This week President Biden made a hard push for his $3.5 Trillion "infrastructure" bill. This came shortly after the House Ways and Means Committee released their proposed tax changes to help pay for the massive spending bill. I've received a lot of calls and emails from our advisors with big concerns about what this will do to the economy and their clients.

First off, we need to understand these are just proposals. There is likely to be some negotiations in the full House to win more support. Secondly, this can only pass if every Senate Democrat agrees (so we may see even more negotiations.) Thirdly, it has already been watered down from the President's goals, most importantly in our world, the top long-term capital gains rate is not the individual income tax rate (the proposed 39.6%), but instead 25% (up from 20%). Fourthly, and most importantly, President Biden has been a hard liner on his campaign promise to not raise taxes on those making less than $400,000 per year. So much so, he refused to endorse a gasoline tax to help pay for the infrastructure as it would technically raise taxes on everybody.

The $400,000 threshold is important. Looking at our more than 3000 client accounts, we only have 8 (0.27%) which would be impacted. Even for those 8 there are still tax planning strategies their advisors can do to help ensure they do not pay the FULL tax increase. Will their taxes go up? Yes. Will they be much higher than they were in 2017 (before the Trump tax cuts)? Maybe just slightly. Do they have significantly more money now than they did in 2017? Most likely given the huge gains in their investment accounts.

The other concern which has been raised is the ideological statement that raising taxes is "bad for the economy". Again, we do not have all the details, but I want to provide a few charts which show little evidence that raising taxes hurts the economy. In fact, tax cuts only seem to provide a temporary boost to the economy.

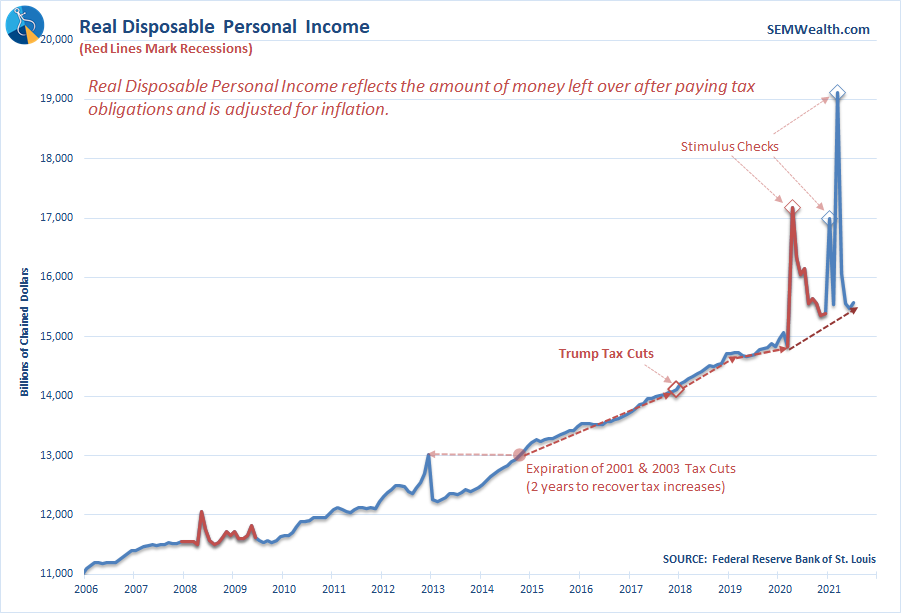

First, let's look at Real Disposable Personal Income (what we have left over after paying taxes, with adjustments for inflation).

We have a few data points. The first is the expiration of the Bush tax cuts from 2001 & 2003 (which were viewed as tax increases). It took 2 years for personal income to recover, which seems like a long time, but the real question is the economic impact. We'll get to that below.

We also have the Trump Tax cuts in late 2017. I overlaid the data with some trend lines. We can see income growth increased slightly following the tax cuts........for about 12 months. They then went sideways. Following COVID and the 3 rounds of stimulus checks, the trend is back to the pre-Trump Tax Cut trend (for now).

