When you're in the heat of the moment it is easy to get lost in the current situation and narratives. It is often useful to take a step back, look at the overall data from a different perspective and focus on longer-term trends. Last week we had four different items where this was important – the Virginia election, the Fed's latest policy announcement, the Jobs report, and the passing of the Infrastructure Bill. These are all topics we could take a deep dive on, but I'll try to keep my musings brief.

A Statement from Virginia

A lot has been made about Virginia's election results where the Republicans swept the ticket and took control of the executive and legislative branches. I have seen hyperbole from both sides when looking at the results. It wasn't a mandate for ultra-right wing policies. It wasn't an endorsement of President Trump. It wasn't about racism. It was simply a reminder about the one fact both sides continue to ignore — Independents control the vote.

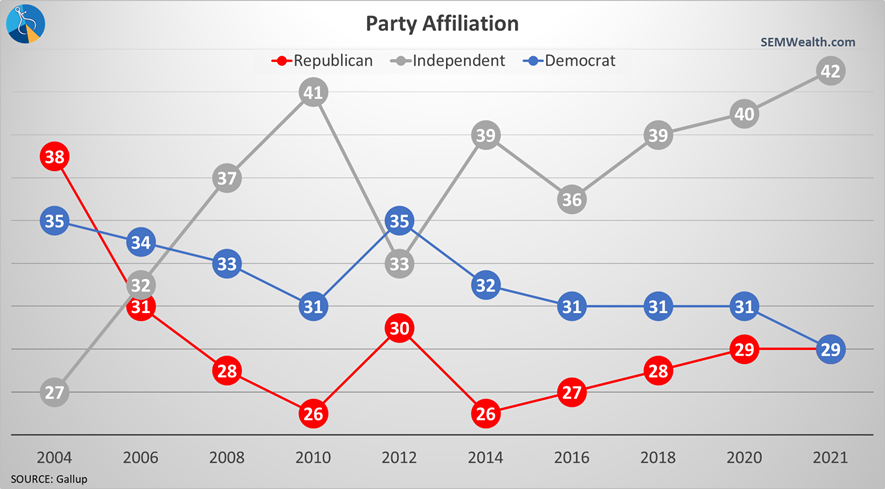

I shared this quite often before and after the election last year. There are more Independents than Republicans or Democrats.

This is part of the trend we've seen for the last 25 years. While the two parties have pulled further to the opposite poles, this has left a large swath of voters without party representation. These voters also tend to be the LEAST vocal and don't get involved in the political arguments. The two parties currently have too much power and tend to squash anybody who doesn't follow along with their far left or right points of view. I predicted over a decade ago in the 2020s we would either see a powerful third and likely fourth party emerge or a major restructuring in leadership and platform as the ideologs running the parties today are replaced.

