I've often used the analogy of treating a cancer patient to describe how our monetary and fiscal policy leaders have treated a recession. A doctor has two goals when treating cancer. The first is the most obvious — eliminate the tumor. The second is to make the patient as comfortable as possible. Doctors are careful to not prescribe too many pain killers as they know they are both addicting and will mask the pain that may help them identify areas that need treated.

Since 1998, the Federal Reserve and Congress has done everything in their power (including creating new powers) to fight any sort of short-term pain caused by a recession. This has included the use of mass government spending (debt) and flooding the Wall Street banks with trillions of dollars of capital.

Those two combined are the cancer killing our economy. Whenever the inevitable shock occurs to the economy the "doctors" quickly rush to increase the dose of pain killers. This may make the economy better over the short-term, but hides the damage the cancer is doing beneath the surface.

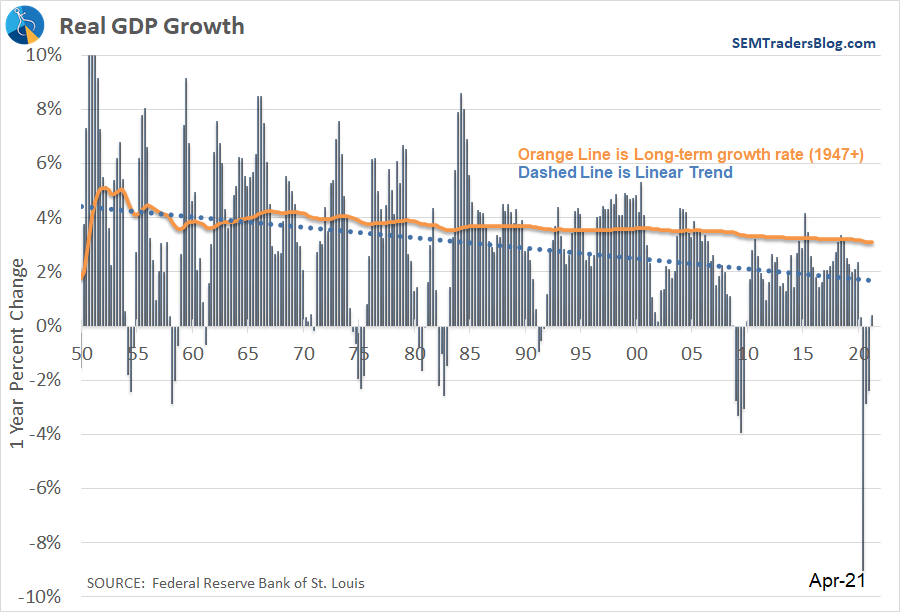

Debt in its simplest form is future spending pulled forward (using tomorrow's money today). Giving the Wall Street banks unlimited liquidity encourages heavy risk taking. When you allow so much money to be absorbed by debt and companies who should have failed, you reduce your potential growth rate. That is exactly what we're seeing happening in our economy. We cannot hit the long-term growth rate even with the unprecedented money dumped on the economy the last 20 years to fight every little slowdown (which is used in all kinds of projections on the solvency of pensions, social security, medicare, municipal debt, etc.)

In the Bush recovery (2002-2007) we saw 4 our of 20 quarter exceed the long-term growth rate. In the Obama recovery (2009-2016) we saw 2 of the 40 quarters exceed the long-term growth rate. In the Trump "expansion" we only saw 1 of the 16 quarters exceed the long-term growth rate. That's 7 quarters of expansion out of 76 where the growth rate hit the long-term average.

The majority of Wall Street "experts" I've listened to have confidently proclaimed we are just at the beginning of a major growth cycle. I hope they are right, but math and a study of basic economics and history says they are wrong. Time will tell.

Last week I walked through the 4 Pillars of the market rally. I detailed each and some weakness that has emerged recently.

