Humans can’t help but be very short-term focused. We all have incredibly busy lives, and it can be difficult to focus on the medium or long-term future when we have to worry about today and tomorrow. The concern is even if we don’t focus on the long-term, it will someday be the short-term. Therefore, even if it isn’t the utmost importance to us, we do have to consider it when making decisions. We certainly know the importance of that with investments, but this mindset is key for pretty much everything.

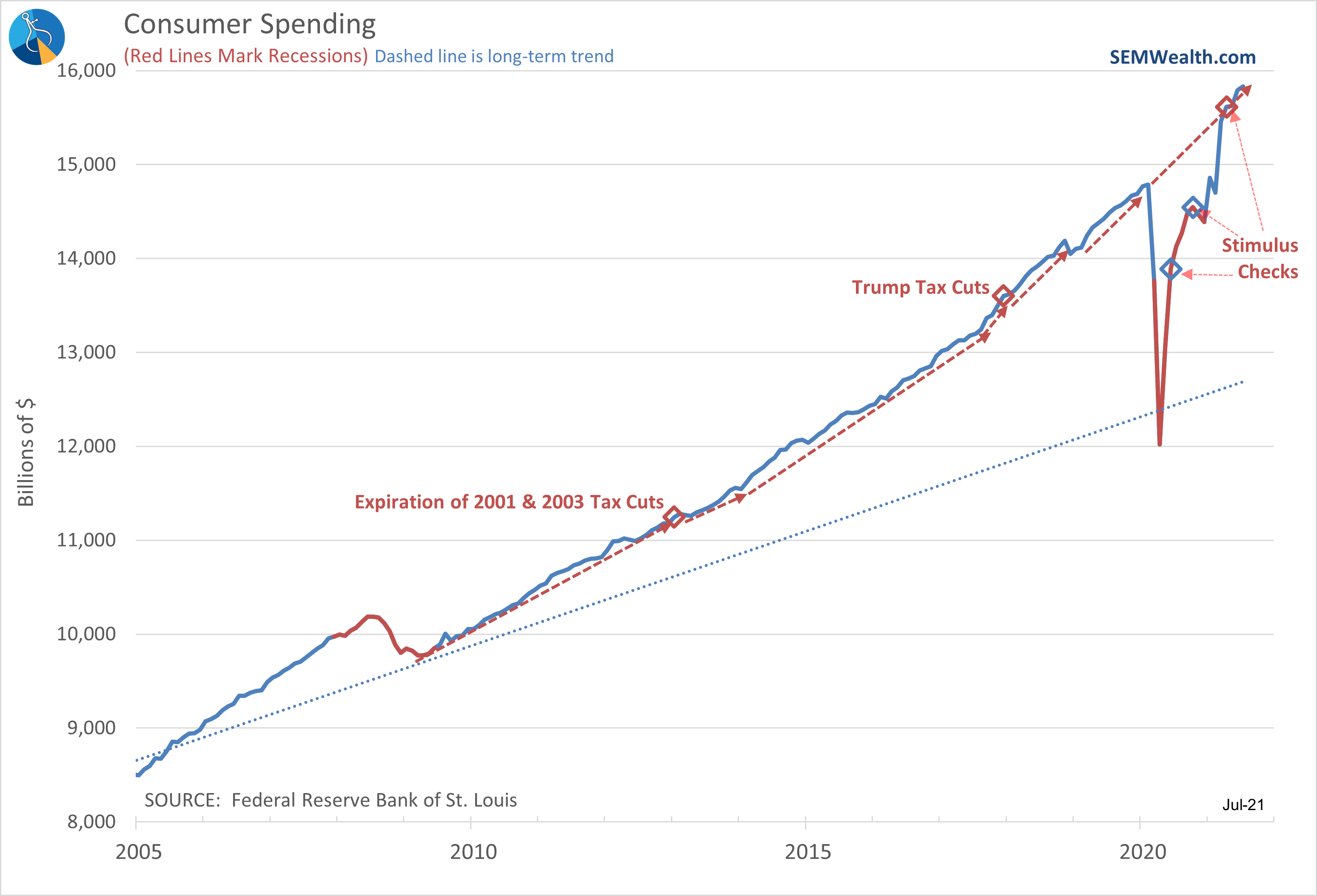

When we went through the last year and we had plummeting economies, the solution was to pump out 3 separate stimulus checks that became popular policy to most people. I mean, we just got money and we didn’t have to do anything to get it. The tradeoff seems like an easy one, because there isn’t a tradeoff. At least in the short-term, there didn’t look like any tradeoff.

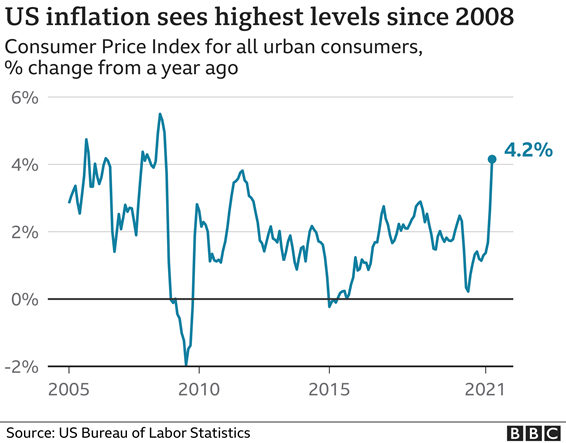

The first side effects of this stimulus appears to be coming into play, with the latest inflation data once again being upward of 5% for the past month. This jump in inflation was the biggest concern to the market this week, and with spending power of the dollar decreasing we could see impacts felt across the whole economy and not just in the stock market. It’s important for us to see the links between government decisions and the effects it has on the people.

The stimulus had very direct benefits, but the consequences seemed very indirect. Government is very good at that. Inflation is directly affecting people, so we must tie back the WHY behind the inflation. When we consider the consequences being increases in inflation, the stimulus might still be popular, but it certainly isn’t as popular as it was previously.

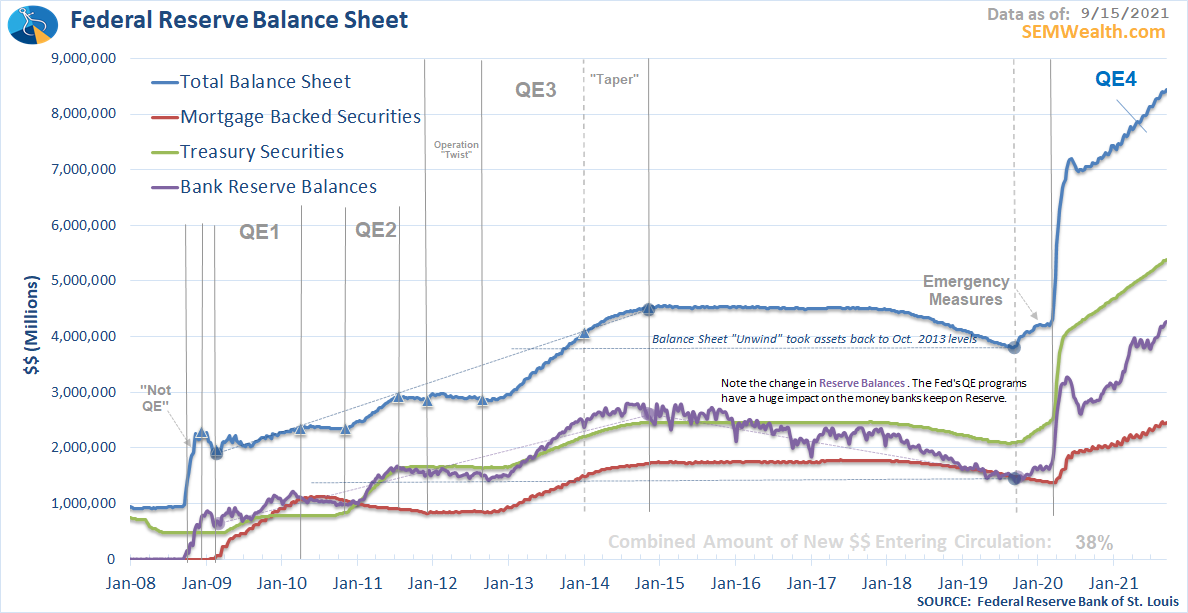

What will be interesting is to see what kind of monetary policy the Fed will use to combat this potential inflation. They have said before that they plan on tapering asset purchases towards the end of this year, and we have already seen the markets react to this news. While aggressive asset purchasing is a theoretically good thing for the market, how will the market respond if we don’t see a stop in asset purchases to combat adverse inflation movement? We know what the plan is now, so how would we respond to a change in plans? If the Fed is not able to start slowing asset purchases, what other possible actions can be taken to bandage the economy if it’s broken? Whatever is going to happen in the future, we will have to keep an eye on these things. Not only short-term, but what long-term consequences the short-term decisions will have because are almost certain that any decisions made will not only impact the short-term but spill into the long-term.

The greater picture concern with all of this is government debt. When it comes to the issue of government debt we can’t really see the effects of the debt, since up until now we have just seen the debt ceiling get voted up and we can just borrow to pay off the debt. This issue could rear its ugly head in October. I have heard people tell me that “the US debt concerns are a myth because the US is powerful enough to simply not pay off the debt and who is going to come in and stop us?” We see this all over the place with the lack of concern about the borrowing of our country. Just because we haven’t seen any real effects on our day-to-day life, that doesn’t mean that will always be the case – the consequences are just delayed, and those delays will probably look indirect. If you want a fuller breakdown about the current concerns with spending, Friday’s blog post from Jeff has tons of great info and insight to help you out.

One thing to keep in mind is there are plenty of things affecting your life that you might not have even considered. While you can take into consideration how these things will affect your life for the next several years, there is a lot that we won’t be able to factor in. For example, the current splintering we are starting to see for the economy is something that we have been expecting for a few years now, but we still don’t know how bad it will all end up, we don’t know how long it will take for the recovery to start, and we don’t know what other policy decisions that will be made to curb the divide that will have larger consequences years after THAT decision is made. It is impossible to know all these things and be able to handle them in an exactly correct manner.

All that can be done is to try to be as prepared for the consequences as possible. In order to do that, we have to be honest about what those consequences might be. When we consider the consequences, we can try to avoid them altogether and not have to worry about the bad in the future. While this is mostly me talking to our government, this is so important for the rest of us as well. Let’s try to focus on bringing more long-term thinking into our short-term and allow our FUTURE short-term to be rid of these issues. Enjoy the last couple official days of Summer (double digit highs here this week in Arizona!)