As we move closer to the final week before the final quarter of 2021, we can take this moment to take a step back to think about how much time has gone by in what has felt simultaneously a blink and an eternity. We are a full year and a half out from the most severe measures of the pandemic and while it feels like that just happened, it has felt slow at the same time. We are still in a lot of ways exactly where we were, and we’re still a little unsure as far as what everything will look like when we are truly behind this, if we ever get to that point. As we start putting up the pumpkin decorations that will turn into the Thanksgiving decorations (perhaps underused in our households) and into Christmas decorations, we can look at what’s going on and try to see how it will impact what we hope to be a more normal 2022.

We are facing some potentially more drastic measures surrounding the debt ceiling (broken down by Jeff here), which is both about the events that have taken place in the past year as some sort of justification, while also being about the same old conflicts that have existed for the past several decades that go back to political philosophy. I’m sure this isn’t the back to normal people were clamoring about! As far as the news on this front, it appears as if we will have some more fighting to go on before some “compromise” gets done that will more than likely lead to an increase in the debt ceiling, and Congress can look like a hero in the 11th hour for separating their differences in the name of bipartisanship.

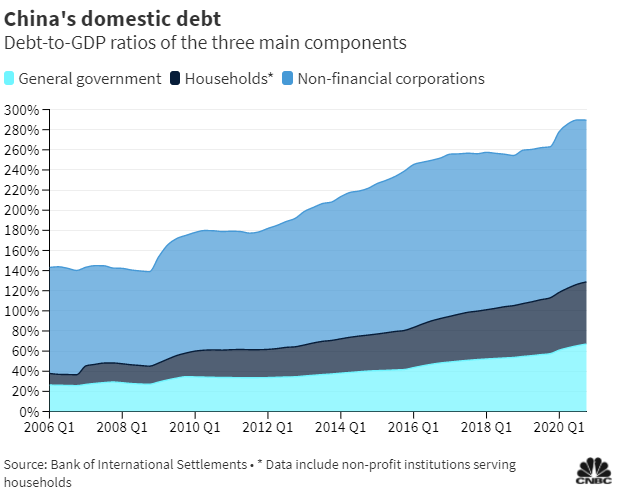

What is also not new, despite just taking place in a somewhat newer wrapping, is the situation surrounding Chinese property conglomerate, Evergrande. They find themselves appearing in need of a bailout, which if they don’t get can lead to one of the largest global companies defaulting that will have ripples across the global economy. While this situation isn’t something that happened before, the details around it are things we’ve seen before. We are familiar with companies that are deemed too big to fail and what could happen if they do fail. We’ve seen that here. Now, what adds an extra wrinkle in this story is the fact that it’s happening with a company that is overseas without American regulation and financial reporting – that adds an extra bit of uncertainty as to how the financial situation of the company got to be so dire.

Perhaps the biggest uncertainty, but one we are all too familiar with, is that the decision made as to what will happen to Evergrande, will happen in China. We can never know for sure what China will do. While we can guess that China would not be too worried about a big bailout package, at SEM we aren’t going to be getting into the weeds of making decisions with our programs based on what we think will happen. All we will do with this situation is monitor it and see how this will affect the market. For what it's worth, our Income Allocator model sold its last Emerging Market bond position last week. Our Dynamic models are also on the verge of removing emerging markets from the mix, which would take away any direct exposure to China.

Based on what we’ve seen so far, we haven’t seen any positive swings in the market over the past week. This will add to the trend that we’ve been seeing over the past few weeks where the market is staying stagnant after a period of record gains. The longer this continues, the more of a chance there is a correction in the other direction. It will be interesting to see how long this movement continues and how all of these larger market news will impact the market. We will also have a new month of data in the next week or so to see where our programs will be pointing. As time goes on, we will continue to get more clarity about what will happen with the markets. However, as of right now, nothing major to report, but we will certainly let you know if something does happen. Have yourselves a great last week of September!