As a financial engineering firm, our focus is on data and how it relates to history. This makes it easier to avoid hyperbole and getting sucked into the latest overreactions in the media and financial markets. As investment managers it has been critical to our nearly 30 years of success helping our clients stay the course with their financial plans.

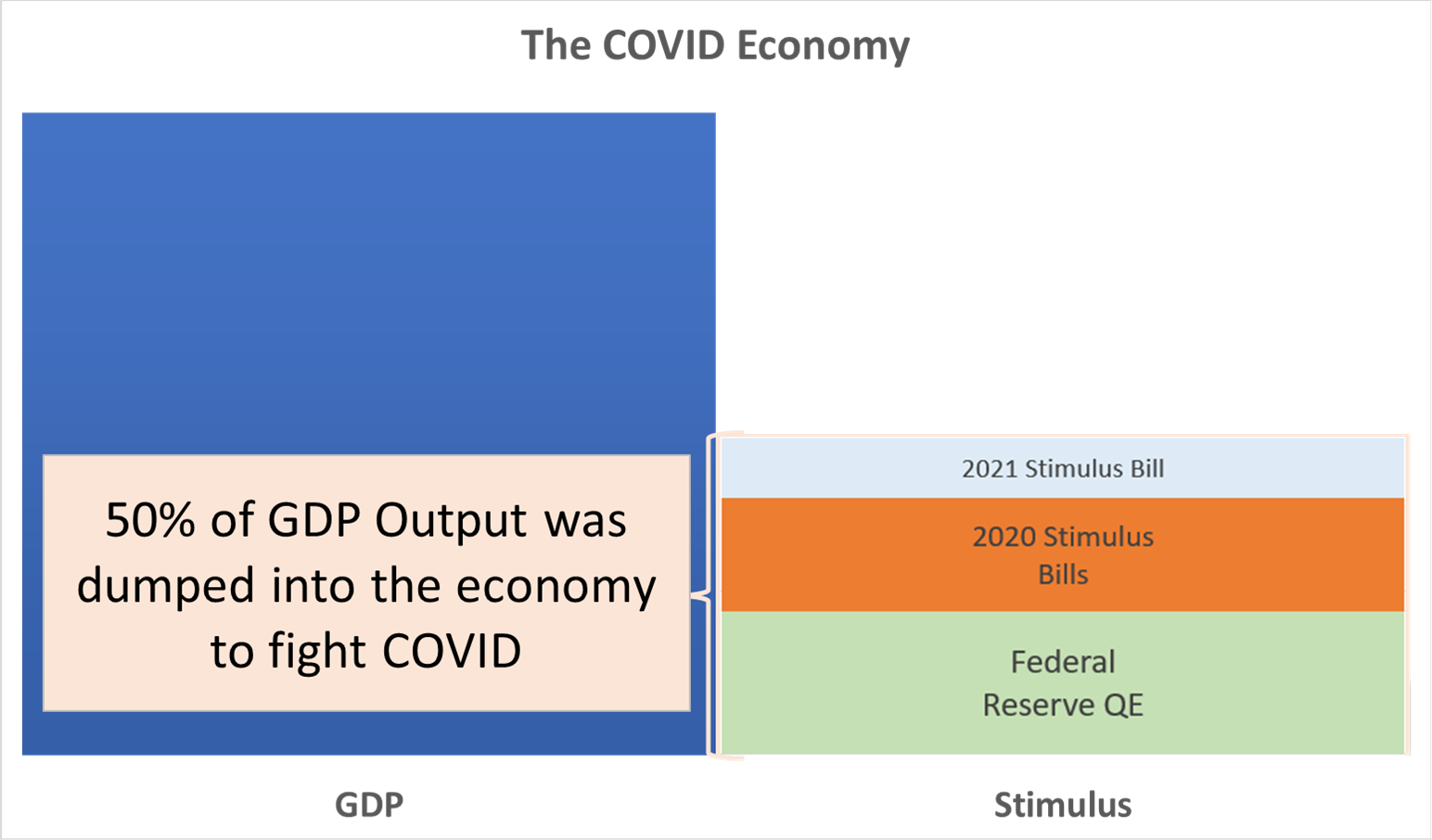

The latest overreaction in the financial markets is over inflation. Yes it is high currently, but what did everyone expect would happen? Our country went through a major shutdown that disrupted nearly everyone's lives. This disrupted spending patterns along with many other things. To offset the shutdown, the Federal Reserve and Congress decided to throw everything they could think of at the economy. This type of "stimulus" was unprecedented.

