Stocks technically hit the "correction" level at one point last week, falling 10% from the highs. After a brief 7% drop in June, stocks had rallied 20% to cap off an impressive summer. Some investors probably feel like this poor guy from the Cowboys.

There really wasn't any real news items to cause the drop, but instead a list of concerns which popped to the forefront. Here are a few of them:

Valuations

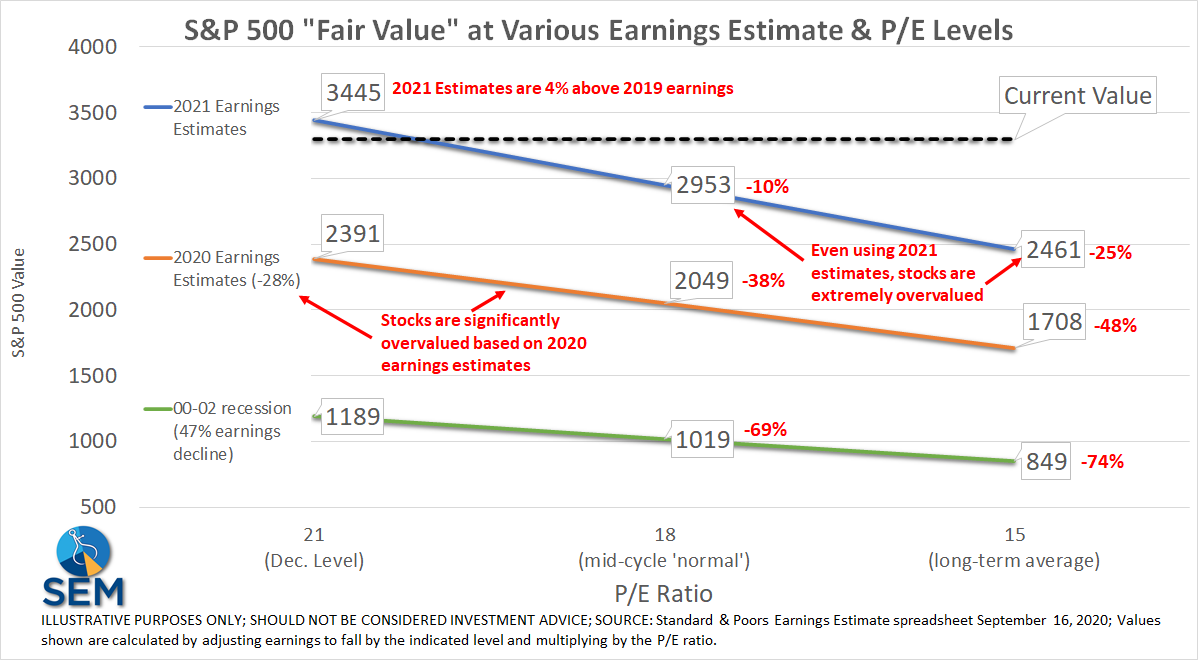

Valuation levels are not a good timing mechanism, but instead help set expectations about future returns. The higher the starting valuation, the lower the returns. What you also see is the higher the valuations are, the faster stocks will fall. I've shown this chart throughout the pandemic to highlight how sensitive stock prices are to small changes in the price-earnings ratio.

Remember, analysts have essentially stopped using 2020 as "forward" earnings, but instead are basing their valuation estimates on 2021 estimates. They have been notoriously bad at predicting THIS YEAR's earnings, yet somehow we are trusting them to know what the economy and corporate environment will be like at the end of NEXT YEAR. The normal P/E ratio using LAST YEAR's earnings is between 15-18. The normal "forward P/E" (using the current year's estimated earnings) is between 12-15. Stocks are trading at 20 times next year's earnings.

Stocks are currently trading at 26 times actual earnings. When valuations are this high, especially when the economic environment is so uncertain leads to rapid declines in prices when expectations are reduced even a small amount. Just moving the P/E based on 2021 earnings down to 18 would lead to an additional 10% drop from here. Moving to the top end of the long-term average "forward P/E" would lead to an additional 25% drop in prices.

Fed Signaling

Fed Chair Jerome Powell appeared before Congress and signaled there isn't too much more they can do from the monetary policy side of things. He did indicate they would remain accommodative and use "all of the tools available", but as the Fed has said repeatedly their tools are short-term in nature. Chair Powell again emphasized fiscal policy (controlled by Congress and the White House) was needed or we could see a much more severe contraction.

