Another month is in the books, and we now have another month of data to look toward to help us find trends in the market cycle. There weren’t any notable headlines or events last week that would have an impact on where the market was moving, so there isn’t a lot of noise to try to sort through.

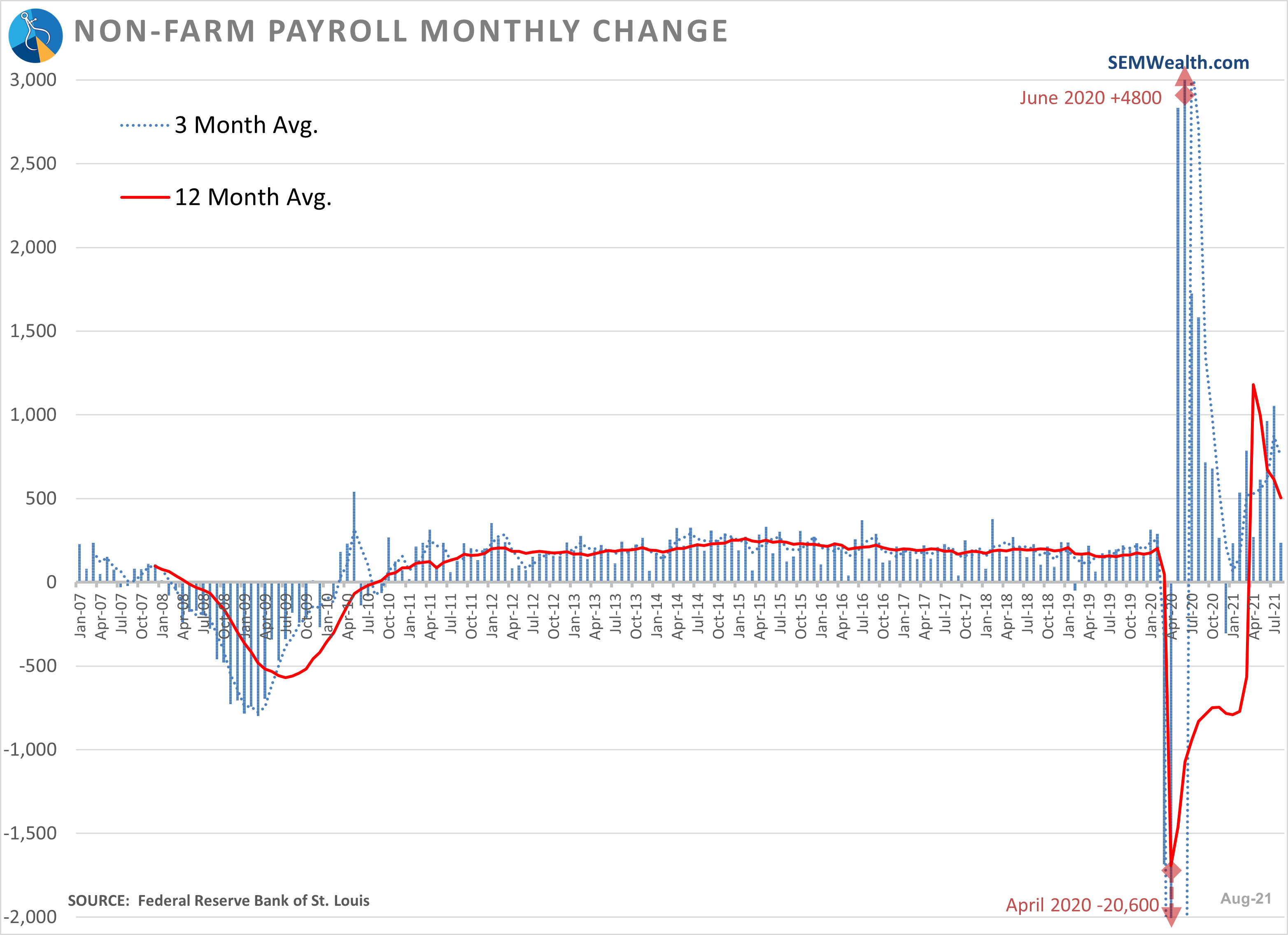

SEM’s dynamic signals did have new economic data through the payrolls report to analyze. Those payroll numbers continued to point upward, which leads the dynamic signals to point bullish. But, the growth of payrolls continue to shrink, which means that those bullish signals are only barely within that signal. We are very close to moving toward a neutral signal, which will likely flip in the upcoming months if we see another decrease in the rate of payrolls (and other economic data points.) That part is key.