I put together this graphic to help put things in perspective.

I broke the stimulus bills up by year as a reminder that President Trump signed 2/3 of the stimulus bills put into effect. As I said from the very first bill, people who absolutely did not need the money received way too much of it and those who did need the money did not receive enough. What did the people who didn't need the money do with it? According to the Federal Reserve, as estimated 36% of the money was used to pay down debt or went into savings or investment accounts. The other 64% was spent.

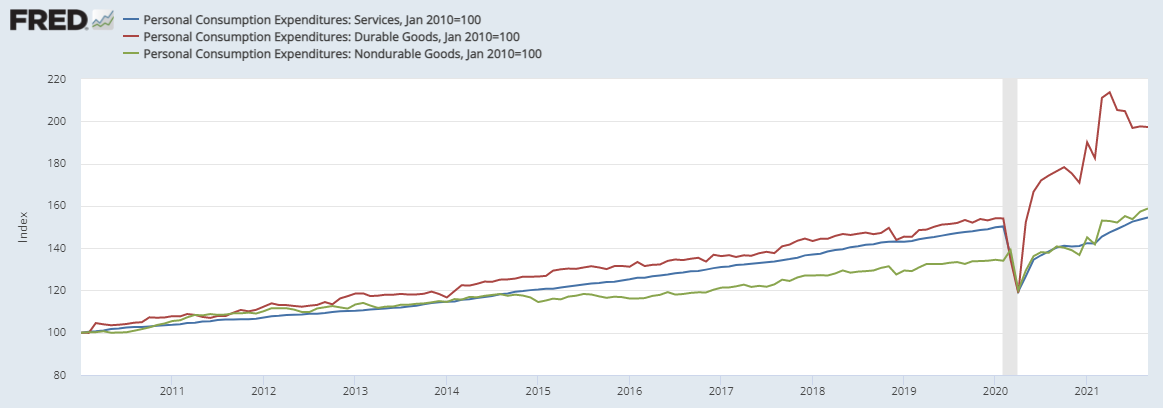

This chart illustrates the change in spending patterns since COVID:

The red line is spending on durable goods. It is obvious where people spent their money. This has created tremendous strain on the entire economic structure. Let's put this in perspective – spending on durable goods is 27% higher than the pre-COVID levels. Following the financial crisis it took 6 years for durable goods spending to increase by that much. Nobody was ready to have 50% of GDP dumped into the economy. Again, people who absolutely did not need the money received it and they spent most of it. We are now paying the price for all that stimulus.

I continue to stand by my assessment that this will be a temporary surge and will lead to a sharp slowdown in the economy in 2022 caused partially by an inventory surplus. That's all part of the economic cycle.

I've talked about the data leading to this assessment the last three weeks and won't rehash them this week. You can view those articles here:

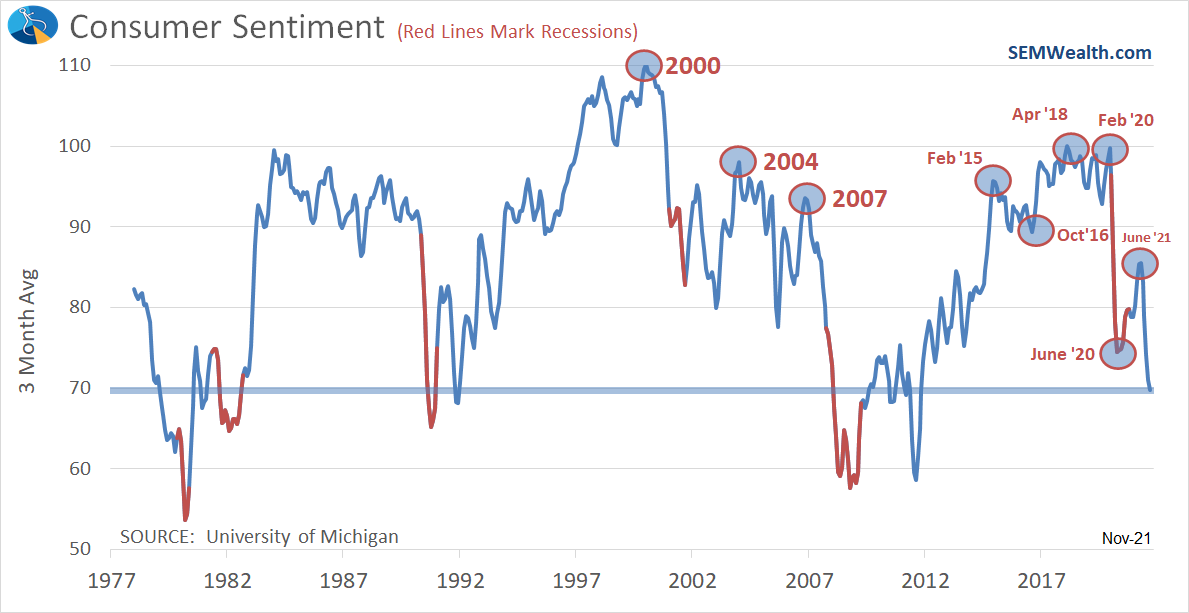

One of the things I've said throughout is we forget inflation is ultimately deflationary. Eventually prices get too high and demand cools (usually after businesses have ramped up their inventories as they fear constantly rising prices hurting their profit margins and thus the inventory surplus). Last week we saw the first read on Consumer Sentiment. Shocking to some given the all-time highs in the stock market, the reopening of the economy, the resumption of in-person learning across the country, the availability of vaccines, and a labor market that is highly favorable to workers is the fact consumers are less optimistic today than they were during the depths of the COVID shutdown.

This all comes at a time where stocks sit at all-time high prices and near tech-era valuation metrics (in some cases above them). This presents a very dangerous situation for investors, especially those in a buy & hold situation or those retired or planning on retiring in the next 10 years.

This is where our engineered approach shines. Our three-pronged management approach allows us to use data, market history, and economic cycles to navigate what is often a very emotional point of the market cycle. Our tactical models, which can change on a daily basis remain invested, but continue to have a couple of times a week where we are literally within one more weak day of hitting our sell threshold. Our dynamic models, which utilize our quantitative economic model are flashing warning signs and moved us to a "neutral" weighting. Our strategic models, designed for the longer-term portion of the economy remain fully invested, but overweight those asset classes which should hold up better if we do see a slowdown.

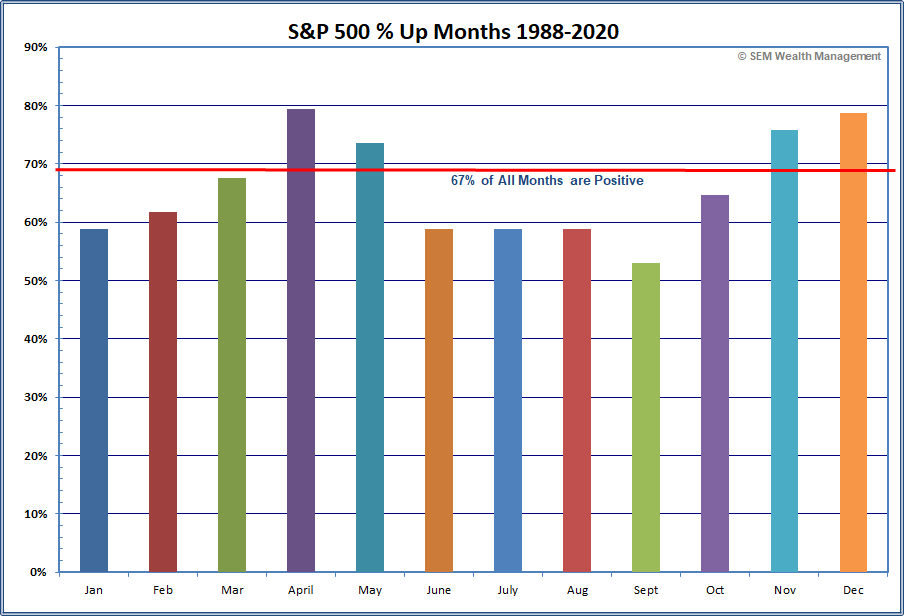

We are at a time seasonally, which is typically a very positive one. I shared this chart last week:

This doesn't mean we can't have big losses in November and December. More importantly, January and February are right around the corner. Often times when the market finishes the year strong those months can have big negative reversals. Given our position in the markets, now would be a good time to evaluate whether a shift to an engineered approach from whatever approach you're currently using makes sense.

If you'd like to hear more and get a chance to answer questions about our outlook, make sure you sign-up for our webinar this Thursday: