Depending on how much time you spend on Twitter, Facebook, watching SEC football games, or NASCAR, you may or may not have heard or seen the expression, "Let's Go Brandon!" Here's one example from Twitter:

For some of you this might be confusing. Why would we be cheering Brandon for high gas prices? Who is this Brandon guy anyway? This video might give you a clue. Warning – the crowd is saying a word that is not typically allowed on network TV and probably isn't safe to play in many work environments or if you have young kids around.

Whether the reporter was "covering up" as a conspiracy to protect the president as some conservatives have said, or simply trying to keep her network from being fined by the FCC, we've now seen the "Let's Go Brandon!" chant go viral to replace the off-color chant that was going around prior to the beginning of October.

While I understand the frustration many people feel towards the president (probably the same frustration the other side felt the prior four years), I wanted to take a look at the narrative behind many of the "Let's Go Brandon!" chants. Remember, I'm an Independent so typically will offend both Republicans and Democrats alike. I don't intend to and respect the reasons each of our readers have chosen to affiliate with one part or the other. I chose to be independent because neither party fully represents my political beliefs, especially my economic ones.

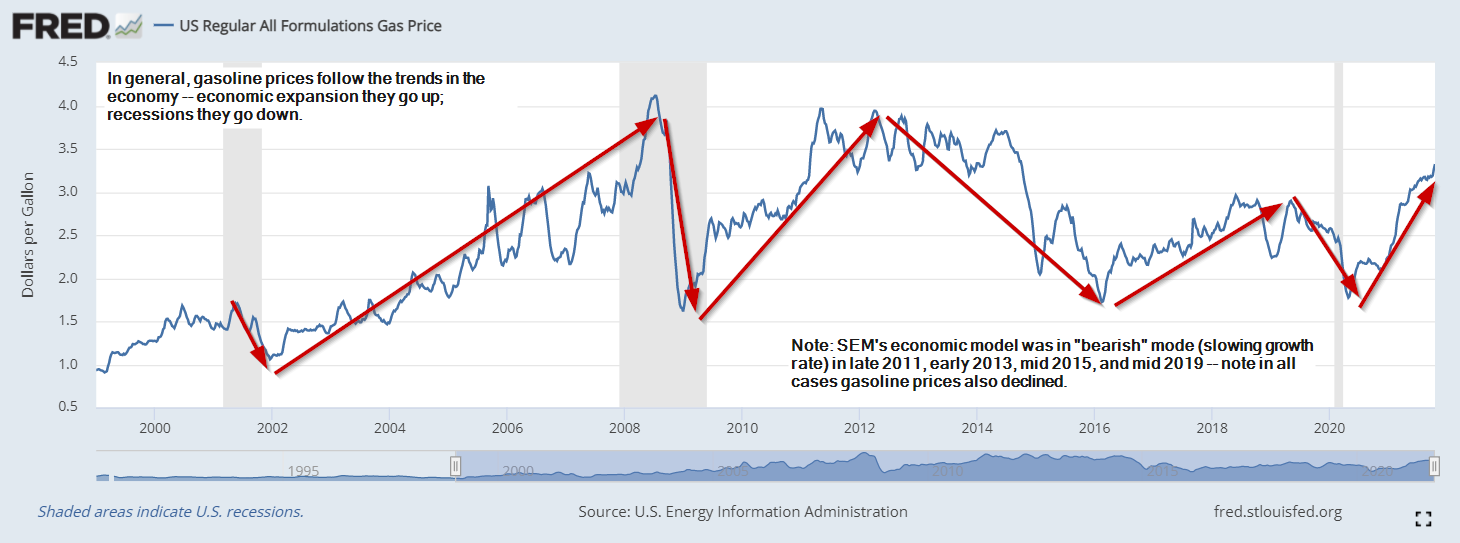

Often times, the "Let's Go Brandon" phrase is used to talk about gas prices like the tweet above. To this I remind everyone that gasoline price trends typically go up and down based on changes to economic growth rates.

Yes prices are surging, but not in a way we shouldn't expect coming out of a recession, especially one where so many people were unable to travel for so long.

