The market doesn't seem to be doing too bad.

Versions of this comment have been used at least a dozen times in the past month in meetings with clients and advisors. The fact stocks have remained near all-time highs despite some major economic headwinds can indeed be viewed as good news if you have a short-term outlook. People forget there were many times in late 2007 and early 2008 where the exact same feeling existed. We saw the same thing in 2000 and early 2001.

The longer the market remains "stable" the more dangerous it actually becomes. At this stage in the market people are buying stocks for two reasons – bond yields are too low and stocks seem to always go up. Every valuation metric is at or near all-time highs. The only way for stocks to go higher are for investors to continue to pay even higher prices for the same amount of growth or for growth to accelerate. The insanity of paying constantly higher prices can continue for longer than most of us believe. Eventually reality and math will set in. Growth will slow which will cause stocks to fall. Those who bought stocks because they were going up will become sellers – rapidly.

The fundamental story of the market is about to get much more difficult. We mentioned the last two weeks some of the economic concerns which are popping up. These are things that will not be solved quickly. When our economic model moves to "transition" or "neutral" it is statistically the most difficult environment for the stock and bond markets. This is the reason we add some "alternative" or "market neutral" funds even in our Dynamic Aggressive Growth model when we are in this stage. We often see a tug-of-war with institutional investors trying to decide if the slowdown is temporary or if they need to adjust their growth expectations (and thus their allocations to risky assets).

Last week on Twitter, long-time hedge fund manager Doug Kass shared a chart from Goldman Sachs. This followed an inflation number which came in stubbornly high.

@tomkeene @ferrotv @jimcramer @WilfredFrost @lisaabramowicz1 @SquawkCNBC @andrewrsorkin@cnbcfastmoney @carlquintanilla while i prefer the term 'slugflation' (sluggish growth, rising inflaiton) over 'stagflation'

— Dougie Kass (@DougKass) October 12, 2021

stocks do poorly in 'stagflationary' periods: pic.twitter.com/a9mH3njeDZ

What's possibly more important than the impact slowing growth and higher inflation (I like Doug's term 'slugflation') has had historically on the stock market is the volatility during those times. We should expect much bigger swings in the market. This will make it critical to have a disciplined, non-emotional strategy to navigate as we possibly enter this new phase of the market cycle. SEM clearly has this in place. Those buying (or hanging on to) stocks simply because "the market doesn't seem to be doing too bad" risk being surprised at how quickly it does start looking bad.

The stock market is holding the 100-day moving average, which is a marker many larger investors use to determine the overall trend. The 200-day moving average, a longer-term indicator is not too far below the 100-day. A breach of both could bring on mass selling.

From our perspective we can see the value of our three distinct management styles. Our economic model have taken money off the table inside our Dynamic models. The strategic models remain fully invested, although they eliminated the small call exposure (which coincidently would get hurt the worst in an economic slowdown). The area I'd focus on is high yield bonds if you're subjectively making your own allocation decisions. I've always said bond traders are smarter than stock traders. Stock traders only care about selling at a higher price. Bond traders actually have to worry about getting paid back, which means they have to focus on reasons a bond issuer may not be able to make their debt payments (such as an economic slowdown.)

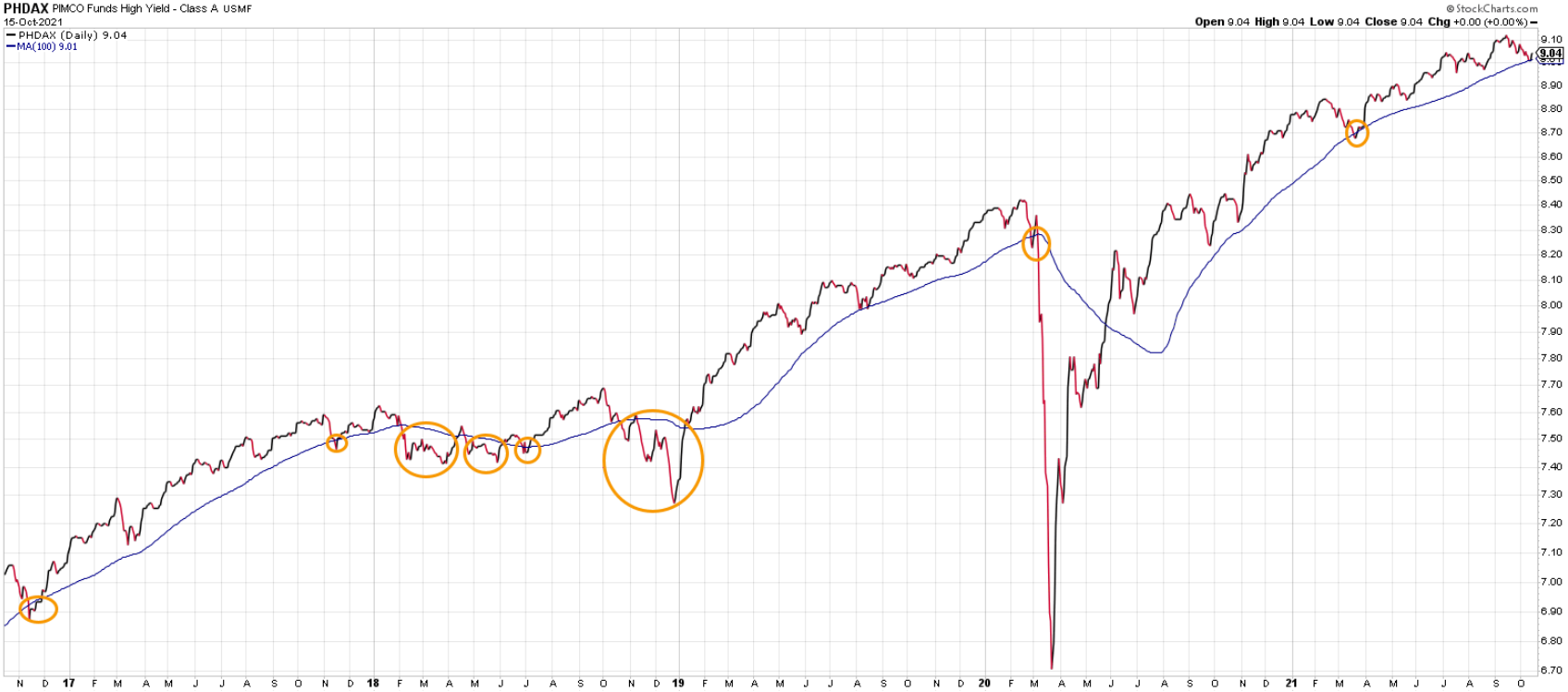

For now, high yield bonds are (barely) holding up. While the chart below is not our actual high yield bond trading system, it is a good representation of the general viewpoint of our blended high yield bond models (we utilize 5 different signals, none of which are based on a simple moving average). Using the same 100-day moving average, you can see how well the trend in high yields has held up since the summer of 2020. If high yields breach this level it would be a clear sign (in my opinion) that bond traders are becoming concerned about a major economic slowdown, which means I would be concerned for anybody not in an SEM managed model who cannot stomach or afford some very large losses in their portfolios.

One of our high yield systems has already sold, but the others are hanging on by a thread. We typically recommend most of our clients utilize a portion of all three of our investment strategies, which means they have already reduced some exposure via our Dynamic models. The tactical models can move to safer investments relatively soon and within a matter of days if necessary. The strategic models, designed for longer-term holding periods remain invested, but the sell points for our long-term trend models inside of these models is not too far below the current prices.

Remember just because the market doesn't seem to be doing too bad doesn't mean it can't quickly turn against you.