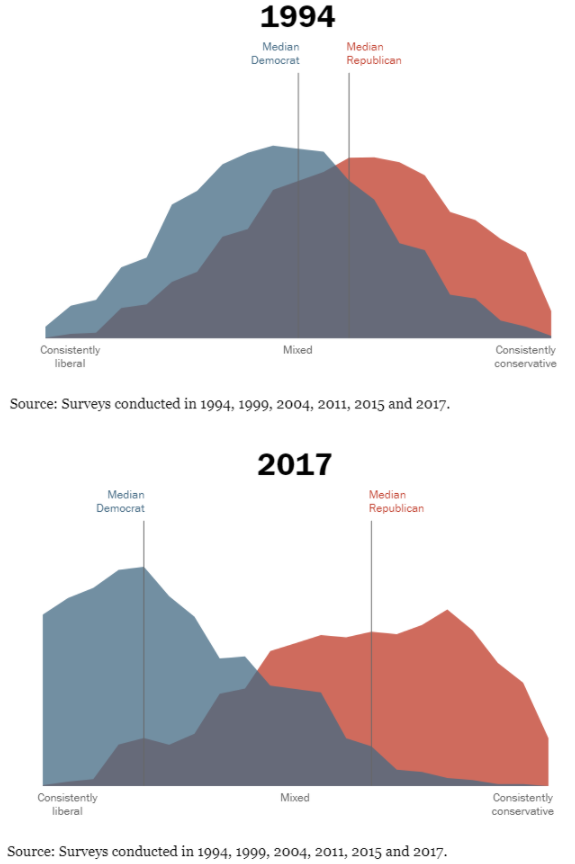

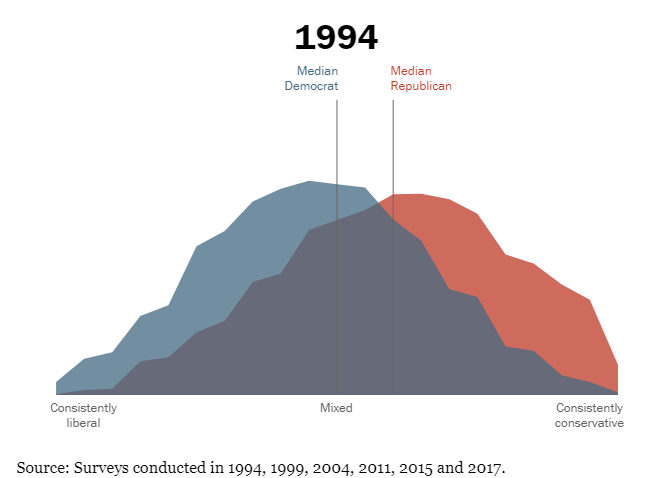

In 2017 I wrote what is one of our most popular posts and one I shared often in the past week to those lamenting the results. I included this chart which shows how far the parties have moved since 1994.

I'd encourage you to check out the full post as this is likely going to be something we watch in real time the rest of this decade.

As for last week's results, here is what really happened. President Biden was the least liberal (most moderate) of all the Democratic primary candidates. The fact the party chose him is important to remember. He then won the general election by winning the Independents who had swung from Obama to Trump in 2016. That percentage was literally the difference in the election.

President Biden campaigned as a moderate. He won because of the moderates. He has then let his party in Congress pull him to the very far left. You would think he would have learned from his own experience. The same thing happened to President Obama who was even more moderate than President Biden in 2008. The agenda push those two allowed to happen from Congress led to a landslide victory for Republicans in 2010.

I have not been afraid of a far left agenda because I thought President Biden would have remembered that lesson and would lead the country as he campaigned. If you look at the exit polls, the Independents in Virginia feared too much government control and wanted to balance things out. It wasn't a push to the far right, but simply a balance of power issue. Both sides should remember that.

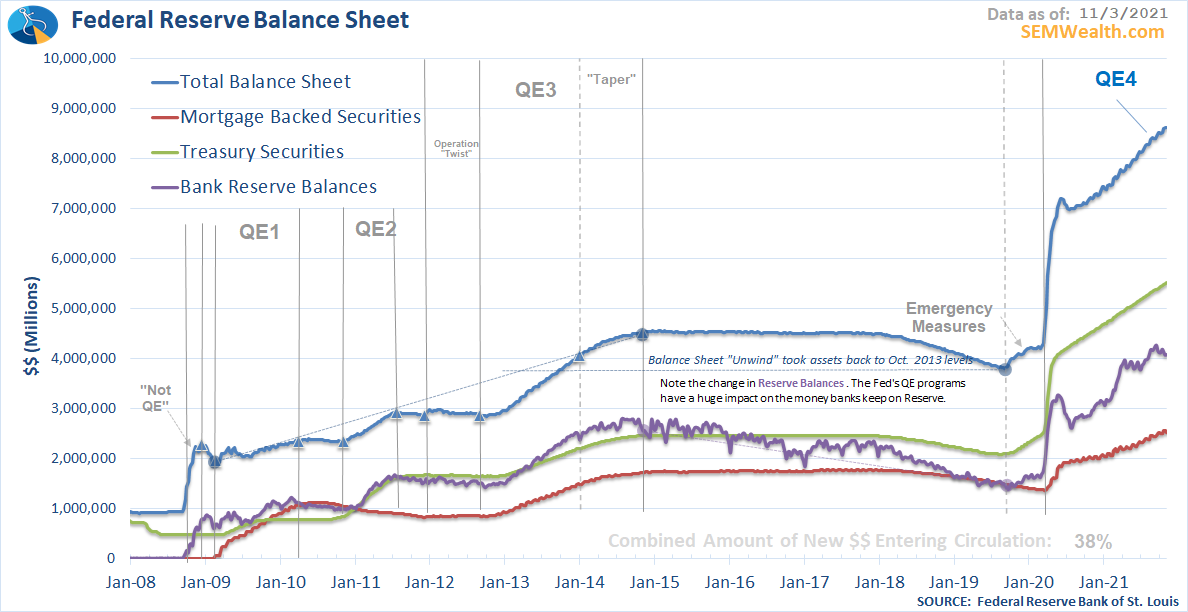

Fed Announces Taper

The least surprising event of the week was the Federal Reserve announcing they were going to "taper" their asset purchases. They've been buying $120 billion per month in assets from the Wall Street banks. They are reducing it by $15 billion this month, with expectations they will continue decreasing it each month until they end the program next June. At that point it is expected they may begin raising interest rates and/or unwinding some of their purchases. Interestingly enough, bond yields actually declined following the announcement. It's too early to read into this reaction. Either the bond market believes the economy may not be able to stand on its own or they believe this is enough to end inflation pressures. Either way, it's less money going to "stimulus", which will force the economy and the markets to stand on its own.

The Fed also reiterated they still believe inflation pressures will slow, but did indicate frustration with some of the more structural issues causing the spike in prices. To me it's not rocket science. Both parties decided to dump $5.3 Trillion into the economy in the name of "stimulus", with the bulk of the money going to people who really didn't need it. At the same time, the Federal reserve added another $4.5 Trillion to the financial system. That's over 45% of our economic output being thrown into circulation. What did they expect would happen? People spent money with abandon at a rate never before experienced in our country. Of course our economy couldn't handle it and prices have gone up accordingly. It's economics 101 – demand goes up prices go up. Demand goes up faster than supply prices go up.

It's not that hard to understand (unless you're a political ideolog, member of Congress, or work for the Federal Reserve). For more see this post from a few weeks back:

More Jobs than Expected?