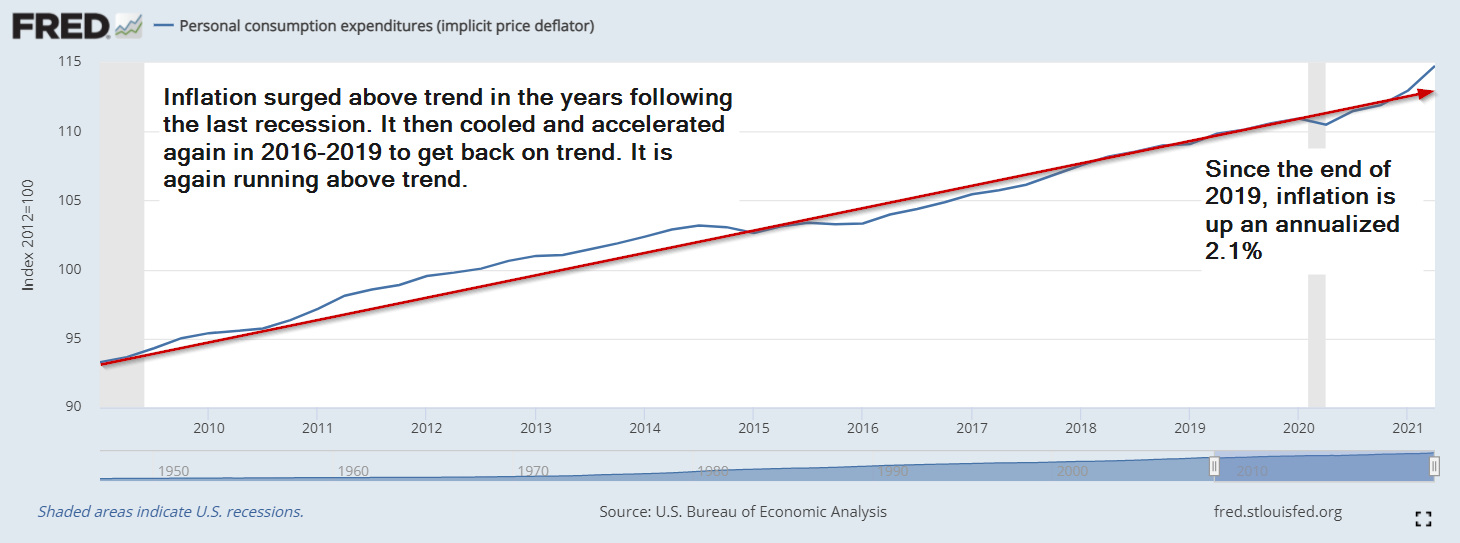

Inflation overall has been a focus of the "Let's Go Brandon" chant. Here's a look at overall inflation. If we step back and look at the TWO YEAR change in prices, it's not as striking as when we compare it to where we were at a year ago.

