Stress will always expose weaknesses. For the past 15 years I've written and spoke about our broken economy. Massive budget deficits, continued reliance on a service economy, a huge trade imbalance, over a hundred trillion dollars in unfunded liabilities (Social Security & Medicare), a massive demographic imbalance impacting our labor force, a constant focus on doing anything possible to avoid recessions, and corporations who focus on managing earnings rather than investing in the future were all things I've highlighted since the mid-2000s. COVID was not the cause of our economic issues. Instead it exposed how fragile our economic system really is.

Don't get me wrong. Americans are resilient. I believe Congress and the Federal Reserve had to act in March and April 2020 to help ease the pain of the mass lockdowns. The issue is everyone is striving to get back to what we had at the beginning of 2020 without realizing that system was broken. STRUCTURAL issues cannot be resolved with short-term measures. It takes time, forward thinking, and willingness to sacrifice short-term growth to put our economy back on a stable long-term path. Very few voters are willing to do that which means very few politicians will do anything to change our path.

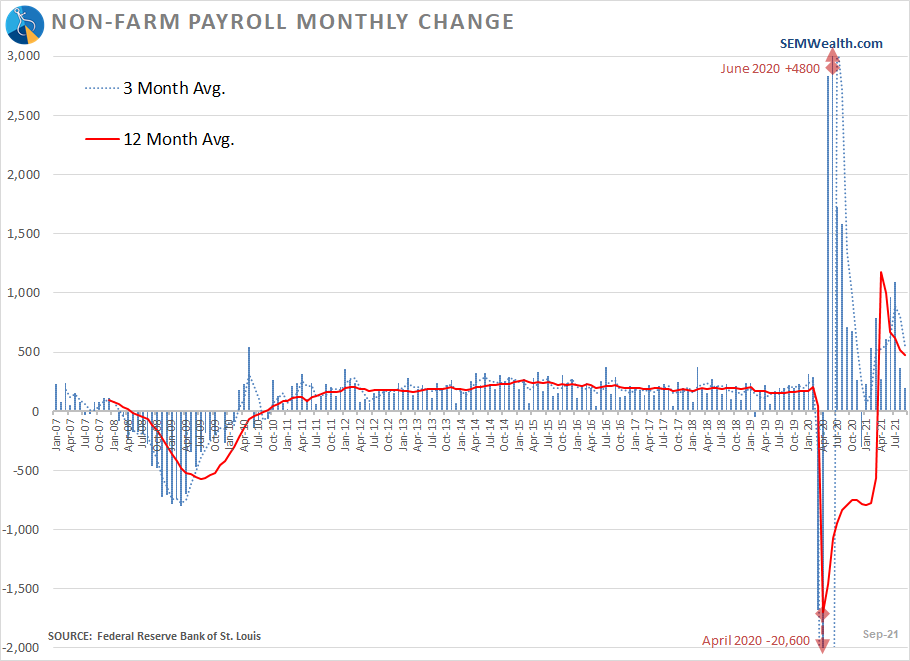

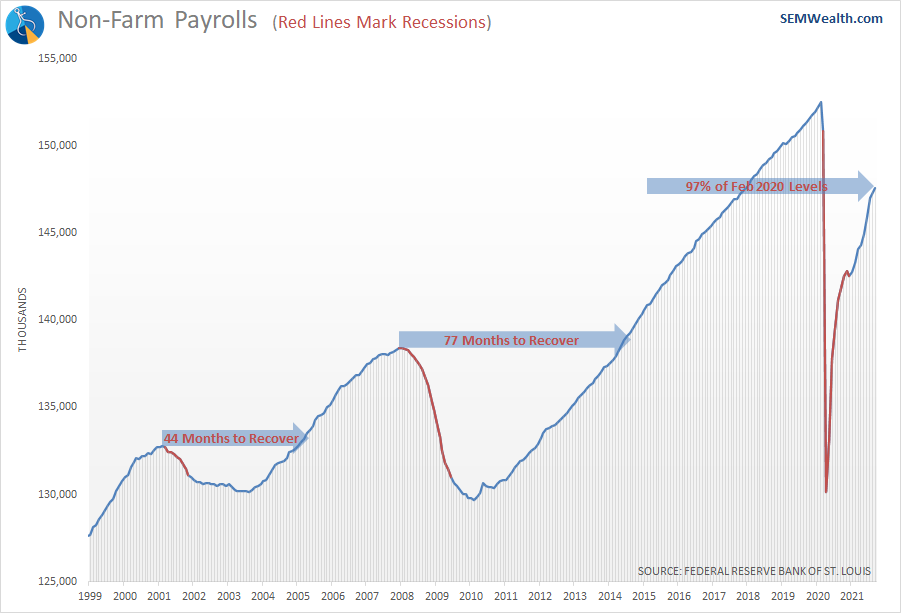

The September Payrolls report released on Friday was another example of our broken economy. Over half of the states had already ended extended unemployment benefits in July and August. All of them ended at the beginning of September. At the same time, all schools are back to in-person learning across the country. Many people theorized this would bring a rush of workers back to the labor force and we'd see all these open jobs filled. Instead, September was yet another disappointment for those banking on the continued strength of the economic recovery.

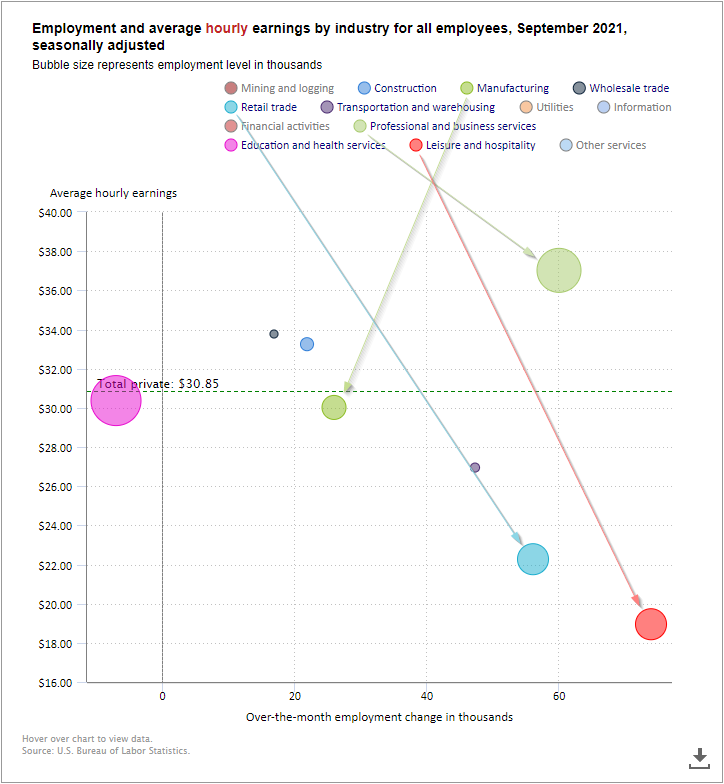

The pace of recovery is slowing. The real issue is the QUALITY of jobs available and the SKILLS of our labor force. We have a huge supply chain issue, but lack the workforce (and infrastructure) to be able to help alleviate the strain. Instead, the two lowest paying sectors (leisure & hospitality and retail trade) continue to be where most of the jobs were added. "Professional & business services", which includes most "white collar" type positions did see some strong growth. Over half of those jobs were in "architecture & engineering" services and "management & technical consulting" services. We did see 26,000 new manufacturing jobs with "fabricated metal" and "machinery" jobs being the bright spot. We lost 6,000 "transportation equipment" manufacturing jobs and should expect to lose more if we cannot overcome our supply chain issues.

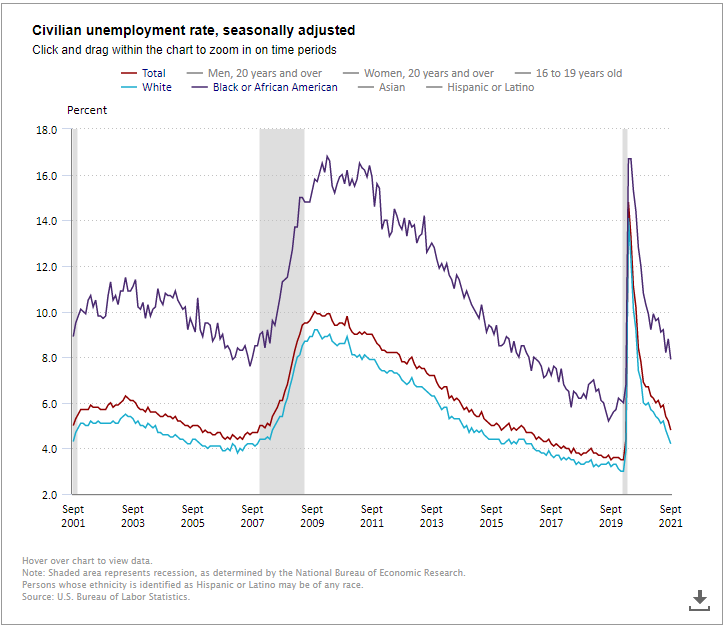

Overall unemployment did decline again, but we continue to see a wide gap in unemployment rates.

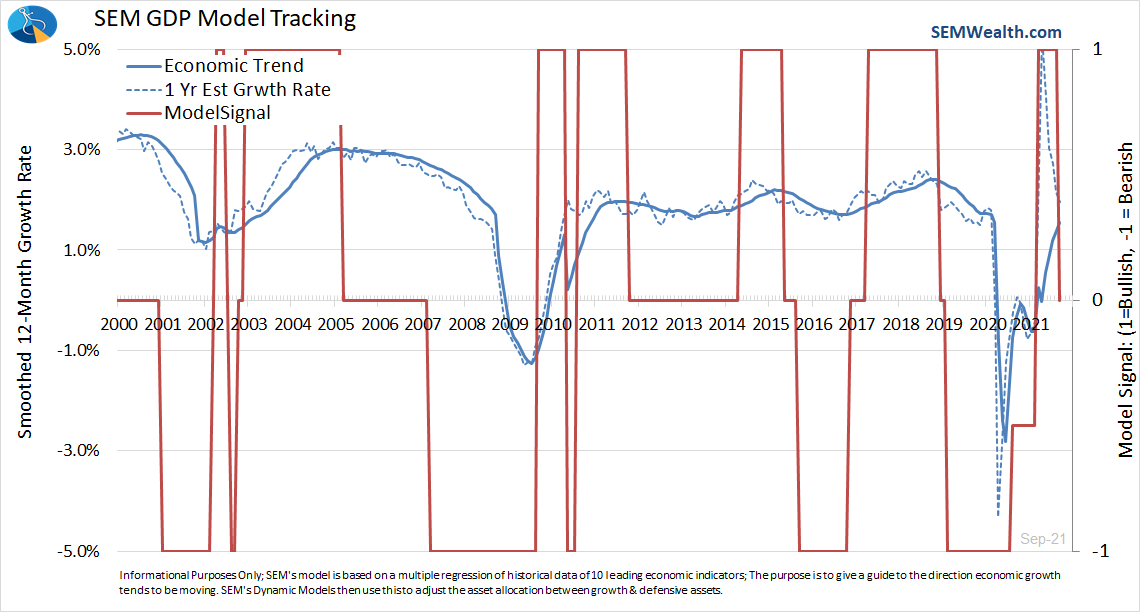

As I mentioned last week, our economic model has picked up on the slowdown and has adjusted to "transition" mode.

High yield bonds are (barely) holding onto their uptrend. I would be concerned about a larger pullback if they start a downtrend. I've said throughout my career bond traders are smarter than stock traders. Bond traders care about whether or not they can get their money back while stock traders just want to sell at a higher price regardless of the reason the price moves higher. This means if bond traders are concerned about the economy and what it means to repayment risk, they will take money off the table.

The stock market was more focused last week on Congress kicking the debt ceiling down the road a few months than the weak economic data. The S&P 500 briefly crossed below its 100-day moving average for the first time since last October.

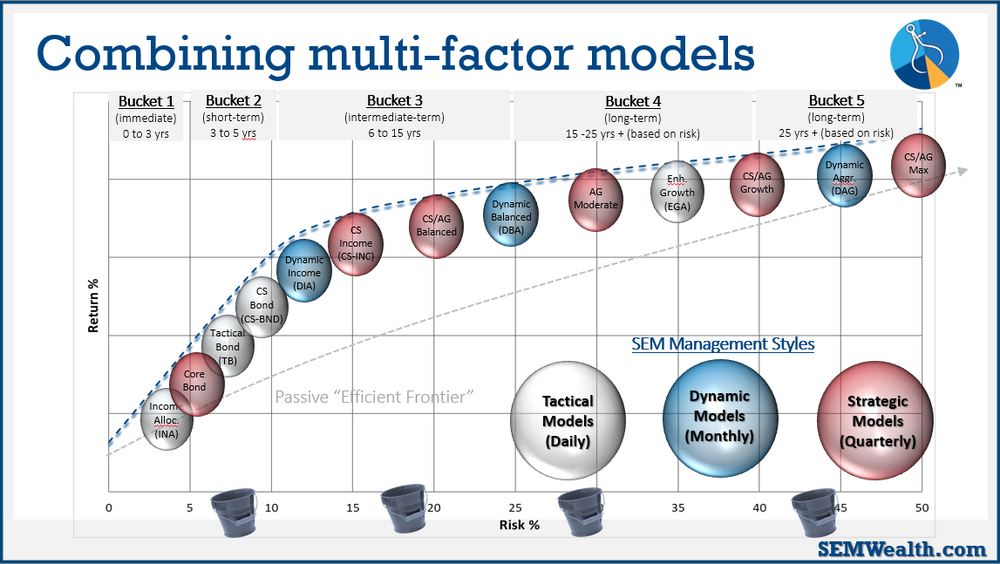

This is the beauty of our three-tiered approach to portfolio management. Our tactical models will adjust first to a change in trend. Our dynamic models focus on the economy. Our strategic models care more about the longer-term trends in the market. Combining all three into one portfolio gives true diversification of ideas, asset classes, and time horizons. You don't need to have an opinion about what will happen next. We just let the data and the models guide us.

Investors have a lot of questions they need to ask. We addressed those in our most recent quarterly newsletter. I'd encourage you to take some time and consider the answers and what it means to your overall plan.