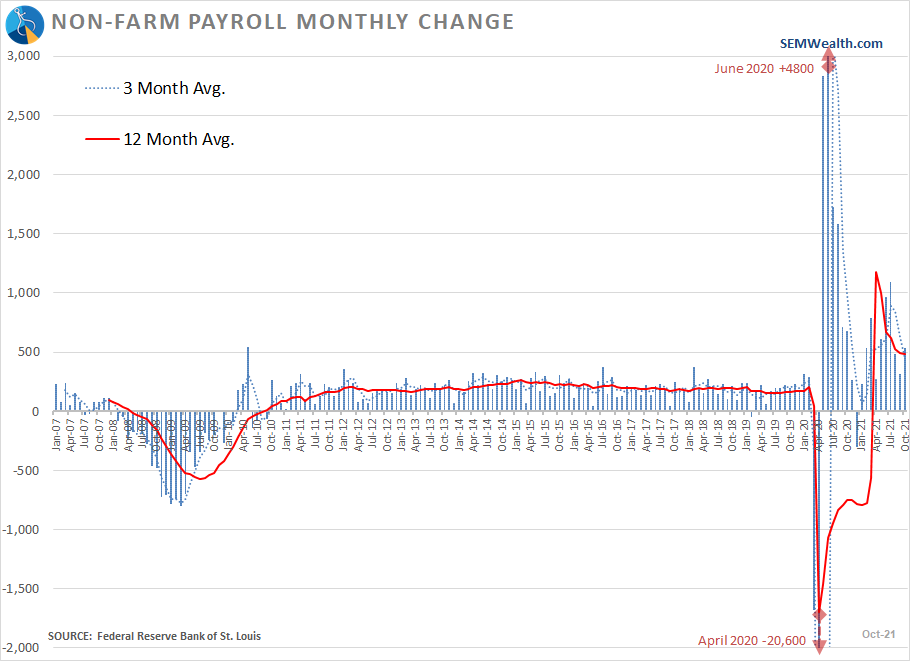

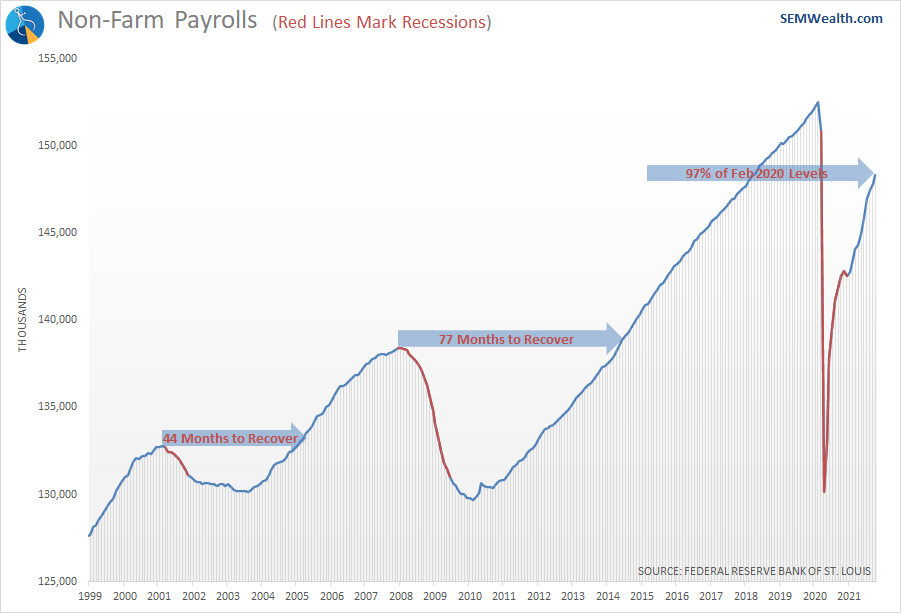

Friday we saw the government's estimate for how many jobs were "created" in October. I won't go into all the problems with this data. We'll see revisions for the next three months and again three years down the road when the number of jobs are actually known. The numbers do not matter as much as the trends.

The trends are decently positive.

The recovery is running much faster than the last two economic recoveries, but we still have a long way to go.

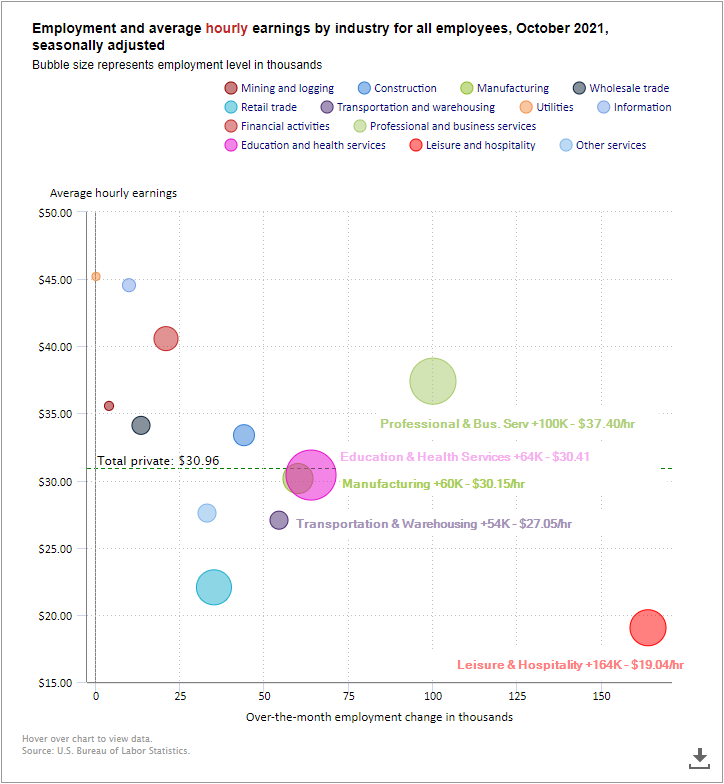

The issue remains the QUALITY of the jobs being added back – the lowest paying sector added the most jobs. It was encouraging to see both manufacturing and transportation/warehousing on the list of gains given the current supply chain issues we are facing.

I touched on it a bit in the "Let's Go Brandon" blog and will touch on it more in our upcoming SEM University, but let me say this for now — an economic crisis ALWAYS changes the STRUCTURE of our work force. We are seeing that now, which will make interpreting the employment picture difficult the next several years.