The Fed also released growth projections following their last monetary policy meeting which showed a prolonged slowdown in economic growth, stretching far longer than most Wall Street analysts are expecting.

Little Chance of Stimulus

The continued stalemate in Congress is making it increasingly likely we will not see any more stimulus. As I've said for months, I really hate saying this, but we do need some (short-term) stimulus to help those who had their financial lives shocked by the pandemic response. There are 2.3 people unemployed for every job opening. In February 2020, we saw 0.9 people unemployed for each opening. We really have two economies – those who have jobs in industries which can easily adapt to social distancing measures and those who did not. Those in the latter category are in a depression while those in the former category have barely felt any impact on their incomes.

The economic data will likely continue to weaken as the air pocket following the expiration of the extended unemployment benefits works its way through the economy.

Election Anxiety

The rhetoric is heating up as we rapidly approach the election. It looks to be an election like no other. While we don't like diving into politics, we will address it from a data-driven perspective when it is moving the markets and leading to our clients and advisors seeking to make big portfolio adjustments before or because of the election.

Last week we sent out this short video to our clients and advisors discussing my number one rule of election year investing.

We are also hosting a 30 minute special SEM University on Tuesday at noon ET. You can sign-up here.

Virus Reboot

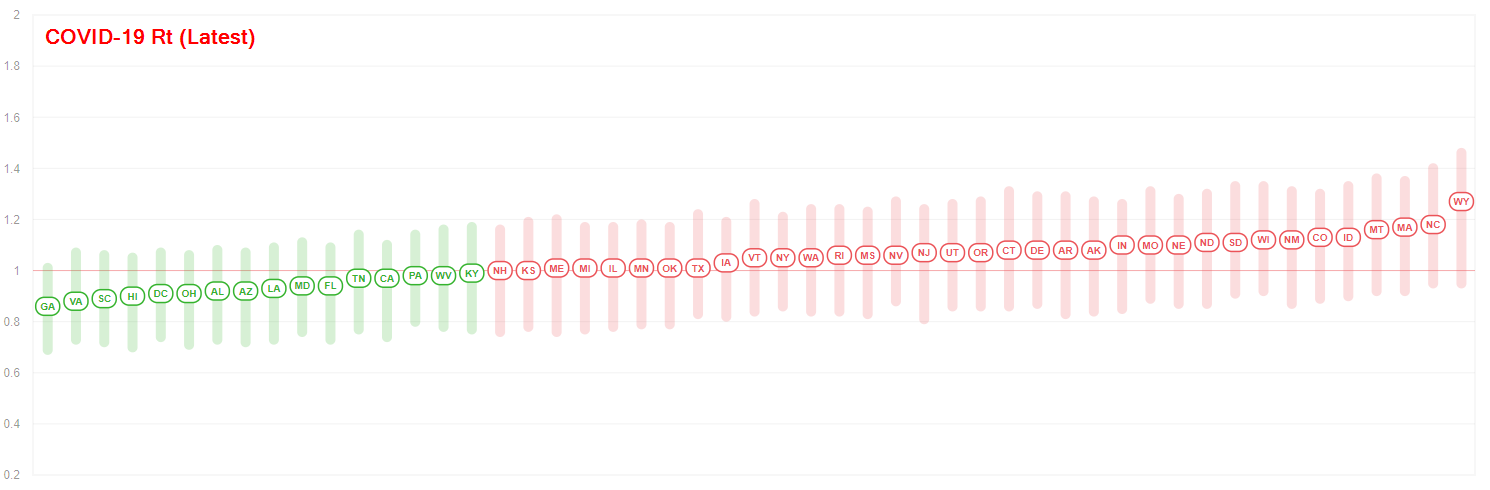

The Coronavirus has again re-emerged in some localities in the US as well as parts of Europe. While so far the surge in cases has not led to hospitalizations or a spike in the death rate, the concern is when combined with the move indoors as temperatures fall and the seasonal cold and flu season, localities may be inclined to increase restrictions once again.

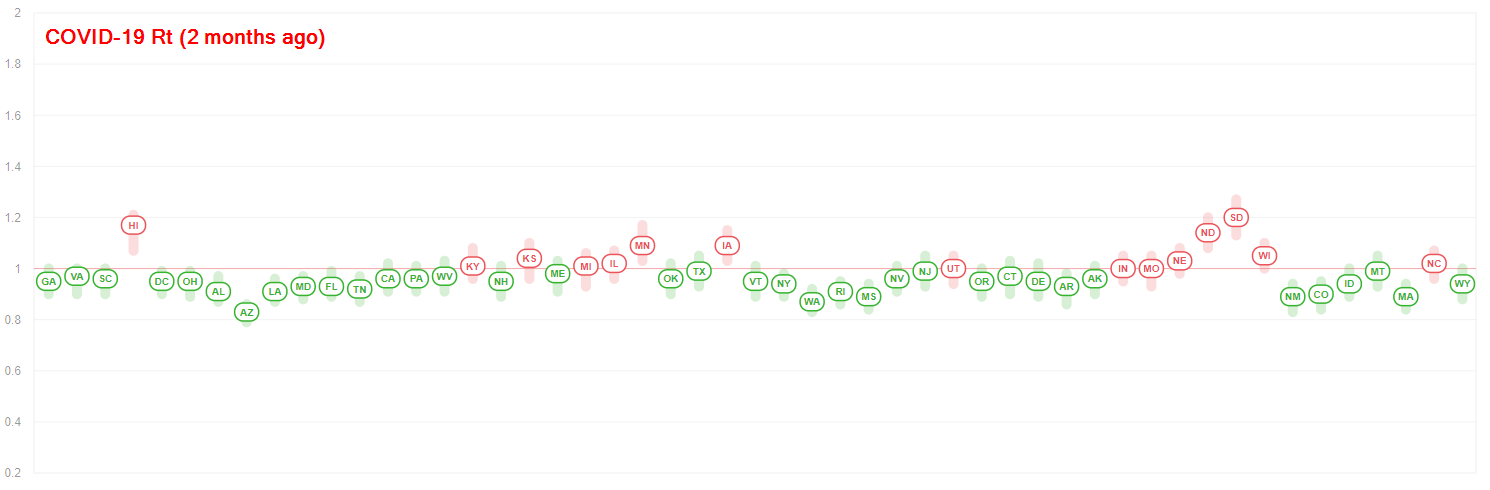

One chart I look at weekly is rt.live. From their website: Rt is a key measure of how fast the virus is growing. It measures the average number of people who become infected by one infectious person. When it is above 1.0 it will spread quickly. When it is below 1.0 the virus will stop spreading.

3 months ago, only 15 states has an Rt above 1.

Now we see only 16 states with an Rt below 1

Science is working, but that doesn't mean we can let our guard down nor can we discount the fact decisions are made by humans and humans are not always rational. If you haven't watched this update from Cornerstone fund partner Eventide (or if you need a reminder), I'd encourage you to check it out.

SEM is Ready

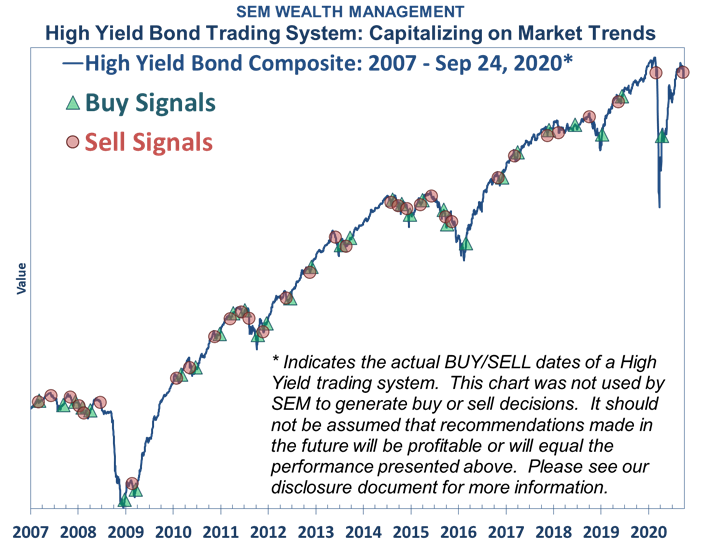

As we proved once again in February and March, our data-driven process is designed to handle all kinds of uncertainty. Last week our high yield bond trend following system inside of Tactical Bond, Income Allocator, and Cornerstone-Bond issued a sell signal, locking in the nice gains we've had since the April buy signal.

I was surprised that high yield prices nearly got back to where they were at in February. We also sold at almost the same levels we sold at in late February.

Our other systems are designed to let the market go through "normal" corrections. We see a 10% correction on average once a year and 5-7% drops 3-5 times a year. So far our economic data driven Dynamic models remain "bearish" as they've been since early 2019. The "strategic" models (AmeriGuard & Cornerstone) have trend following indicators that are still solidly invested. Just as they did in March, they can move quickly if necessary should things deteriorate even more.