The last two years has been a challenge to say the least. At SEM we've attempted to do what we always do – allow the data to drive our decisions. We've provided what we hope is a consistent, independent look at the current news moving the markets to help our readers, advisors, and clients see through the often polarizing narrative. Part of that has been tapping into trustworthy resources and experts to look at things we are not experts in.

One of the most helpful resources has been a Cornerstone Portfolio partner, Eventide Funds. Their Chief Investment Officer, Finny Kuruvilla in addition to being an MD has a PhD in Chemistry and Chemical Biology. I don't know of a more credentialed investment manager when it comes to understanding the pandemic.

One thing Dr. Kurivilla said from the outset was to expect the coronavirus to mutate into something that spreads more rapidly but becomes less deadly. While scientists continue to study the latest variant, the preliminary results so far seem to point in that direction. The market clearly is worried about the omicron variant. Part of that is warranted as the panic could hit the economy at a time where most Americans felt we were finally returning to "normal".

What's really happening is by most indicators, the market was at all-time high valuations, sentiment was at extreme levels, and expectations were for an even stronger 2022. Readers of this blog know that this came in the face of signs the economy was cooling. The data told a different story than the bullish outlook.

I discussed the data and how our systems have adjusted in the face of the sell-off in this short market musings video last week:

We discussed the overall economy earlier in November in our latest SEM University. The data is saying the economy has weakened significantly. When you add to that the fact the Fed is planning on accelerating their "normalization" of policy (pulling back stimulus), it makes sense for prices to reset.