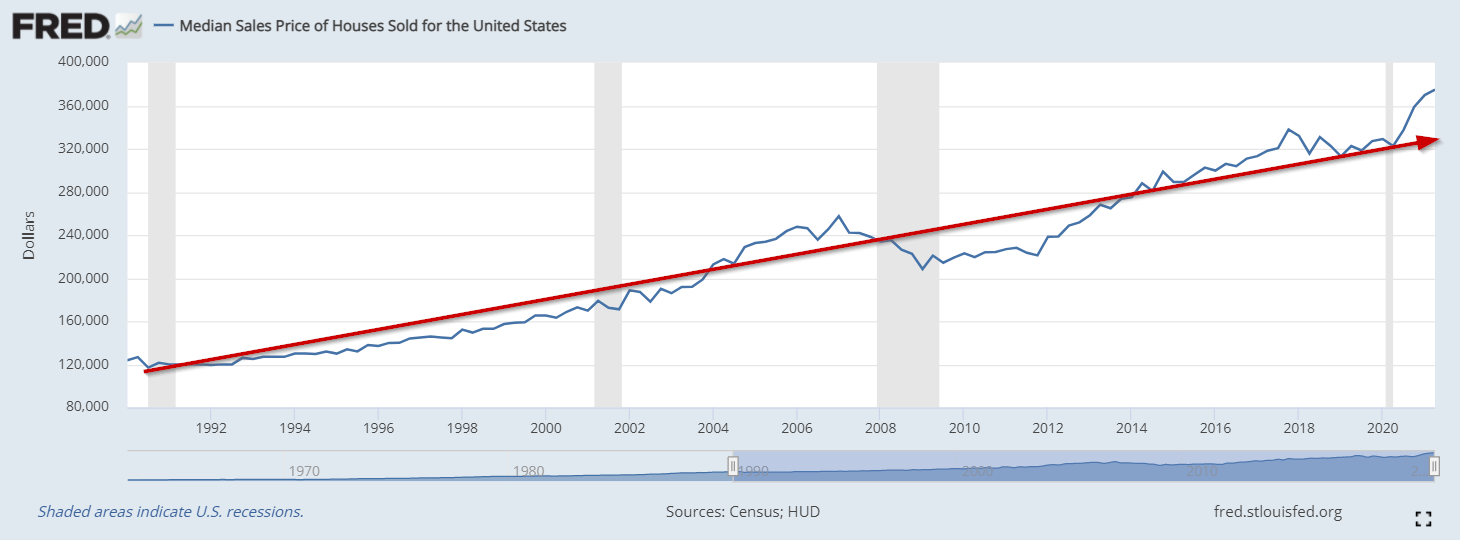

While I haven't seen Brandon blamed for house prices, this is one area that was surging well before President Biden took office. It is an area that will eventually create a drag on the economy and certainly an area that is now hitting the inflation indicators.

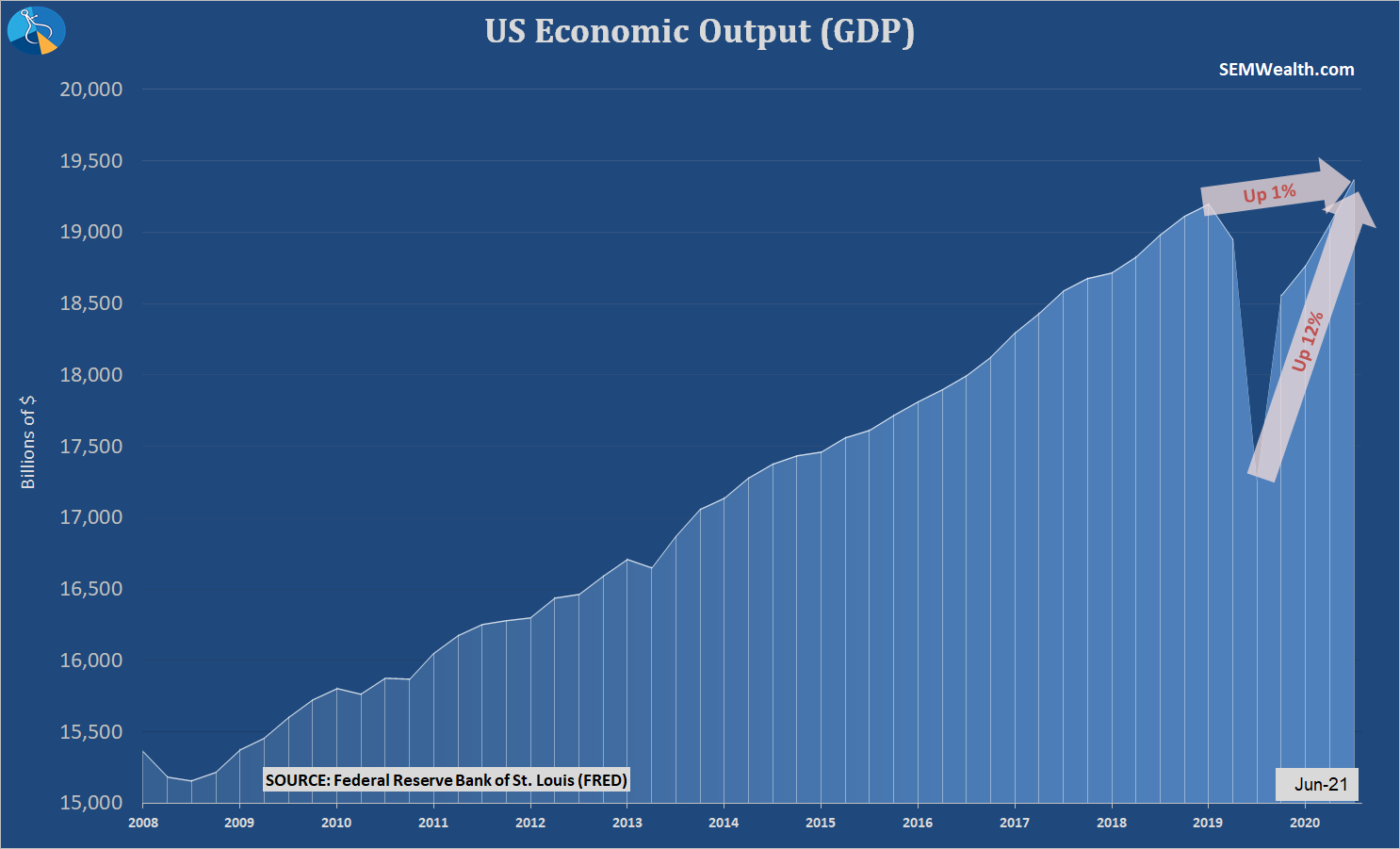

For the most part, inflation will be above average during times of economic growth and fall when growth slows. The economy has now recovered the full COVID losses and is up 12% since the bottom in the summer of 2020.

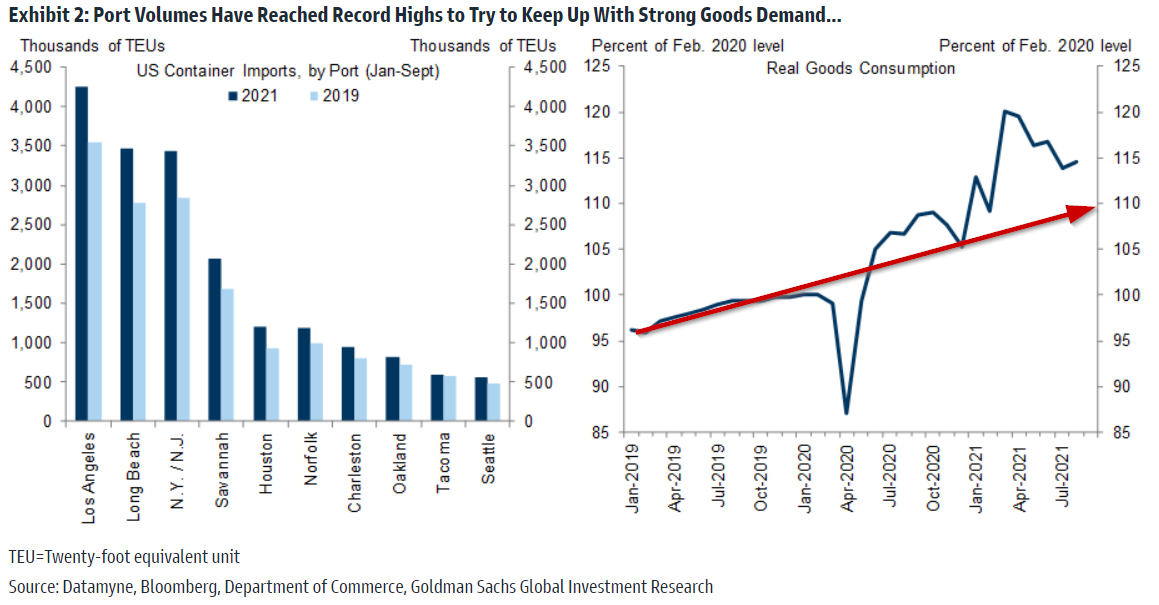

The supply chain shortages are also being blamed on Brandon. What is actually happening is unprecedented demand for "stuff" that our infrastructure simply wasn't ready for. This chart from Goldman Sachs illustrates the change in demand for consumer goods, both in terms of the various US ports as well as in overall demand.