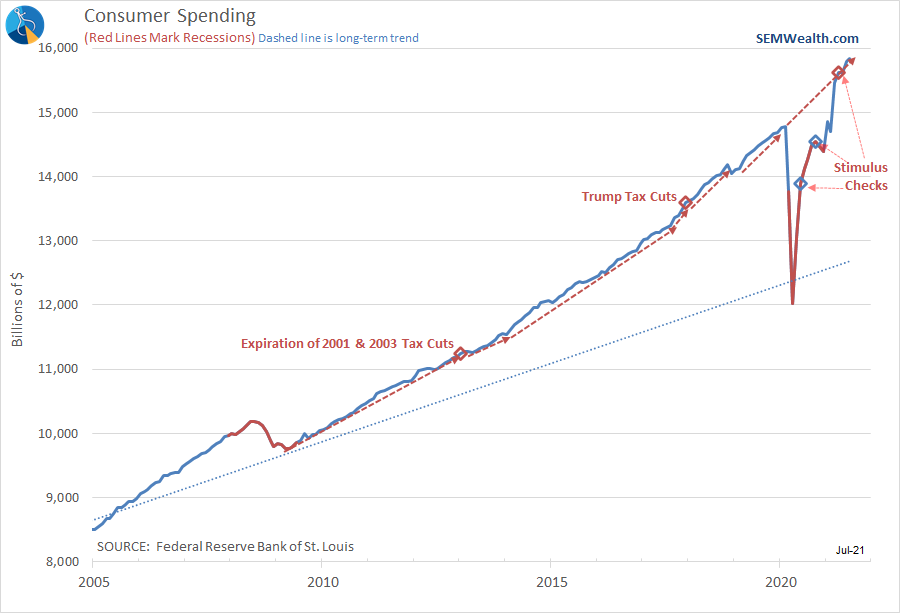

More importantly, what happened to Consumer Spending?

You certainly can see the increase in spending even before the Trump Tax Cuts (consumer confidence jumped after his election). The pace of spending slowed slightly after the first year and settled at a level marginally faster than before the tax cuts. Interestingly enough, if we draw a line from the February 2020 peak to today, we are back at the same pace we were at prior to COVID.

One of the roles of government is to fill in the gaps during economic recessions. While I believe they sent way too much money to people who didn't need it (like those who never lost their jobs or their source of income because they were already retired), it appears so far the government served this role well. The problem is they always forget the second part of their role – to pay back what they borrowed during the recession so they are on more stable footing to fight the next slowdown.)