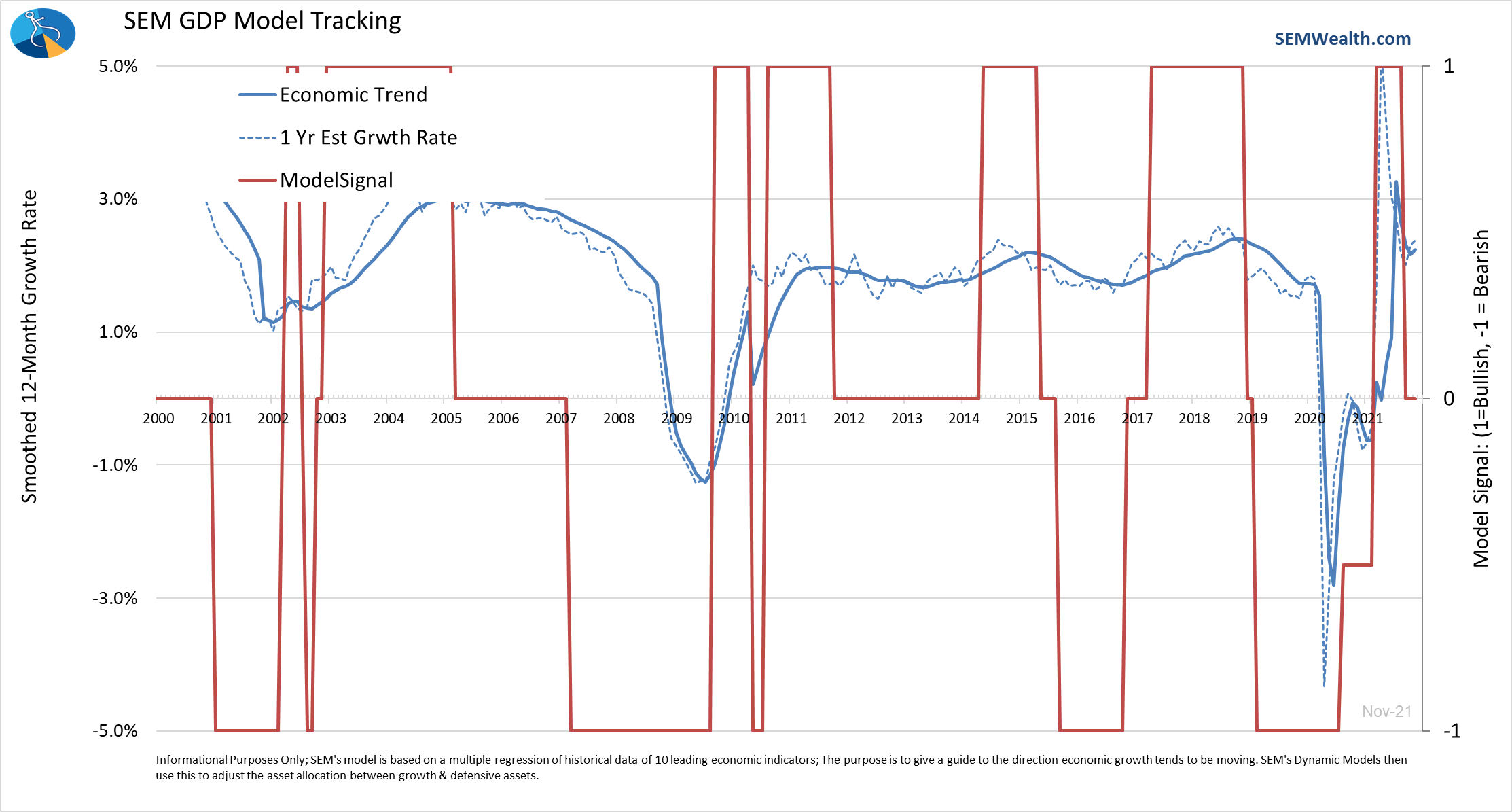

As for the economy, our economic model remains in transition mode where it has been since October.

