Critical Questions

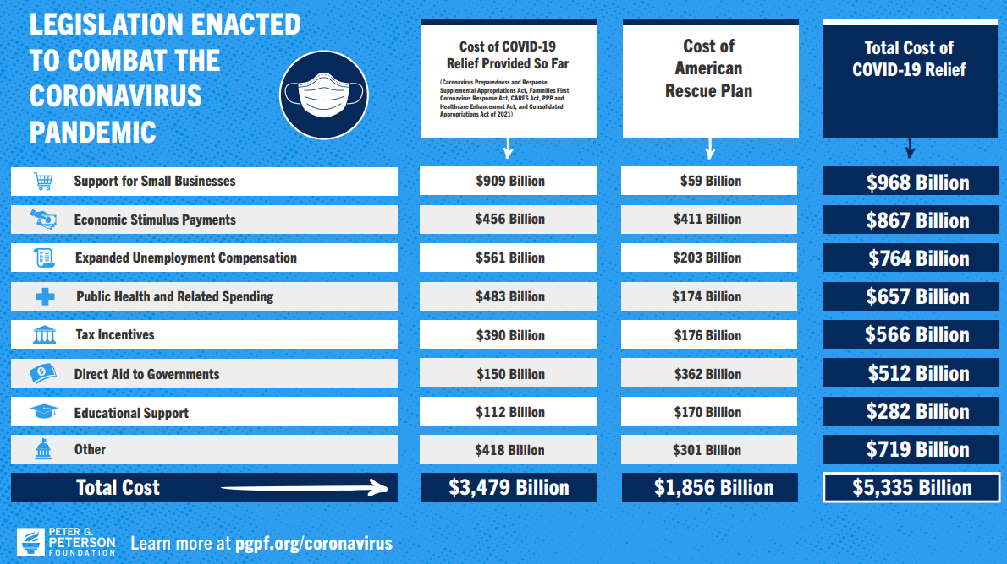

As we enter the final quarter of what has been a good year for stocks, the question for investors is — how much longer this can continue? Following the nearly complete shutdown of our economy due to COVID19 and with the help of $5.3 Trillion in ‘stimulus’ spending from Congress we have witnessed recent economic growth that will go down in the record books. As investors, it is important to look ahead and not base our outlook on the recent past. There are some critical questions to be addressed during the 4th quarter which will set the stage for how 2022 will take shape. While we obviously do not have all the answers, our decisions should be designed to allow successful outcomes regardless of how it turns out.

1.) Will the economy be able to stand on its own?

Congress is working on an additional $4.5 Trillion of spending ($1 Trillion in infrastructure spending and $3.5 Trillion in ‘social’ spending). The details are still being worked out, including how it will be paid for, but we do know one thing — unlike the COVID relief listed above, this money will not hit the economy immediately. We won’t see any more stimulus checks or huge tax cuts to juice the economy. At the same time, the Fed has hinted they will begin “tapering” their own stimulus measures before year end. During the last recovery, any Fed tapering measures caused bumps along the way. With the significantly larger asset purchases these bumps could be even bigger.

2.) Will inflation stay high?

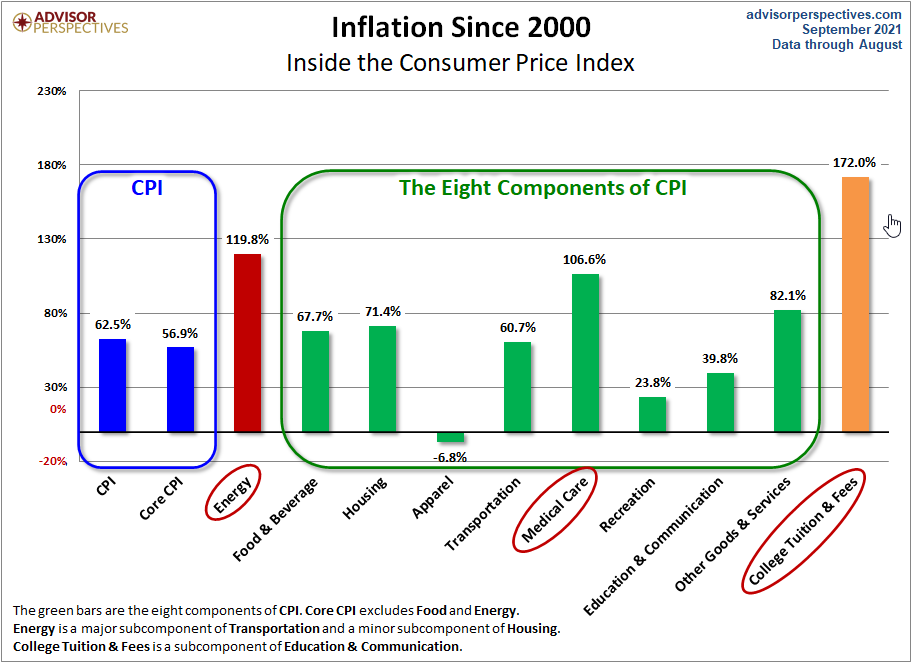

Most economic experts chalked up inflation numbers which crossed the 5% level earlier this year as “temporary”, with expectations for it to come back to “normal” around 2%. Supply chain disruptions, labor shortages, higher COVID prevention steps, and potentially higher taxes could lead to inflation pressures which could lead to the Fed both escalating the speed of their “tapering” as well as possibly increasing interest rates. We can throw in another question — can the economy handle higher interest rates? Regardless of these short-term pressures, this chart highlights where we are seeing the highest inflation, including items which do not show up in the official inflation numbers. Inflation is a tax on the economy, creating a drag on growth.

