The US Government is out of money. Treasury Secretary Janet Yellen has said she is using "extreme, emergency measures" to move money between accounts in order to cover US obligations. She expects these methods to be exhausted around October 18. At that point the US would no longer be able to issue new bonds to cover maturing bonds, which is technically a default of our debt. The last time we were this close to a technical default was in the summer/fall of 2011. It also led S&P to pull its AAA credit rating from the US.

Back then I described the antics as the "Debt Ceiling Circus". It was a miserable time as a money manager because we all were at the mercy of our politicians. Deals would be rumored and the markets would rally. They would fall through and markets would drop. Again and again and again we saw this until they finally compromised and extended the debt ceiling. By all accounts, Republican Senators are ready to go through this again. Democrats also seem willing to risk letting the government funding to run out on September 30, meaning we risk yet another government shutdown.

I get so irate at the way politicians change their view of the debt ceiling based on which party is in the White House. Republicans repealed the debt ceiling for two years in 2019 with President Trump in the White House. They also were the ones crying for "restraint" in 2011 with President Obama in the White House. Look, I hate the US of debt in our country more than anybody. I've been a vocal critic of this reckless spending for a couple of decades now. It's actually one of the reasons I left the Republican party to become Independent in 2008. Using taxpayer funded debt to bail out failed banks is not something Republicans were supposed to represent. That's not capitalism and its certainly not fiscal conservatism.

Both like spending money — if their party is in the White House. As former Fed President Richard Fisher said, "The only difference between Republicans and Democrats is Democrats enjoy spending money a little more than Republicans."

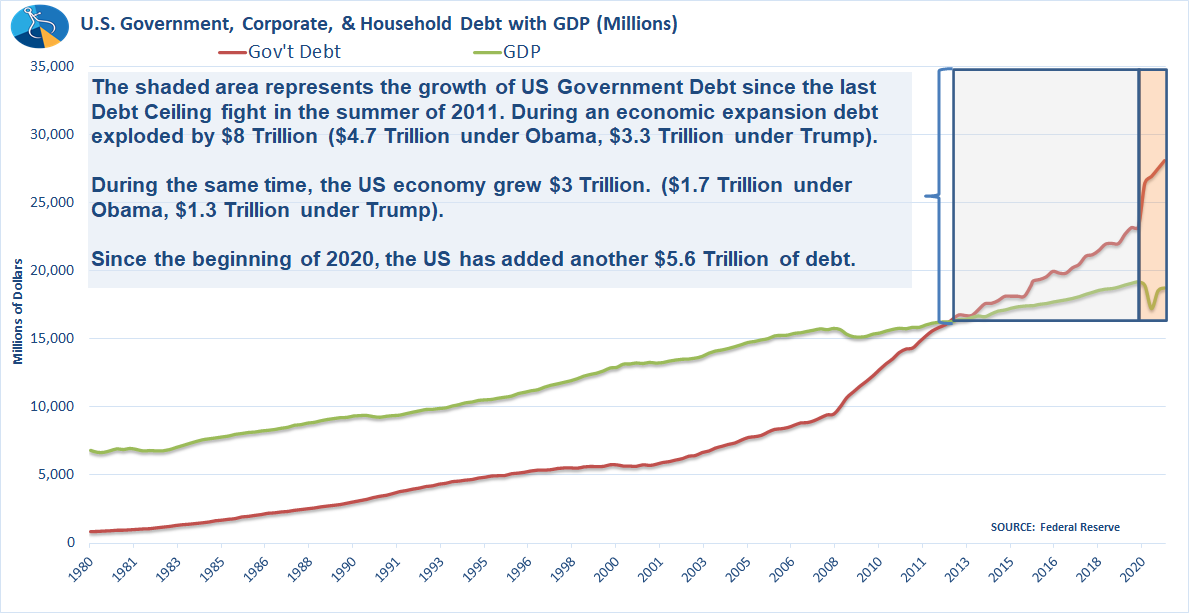

Following the Debt Ceiling Circus in 2011, our economy enjoyed an 8 year economic expansion. 4 under President Obama and 4 under President Trump. During that time the US added $8 Trillion of new debt. At the same time, the US economy grew a meager $3 Trillion.

