancelled last summer, this summer has thus far been one where we should be especially careful in making any determination of what happens next.

That said, when the markets are open SEM is open. Whether or not there is volume behind a move, we still have to adapt our portfolios. Many of our trading systems have mechanisms to adjust to the lower volume in the summer, but it doesn't mean we won't have to make changes in our portfolios.

For those of you at your desks this week or checking in from wherever you are, here are three themes I've seen developing so far this summer:

1.) Bond market is pricing in a slowdown (mostly)

Going into the summer there was fear we would see runaway inflation. We saw bond yields spike to as high as 1.78% on the 10-year Treasury. Since Memorial Day we've seen yields drop from 1.62% to as low as 1.25% last week. They are currently sitting at what could be considered key support levels touched in 2012 & 2016 (1.3%).

The long-term trend (the top yellow line) is still down (going back to the mid 1980s). Lower 10-year yields at this point in the cycle is not a good sign. We should see inflationary pressures as the economy recovers, which means yields should go up on Treasury bonds. The fact it is not is a concern for those pricing in a "roaring 20s" type recovery.

What's keeping me from sounding the alarm (besides the calendar) is the fact high yield bond spreads have barely moved. If the market was truly concerned about the strength of the recovery we would see these yields moving higher. For now, when looking at the spread between high yield (junk) bonds and Treasury bonds we can see there is very little compensation for taking on a whole lot of credit risk.

For more on high yield bond spreads, check out our Summer Client Newsletter:

2.) Stock market relying on increasing earnings

There are three things that drive stock returns:

- Earnings Expectations

- Dividends

- P/E ratio (the price investors are willing to pay for those earnings)

One reason we do not adhere to "fundamental" analysis is both earnings expectations and the P/E ratio are driven by behavioral biases. I won't go into all the specifics today, but think of it like this — all analysts start with a preset number (typically last year's earnings) and then project what the future will look like. We are naturally prone to predict things will be better. How much better is based on how we feel.

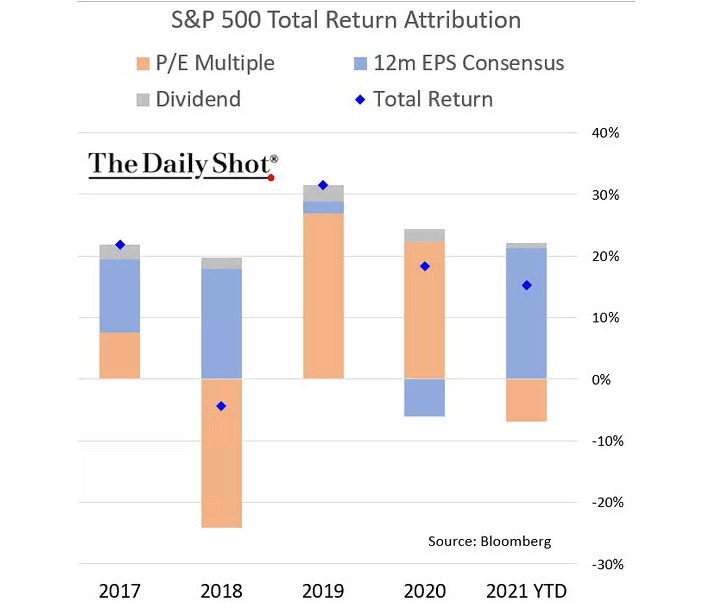

This chart from The Daily Shot illustrates how each component contributed to returns for the past 5 years. In 2018, when analysts expected the impact of the Trump tax cuts to be temporary (they were correct), the P/E multiple was slashed and we saw a decline in stock prices. In 2019, earnings barely climbed, yet the P/E multiple jumped (people felt 'good' about the future), leading to a strong year. In 2020 earnings declined, but the overwhelming amount of stimulus dumped on the markets and economy led investors to again feel 'good' about the future, so they paid a significantly higher P/E multiple.

So far in 2021, the P/E multiple has declined, but earnings growth expectations have jumped significantly (most analysts are forecasting a 'roaring 20s' recovery). Going back to theme number 1 — if the Treasury market is giving us an early signal about a looming slowdown this will not be good for stocks. The "mood" would likely sour significantly if despite the nearly $10 Trillion in combined stimulus we only got a year of strong economic growth. This would lead to the doubly negative combination of lower earnings expectations and lower P/E multiples. This brings us to theme number 3.

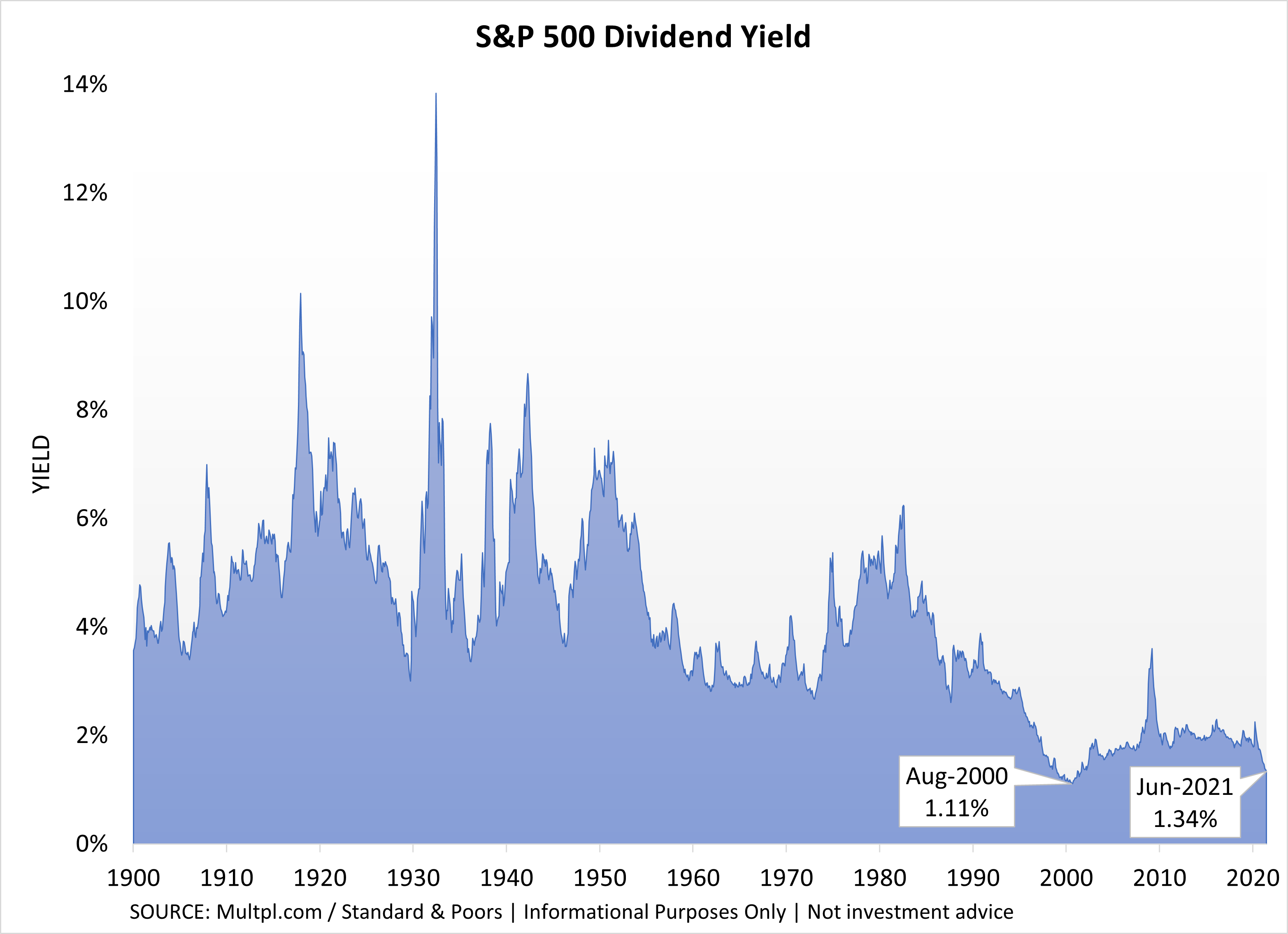

3.) Dividends won't help

Don't get me wrong. I like dividends. In fact our Dynamic models and even our AmeriGuard models are currently invested in dividend growth stocks. What I take issue with is when financial advisors look at low bond yields and recommend dividends as a source of income. I shouldn't have to say it, but apparently I do since so many "advisors" make this recommendation:

Bonds and dividend stocks have completely different risk levels

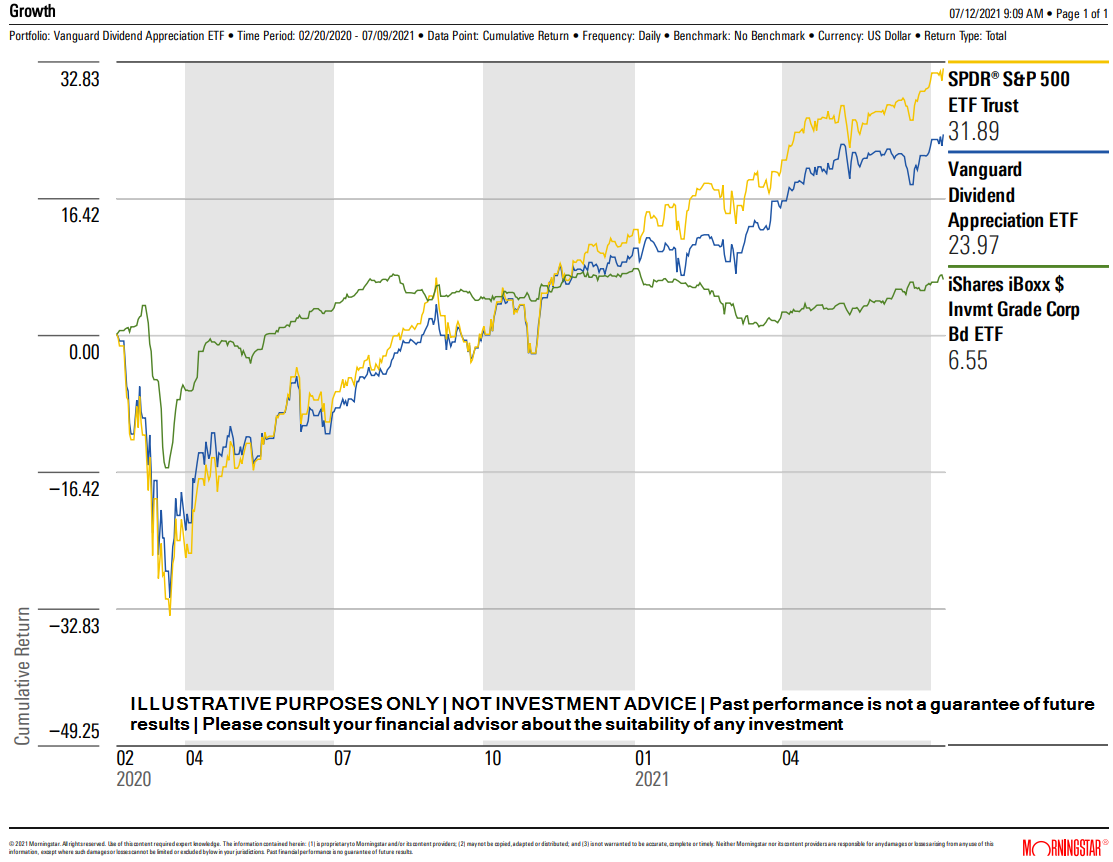

Just look at the past 17 months. Dividend stocks (as represented by the Vanguard Dividend Growth index) lost almost as much as the S&P 500. Yes it has posted a nice 24% return over the time frame, but most investors who utilize bonds for income CANNOT AFFORD A 30% LOSS.