3.) Are taxes going up?

Probably. The question will be for which groups and by how much. The real question should be — what will be the side effects of higher taxes? Higher taxes do not necessarily mean lower economic growth, but if the economy isn’t strong enough to stand on its own, there could be a more rapid slowdown. This is one of many areas we will review when you complete the assessment at Risk.SEMWealth.com.

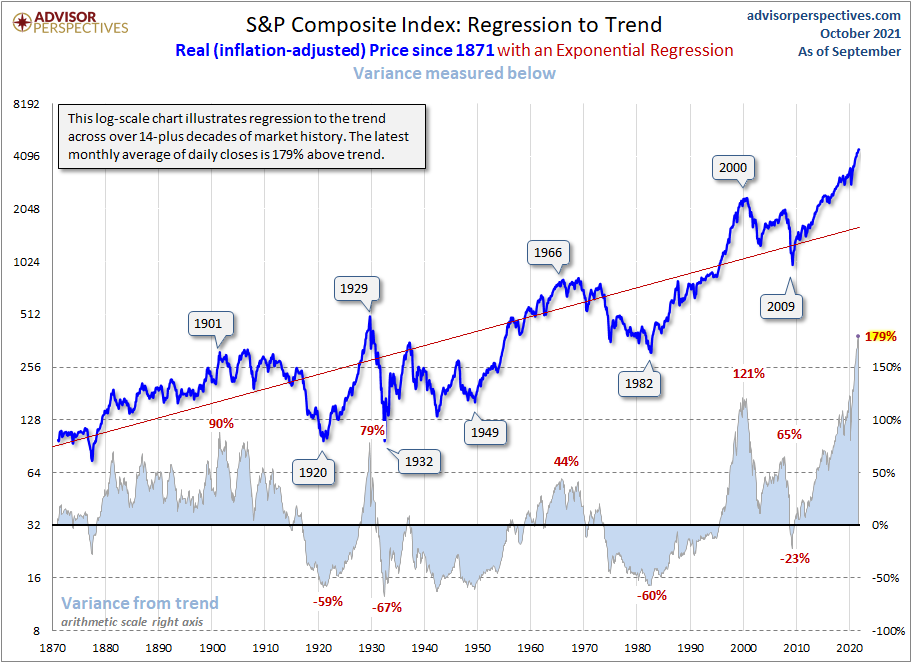

4.) Are stocks overvalued?

Whatever metric you look at stocks are most certainly at levels we’ve only experienced during past market bubbles. We discussed this last quarter. The problem is just because stocks are overvalued it doesn’t mean they will go down immediately. It usually takes some sort of a catalyst that is not always obvious at the peak. A small slowdown in the economy or a disruption in a key industry leads to slightly lower earnings. This leads to a more negative tone during the quarterly earnings season. This leads to fear about what other companies or industries may be at risk. When valuation levels are at extremes, the market is sensitive to slight negative changes. It may be something related to the prior questions or something none of us have even thought of yet. When stocks are this highly valued, we should be asking, can I handle a 35-50% drop in my stock portfolio that could last 18-24 months?

5.) Will the Fed and/or Congress Prevent Another Recession or Bear Market?

This is by far the biggest source of complacency. Congress and the Fed reacted so quickly in March 2020 and followed-up two more times with unprecedented actions, investors believe this will be the experience during any future crisis. Where investors have it wrong is not every recession or bear market will be caused by a common “enemy”. Think back to March 2020 and even when the other stimulus bills were passed. Both political parties knew COVID was the cause of so much economic turmoil differences were put aside to act. The bills were written by Democrats and signed by President Trump.

It is highly unlikely we will see Congress act with such bipartisanship again. Most of the emergency measures the Fed utilized had to be authorized by Congress. Those authorizations were all pulled in the last weeks of the Trump administration. 2020 was the exception, not the rule. Recessions will happen. Leaders will be caught off guard. Businesses and industries will suffer. Overvalued stocks will be slammed. This is “normal”, so you should be asking yourself — can my portfolio, financial plan and psyche sustain a recession?

For the latest updates throughout the quarter go to TradersBlog.SEMWealth.com

Am I in the right portfolio?

We asked a bunch of questions in this issue of ENCORE which need to be addressed. The answers to these questions are not as important as this one — am I in the right portfolio. This is the time of year where we are required to ask every one of our clients questions about themselves to determine if their investment portfolio is “suitable”. At SEM we believe this annual survey is critically important for us to be able to properly manage your investment portfolio. We have a wide range of options which can be customized to fit into your financial plan, cash flow strategy, and investment personality.

The attached “Suitability Standard” article explains the process. How you answer these questions will allow us to determine any adjustments that need to be made. For some people, negative answers to the questions posed in this issue may be non-events. For others, even a single negative outcome to those questions could cause serious complications to your financial picture. This is why it is so important to provide us with an update. It takes less than 5 minutes to complete. Whether you’re a current client or not, head on over to Risk.SEMWealth.com to get started finding the answer to this most critical question.

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.