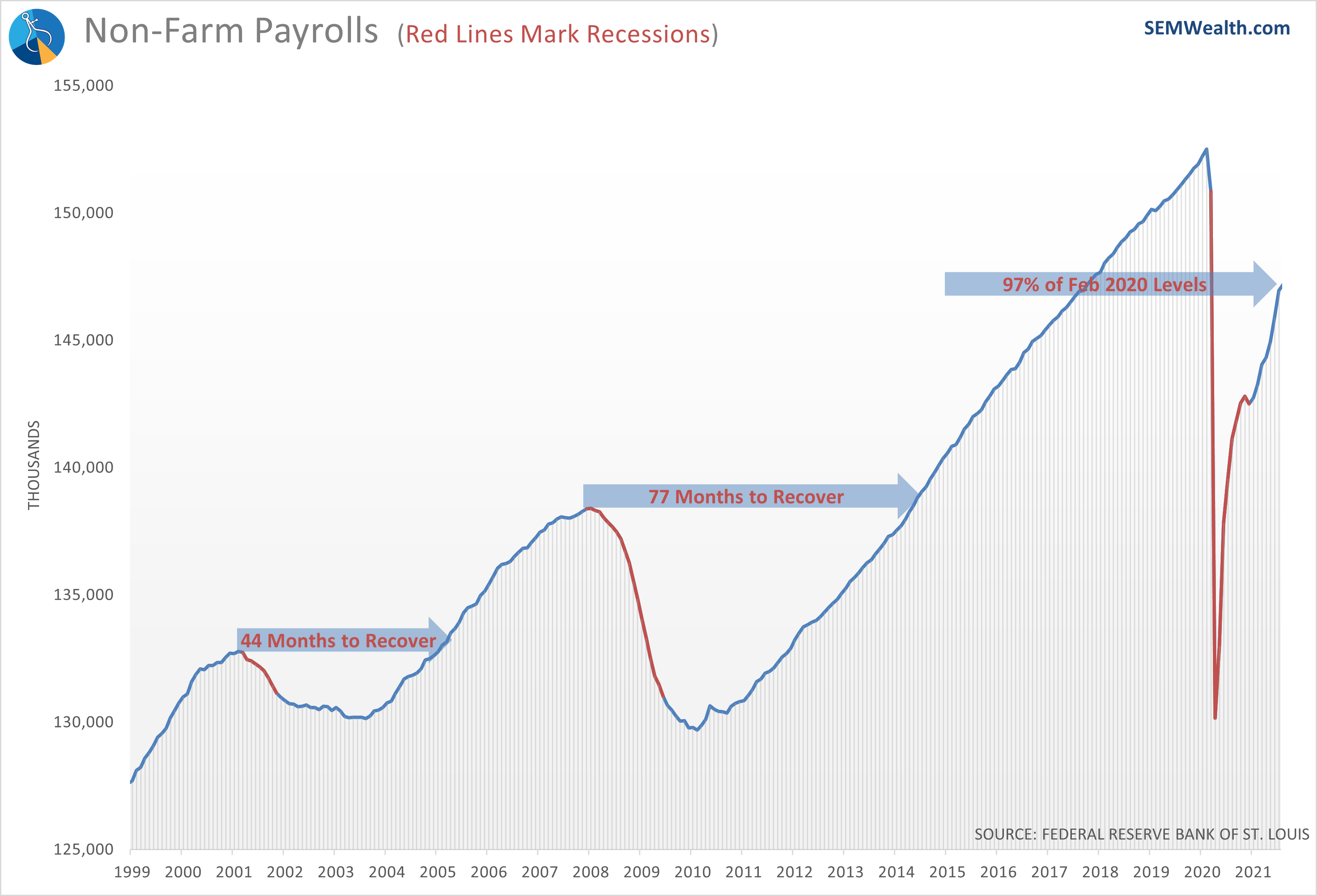

We are still only at 97% of where payrolls were at in February 2020, so there is still room within our economy to see a little more growth before hitting our ceiling. How quickly we get there will be a factor on how we see the market heading for the future.

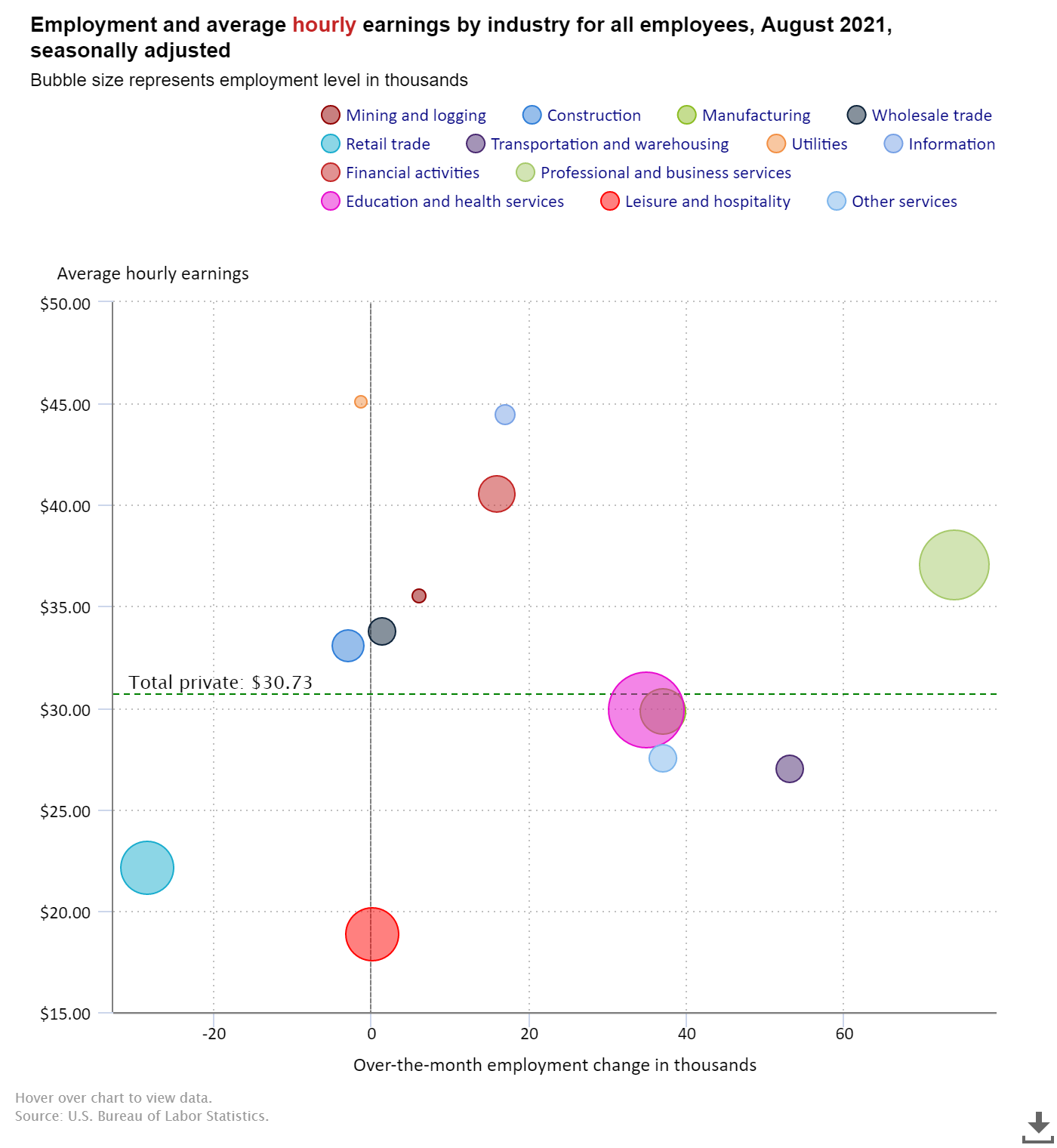

When we break down those numbers by sector, we can see some other interesting insights to how the market is performing. The 2 worst industries, in terms of change, over the past month were retail and leisure. With both of these being cyclical, we can see that the growable parts of the economy is lagging behind the rest of the economy. The more stable sectors for growth – healthcare, education, and professional & business services performed better over the past month.

When looking at this data it is certainly pointing toward a peaking economy, so it will be something we will closely monitor. Depending on what you are expecting the market to do, these data points might not be shocking. It will be important to maintain proper expectations for the market moving forward. It is also important to consider that even if the February 2020 peak is reached, the leadup to reaching that peak has also significantly slowed. If the expectations of the market and the sentiment surrounding it remain high, then not reaching those expectations will lead to disappointment and could see corrections.

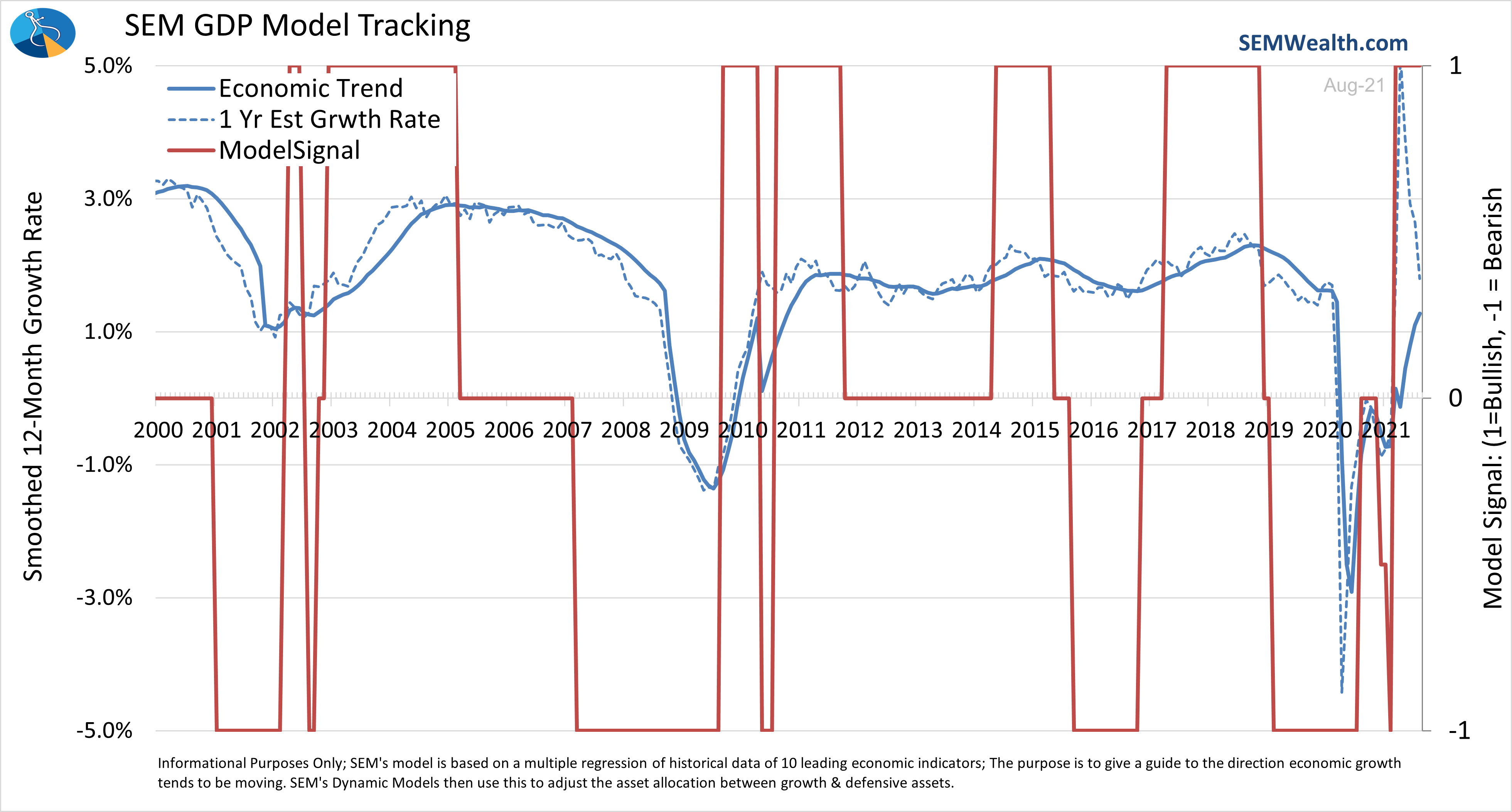

Our economic model remains "bullish", but the expected 12 month growth rate is just under 2%. This is obviously better than we were a year ago (-0.3% in our model), but as we step forward a couple of months if we don't see an improvement in the overall economy we'll be once again looking at a below average economy. That could be especially dangerous for investors with stocks at all-time highs in both price and valuations.

No matter what happens, SEM continues to operate business-as-usual and will continue to tell you what the data is telling us.

Jeff's Random Musings

"The Social Security Board of Trustees released their annual report this week. Many of you may have seen the headline that the “Trust Fund” will be depleted one year earlier --- in 2034. Based on conversations I’ve had with advisors and clients the past 15 years, I don’t believe many people understand what that means..."

Check out Jeff's recent blog discussing Social Security for his random musings this week.