Trust me, I am not condoning we continue spending money without regard of what happens when we have to pay it back, but I am urging everyone to understand it was BOTH parties who voted for all of this debt and BOTH parties who should stand-up and vote to payback the debt already owed. I would love to see some sort of "pay as you go" legislation, but that is unlikely to happen with this generation of politicians. The Republicans pushed for it during the 2011 Debt Ceiling Circus and then repealed it to pass the Trump Tax Cuts in 2017 because they couldn't find a way to make them pay for themselves.

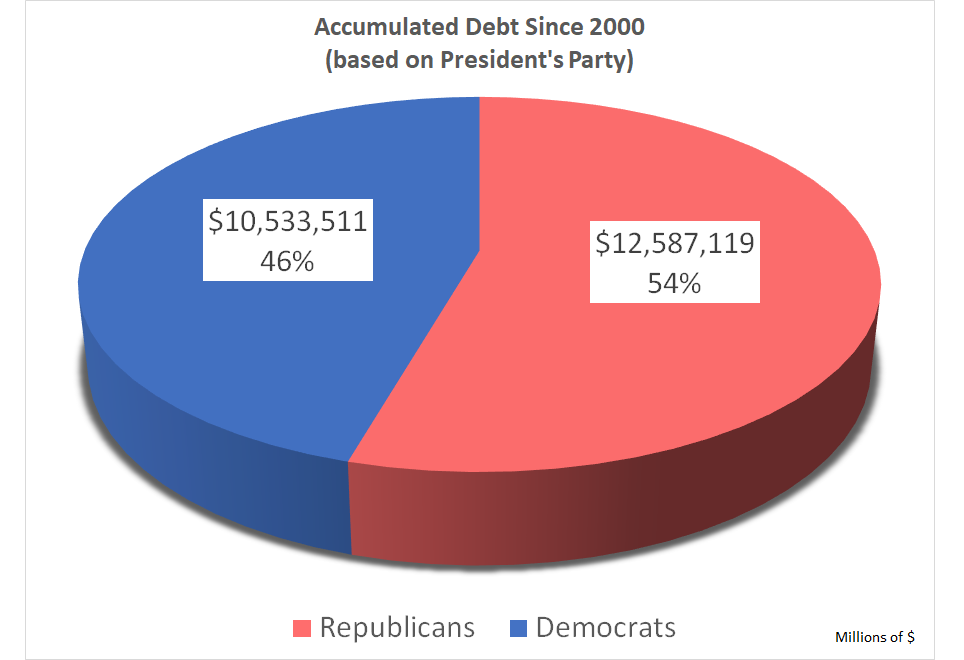

The last time we had a balanced budget was back in the late 1990s. We actually ended up with a surplus which President Bush and the Republican Congress voted to send back to the American people. At the time our national debt was $5.6 Trillion (the same amount we've added since the beginning of 2020). Since then we've added an astounding $23 Trillion. Who is responsible for paying the bills? One would argue the party who was in the White House signing the budget legislation. Here is that split:

To be fair, $3.2 Trillion of the debt came from the COVID relief packages. Without that the split would be 47% Republicans and 53% Democrats. Republicans cannot act like fiscal conservatives with a Democrat in the White House and then turn to runaway spending when a Republican is in charge. Why do we as voters continue to allow this to happen?

Call your Congressional representatives and tell them to end this idiocy. More importantly, call your party representative and tell them you want somebody who actually cares about protecting future generations by stopping this insane spending trajectory we've been on the last 20 years.

While you're at it, take a look at the bigger issue and ask your party leadership what they are doing to address a far bigger issue – the insolvency of Social Security. Each year paying for these unfunded liabilities will eat away more and more of our current spending, which will lead to even MORE government debt.