The Social Security Board of Trustees released their annual report this week. Many of you may have seen the headline that the “Trust Fund” will be depleted one year earlier --- in 2034. Based on conversations I’ve had with advisors and clients the past 15 years, I don’t believe many people understand what that means.

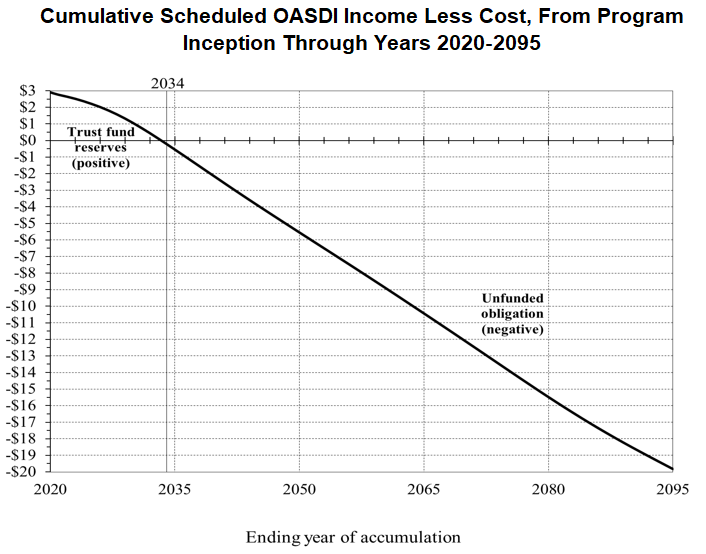

Here is a chart from the report illustrating the projected balance of the Trust Fund.

In theory, Social Security was supposed to be run like a pension fund where the government sets aside the employee and employer contributions in a separate fund. Each year actuaries would review the fund balances and benefit projections and adjust a.) the amount each employee contributes, b.) the amount the employer contributes, c.) the expected payout to beneficiaries, and d.) the rules on when beneficiaries can begin receiving benefits. For over 20 years the Trust Fund was expected to run out of money in the mid-2030s. Other than a slight adjustment in the retirement age, nothing has been done to shore up the fund. In fact, several times the President and Congress suspended payroll contributions into the fund to “help” the economy during an economic slowdown.

The chart is illustrating the problem our country now faces. In 2020, the Trust Fund paid out more money than it received. It is expected to do this each year until it runs out of money in 2034. According to a July 2021 report from the Congressional Research Service (a bi-partisan non-profit research organization), when this happens the Social Security Administration (SSA) would be prohibited from paying out benefits. After insolvency, the report states:

“Maintaining financial balance after trust fund insolvency would require substantial reductions in Social Security benefits, substantial increases in tax revenues, or some combination of the two. The trustees project that following depletion of the combined funds in 2035, Congress could restore balance by reducing scheduled benefits by about 21%; the required reduction would grow gradually to 27% by 2094. An alternative could be for Congress to raise the Social Security payroll tax rate from 12.4% to 15.7% following depletion in 2035, then gradually increase it to 16.9% by 2094.” Social Security: What Would Happen If the Trust Funds Ran Out? (fas.org)

Congress has constantly ignored this problem my entire working life. Remember Ross Perot back in 1992? He was the last presidential contender to dare bring up this problem. The AARP lobby is powerful in both political parties. Nobody dares touch Social Security.

The report goes on to state:

“Trust-fund insolvency could be avoided if expenditures were reduced or receipts increased sufficiently. The sooner adjustment to Social Security policy is undertaken, the less abrupt the changes would need to be, because they could be spread over a longer period and would therefore affect a larger number of workers and beneficiaries. As well, enacting adjustment to Social Security policy sooner, rather than later, would give workers and beneficiaries more time to plan and adjust their work and savings behavior.”

I understand this is a vital retirement program that tens of millions of people trusted would be there for them. The problem is, the government WE ELECTED chose to spend the trust fund to support our current standard of living and never ran it like a pension fund. Let’s look at the math behind Social Security:

-The average American paid $2,463 per year into Social Security through 2016.

-Growing at 7% interest that would be a retirement fund of $491,700, assuming a 40-year working career.

-The average American on Social Security receives $1543 per month.

-Assuming 5% investment growth that would allow for 17 years of payments.

-The average life expectancy for somebody reaching age 65 is 18 years.

If Social Security had been managed like all other pension funds, we would not have a problem. The reason it is insolvent, is voters since the late 1970s have allowed Congress to borrow from the Social Security fund to support current spending. This boosted economic growth (and likely the earnings and investment returns of all those workers), but now it must be paid back. This is like workers who borrow against their 401ks. Ignoring the interest owed on the borrowed funds, here's the reality of Social Security:

-Growing at 0% interest, the average Social Security retirement fund is $98,520.

-At 0% interest, this fund equals 5 years of distributions.

-Therefore, the average American receives 13 years of UNFUNDED distributions from Social Security.

By the way, older Americans paid significantly less prior to the early 1980s when the FICA tax was doubled -- meaning Gen X and Millennials are paying much more as a percentage into the system than the Boomers did.

For what it’s worth, Medicare is much, much worse. Both political parties are to blame. These “entitlements” sound great on paper, but have failed us because politicians and the voters who elected them constantly focus on the short-term instead of the long-term.

I started my career in the mid-1990s. For anybody my age and younger I’ve removed Social Security benefits from the retirement plan AND included a significantly higher tax rate. Is that “fair”? Why should one generation pay in a small fraction of their income to receive a benefit that must be paid for by younger generations who have little chance of receiving the same benefit?

If you are 50 or younger you NEED to take control of your retirement. I'd highly recommend you head over to WhatsMyScore.net to take our free financial assessment. You cannot count on the government to support you. The sooner you get started the better.

I truly hope our country can find a way to solve this problem equitably, otherwise things could get ugly when the Trust fund runs out of money. We’re two years closer to that date than we were a year ago.

I last wrote about this following the 2019 Trustees' report. It included some Myths and Facts regarding these "entitlements". I'd encourage you to take a look: