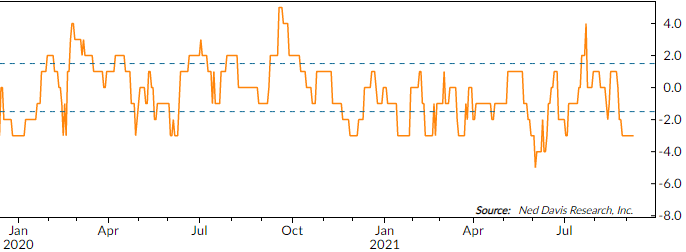

The shorter work week didn’t allow us much time to get new news that would point the market in a certain direction, but the market didn’t stay flat. We are at a point, like we’ve been mentioning quite often lately, that the market NEEDS positivity to continue to reach the growth expectations. “Business as usual” isn’t good enough at this stage. This is exactly how slippery the slope can get. While this week was certainly not a good week for the market, down every day for the week, it can certainly be much worse. When we have been expecting record returns year over year, down days stacking up back to back are certainly not going to help reach the extremely high expectations that the market participants have.

This week, we started to see financial institutions change their tone in stock sentiment – with at least 4 Wall Street firms predicting a 10-25% correction due to slowing growth and high valuations. While this isn’t really news – more future projections – it is interesting to see if the lowering sentiments by these institutions will create a correction of the market based on where they are setting these new, lower expectations. As we've seen over the last 10-12 years, if we lower these expectations, see a correction in market value, then start to exceed those expectations, we could see a new period of growth. That would depend on how the rest of the market participants taper their own expectations.

A minor correction can turn into a major sell-off if sentiment change isn’t enough to change expectations. We have been able to exceed expectations for the greater part of a decade, so it could take a while for our mindsets to calibrate. We have seen how much resistance there can be to changes. The issue if this happens is we have a much lower chance at reaching the high expectations, and if we completely whiff on growth based on high expectations, we might see a more uncontrollable market slide.

One thing that appears certain is that a market that factors in momentum does not have much upward momentum left in it. We should probably expect more weeks like this, if not more severe weeks ahead. In my opinion, the quicker the market participants can calibrate their expectations to wash out the excesses, the quicker we can get to another market climb.

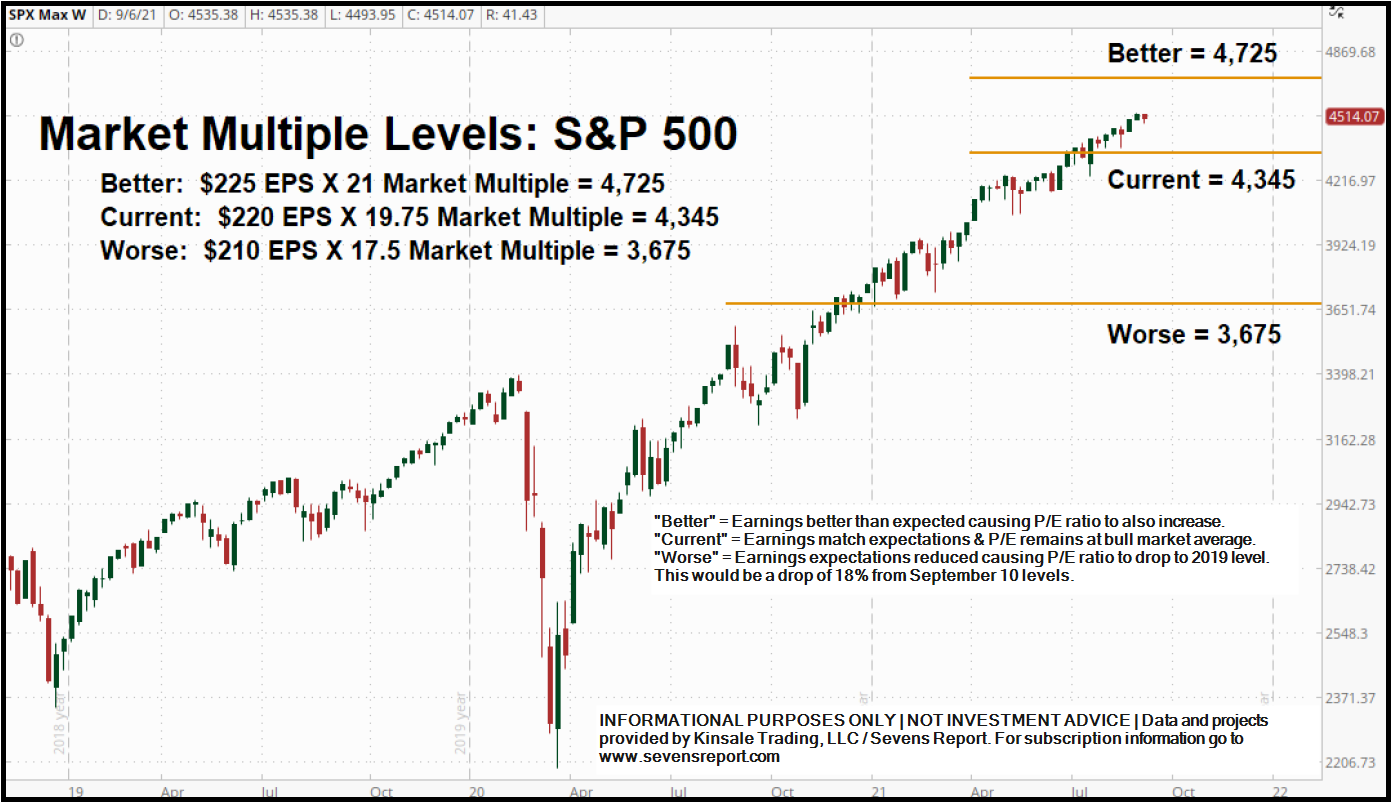

One of the research providers we utilize is the Sevens Report. They do a good job of summarizing the research from all the Wall Street firms and giving an assessment of what really matters in the big picture. Each month they provide short-term (3-6 month) scenarios for the S&P 500 based on the current situation. The latest update shows very little upside with a whole lot of downside.

As we mentioned last week, the SEM signals are still slightly bullish. There wasn’t anything that happened this past week to change that, but we are still alert and prepared for whichever scenario we are given. We certainly are hoping for the best, but that won’t stop us from making the proper updates to our models.

Jeff's Random Musings

As Cody mentioned, the first week of September was tough for stocks. I think it was tough for all of us, especially those of us who were out of the office the last bit of summer. I discussed this in our latest market musing video:

For those of you who prefer to read rather than watch your market updates, here are the highlights:

- The economy and markets have had an easy time thanks to unprecedented stimulus from the Fed & Congress.

- We’re entering a new season, which is going to force the economy to stand a bit more on its own.

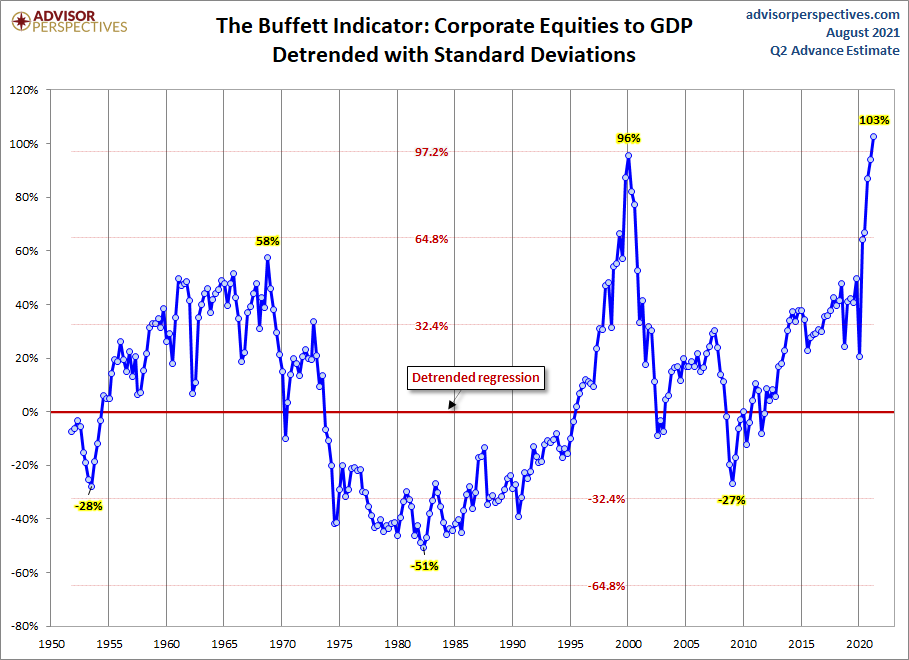

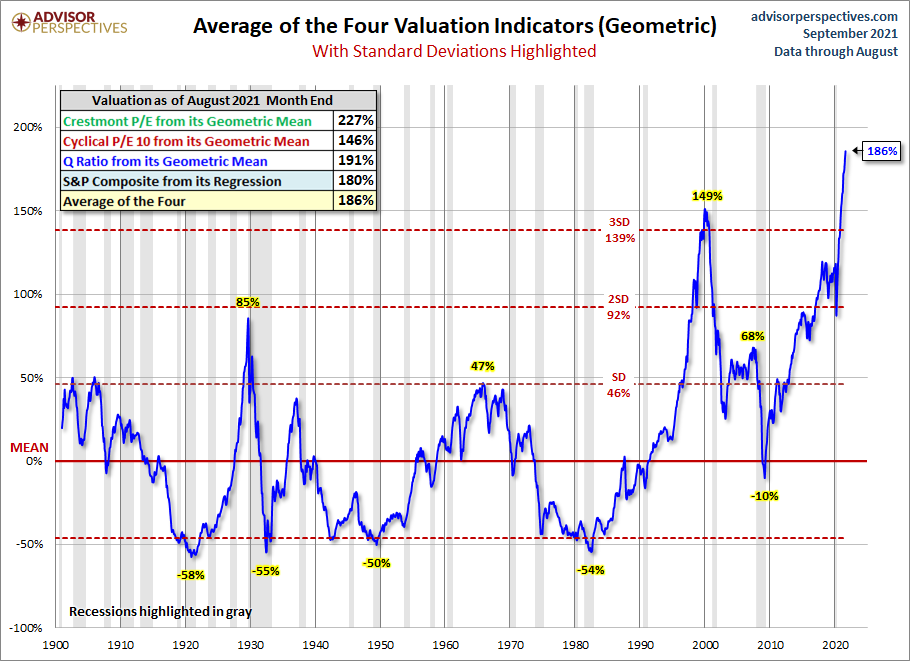

- With record high valuations we have to see MORE growth. Simply getting the EXPECTED growth will not be enough as Cody hinted at above.

- We’re starting to see signs the economy is slowing already. The next few months could be critical (see last week’s blog with our latest economic update).

- I’m seeing way too many portfolios with other advisors and investment managers which have far too much stock exposure given the investor’s financial situation. Now is the time to get a second opinion. The gains we’ve enjoyed in stocks the last few years are not sustainable. The market is a “mean reverting” mechanism. The longer we have well above average returns, the harder the correction will be.

If you have investments outside of SEM and would like a free portfolio X-Ray, click here to take our Risk & Objective Questionnaire. In the “advisor” section put my name (Jeff Hybiak), and I’ll take a look.

For our SEM clients, we truly appreciate the trust you’ve put in SEM. While we all have our opinions, rest assured we let the numbers speak for themselves. This allows our clients to unemotionally participate in as much upside as possible without risking losses that may not be comfortable or worse cause serious consequences in the overall financial plan. If you’d like us to review your current allocations, you can take our Risk & Objective Questionnaire. Make sure you mark “yes” you are a current client. Once we receive it we will review your account with your advisor.

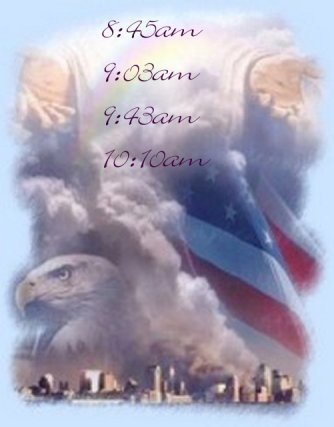

Every September we take some time to reflect on the attacks on our country on September 11, 2001. Each year we update the blog I wrote on the 10-year anniversary of the attacks.

On a related note, if you're a Christian the 9/11 anniversary is a time to reflect on the impact we are making on our world. We are all given certain gifts from God and He expects us to use them for good. Courtney discussed some of those ways in our monthly Cornerstone Impact blog.

[Feature Image Credit: blog.margaritaville.com/2018/09/last-summer-weekend/]