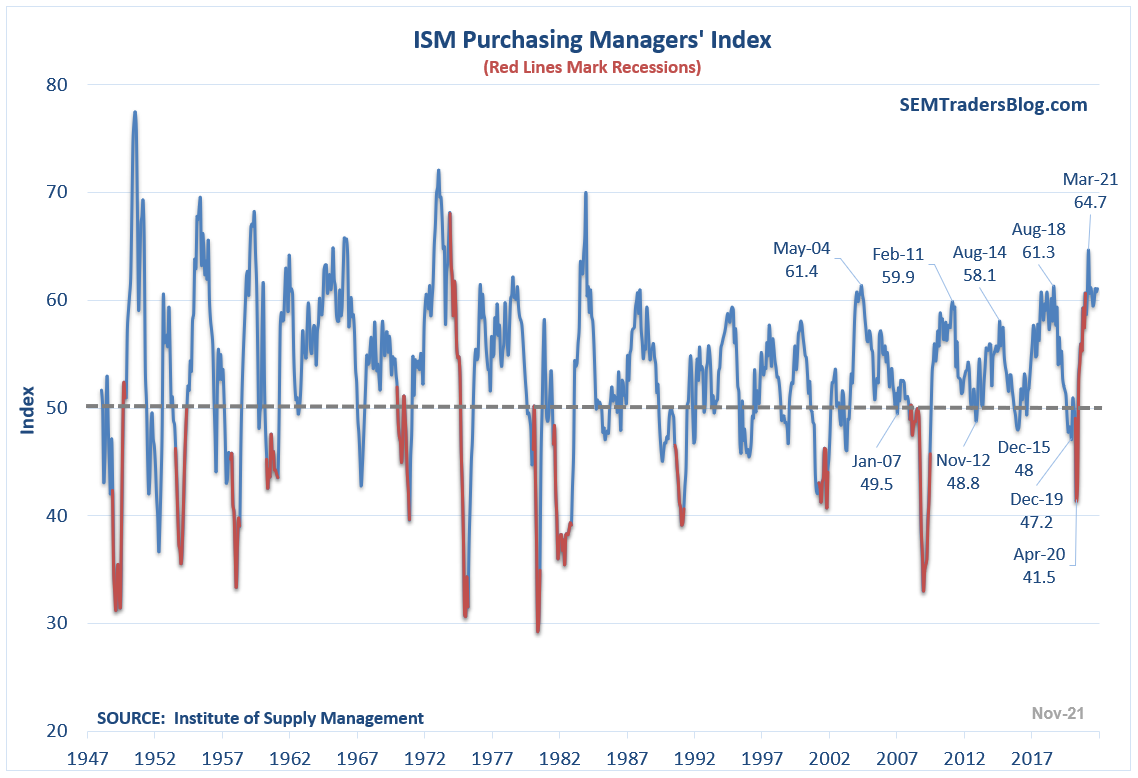

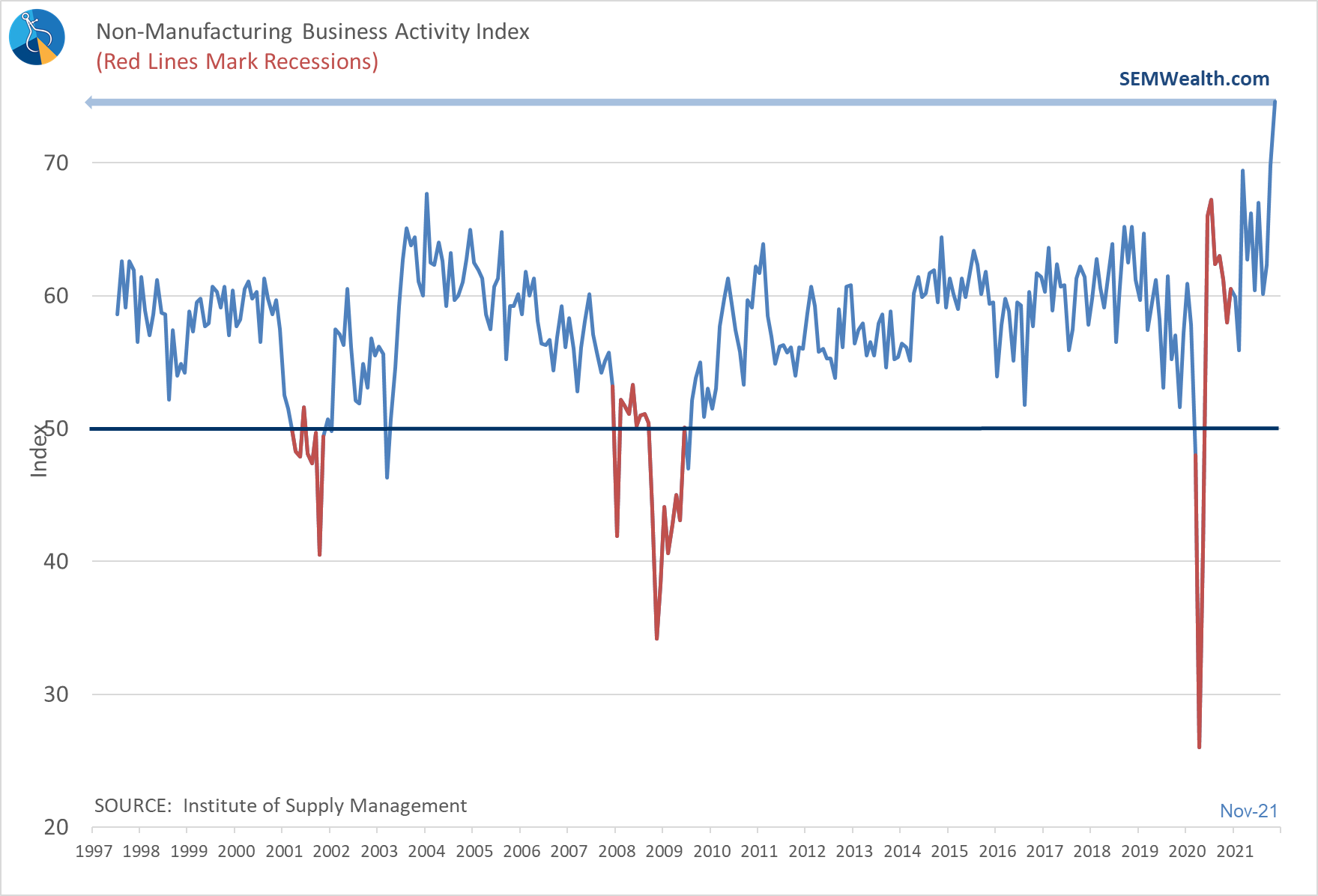

Literally the only two indicators that kept it there were two so-called "soft" data points – the ISM Surveys of Manufacturers and Service Businesses. I like these indicators because they give us a quick look at how the economy was performing in the just ended month while the other indicators take a bit of time to gather the data.

These indicators are also simple to understand – over 50 indicates "expansion", under 50 indicates a "contraction". The Manufacturers' Index is still well above 60 and improved again in November.

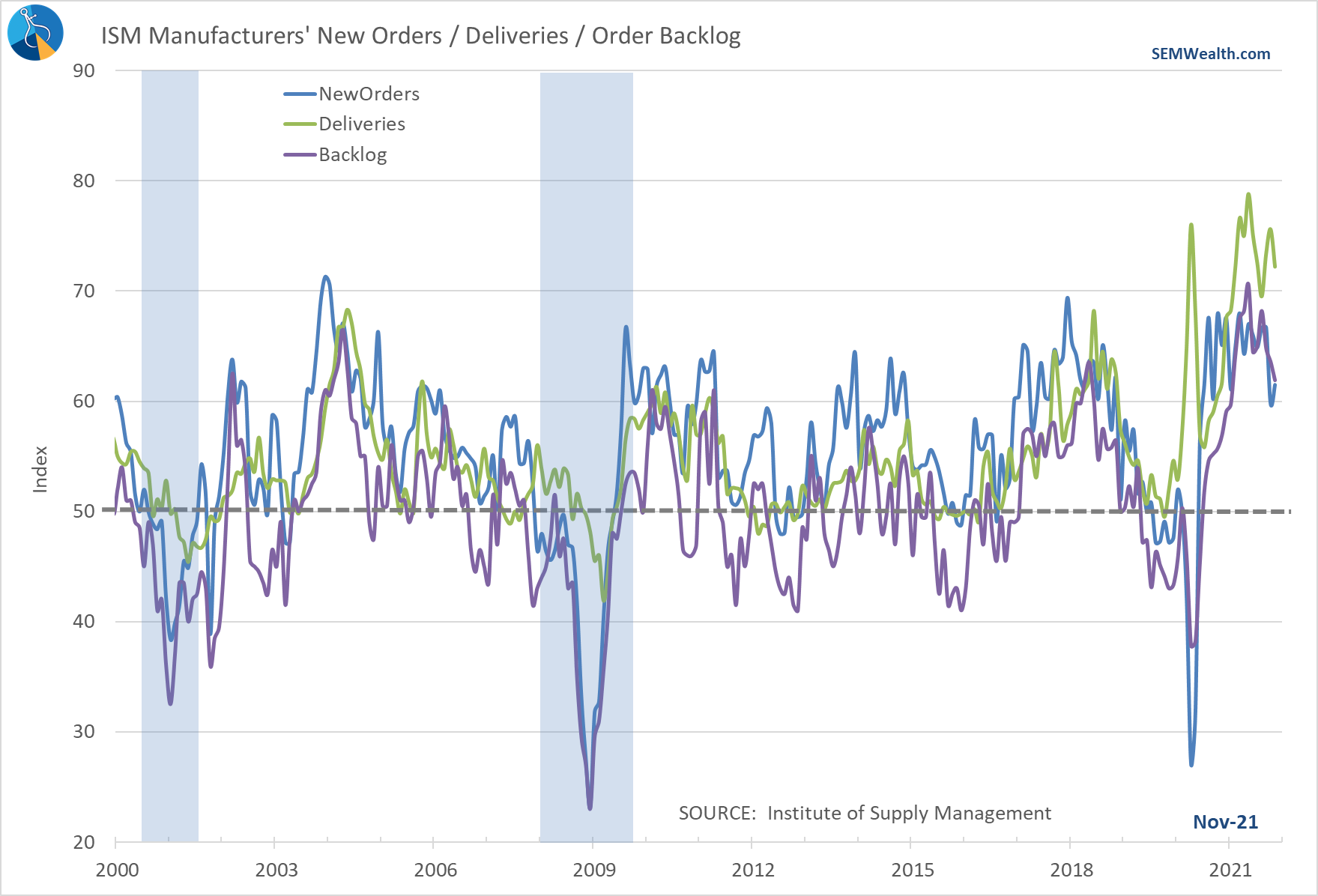

Inside the index, a few of the leading indicators on future orders are showing signs of a possible slowdown.

This could be due to inflation causing a slowdown in orders, less money being sent to consumers from the government, or consumers spending money on services. It's likely a combination of all 3, with the latter for sure playing a role based on the November Service Business activity index, which hit an all-time high.

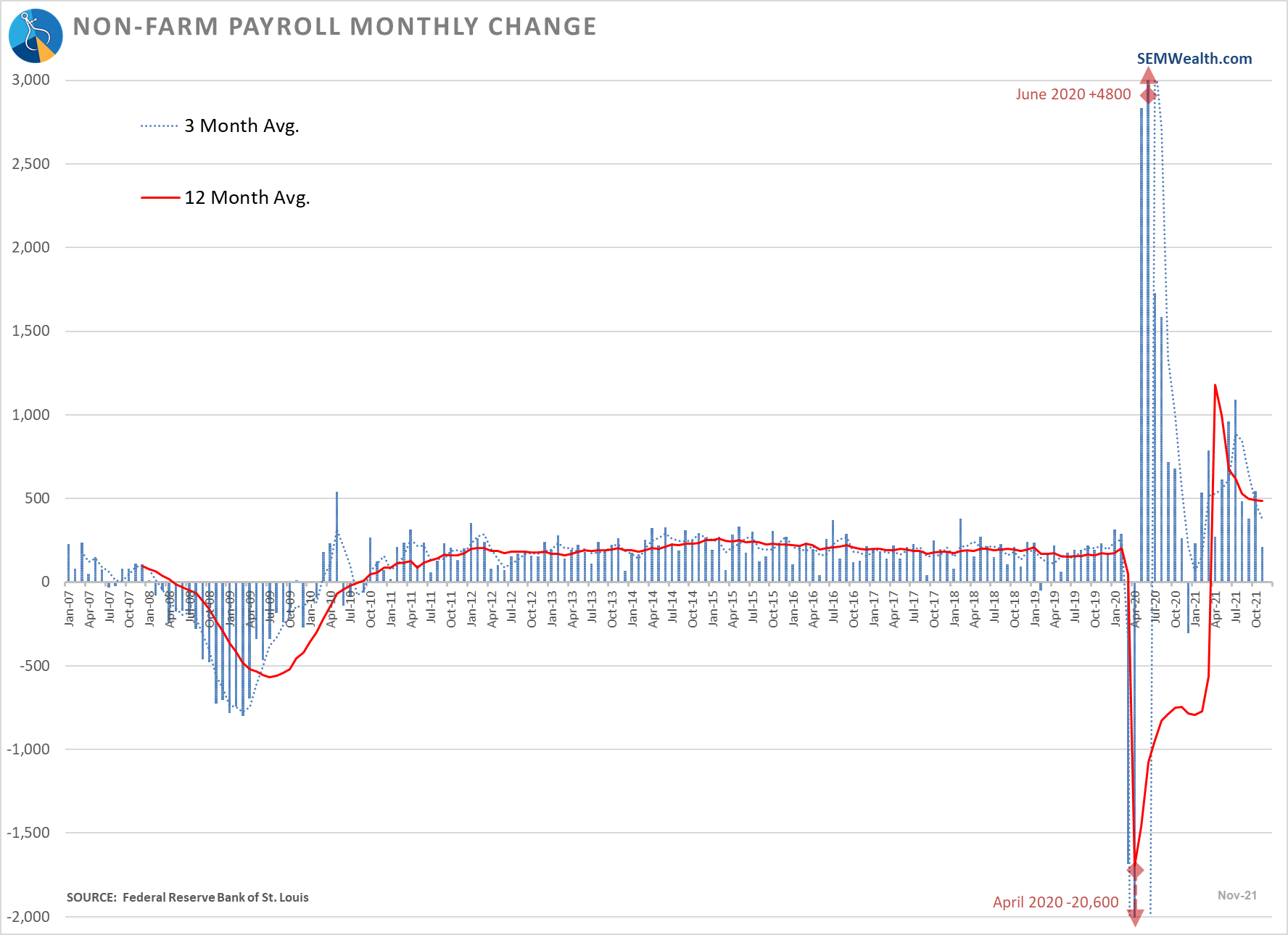

Meanwhile, the number of new jobs being created continues to disappoint.

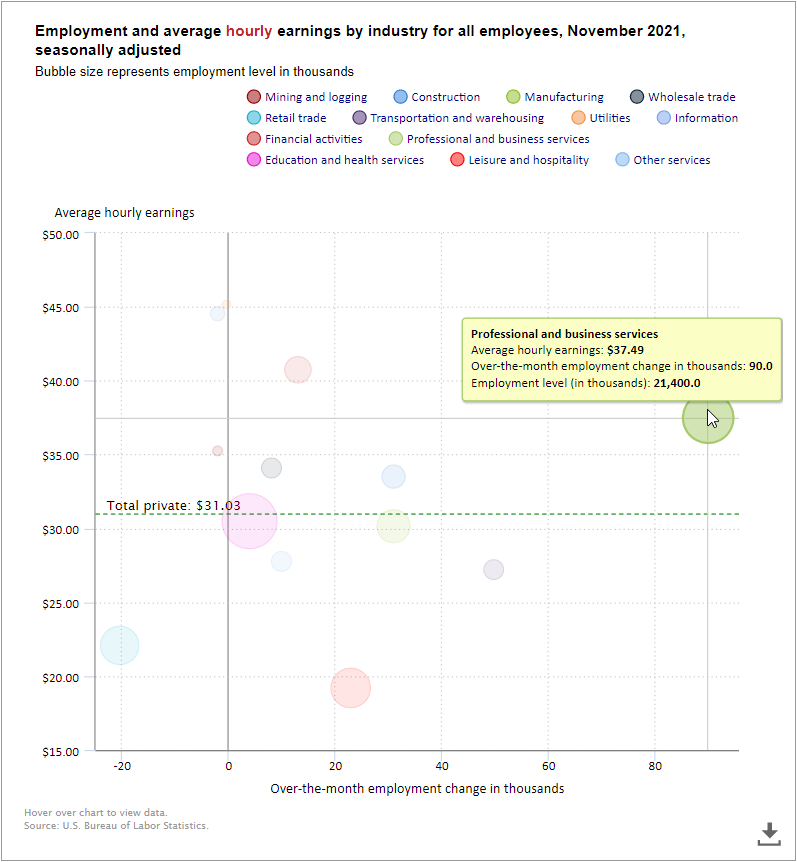

On the bright side, the largest sector for employment growth was professional and business services, which also includes above average hourly wages. This breaks the nearly year long trend where the biggest increases came in sectors with below average wages.

As always our data driven approach will guide us as we move through the last month of the year. Statistically December is usually a pretty good month, but there are still times where December can post big losses for the market. We've already made adjustments to our portfolios and are ready to make additional ones if necessary. I'd encourage you to closely examine your investment allocations and ask whether or not they are ready for what could be a much different year in 2022.