Infrastructure Bill Passes

You gotta love politics. It's no coincidence after voters expressed concern about how the Democrats are leading that they found a way to pass one of the key building blocks of President Biden's "Build Back Better" campaign promise. Here's what's frustrating to me – every President wants infrastructure spending. President GW Bush had a large infrastructure push. President Obama was known for his promise of "shovel ready projects" in the American Recovery Act of 2009. President Trump campaigned heavily on infrastructure spending and was known for his failed "infrastructure weeks" in his first two years where he made promises of a major bill being put forth only to see nothing materialize.

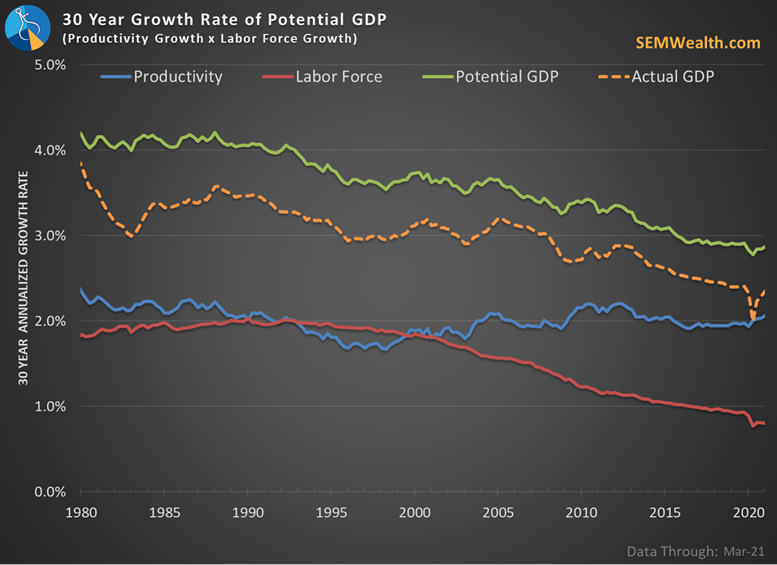

If you've been around me or this blog much you know I'm a huge fan of infrastructure (if done correctly). In my opinion, every budget related bill put forth by Congress should answer these two questions – does it increase the number of workers and/or does it make workers more productive. This is the ONLY way to grow the economy. Doing either of these things is an investment. If the answer is no, it is SPENDING, which takes money from one person and gives it to another. This most likely will also increase the deficit, which means we have to pay for today's SPENDING with future output, which becomes a drag on longer-term growth.

I've shown this chart numerous times to illustrate the long-term problem our economy is facing. It shows the economic equation.

Productivity growth has been running around the same rate for a long time. What frustrates me is how the far left Democrats in Congress literally held this infrastructure bill hostage. It includes many items that are needed to make future workers more productive. It was overwhelmingly approved by the Senate back in August by a 69-30 vote. Clearly BOTH SIDES wanted this bill.

The other part of the "Build Back Better" package is much more controversial. It is considered a "social" bill that has many pet projects the "progressives" have had on their list for a decade or more. I won't go into the details since they are still working on it, but I will say there are some "soft" infrastructure items in there that answer a key part of the question on whether it is investment or spending — if it helps more Americans work, it should be considered infrastructure. This means making it easier for working parents to pay for child care, universal pre-K, and child tax credits could allow for more people to return to the workforce. Our labor force is shrinking rapidly and we need more workers!

Unfortunately it seems one of the more important items – universal free community college tuition, which included trade school. For many people this would work on both questions – adding to the workforce AND making them more productive. This comes on the heels of the one year anniversary of losing our son, Tyler. We had held off fundraising for his scholarship fund this year as I sincerely hoped we would see Congress make this universally available. Last year we handed out 4 scholarships totaling $10,000 to help pay for mechanic, electrician, and nursing schools to local high school seniors. You can learn more about why we created this fund and ways you can donate here:

What's this mean for the markets?

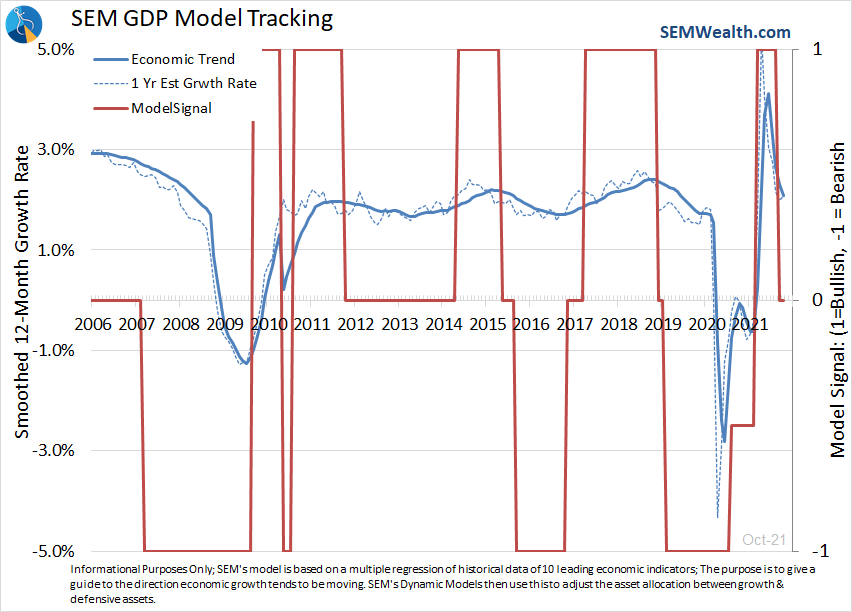

Last week I mentioned how some of our leading indicators were showing signs of cooling. This confirmed our economic model's "transition" or "neutral" position.

The jobs report as well as a very strong ISM Services report did cause a slight uptick in our model forecast, but not enough to change states back to bullish.

Our tactical systems continue to hold onto a "buy" signal as the trend remains higher. For the past few months we've had several occasions where our signals get to the point where one more down day will lead to a "sell" signal, only to see the markets reverse higher. Our "strategic" models (Cornerstone & AmeriGuard) remain fully invested as they've been since a few weeks after the bottom in late March 2020.

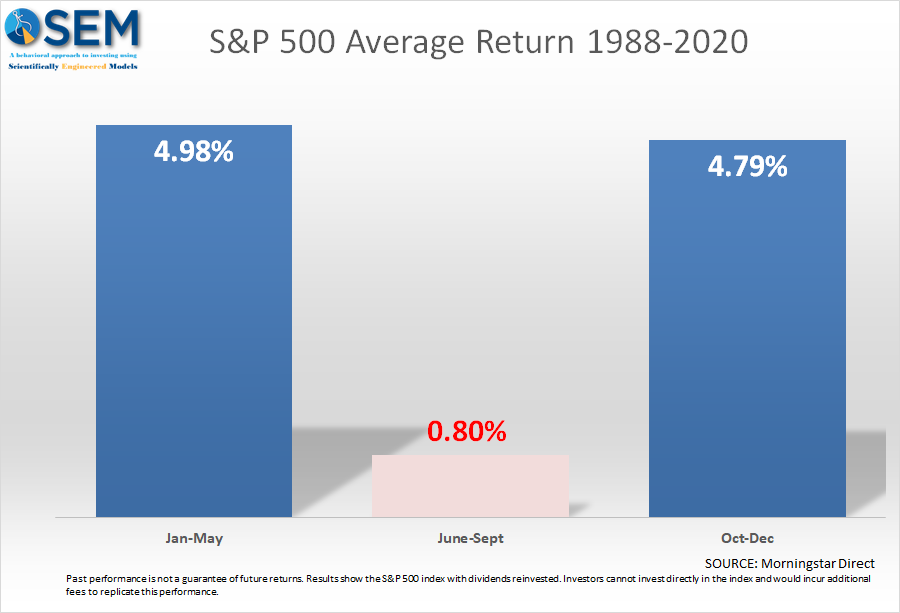

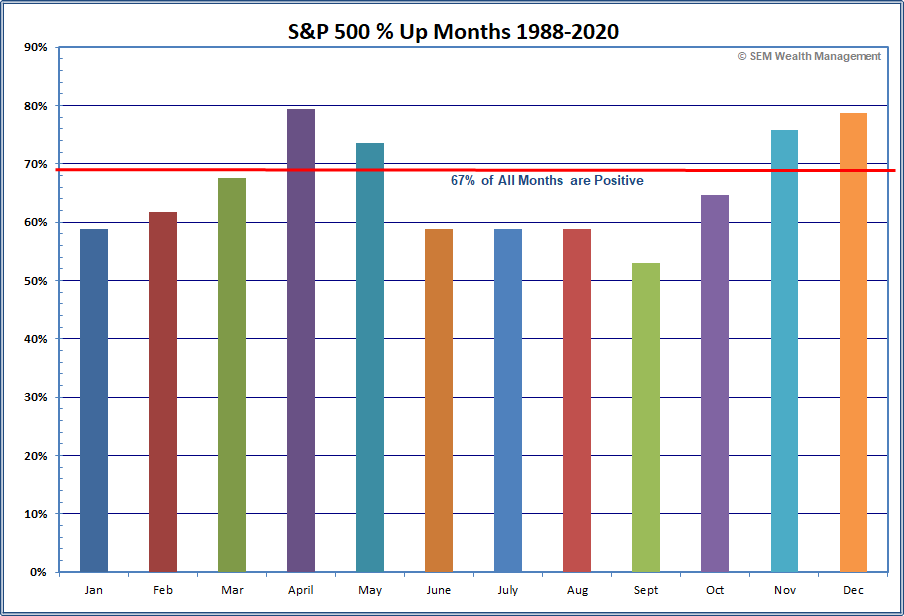

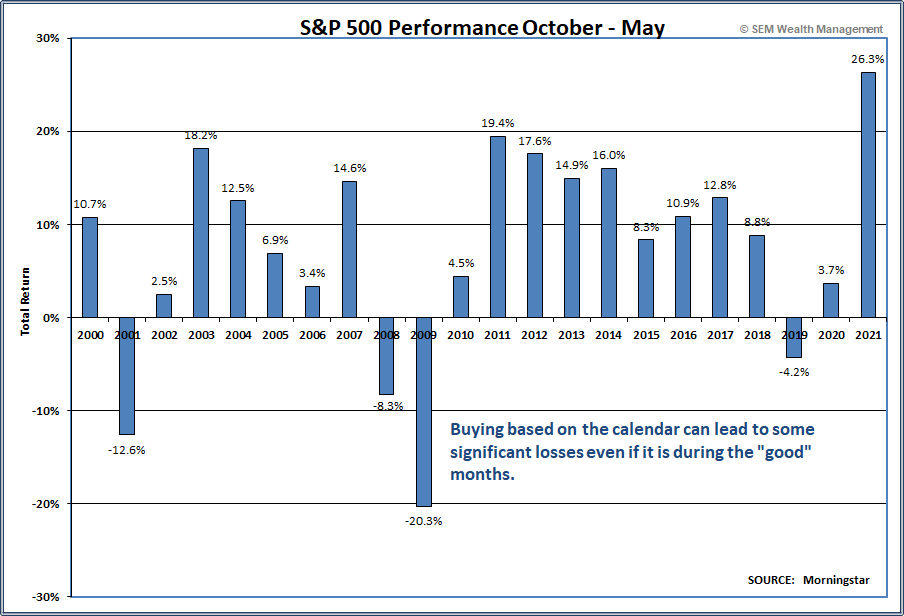

From a seasonal perspective, we're in the best period for the markets. (October - May).

On average November and December are two of the most consistently positive months for the market.

The calendar and trends certainly favor stock investors right now. However, keep in mind, the stock market is already up 9% since October 1. The average return for the last three months is 4.8%. Typically when you have returns nearly double the long-term average you are at risk for a sharp sell-off. We still have Congress trying to decide how they will push for President Biden's other "Build Back Better" spending plan and more importantly how they will pay for it. The Virginia election should eliminate the chances of massive tax hikes or other negative impacts on the economy, but it doesn't mean all risks are off the table.

Most likely we will not have to deal with all the negatives until early next year, but we do have to remember the market has lost large amounts during the "good" months, which is why we continue to follow our data driven, three-pronged, unemotional approach.

Don't forget to sign-up for our SEM University next week where we will look deeper into the current economic picture.