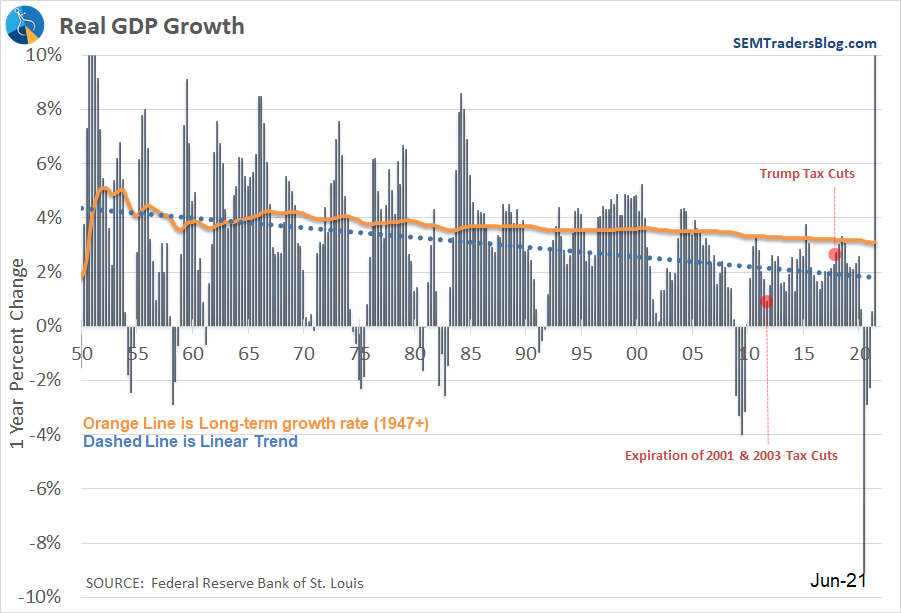

Next, let's look at overall economic growth.

We can see with the expiration of the 2001 & 2003 Tax Cuts the quarters leading up to them and the quarter they expired indeed showed a sharp slowdown in economic growth. However, the economy recovered quickly (and actually ended up EXCEEDING the growth rate of the economy following the Trump Tax Cuts). Those cuts only led to 4 quarters of increasing economic growth. The economy then went through a sharp slowdown in growth rates. GDP was growing at a 1.9% rate, well below the long-term average just before COVID hit.

While I always enjoy Americans keeping more of our money, I was a critic of the Trump Tax Cuts from the beginning, mostly because of the timing, structure, focus, and messaging. Here is what I wrote in November 2017.

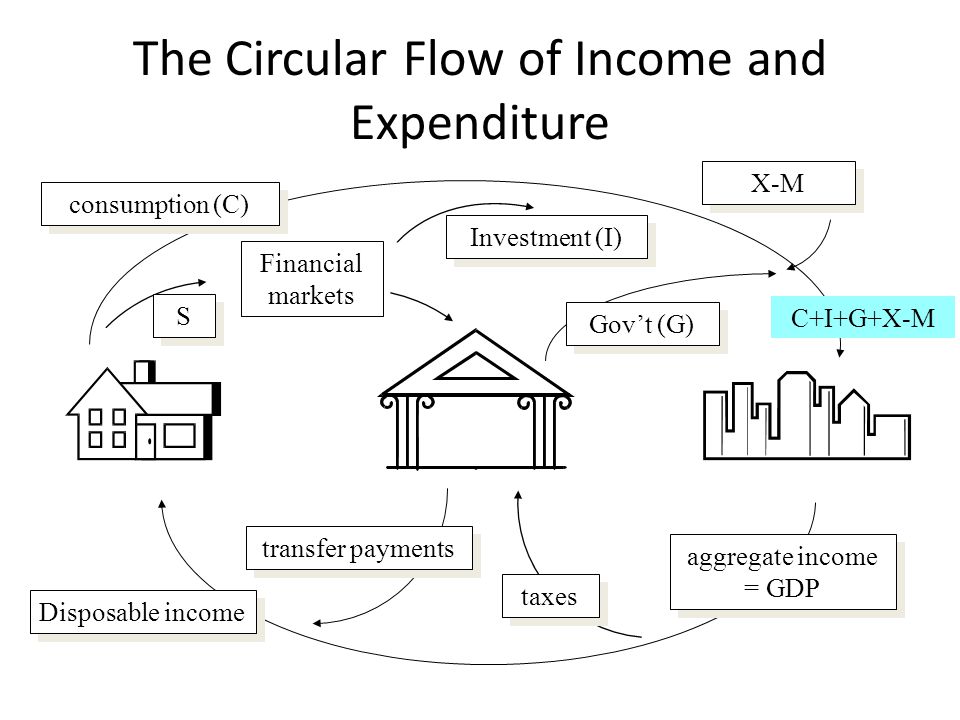

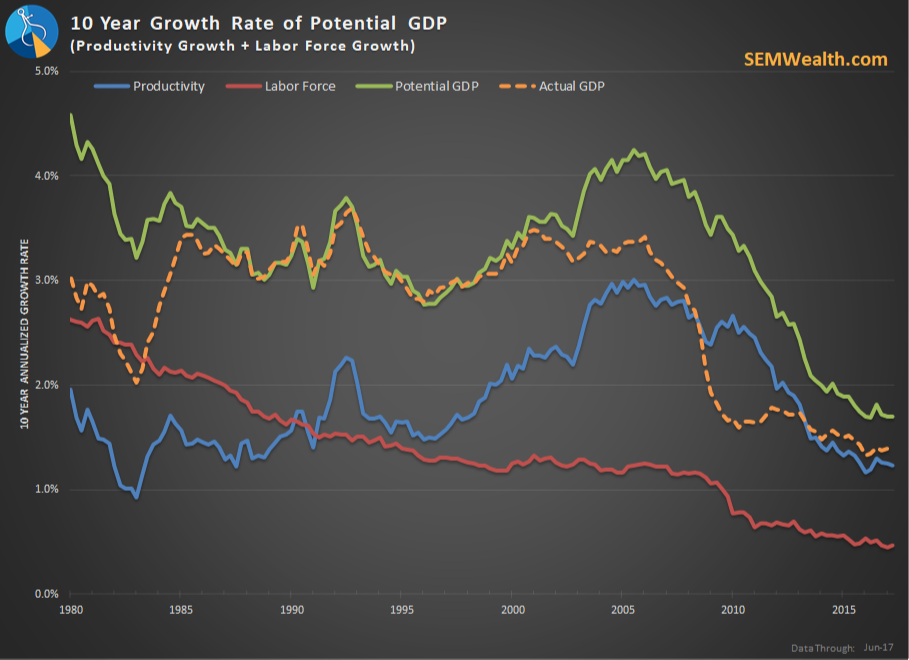

I discussed something I've been hammering both sides on for the past decade – the Potential GDP Equation. Essentially, our economy comes down to two things: how many people are working and how much are they producing. Therefore, economic growth over the long-term will be the sum of the growth of those two components.

The Trump Tax Cuts did little to nothing to increase either of those variables.

Turning to the spending side of Biden's "infrastructure" bills, Republicans have been critical of all the things being thrown into the bill. I've admired their creativity as it seems the economists who helped craft it are focusing on the two variables – how do we get more people working and how do we get them to produce more?

Paying for childcare allows more parents to work. Universal pre-K helps give future workers a head start. Free community college can help train workers in industries that need different skills. Add all of those to the planned improvements to our roads, bridges, public transportation systems, internet access, and other traditional infrastructure projects and we can see how these bills potentially could help more people work and help them produce more.

Where I take issue is all the other things they have thrown in as "infrastructure". Not to be cold hearted, but when it comes to economic growth those not working are a drain on the system. I'm not saying we shouldn't be helping them, but it's definitely not "infrastructure". Things like expanding Medicare to cover dental and vision are a DRAIN on the economy. Paying off student loans, while helpful to those with student loans, is not "infrastructure". In both cases you're taking money from what group of taxpayers and giving it to another.

If the bill does not clearly address these questions: how do we get more people working and how do we get them to produce more, it is not "infrastructure", which means it will HURT the overall economy.

Hopefully you can see not all tax increases are bad (or are all tax cuts good). Not all government spending is wasteful either. If we truly care about the future of our country we all need to come together and focus on how do we get more people working and how do we help them produce more.

By the way, not that anybody is surprised, but none of the politicians cared to address the looming insolvency of Social Security. On a related note, the Social Security estimates expect normal (3.1% GDP growth). If we fail to hit those numbers (which is inevitable if Congress does not address the two key economic questions), Social Security will run out of money even sooner. Just as the Republicans believed their tax cuts would boost the economy long-term, the Democrats truly believe their spending and tax hikes will boost the economy long-term. Both are wrong.

Finally, if you want to learn more about how our economy works at a fundamental basis and where it needs fixed, check out this post: