Maximum Risk

The first half of 2021 was impressive. The S&P 500 returned 15%, nearly double its long-term average annual return! With nearly all aspects of the economy reopening, the expectation is for strong economic growth, which has investors expecting strong earnings growth. This enthusiasm has led to a continued push into stocks and away from lower risk assets.

While at SEM we are all excited for the end of economic restrictions due to COVID, we understand the market and economy moves in cycles. Regardless of the cause of the expansion, math and basic economic fundamentals tell us it is impossible for all aspects of the economy and the market to rally indefinitely. Not all companies can be winners and the economy cannot continue at its current pace without eventually causing overheating. This overheating will then begin to hurt segments of the economy, which if not handled correctly can swing us back into recession.

The indicators inside our trading systems are not raising any red flags just yet, but there are several data points which indicate both the stock and the bond markets are at a point of maximum risk.

Bond investors are receiving very little compensation for the economic risks they are taking when lending money to corporations. The difference between High Yield Bond Yields (Junk Bonds) and 10-Year Treasury Bonds have only been lower twice —just before the bursting of the tech and housing bubbles in 1999 & 2006 respectively.

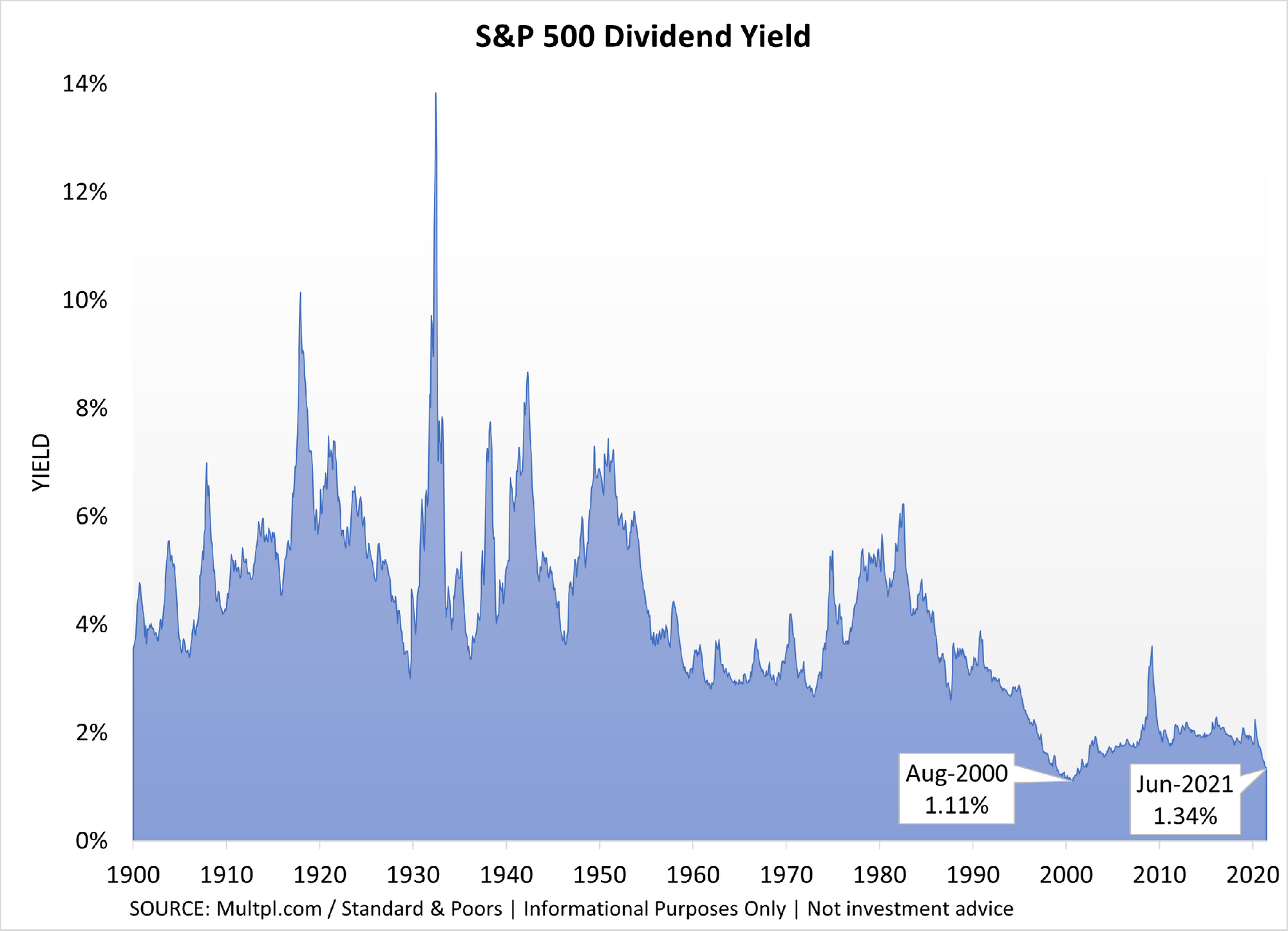

We’ve heard too many times other financial advisors looking at low bond yields and recommending investors turn to dividend paying stocks to generate income. The issue with this advice is the very low dividend yields available. The only time they have been lower was in 2000. What investors also miss is the extreme risk you take by owning dividend stocks. Based on history, these stocks could lose 30-55%, something the meager dividend yield will not cover.

Our advice is to be patient. Do not take additional risks just to get higher yields. Like past cycles, this one will end and there will be much more attractive yields available. SEM’s systems are designed to wait for these opportunities.

For the latest updates throughout the quarter subscribe to SEMTradersBlog.com.

Extreme Optimism

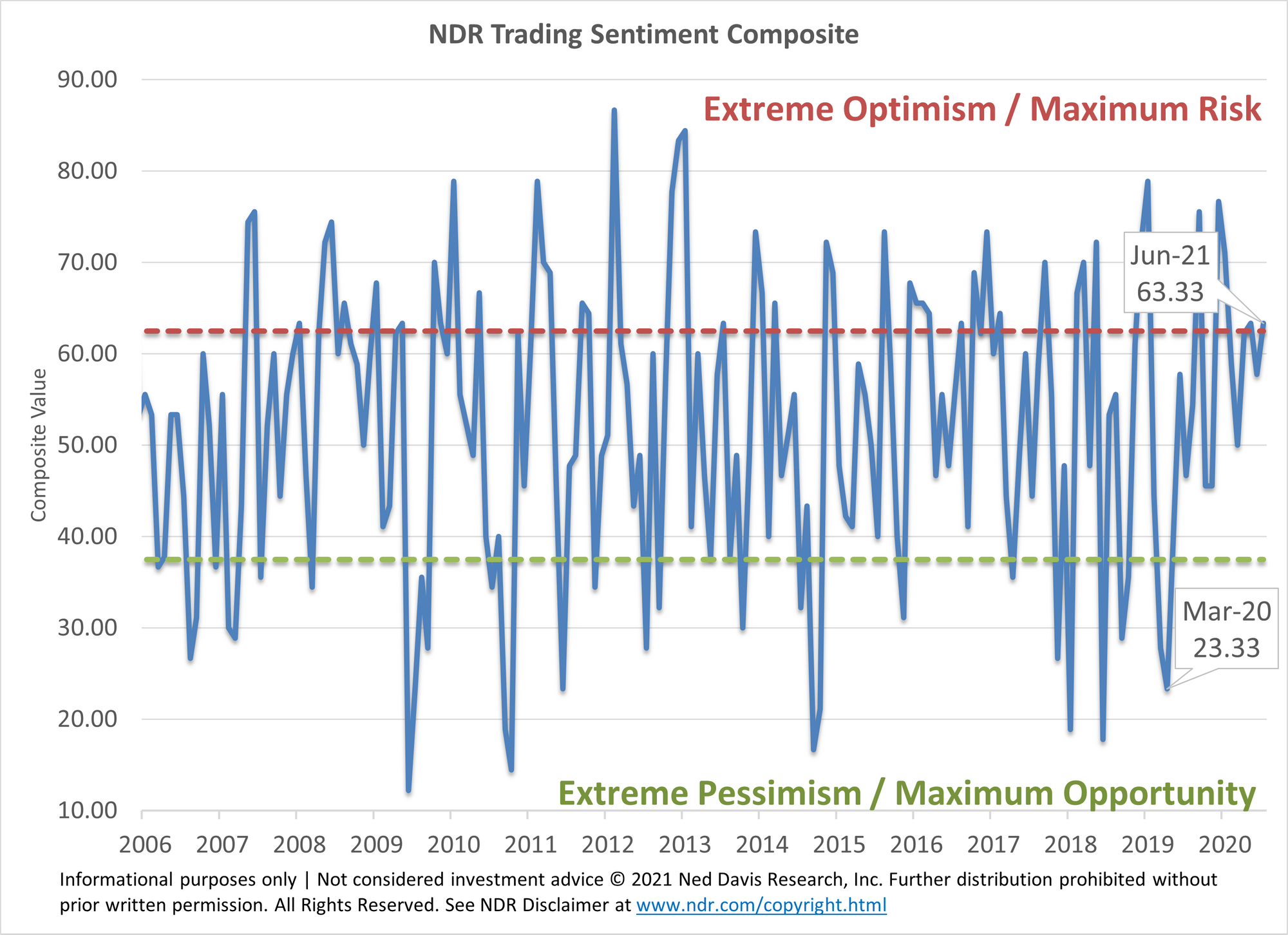

Sentiment surveys are not very good timing mechanisms, but they can serve as a barometer on how investors feel about the current market environment. Ned Davis Research calculates a composite of over 20 sentiment measures. Historically when the majority of the surveys are “bullish” the potential returns are diminished. Conversely, the best opportunities have come when the majority of surveys are “bearish”. When the majority of advisors are already bullish, there are fewer people to buy stocks to push them even higher.

According to Ned Davis Research, going back to 1994, the average annualized return for stocks when sentiment was in the upper region was –7.36%. When in the lower band, the average return was 23.9%. The average return over this time frame was 8.8%. In other words, this is yet another indicator that is warning investors to lower their expectations.

More importantly, we have seen a high number of investors with accounts outside of SEM who have significantly more risk in their portfolios than their willingness and ability to assume risk would indicate is prudent. Given the strong returns over the past few years, this may be a good opportunity to cash in those gains.

If you’re not sure of the risks you have in your outside accounts or you want to see how much risk you should be taking in your accounts, we encourage you to go to Risk.SEMWealth.com. At the end of the short questionnaire there is a link to upload your current positions so we can compare them to your results.

Working according to plan

In investing it is important to have a benchmark to measure your results. The benchmark should match the stock/bond allocations in your portfolio so you can compare the returns and risks of your investments. Looking at the preliminary results through June, we are quite pleased with how our models have performed.

An impressive 15 of our 20 investment models are outperforming their benchmarks through the first half of 2021. Looking at the 5 which have underperformed their benchmarks, 4 of them (AmeriGuard-Max, Cornerstone-Max, Enhanced Growth and Core Stock) suffered due to the strange rotation back into the highly overvalued large cap growth stocks during the 2nd quarter. All 3 models are underweight large cap growth and have overweight positions in large cap value along with small & mid-cap stocks. The other model, Dynamic Income was invested heavily in dividend stocks (large cap value). Based on our indicators, we expect value and small company stocks to outperform in the next phase of the cycle, which means these 5 models should be well positioned going forward. Keep in mind, most SEM clients have multiple SEM models inside their accounts. We strongly encourage the use of all three of our management styles to increase diversification.

If you would like to discuss your current allocation head over to Risk.SEMWealth.com or contact your financial advisor.

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.