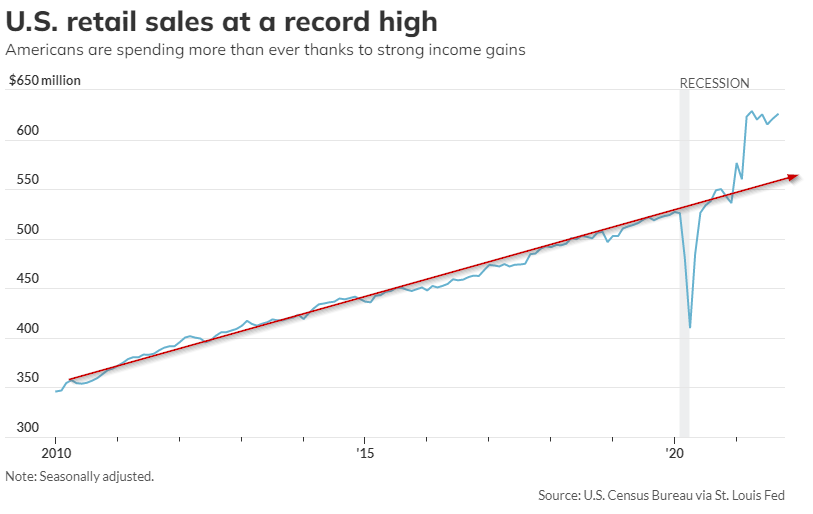

We are bringing in 15% more goods now than we were in the month before COVID hit. This also shows up when you look at retail sales.

I caution anybody from placing specific blame on one person or one party. Policies take a long time to filter through the economy and there are always unintended side effects. The surge in retail sales, prices, consumer goods coming through US ports, and the overall economy started with the $5 Trillion of stimulus approved by a split Congress and signed mostly by President Trump, with a small remainder passed after President Biden took office. Turns out when you flood Americans with cash, especially those who really didn't need the cash, they end up spending it on lots of "stuff".

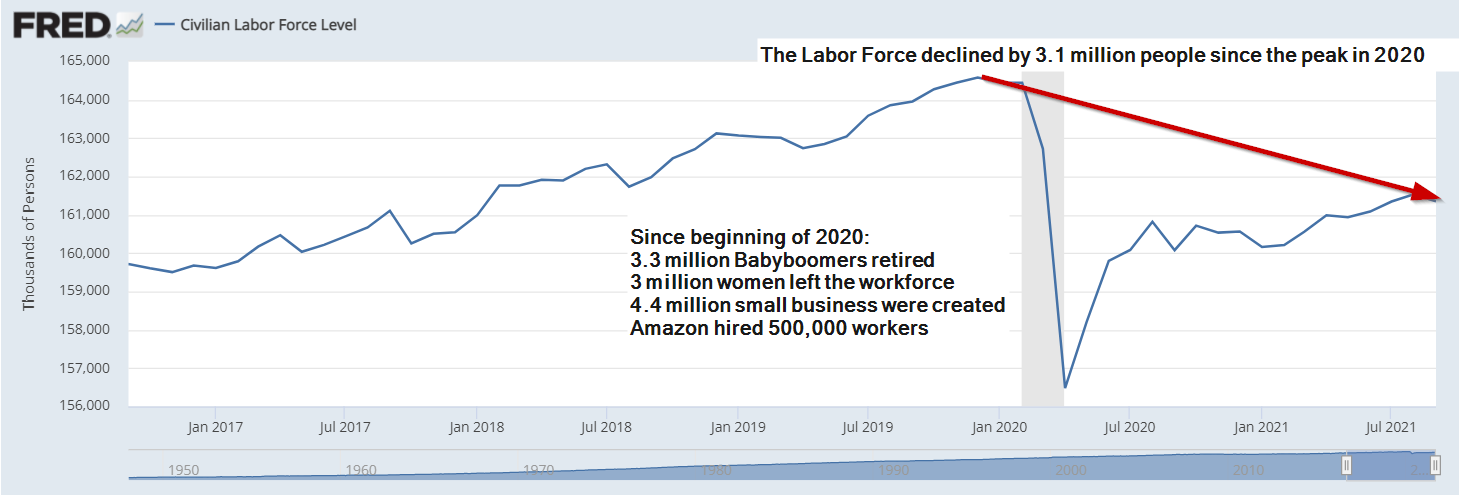

Finally, I wanted to look at the other issue that typically leads to a "Let's Go Brandon" chant – the lack of available workers. Many people are blaming the extended unemployment benefits on the lack of workers in the leisure and hospitality area, which is leading to price hikes and poor service in the industry. The problem is nobody is looking at the STRUCTURAL changes we saw occur during and after COVID.

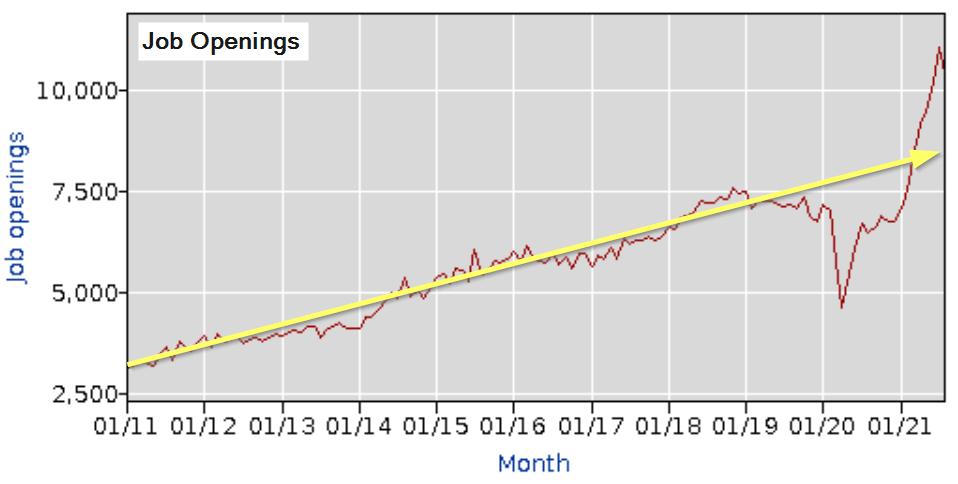

First off, the spike in job openings has matched the spike in consumer goods demands and retail sales. More people are spending money so we need more workers.

The issue in addition to too much DEMAND for workers in a low paying industry is our labor force changed significantly over the past two years.

The most obvious change is the large amount of Babyboomers who retired sooner than expected. When you add that to the number of women who have left the workforce, the number of leisure and hospitality workers who ended up at other places like Amazon, and the number of people who decided to start a small business, it is a much deeper story than "paying people to stay home". Yes that could be part of it, but it's nowhere near the whole story.

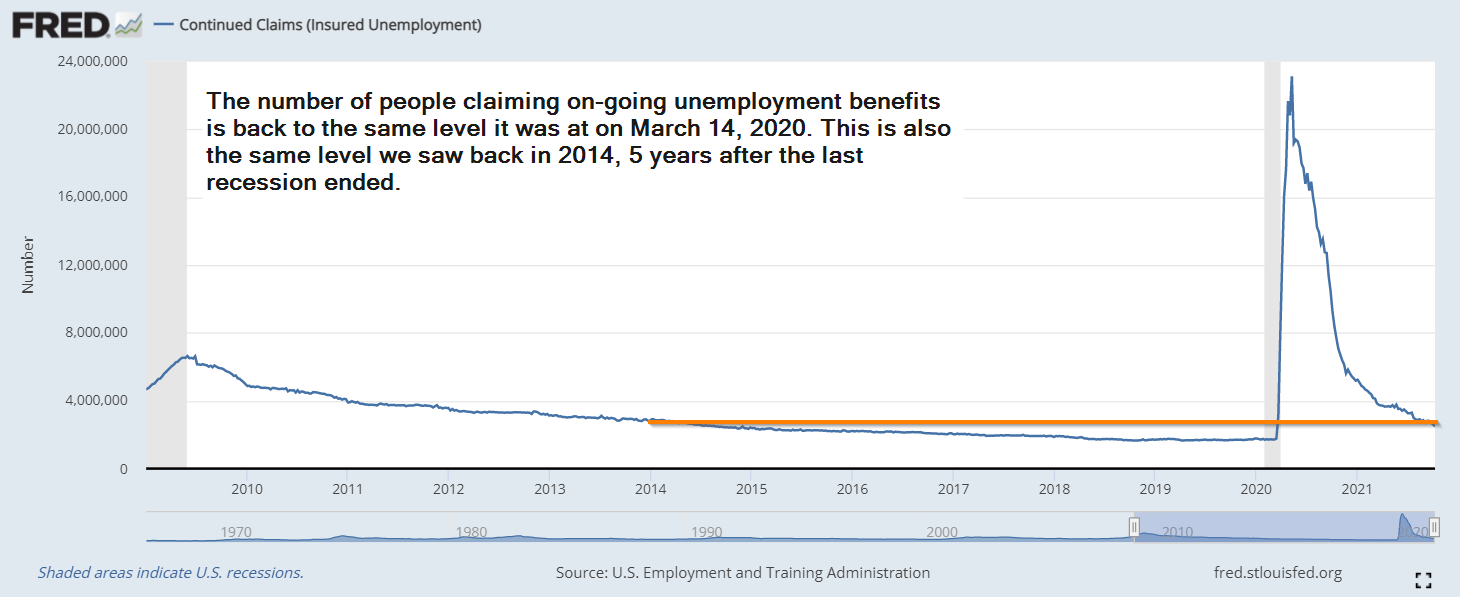

In fact, if you look at the number of people actually receiving unemployment benefits, we're all the way back to the same level we were at in the early days of COVID. We are much, much better off than we were following the 2008-2009 recession in terms of long-term recipients of unemployment insurance.

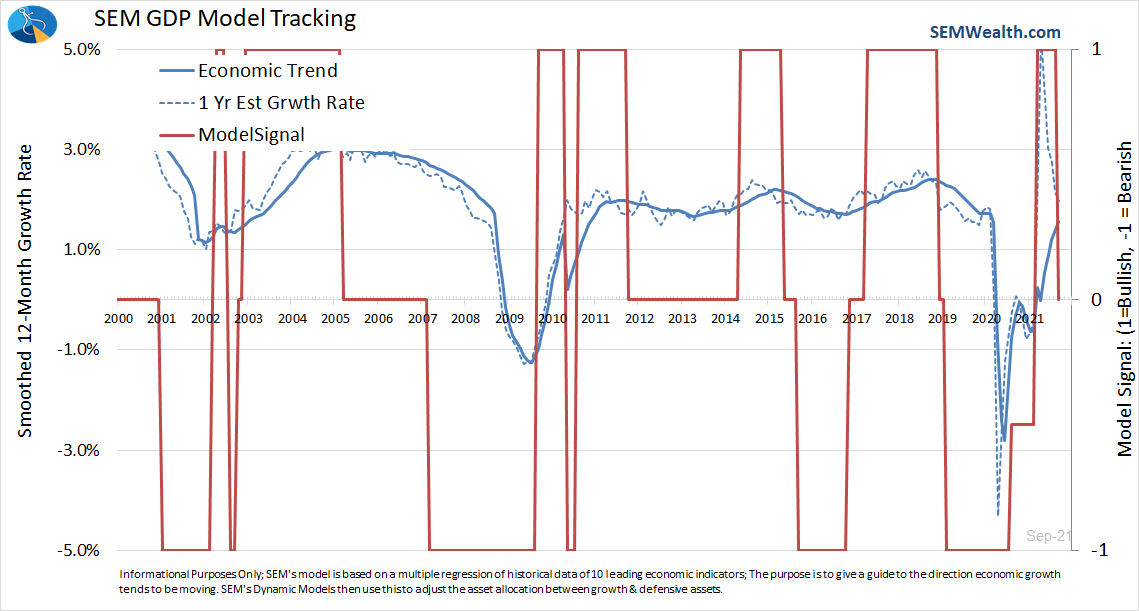

I hope this helps explain what is actually going on in the economy. It's not about politics, or one party being better or worse than the other, it's simply a function of a huge imbalance in the supply/demand equation. The DATA tells us these imbalances will work themselves out. Our economic model is already seeing signs the stronger demand is wearing off and we could be looking at a slowdown in the early part of 2022.

Overall, I still believe we could be looking at long-term "disinflation" (not quite deflation, but inflation below the long-term 'average').

- Deficits are deflationary (because we have to use future revenue to pay for past spending)

- More people retiring is deflationary (fewer workers "producing" growth)

- More people saving is deflationary (a trend we have seen accelerating in the younger generations)

- Higher productivity is deflationary (something the worker shortage is forcing businesses to pursue)

- Inflation is deflationary (the more prices go up, the less people will want to spend)

At SEM we focus on the data, not political narratives. Regardless of who is president or in charge of Congress we have learned over our 30 year history that both parties come with some good and some bad. More importantly policies take years to fully filter through the economy so reacting emotionally to any policies can do damage to your long-term investment results.

So whichever side of the political spectrum you may fall, know that the story goes much deeper and SEM will be here to adjust to whatever the end result may be.