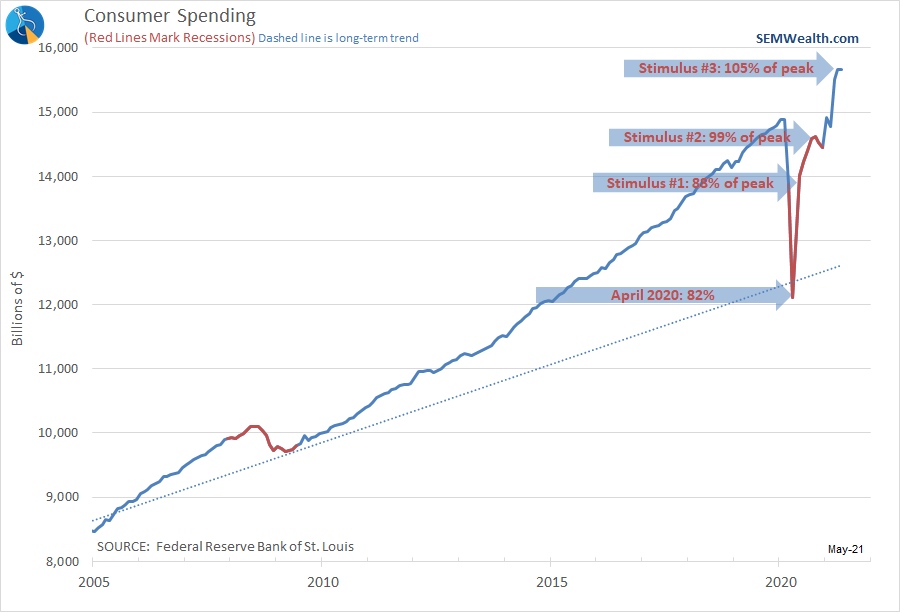

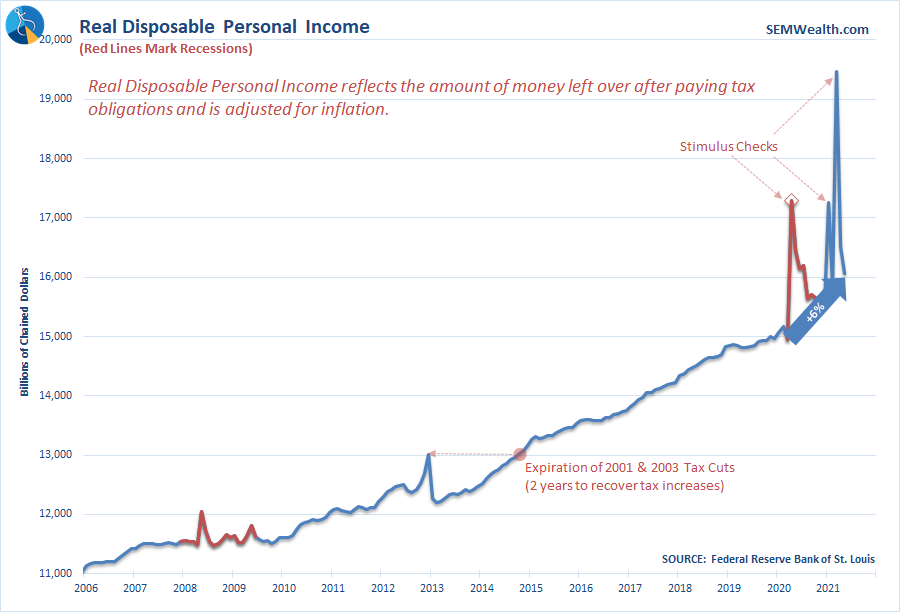

On Friday we got a look at May income and spending data. While I expect these numbers to increase (based on what we're seeing on the weekends here in Virginia in terms of traffic), it is clear the economy has relied too heavily on pain killers. Remember, May still had some stimulus money flowing (via income tax returns) and the Fed was still in mass stimulus mode.

If you look closely, you can see Consumer Spending was barely up in May.

Personal Income is still 6% higher than it was before the pandemic, but it's safe to say most of the benefits of the three rounds of stimulus are gone.

Soon the economy will be left to stand on its own. By September when kids are back in school and extended unemployment benefits have expired, we'll finally get a glimpse of what the post-COVID economy looks like. My guess is it will not support the record high valuations we are seeing in the high flying growth stocks. (High valuations only work if growth continues to increase).

That of course is just my guess. At SEM's we'll allow our models and not our opinions dictate how we invest. As we've proven time and time again, when the next slowdown is on the horizon we stand ready to quickly retreat to lower risk investments.

Finally, in case you missed it, last week I hosted our latest SEM University talking about SEM's brand of impact investing. The results may surprise you as they are certainly not what the Wall Street experts have told us you can expect when you focus on making a real impact for our world with your investments.