Investment Grade Bonds 'only' returned 6.55% over that time frame, but bonds play a completely different role in a portfolio than dividend stocks. For what it's worth the current yield on investment grade bonds is 2.1% versus the current dividend yield of 1.3%, which is the 2nd lowest on record.

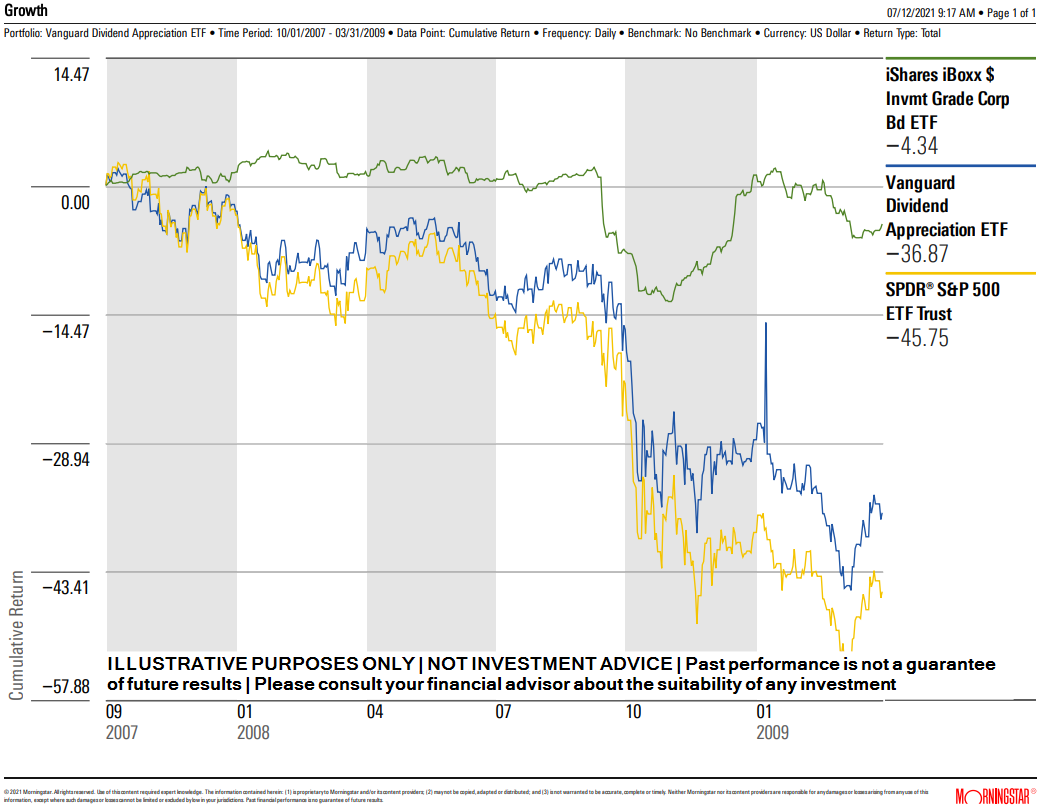

Let's look at other recessions and how little dividend stocks did to protect conservative investors, especially when compared to bonds. Dividend stocks lost 42% versus a 13% loss for Investment Grade Bonds.

We understand the concerns conservative and income investors have about the lack of yields in the current environment. If you share those concerns we'd encourage you to use our Risk Questionnaire link. Our team has worked with several clients lately who felt they needed higher returns, but didn't want to increase their risk levels. We have many unique solutions which can be customized to nearly any situation, including our Cornerstone Portfolios. So far in 2021, the Cornerstone Portfolios are posting strong returns, especially on the conservative income side. Learn more here and by watching the video below: